Capital Group Emerging Markets Local Currency Debt Fund (LUX)

Trarre vantaggio dal dinamismo del debito emergente in valuta locale

Da dicembre 2023 [Capital Group Emerging Markets Local Currency Debt Fund (LUX) [Capital Group Euro Bond Fund (LUX)] [Capital Group Global Corporate Bond Fund (LUX)] sono registrati come fondi Articolo 8, in base alla regolamentazione Europea SFDR (Sustainable Finance Disclosure Regulation).

I più recenti avvisi agli azionisti

La sua selezione è stata cambiata, si prega di aggiornare cliccando su "VAI".

Aspettate, per favore. La pagina viene ricaricata...

Risultati

The information in relation to the index is provided for context and illustration only. The fund is an actively managed UCITS. It is not managed in reference to a benchmark.

Past results are not a guarantee of future results.

Prezzo e dividendi

Partecipazioni

Considerazioni sui rischi

Fattori di rischio da prendere in considerazione prima di investire:

- Il presente documento non ha pretesa di fornire consulenza sugli investimenti, né deve essere inteso come raccomandazione personale.

- Il valore degli investimenti e il reddito da essi derivante possono sia aumentare che diminuire ed è possibile perdere una parte o la totalità dell’investimento iniziale.

- Se la valuta in cui si investe si apprezza nei confronti della valuta in cui sono denominati gli investimenti sottostanti del fondo, il valore dell’investimento diminuirà. La copertura valutaria cerca di limitare questo fenomeno, ma non vi è alcuna garanzia che tale copertura sia completamente efficace.

- Alcuni portafogli possono investire in strumenti finanziari derivati a scopo di investimento, copertura e/o efficiente gestione del portafoglio.

- Questo fondo pone ulteriori rischi: Bond Connect, Obbligazioni, CIBM, Controparte, Strumenti derivati, Mercati emergenti, Liquidità, Operativo e Sostenibilità.

Rischi del fondo

Rischio Bond Connect: gli investimenti in obbligazioni cinesi onshore negoziate sul CIBM tramite Bond Connect sono soggetti a diversi rischi associati alla compensazione e al regolamento, nonché ai rischi di liquidità, controparte e normativi.

Rischio obbligazionario: il valore delle obbligazioni può cambiare in seguito alle variazioni dei tassi di interesse. In genere, quando i tassi di interesse aumentano, il valore delle obbligazioni diminuisce. I fondi che investono in obbligazioni sono esposti al rischio di credito. Un deterioramento della solidità finanziaria di un emittente potrebbe far crollare il valore delle sue obbligazioni o renderle prive di valore.

Rischio CIBM: il fondo può investire nel mercato obbligazionario interbancario cinese (China Interbank Bond Market). Questo mercato può essere volatile e soggetto a problemi di liquidità a causa di ridotti volumi di negoziazione. Di conseguenza, il prezzo dei titoli di debito negoziati su questo mercato può subire oscillazioni importanti, gli spread possono essere elevati e i costi di realizzo significativi.

Rischio di controparte: altri istituti finanziari forniscono servizi al fondo, come la custodia degli asset, o possono fungere da controparte nell’ambito di contratti finanziari come ad esempio i derivati. Esiste il rischio che la controparte non adempia ai propri obblighi.

Rischio strumenti derivati: i derivati sono strumenti finanziari che sfruttano un asset sottostante e che possono essere utilizzati a titolo di copertura di esposizioni esistenti o per ottenere un’esposizione economica. Il risultato di uno strumento derivato potrebbe non corrispondere a quanto previsto, registrando perdite superiori al costo del derivato con conseguenti perdite per il fondo.

Rischio mercati emergenti: gli investimenti nei mercati emergenti sono generalmente più sensibili agli eventi di rischio, come le variazioni di contesto economico, politico, fiscale e normativo.

Rischio di liquidità: in condizioni di mercato critiche, alcuni titoli detenuti dal fondo potrebbero non essere in grado di essere venduti al loro pieno valore, o non poter essere venduti affatto. Ciò potrebbe indurre il fondo a rinviare o sospendere i riscatti delle sue azioni, il che significa che gli investitori potrebbero non avere accesso immediato al loro investimento.

Rischio operativo: il rischio di potenziali perdite derivanti dall’inadeguatezza o dalla disfunzione di processi, risorse umane e sistemi interni, oppure da eventi esogeni.

Rischio di sostenibilità: evento o condizione ambientale, sociale o di governance che, se si verifica, potrebbe avere un impatto considerevolmente negativo – effettivo o potenziale – sul valore di un investimento del fondo.

Documentazione

Informative relative alla sostenibilità

Le informative relative alla sostenibilità sono riviste di volta in volta secondo necessità per rilevare eventuali modifiche o revisioni. I termini in maiuscolo sono utilizzati in conformità alle definizioni e ai riferimenti riportati nel Prospetto Capital International Fund.

La sezione "Sintesi" di seguito è stata redatta in inglese ed è stata tradotta in altre lingue ufficiali dello Spazio economico europeo. In caso di incoerenze o conflitti tra le diverse versioni della presente sezione "Sintesi", prevarrà la versione in lingua inglese.

Data

Queste informazioni sono valide alla 15 Dicembre 2023.

Sintesi

Questo Fondo promuove caratteristiche ambientali o sociali, ma non ha come obiettivo un investimento sostenibile.

Il Consulente per gli investimenti individua determinati emittenti o gruppi di emittenti che esclude dal portafoglio per promuovere le caratteristiche ambientali o sociali sostenute dal Fondo. Il Consulente per gli investimenti valuta e applica filtri ESG e basati su norme per implementare le esclusioni sugli emittenti societari e sovrani, in relazione a determinati settori come tabacco, combustibili fossili e armi, nonché alle imprese che violano i principi dello United Nations Global Compact.

A supporto di questo screening, per gli emittenti sovrani, il Consulente per gli investimenti si avvale dell'uso di ricerche proprietarie. Il Consulente per gli investimenti si avvale di dati di istituzioni terze per calcolare i punteggi ESG nell'intero universo sovrano. Questa valutazione evidenzia gli indicatori relativi a vulnerabilità al cambiamento climatico, dimensioni dello sviluppo umano e varie misure di governance. I dati per ciascun emittente vengono analizzati per calcolare i punteggi compositi delle performance ESG sovrane. Sono esclusi dall'universo di investimento del Fondo gli emittenti sovrani le cui performance sono considerate deludenti.

Per gli emittenti societari, il Consulente per gli investimenti si avvale di fornitori terzi che identificano la partecipazione di un emittente ad attività o ai ricavi da esse derivanti che non sono conformi ai filtri ESG e basati su norme. In questo modo, i dati dei fornitori terzi vengono utilizzati per sostenere l'applicazione di filtri ESG e basati su norme da parte del Consulente per gli investimenti. Nel caso in cui le esclusioni non possano essere verificate mediante fornitori terzi, o qualora il Consulente per gli investimenti ritenga che i dati e/o le valutazioni di terzi siano incompleti o inesatti, il Consulente per gli investimenti cercherà di identificare le attività di coinvolgimento delle imprese attraverso valutazioni proprie (utilizzando anche altre fonti di dati di terzi).

La Negative Screening Policy applicata dal Consulente per gli investimenti è reperibile all'indirizzo:

https://www.capitalgroup.com/content/dam/cgc/tenants/eacg/negative-screening-policy.pdf

Il Fondo promuove, tra gli altri criteri, quelli ambientali e sociali, a condizione che le società in cui vengono effettuati gli investimenti seguano prassi di buona governance. Le prassi di buona governance sono valutate nell'ambito del processo di integrazione ESG del Consulente per gli investimenti. Tali prassi vengono valutate attraverso un processo di monitoraggio. Ove necessario, viene condotta anche un'analisi fondamentale di una serie di metriche di governance che coprono aree come le prassi di audit, la composizione del consiglio e la retribuzione dei dirigenti, tra le altre.

Le informazioni sui principi di corporate governance di Capital Group sono disponibili anche nelle Procedure e principi di voto per delega. La Dichiarazione sulla politica ESG fornisce ulteriori dettagli sulle valutazioni di Capital Group riguardanti questioni ESG specifiche, tra cui condotta etica, informative e corporate governance, ed è disponibile su:

https://www.capitalgroup.com/content/dam/cgc/tenants/eacg/esg/files/esg-policy-statement(en).pdf

La Negative Screening Policy di Capital Group si applicherà all'intero portafoglio, ad eccezione della liquidità, dei mezzi equivalenti e dei fondi del mercato monetario. I derivati su indici utilizzati a fini di copertura e/o di investimento non saranno valutati su base "look-through". Pertanto, potrebbero verificarsi circostanze in cui il Fondo può acquisire esposizione indiretta a un emittente coinvolto nelle categorie escluse (attraverso, a titolo esemplificativo ma non esaustivo, derivati e strumenti che danno esposizione a un indice). I derivati single-name dovranno essere conformi alla Negative Screening Policy. Il Consulente per gli investimenti si assicurerà che la garanzia ricevuta sia allineata alla politica.

L'allocazione delle attività pianificata viene monitorata costantemente e valutata con cadenza annuale.

Per misurare il rispetto delle caratteristiche ambientali e/o sociali promosse, il Fondo prende in considerazione i seguenti principali effetti negativi (PAI) sui fattori di sostenibilità:

- Principale effetto negativo 4 sull'esposizione a imprese attive nel settore dei combustibili fossili.

- Principale effetto negativo 10 sulle violazioni dei principi dello United Nations Global Compact.

- Principale effetto negativo 14 sulle armi controverse.

Le esclusioni sono identificate principalmente attraverso un fornitore terzo, MSCI ESG Business Involvement Screening Research ("MSCI ESG"). Tra le altre fonti di dati figurano le violazioni dell'MSCI United Nations Global Compact.

La metodologia e le fonti relative alle esclusioni e all'approccio di integrazione ESG nel loro complesso sono soggette ad alcune limitazioni.

I membri dei team preposti alla conformità, alla gestione del rischio e al controllo interno di Capital Group conducono valutazioni periodiche sulla progettazione e sull'efficacia operativa delle attività ESG della società e sui controlli chiave. Il dialogo con le imprese è parte integrante del servizio di gestione degli investimenti del Consulente per gli investimenti rivolto ai clienti. Ciò consente all'impresa di impegnarsi e generare un dialogo su qualsiasi problema che potrebbe influire sulle prospettive a lungo termine, comprese le esposizioni a questioni di sostenibilità.

Il Fondo non ha designato un indice di riferimento per il conseguimento delle caratteristiche ambientali e/o sociali che promuove.

Nessun obiettivo di investimento sostenibile

Questo Fondo promuove caratteristiche ambientali o sociali, ma non ha come obiettivo un investimento sostenibile. Il Fondo non effettua investimenti sostenibili.

Caratteristiche ambientali o sociali del prodotto finanziario

Le caratteristiche ambientali e/o sociali promosse dal Fondo sono descritte di seguito.

In aggiunta all'integrazione dei rischi di sostenibilità nell'ambito del processo decisionale di investimento del Consulente per gli investimenti, il Fondo valuta e applica filtri ESG e basati su norme per implementare le esclusioni sugli emittenti societari e sovrani. Nell'applicare questi filtri, il Fondo prende in considerazione il Principale effetto negativo 4 sull'esposizione a imprese attive nel settore dei combustibili fossili, il Principale effetto negativo 10 sulle violazioni dei principi dello United Nations Global Compact e il Principale effetto negativo 14 sulle armi controverse.

Il Consulente per gli investimenti può selezionare gli investimenti nella misura in cui siano in linea con la Negative Screening Policy.

Al fine di raggiungere le caratteristiche ambientali o sociali promosse dal Fondo, non è stato designato alcun indice di riferimento.

Strategia di investimento

Il Fondo valuta e applica filtri ESG e basati su norme per implementare le esclusioni sugli emittenti societari e sovrani. Il Consulente per gli investimenti valuta e applica filtri ESG e basati su norme per implementare le esclusioni sugli emittenti societari, in relazione a determinati settori come tabacco, combustibili fossili e armi, nonché alle imprese che violano i principi dello United Nations Global Compact. Nell'applicare questi filtri, il Fondo prende in considerazione il Principale effetto negativo 4 sull'esposizione a imprese attive nel settore dei combustibili fossili, il Principale effetto negativo 10 sulle violazioni dei principi dello United Nations Global Compact e il Principale effetto negativo 14 sulle armi controverse.

A supporto di questo screening, per gli emittenti sovrani, il Consulente per gli investimenti si avvale dell'uso di ricerche proprietarie. Il Consulente per gli investimenti si avvale di dati di istituzioni terze per calcolare i punteggi ESG nell'intero universo sovrano. Questa valutazione evidenzia gli indicatori relativi a vulnerabilità al cambiamento climatico, dimensioni dello sviluppo umano e varie misure di governance. I dati per ciascun emittente vengono analizzati per calcolare i punteggi compositi delle performance ESG sovrane. Sono esclusi dall'universo di investimento del Fondo gli emittenti sovrani le cui performance sono considerate deludenti.

Per gli emittenti societari, il Consulente per gli investimenti si avvale di fornitori terzi. In questo modo, i dati dei fornitori terzi vengono utilizzati per sostenere l'applicazione di filtri ESG e basati su norme da parte del Consulente per gli investimenti. I fornitori terzi forniscono un profilo del coinvolgimento di ogni impresa in attività specifiche o dei ricavi derivanti da tali attività, che non sono conformi ai filtri ESG e basati su norme applicati al Fondo.

La Negative Screening Policy applicata dal Consulente per gli investimenti è reperibile all'indirizzo:

https://www.capitalgroup.com/content/dam/cgc/tenants/eacg/negative-screening-policy.pdf

Il Fondo promuove, tra gli altri criteri, quelli ambientali e sociali, a condizione che le società in cui vengono effettuati gli investimenti seguano prassi di buona governance. Le prassi di buona governance sono valutate nell'ambito del processo di ammissibilità del Consulente per gli investimenti. Tali prassi vengono valutate attraverso un processo di monitoraggio. Ove necessario, viene condotta anche un'analisi fondamentale di una serie di metriche che coprono le prassi di audit, la composizione del consiglio e la retribuzione dei dirigenti, tra le altre. Il Consulente per gli investimenti si confronta inoltre periodicamente con le imprese in materia di corporate governance ed esercita i propri diritti di voto per delega nelle entità in cui investe il Fondo.

La Dichiarazione sulla politica ESG di Capital Group fornisce ulteriori dettagli sulle valutazioni di Capital Group riguardanti questioni ESG specifiche, tra cui condotta etica, informative e corporate governance. Le informazioni sui principi di corporate governance di Capital Group sono disponibili nelle Procedure e principi di voto per delega, nonché nella Dichiarazione sulla politica ESG.

Ulteriori dettagli sono disponibili nella Dichiarazione sulla politica ESG su:

https://www.capitalgroup.com/content/dam/cgc/tenants/eacg/esg/files/esg-policy-statement(en).pdf

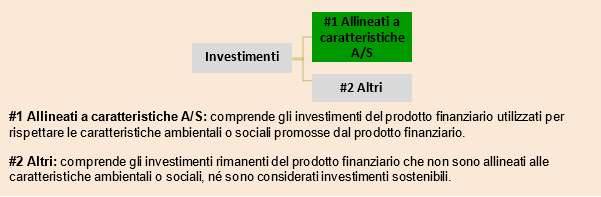

Quota degli investimenti

Generalmente, almeno il 90% degli investimenti del Fondo in titoli trasferibili al momento dell'acquisto viene utilizzato per rispettare le caratteristiche ambientali o sociali promosse dal Fondo (in base alla Negative Screening Policy e alle restrizioni alle emissioni di carbonio, quali elementi vincolanti stabiliti dal Consulente per gli investimenti) e un massimo del 10% degli investimenti del Fondo in titoli trasferibili rientra nella categoria "#2 Altri", quindi non può essere utilizzato per rispettare le caratteristiche ambientali o sociali promosse dal Fondo e pertanto non è allineato.

La Negative Screening Policy del Fondo si applicherà all'intero portafoglio, ad eccezione della liquidità, dei mezzi equivalenti e dei fondi del mercato monetario.

L'allocazione delle attività pianificata viene monitorata costantemente e valutata con cadenza annuale.

Monitoraggio delle caratteristiche ambientali o sociali

La Negative Screening Policy è un indicatore di sostenibilità utilizzato dal Fondo per misurare il rispetto di ciascuna delle caratteristiche ambientali o sociali che promuove.

Per misurare il rispetto delle caratteristiche ambientali e/o sociali promosse, il Fondo prende in considerazione i seguenti principali effetti negativi (PAI) sui fattori di sostenibilità:

- Principale effetto negativo 4 sull'esposizione a imprese attive nel settore dei combustibili fossili.

- Principale effetto negativo 10 sulle violazioni dei principi dello United Nations Global Compact.

- Principale effetto negativo 14 sulle armi controverse.

Il Fondo applica regole restrittive sugli investimenti al momento dell'acquisto, prima della negoziazione nei sistemi di gestione del portafoglio per limitare l'investimento in imprese o emittenti sulla base dei criteri di esclusione. Il portafoglio viene inoltre sottoposto a controlli di conformità regolari/sistematici dopo la negoziazione.

A supporto di questo screening, per gli emittenti sovrani, il Consulente per gli investimenti si avvale dell'uso di ricerche proprietarie. Il Consulente per gli investimenti si avvale di dati di istituzioni terze per calcolare i punteggi ESG nell'intero universo sovrano. Questa valutazione evidenzia gli indicatori relativi a vulnerabilità al cambiamento climatico, dimensioni dello sviluppo umano e varie misure di governance. I dati per ciascun emittente vengono analizzati per calcolare i punteggi compositi delle performance ESG sovrane. Sono esclusi dall'universo di investimento del Fondo gli emittenti sovrani le cui performance sono considerate deludenti.

Per gli emittenti societari, il Consulente per gli investimenti si avvale di fornitori terzi. In questo modo, i dati dei fornitori terzi vengono utilizzati per sostenere l'applicazione di filtri ESG e basati su norme da parte del Consulente per gli investimenti. I fornitori terzi forniscono un profilo del coinvolgimento di ogni impresa in attività specifiche o dei ricavi derivanti da tali attività, che non sono conformi ai filtri ESG e basati su norme applicati al Fondo.

Nel caso in cui le esclusioni non possano essere verificate mediante fornitori terzi, o qualora il Consulente per gli investimenti ritenga che i dati e/o le valutazioni di terzi siano incompleti o inesatti, il Consulente per gli investimenti cercherà di identificare le attività di coinvolgimento delle imprese attraverso valutazioni proprie (tra cui anche fonti di dati di terzi). Per ulteriori dettagli, consultare la Negative Screening Policy del Fondo.

Metodologie

Il Fondo implementa un criterio vincolante relativo all'ESG: filtri basati su settori e su norme sotto forma di esclusioni.

La classificazione SFDR è relativa al regolamento dell'Unione europea e non equivale ad approvazione o a riconoscimento come Fondo ESG da parte delle autorità di regolamentazione della regione Asia-Pacifico.

I filtri negativi sono allineati ai due PAI sopra elencati.

Fonti e trattamento dei dati

Le esclusioni sono identificate principalmente attraverso un fornitore terzo, MSCI ESG Business Involvement Screening Research ("MSCI ESG"). Tra le altre fonti di dati figurano le violazioni dell'MSCI United Nations Global Compact.

Capital Group riesamina periodicamente la qualità delle prestazioni delle organizzazioni dei fornitori di servizi e conduce attività di monitoraggio continuo e di dovuta diligenza commisurate all'importanza dei servizi forniti.

La Negative Screening Policy del Fondo applicata è reperibile all'indirizzo:

https://www.capitalgroup.com/content/dam/cgc/tenants/eacg/negative-screening-policy.pdf

Limitazioni delle metodologie e dei dati

La metodologia e le fonti relative alle esclusioni e all'approccio di integrazione ESG nel loro complesso sono soggette ad alcune limitazioni. Al fine di identificare tutte le imprese quotate in borsa che sono coinvolte in attività quali la produzione di prodotti controversi e i cui ricavi derivano da attività incoerenti con i filtri ESG e basati su norme, il Fondo utilizza i dati di fornitori terzi. Nel caso in cui i dati non possano essere ottenuti mediante fornitori terzi, o qualora il Consulente per gli investimenti ritenga che i dati e/o le valutazioni di terzi siano incompleti o inesatti, il Consulente per gli investimenti cercherà di identificare le attività di coinvolgimento delle imprese attraverso valutazioni proprie (utilizzando anche altre fonti di dati di terzi).

Dovuta diligenza

I membri dei team preposti alla conformità, alla gestione del rischio e al controllo interno di Capital Group conducono valutazioni periodiche sulla progettazione e sull'efficacia operativa delle attività ESG della società e sui controlli chiave. Ciò include il rispetto dei processi e delle procedure interne, nonché del panorama normativo nelle giurisdizioni in cui opera l'impresa. Capital Group incontra regolarmente i fornitori di dati terzi per esaminare la qualità dei servizi forniti.

Inoltre, sono in atto controlli pre- e post-negoziazione, come descritto in maggiore dettaglio nella sezione "Monitoraggio delle caratteristiche ambientali o sociali" di cui sopra.

Politiche di impegno

Il dialogo con le imprese è parte integrante del servizio di gestione degli investimenti del Consulente per gli investimenti rivolto ai clienti. I team di investimento di Capital Group si incontrano regolarmente con la direzione aziendale, compresi i direttori esecutivi e non esecutivi, i presidenti e i direttori finanziari. Ciò consente all'impresa di impegnarsi e generare un dialogo su qualsiasi problema che potrebbe influire sulle prospettive a lungo termine, comprese le esposizioni a questioni di sostenibilità.

Qualora i team di investimento di Capital Group individuino un problema rilevante per il valore a lungo termine di un'impresa o la relativa performance ESG desti preoccupazione, i professionisti di investimento e i team di governance di Capital Group si impegneranno con la direzione della relativa impresa. La risposta della direzione e le misure adottate per ridurre al minimo i rischi associati, costituiscono una parte importante della valutazione di Capital Group della qualità gestionale, che è di per sé un fattore chiave nelle decisioni di selezione dei titoli.

Indice di riferimento designato

Il Fondo non ha designato un indice di riferimento per il conseguimento delle caratteristiche ambientali e/o sociali che promuove.