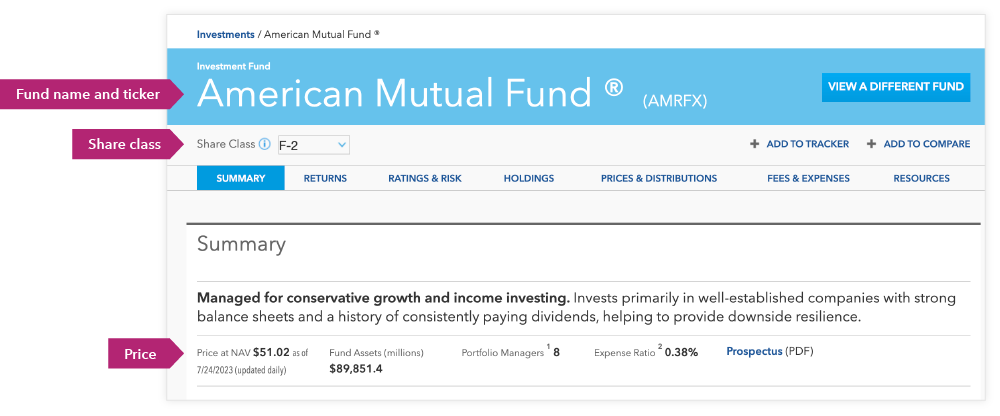

Fund name and ticker

The ticker symbol (the letters after the name) uniquely identifies the fund and its share class. It’s also how brokerages and research sites like Morningstar® identify it. When comparing funds with similar names, it can help you avoid confusion.