As we embark on a new year, the challenges ahead are well defined. Interest rates are elevated. Elections are upcoming. And U.S. stock indexes are near all-time highs. Are these events setting the stage for a disappointing pullback or another bull run?

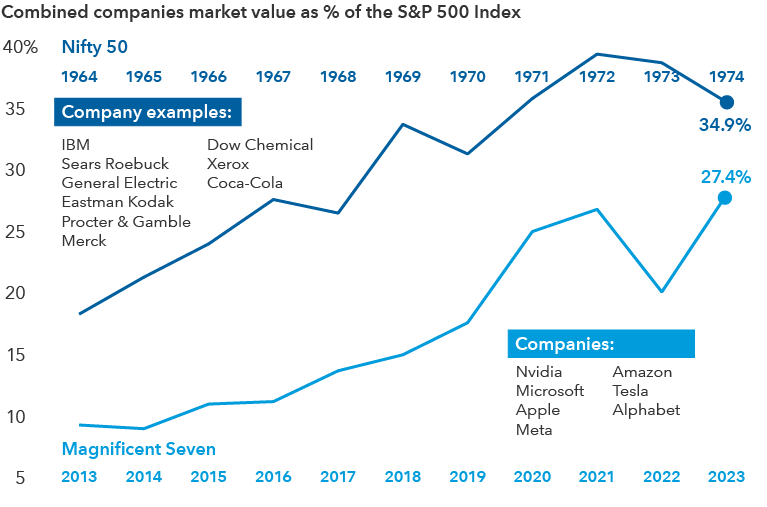

In this wide-ranging Q&A, Rob Lovelace, principal investment officer of New Perspective Fund®, offers his view on where markets are headed, the rise of the Magnificent Seven, the interest rate environment and select investment themes driving his portfolio decisions.