Portfolios composed to help you focus on what matters

Years of fundamental research, a long-term track record and skilled investment experience are brought together to create the American Funds Portfolio Series.

Objective-based

Pursue a wide range of goals based on time frame, risk tolerance and investor needs.

Trusted

Invest in a blend of funds with proven track records carefully selected by senior investment professionals.

Monitored

Benefit from regular reviews by the Portfolio Solutions Committee to ensure underlying funds and allocations are aligned with fund objectives.

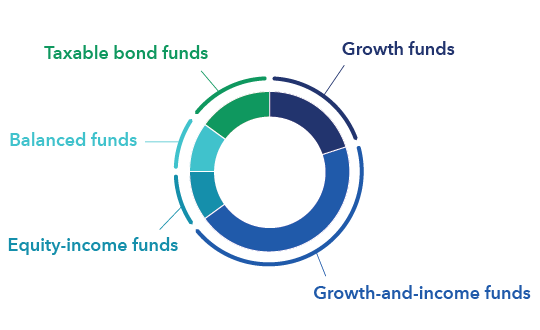

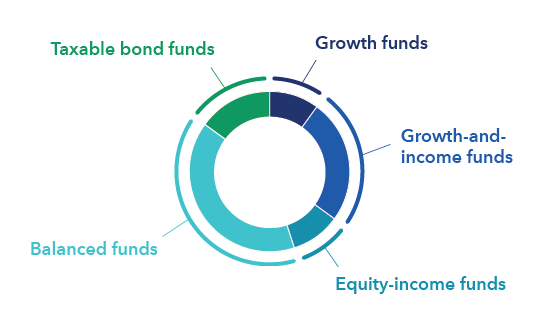

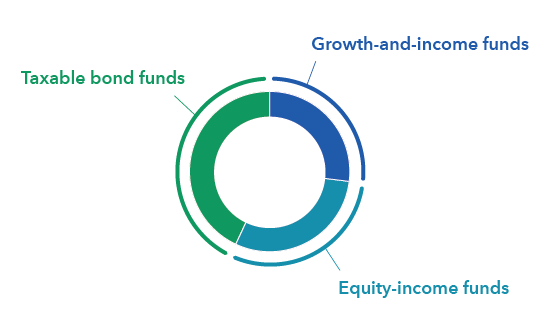

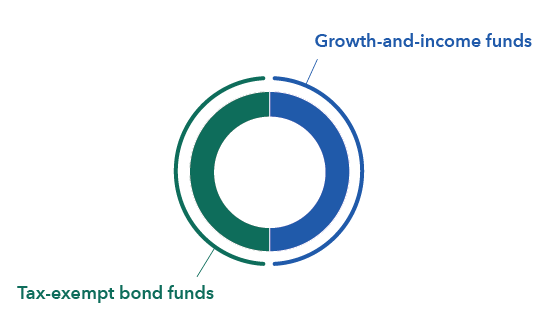

Portfolio series funds

Features & benefits

The American Funds Portfolio Series is designed to help investors pursue long‐term investment success.

Consider what these funds offer:

Flexibility

Easily incorporate the funds into your investment portfolio based on common objectives.

Choice

Portfolios are designed to meet distinct objectives, ranging from growth to preservation, for near-term and long-term goals.

Convenience

Purchase a diversified portfolio in a single transaction.

Portfolio oversight

Your investment, our priority

A group of senior investment professionals with varied backgrounds and investment approaches and decades of industry experience regularly review the funds' results and holdings.

Active management of funds

The Portfolio Solutions Committee may add or remove underlying funds or change the current underlying fund weightings to help the funds meet their objectives.

Staying aligned with your objectives

Investors should meet regularly with their financial professional to determine if their investments continue to meet their needs.

Resources

Our proprietary approach

Our time-tested investment process sets us apart.

Related products

Other resources

Morningstar weighs in on American Funds Portfolio Series

Several of our model portfolios and Portfolio Series funds recently received analyst ratings from Morningstar.