- Investments

- / American Funds® U.S. Government Money Market Fund

Investment Fund

American Funds® U.S. Government Money Market Fund (USGXX)

Purchase Restrictions: Class F-3 shares are available through certain registered investment advisor and fee-based programs, but are not available for purchase in most employer-sponsored retirement plans. See the prospectus for details.

Summary

Internal Prompt

Price at NAV

$1.00

as of 3/11/2026 (updated daily)

Fund Assets (millions)

$35,146.6

Portfolio Managers

N/A

Expense Ratio

(Gross/Net %)

0.30 / 0.30%

(Gross/Net %)

Internal Prompt

Returns at NAV

Read important investment disclosures

Returns as of 2/28/26 (updated monthly).

Yield as of 2/28/26 (updated monthly).

Read important investment disclosures

Returns as of 2/28/26 (updated monthly).

Yield as of 2/28/26 (updated monthly).

Asset Mix

| U.S. Equities0.0% | Non-U.S. Equities0.0% | ||

| U.S. Bonds6.4% | Non-U.S. Bonds0.0% | ||

| Cash & Equivalents |

| U.S. Equities0.0% | |

| Non-U.S. Equities0.0% | |

| U.S. Bonds6.4% | |

| Non-U.S. Bonds0.0% | |

| Cash & Equivalents |

As of 2/28/2026

(updated monthly)

Description

Fund Objective

The investment objective of the fund is to provide you with a way to earn income on your cash reserves while preserving capital and maintaining liquidity. The fund is a government money market fund that seeks to preserve the value of your investment at $1.00 per share.

Fund Statistics

41 days

Weighted Average Maturity

Weighted Average Maturity

62 days

Weighted Average Life

Weighted Average Life

As of 2/28/2026

(updated monthly)

Liquidity, Net Flows & Pricing

| As of Date | Daily Liquid Assets (%) | Weekly Liquid Assets (%) | Net Flows ($) | Market Value NAV ($) |

|---|---|---|---|---|

| 3/10/26 | 66.39 | 84.81 | 9,533,112.20 | 1.0001 |

| 3/9/26 | 65.67 | 84.34 | 62,374,467.09 | 1.0001 |

| 3/6/26 | 66.85 | 83.75 | -2,779,067.28 | 1.0002 |

| 3/5/26 | 66.89 | 83.79 | -25,055,521.80 | 1.0001 |

| 3/4/26 | 67.07 | 86.05 | 10,340,217.72 | 1.0001 |

| 3/3/26 | 66.42 | 84.85 | 11,402,140.33 | 1.0001 |

Fund Facts

| Fund Inception | 5/01/2009 |

|

Fund Assets (millions) As of 2/28/2026

|

$35,146.6 |

|

Shareholder Accounts

Shareholder accounts are as of 1/31/2026

|

1,508 |

|

Regular Dividends Paid |

Monthly |

| Minimum Initial Investment | $1,000 |

|

Capital Gains Paid

|

Dec |

| Fiscal Year-End | Sep |

| Prospectus Date | 12/01/2025 |

| CUSIP | 02630U 77 6 |

| Fund Number | 759 |

Returns

Internal Prompt

-

Month-End Returns as of 2/28/26

-

Quarter-End Returns as of 12/31/25

Month-End Returns as of 2/28/26

Quarter-End Returns as of 12/31/25

-

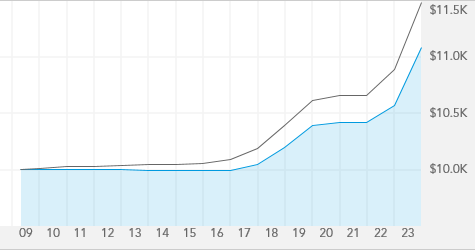

Growth of 10K

-

High & Low Prices

Growth of 10K

Read important investment disclosures

For Class F-3 Shares, this chart tracks a hypothetical investment with dividends reinvested, over the last 20 years, or since inception date if the fund has been in existence under 20 years, through 12/31/2025.

High & Low Prices

For Class F-3 Shares, this chart tracks the high and low prices at NAV for USGXX over the last 20 years, or since inception date if the fund has been in existence under 20 years, through 3/11/2026.

Internal Prompt

|

7-Day SEC Yield

|

7-Day SEC Yield

|

|

| Fund at NAV | 3.38% | 3.32% |

| Fund at MOP | N/A | N/A |

Holdings

Money Market Breakdown

Sectors

| U.S. Treasuries 51.4% | |

| Government Agency Securities 31.1% | |

| Repurchase Agreements 10.8% | |

| Agency Notes & Bonds 6.7% |

% of net assets as of 12/31/2025 (updated monthly)

Top Securities

U.S. Treasury 0% 2/12/2026

4.3%

U.S. Treasury 0% 1/13/2026

3.1%

U.S. Treasury 0% 1/27/2026

2.7%

U.S. Treasury 0% 4/23/2026

2.1%

U.S. Treasury 0% 1/29/2026

2.1%

FED HM LN BK BD 1/9/2022

2.0%

U.S. Treasury 0% 1/15/2026

2.0%

FED HM LN BK BD 2/4/2026

1.9%

FED HM LN BK BD 1/28/2026

1.8%

U.S. Treasury 0% 2/19/2026

1.8%

% of net assets as of 12/31/2025 (updated monthly)

Prices & Distributions

Internal Prompt

-

Historical Prices Month-End

-

Historical Prices Year-End

Historical Prices Month-End

Historical Prices Year-End

| 2017-2026 |

Internal Prompt

-

Historical Distributions as of 03/11/26

Historical Distributions as of 03/11/26

| 2026 |

Daily Dividend Accrual

for Pay Date

for Pay Date

Close

| Rate | As of Date |

|---|---|

| 0.00018597 | 03/02/2026 |

| 0.00009295 | 03/03/2026 |

| 0.00009366 | 03/04/2026 |

| 0.00009283 | 03/05/2026 |

| 0.00009271 | 03/06/2026 |

| 0.00027818 | 03/09/2026 |

| 0.00009268 | 03/10/2026 |

| 0.00009269 | 03/11/2026 |

| Record Date | Calculated Date | Payment Date |

|---|

Current Daily

Dividend Accrual

Dividend Accrual

Close

| Rate | As of-Date | |

|---|---|---|

| 0.00018597 | 03/02/2026 | |

| 0.00009295 | 03/03/2026 | |

| 0.00009366 | 03/04/2026 | |

| 0.00009283 | 03/05/2026 | |

| 0.00009271 | 03/06/2026 | |

| 0.00027818 | 03/09/2026 | |

| 0.00009268 | 03/10/2026 | |

| 0.00009269 | 03/11/2026 |

Fees & Expenses

Internal Prompt

Fees

| Annual Management Fees | 0.26% |

| Other Expenses | 0.04% |

| Service 12b-1 | -- |

As of each fund's most recent prospectus.

Internal Prompt

Expense Ratio

| USGXX | 0.30% |

|

Lipper Instl U.S. Government Money Market

Funds Average

|

0.34% |

Fund as of most recent prospectus.

Lipper Category as of 12/31/25 (updated quarterly).

Resources

Prospectuses & Reports for USGXX

Growth of a hypothetical $10,000 investment

This chart tracks a Class F-3 share investment over the last 20 years, or, since inception date if the fund has been in existence under 20 years.

Annual Returns

For Class F-3 Shares, this chart tracks the total returns since the fund's inception date (Friday, May 1, 2009) through December 31, 2025. Fund returns and, if available, index returns are for calendar years except for the inception year (2009), which may not be a full calendar year. In cases where the index was launched after the fund inception, the index returns are shown in calendar years.

Internal Prompt

Volatility & Returns

Internal Prompt

Volatility & Return chart is not available for funds less than 10 years old.