Capital Group Global Bond Fund (LUX)

Establecemos vínculos entre los mercados de renta fija global y la deuda de alta calificación

Desde el 22 de septiembre de 2025, el fondo Capital Group Global Bond Fund (LUX) está clasificado como un fondo artículo 8 según el Reglamento Europeo de Divulgación de Finanzas Sostenibles (SFDR, por sus siglas en inglés).

Information: Changes to the distribution policy of share classes of the Funds with fixed distribution policies. For more details, read here.

Últimas notificaciones a los accionistas

Your selection has changed, please hit "GO" to refresh.

Please wait. Page is being reloaded...

La información relativa al índice se proporciona únicamente a título ilustrativo y de contexto. El fondo se gestiona de manera activa. Su gestión no está vinculada a un índice de referencia.

Los resultados históricos no son indicativos de los resultados futuros.

Precio y dividendos

Cartera

Consideraciones de riesgo

Factores de riesgo que han de tenerse en cuenta antes de invertir:

- El presente documento no pretende ofrecer un consejo de inversión y no debe ser considerado como una recomendación.

- El valor de las inversiones y sus respectivos dividendos puede subir o bajar y es posible que los inversores no recuperen los importes invertidos inicialmente.

- Los resultados históricos no son indicativos de los resultados futuros.

- Si la divisa en la que invierte se fortalece frente a la divisa en la que se realizan las inversiones subyacentes del fondo, el valor de su inversión disminuirá. La cobertura de divisas trata de limitar esto, pero no hay garantía de que dicha cobertura sea completamente eficaz.

- Algunas carteras pueden invertir en instrumentos financieros derivados con fines de inversión, cobertura y/o gestión eficiente de la cartera.

- Este fondo lleva asociados ciertos riesgos adicionales de ABS y MBS, Bond Connect, Bonos, Mercado Interbancario de Bonos de China (CIBM), Contraparte, Instrumentos derivados, Mercados emergentes, Liquidez y Operativo.

Riesgos del fondo

Riesgo de ABS y MBS: el fondo puede invertir en bonos de titulización (ABS) y de titulización hipotecaria (MBS). Los prestatarios subyacentes de estos títulos podrían no devolver íntegramente la cantidad que adeudan, lo que puede ocasionar pérdidas al fondo.

Riesgo de Bond Connect: la inversión en bonos de China continental que se negocian en el Mercado Interbancario de Bonos de China (CIBM) a través del programa Bond Connect está sujeta a varios riesgos relacionados con la compensación y liquidación, así como a riesgos de liquidez, normativos y de contraparte.

Riesgo de bonos: el valor de los bonos puede cambiar como consecuencia de las variaciones en los tipos de interés. Normalmente, cuando los tipos de interés suben, el valor de los bonos disminuye. Los fondos que invierten en bonos están expuestos al riesgo de crédito. El deterioro de la situación financiera de un emisor puede reducir el valor de sus bonos o hacer que estos pierdan su valor.

Riesgo del Mercado Interbancario de Bonos de China (CIBM): el fondo puede invertir en el Mercado Interbancario de Bonos de China. Este mercado puede ser volátil y estar sujeto a restricciones de liquidez como consecuencia de los reducidos volúmenes de negociación. Por lo tanto, el precio de los títulos de deuda que se negocian en este mercado puede fluctuar de manera significativa, los diferenciales pueden ser considerables y los costes de realización pueden ser elevados.

Riesgo de contraparte: hay otras instituciones financieras que prestan ciertos servicios al fondo, como la custodia de activos, o que pueden actuar como contraparte en contratos financieros como los derivados. Existe el riesgo de que la contraparte en cuestión no cumpla sus obligaciones.

Riesgo de instrumentos derivados: los derivados son instrumentos financieros cuyo valor se deriva de un activo subyacente y que pueden utilizarse para cubrir exposiciones existentes o para obtener exposición económica. Un instrumento derivado podría no ofrecer los resultados esperados, generar pérdidas superiores al coste del derivado y ocasionar pérdidas al fondo.

Riesgo de mercados emergentes: la inversión en los mercados emergentes suele mostrarse más sensible a ciertos factores de riesgo, como los cambios en el entorno económico, político, fiscal y jurídico.

Riesgo de liquidez: en condiciones de tensión de los mercados, es posible que ciertos títulos incluidos en el fondo no puedan venderse por su valor íntegro o no puedan venderse en absoluto, lo que podría obligar al fondo a aplazar o suspender el reembolso de sus participaciones e impedir que los inversores tuvieran acceso inmediato a su inversión.

Riesgo operativo: riesgo de pérdidas potenciales derivadas de procesos, personas y sistemas internos inadecuados o fallidos o de factores externos.

Documentación

Literatura

FICHAS Y FOLLETO

INFORMACIÓN EN MATERIA DE SOSTENIBILIDAD

La información en materia de sostenibilidad podrá ser revisada según sea necesario oportunamente para recoger cualquier cambio o revisión. Los términos en mayúscula se utilizan de acuerdo con las definiciones y referencias incluidas en el folleto de Capital International Fund.

Capital International Fund – Capital Group Global Bond Fund (LUX) (el «Fondo»)

Identificador de entidad jurídica: 549300LPLX1R6Z33PK70

El siguiente apartado «Resumen» se ha redactado en inglés y se está traduciendo a otros idiomas oficiales del Espacio Económico Europeo. En caso de incoherencia(s) o conflicto(s) entre las distintas versiones de este apartado «Resumen», prevalecerá la versión en lengua inglesa.

Resumen

Sin objetivo de inversión sostenible

Este Fondo promueve características medioambientales o sociales, pero no tiene un objetivo de inversión sostenible.

Características medioambientales o sociales del producto financiero

El Fondo promueve las características medioambientales o sociales excluyendo las inversiones en emisores según criterios ASG y basados en normas.

Estrategia de inversión

CRMC (el «Asesor de inversiones») identifica determinados emisores o grupos de emisores que excluye de la cartera para promover las características medioambientales o sociales que apoya el Fondo. El Asesor de inversiones evalúa y aplica criterios de selección ASG y basados en normas para realizar exclusiones de emisores corporativos y soberanos con respecto a determinados sectores, como los combustibles fósiles y las armas, así como a las empresas que infringen los principios del Pacto Mundial de las Naciones Unidas (la «Política de selección negativa»).

El Fondo promueve, entre otras, características medioambientales y sociales, siempre que las empresas en las que se invierta sigan prácticas de buena gobernanza. Las prácticas de buena gobernanza se evalúan en el marco del proceso de integración ASG del Asesor de inversiones. Al evaluar las prácticas de buena gobernanza, el Asesor de inversiones tendrá en cuenta, como mínimo, las cuestiones que considere pertinentes para los cuatro pilares prescritos de la buena gobernanza (es decir, las estructuras de buena gestión, las relaciones con los trabajadores, la remuneración del personal y el cumplimiento de las obligaciones fiscales). Dichas prácticas se evalúan mediante un proceso de seguimiento. En su caso, también se realiza un análisis fundamental de una serie de parámetros de gobernanza que abarcan ámbitos como las prácticas de auditoría, la composición de los consejos de administración y la remuneración de los ejecutivos, entre otros.

La Política de selección negativa de Capital Group se aplicará a toda la cartera, a excepción de liquidez, los equivalentes a liquidez y los fondos del mercado monetario. Los derivados sobre índices que se utilicen con fines de cobertura y/o inversión no se evaluarán con respecto a la transparencia. Por consiguiente, podría haber circunstancias en las que el Fondo pueda obtener exposición indirecta a un emisor incluido en las categorías excluidas (a través de, entre otros, derivados e instrumentos que ofrezcan exposición a un índice). Los derivados uninominales deberán cumplir la Política de selección negativa. El Asesor de inversiones se asegurará de que las garantías recibidas se ajusten a la política.

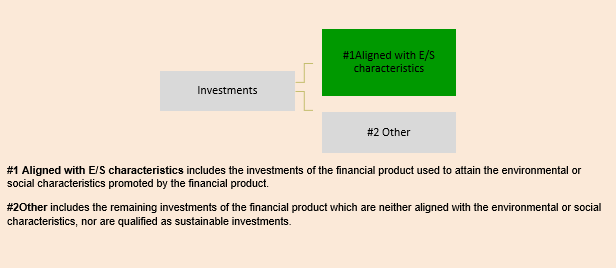

Proporción de inversiones

La asignación de activos prevista se supervisa continuamente y se evalúa anualmente. Al menos el 30% de las inversiones del Fondo se ajustan a características medioambientales o sociales. Un máximo del 70% de las inversiones del Fondo, incluidas las inversiones no ajustadas a las características medioambientales o sociales promovidas, los derivados y/o el efectivo y equivalentes de efectivo se encuentran en la categoría «n.° 2 Otras». El Fondo no se compromete a realizar inversiones sostenibles.

Seguimiento de las características medioambientales o sociales

Los indicadores de sostenibilidad utilizados por este Fondo para medir la consecución de cada una de las características medioambientales o sociales que promueve son los siguientes.

El Asesor de inversiones aplica exclusiones ASG y basadas en normas para adoptar una Política de selección negativa a las inversiones del Fondo. El Fondo supervisará:

• el porcentaje de emisores soberanos que no superan el proceso del Asesor de inversiones de evaluación a los emisores soberanos; y

• el porcentaje de emisores corporativos que no han superado una selección en el marco de la Política de selección negativa.

Métodos

El Fondo aplica un criterio vinculante en materia ASG: selecciones basadas en sectores y en normas mediante exclusiones.

Fuentes y tratamiento de datos

Las exclusiones se determinan principalmente a través de un proveedor externo, MSCI ESG Business Involvement Screening Research («MSCI ESG»). Otros datos son los indicadores del Pacto Mundial de las Naciones Unidas de MSCI y de la huella de carbono de MSCI.

Limitaciones de los métodos y los datos

La metodología y las fuentes relativas a las exclusiones y al enfoque de integración ASG en su conjunto tienen ciertas limitaciones.

Diligencia debida

Los miembros del personal de cumplimiento normativo, gestión de riesgos y auditoría interna de Capital Group realizan evaluaciones periódicas sobre el diseño y la eficacia operativa de las actividades ASG y los controles clave de la empresa.

Políticas de implicación

Entablar un diálogo con las empresas forma parte integrante del servicio de gestión de inversiones que el Asesor de inversiones presta a sus clientes. Esto permite a Capital Group implicarse y entablar un diálogo sobre cualquier cuestión que pueda afectar a las perspectivas a largo plazo de la empresa participada, incluida la exposición a cuestiones de sostenibilidad.

Índice de referencia designado

El Fondo no ha designado un índice de referencia que responda a las características medioambientales y/o sociales que promueve.

Sustainability-related disclosures

The sustainability-related disclosures are meant to be revised as necessary from time to time to capture any changes or reviews. The capitalized terms are used in accordance with the definitions and references outlined in Capital International Fund Prospectus.

Capital International Fund – Capital Group Global Bond Fund (LUX) (the “Fund”)

LEI: 549300LPLX1R6Z33PK70

The below section “Summary” was prepared in English and is being translated to other official languages of the European Economic Area. In case of any inconsistency(ies) or conflict(s) between the different versions of this section “Summary”, the English language version shall prevail.

Summary

No sustainable investment objective

This Fund promotes environmental or social characteristics, but does not have as its objective sustainable investment.

Environmental or social characteristics of the financial products

The Fund promotes the environmental or social characteristics of excluding investments in issuers based on ESG and norms-based criteria.

Investment strategy

CRMC (the “Investment Adviser”) identifies certain issuers or groups of issuers that it excludes from the portfolio to promote the environmental or social characteristics supported by the Fund. The Investment Adviser evaluates and applies ESG and norms-based screening to implement exclusions on corporate and sovereign issuers with respect to certain sectors such as fossil fuel and weapons, as well as companies violating the United Nations Global Compact principles (the “Negative Screening Policy”).

The Fund promotes, among other characteristics, environmental and social characteristics, provided that the companies in which investments are made follow good governance practices. Good governance practices are evaluated as part of the Investment Adviser’s ESG integration process. When assessing good governance practices, the Investment Adviser will, as a minimum, have regard to matters it sees relevant to the four prescribed pillars of good governance (i.e., sound management structures, employee relations, remuneration of staff and tax compliance). Such practices are assessed through a monitoring process. Where relevant, fundamental analysis of a range of governance metrics that cover areas such as auditing practices, board composition and executive compensation, among others, is also conducted.

The Capital Group’s Negative Screening Policy will apply to the entire portfolio, with the exception of cash, cash equivalents and money market funds. Index derivatives that are used for hedging and/or investment purposes will not be assessed on a look–through basis. Therefore, there may be circumstances where the Fund may gain indirect exposure to an issuer involved in the excluded categories (through, including but not limited to, derivatives and instrument that gives exposure to an index). Single-name derivatives will need to be compliant with the Negative Screening Policy. The Investment Adviser will ensure that collateral received is aligned with the policy.

Proportion of investments

The planned asset allocation is monitored continuously and evaluated on a yearly basis. At least 30% of the Fund's investments are aligned with E/S characteristics. A maximum of 70% of the Fund’s investments including investments non-aligned with the E/S characteristics promoted, derivatives and/or cash and cash equivalents are in category “#2 Other”. The Fund does not commit to make any sustainable investments.

Monitoring of environmental or social characteristics

The sustainability indicators used by this Fund to measure the attainment of each of the environmental or social characteristics it promotes are as follows.

The Investment Adviser applies ESG and norms-based exclusions to implement a Negative Screening Policy to the Fund’s investments. The Fund will monitor:

• percentage of sovereign issuers failing the Investment Adviser’s process for assessing sovereigns; and

• percentage of corporate issuers failing a screen under the Negative Screening Policy.

Methodologies

The Fund implements one binding ESG-related criteria: sector- and norms-based screens in the form of exclusions.

Data sources and processing

Exclusions are primarily identified through a third-party provider, MSCI ESG Business Involvement Screening Research (“MSCI ESG”). Other data points include the MSCI United Nations Global Compact and MSCI Carbon Footprint Metrics.

Limitations to methodologies and data

The methodology and sources relating to the exclusions and the ESG integration approach as a whole have certain limitations.

Due diligence

Members of Capital Group's compliance, risk management and internal audit staff conduct periodic assessments on the design and operating effectiveness of the firm’s ESG activities and key controls.

Engagement policies

Establishing dialogue with companies is an integral part of the Investment Adviser’s investment management service to clients. This enables Capital Group to engage and generate dialogue on any issues that could affect the investee company’s long-term prospects, including exposures to sustainability issues.

Designated reference benchmark

The Fund has not designated a reference benchmark to meet the environmental and/or social characteristics it promotes.

No sustainable investment objective

This Fund promotes environmental or social characteristics but does not have as its objective sustainable investment. The Fund does not make any sustainable investments.

Environmental or social characteristics of the financial product

The Fund promotes environmental and social characteristics, provided that the companies in which investments are made follow good governance practices.

The Investment Adviser evaluates and applies ESG and norms-based exclusions to implement a Negative Screening Policy to the Fund’s investments at the time of purchase.

For sovereign issuers, the Investment Adviser conducts an eligibility assessment leveraging its proprietary sovereign ESG framework, which covers a range of ESG indicators to evaluate how well a country manages its ESG risk. The Investment Adviser uses its proprietary sovereign ESG framework to assess the ESG and Governance score of a sovereign issuer against predetermined thresholds.

For corporate issuers, the Investment Adviser relies on third-party providers who identify an issuer’s participation in or the revenue which they derive from activities that are inconsistent with these screens.

The Investment Adviser selects investments to the extent they are in line with the negative screening policy.

Investment strategy

The Investment Adviser applies the following investment strategy to attain the environmental and/or social characteristics promoted.

Negative Screening Policy: The Investment Adviser evaluates and applies ESG and norms-based exclusions to implement a Negative Screening Policy to the Fund’s investments at the time of purchase.

To support this screening on sovereign issuers, the Investment Adviser conducts an eligibility assessment leveraging its proprietary sovereign ESG framework, which covers a range of ESG indicators to evaluate how well a country manages its ESG risk. To be eligible for investment, sovereigns must score above pre-determined thresholds for their proprietary ESG score on both an absolute and GNI-adjusted basis. If the Investment Adviser believes that the third-party data and/or assessment is incomplete or inaccurate, the Investment Adviser reserves the right to identify exclusions for sovereign issuers through its own assessment. The Investment Adviser also periodically reviews sovereign issuers and if a previously eligible sovereign issuer held in the Fund becomes ineligible, the sovereign issuer will not contribute towards the environmental and/or social characteristics of the Fund and the sovereign issuer will generally be sold within six months from the date of such determination, subject to the best interests of investors in the Fund (save that if the Investment Adviser believes that a score is below a pre-defined threshold for a temporary or a transitory reason, the Investment Adviser may, from time to time, exercise its discretion to keep holding or purchase securities issued by the sovereign issuer).

For corporate issuers, the Investment Adviser relies on third party provider(s) who identify an issuer’s participation in or the revenue which they derive from activities that are inconsistent with the ESG and norms-based screens. In this way, third party provider data is used to support the application of ESG and norms-based screening by the Investment Adviser. In the event that exclusions cannot be verified through third-party providers or if the Investment Adviser believes that data and/or assessment is incomplete or inaccurate, the Investment Adviser reserves the right to identify business involvement activities through its own assessment (including by using other third-party data sources). If an eligible corporate issuer held in a Fund subsequently fails a screen, the issuer will not contribute towards the environmental and/or social characteristics of the Fund and will generally be sold within six months from the date of such determination, subject to the best interests of investors in the Fund.

What is the policy to assess good governance practices of the investee companies?

The Investment Adviser ensures that the companies in which investments are made follow good governance practices.

When assessing good governance practices, the Investment Adviser will, as a minimum, have regard to matters it sees relevant to the four prescribed pillars of good governance (i.e., sound management structures, employee relations, remuneration of staff and tax compliance).

As described above, the Investment Adviser applies a Negative Screening Policy to the Fund. As part of this, the Investment Adviser excludes companies that, based on available third-party data, are viewed to be in violation of the principles of the UNGC, which include Principle 10 (anti-corruption) and Principle 3 (employee relations).

In addition, good governance practices are evaluated as part of the Investment Adviser’s ESG integration process. Such practices are assessed through a monitoring process based on available third-party indicators relating to corporate governance and corporate behavior. Third-party data may be inaccurate, incomplete or outdated. Where the corporate governance and corporate behavior indicators cannot be verified through the third-party provider, the Investment Adviser will aim to make such determination through its own assessment based on information that is reasonably available. Where relevant, fundamental analysis of a range of metrics that cover auditing practices, board composition, and executive compensation, among others, is also conducted. The Investment Adviser also engages in regular dialogue with companies on corporate governance issues and exercises its proxy voting rights for the entities in which the Fund invests.

If a previously eligible company held in a Fund subsequently fails the Investment Adviser’s assessment of good governance practices, the company will generally be sold within six months from the date of such determination, subject to the best interests of investors in the Fund.

Capital Group’s ESG Policy Statement provides additional detail on Capital Group’s ESG philosophy, integration, governance, support and processes, including proxy voting procedures and principles, as well as views on specific ESG issues, including ethical conduct, disclosures and corporate governance. Information on Capital Group’s corporate governance principles can be found in its Proxy Voting Procedures and Principles as well as in the ESG Policy Statement.

Information on Capital Group’s corporate governance principles can be also found in its Proxy Voting Procedures and Principles, available on:

The ESG Policy Statement provides additional detail on Capital Group’s views on specific ESG issues, including ethical conduct, disclosures and corporate governance, available on:

http://www.capitalgroup.com/content/dam/cgc/tenants/eacg/esg/files/esg-policy-statement(en).pdf

Proportion of investments

At least 30% of the Fund's investments are in category “#1 Aligned with E/S characteristics” and so are used to attain the environmental or social characteristics promoted by the Fund (being subject to the Investment Adviser’s binding Negative Screening Policy). A maximum of 70% of the Fund’s investments including investments non-aligned with the E/S characteristics promoted, derivatives and/or cash and cash equivalents are in category “#2 Other”.

The Fund does not commit to make any sustainable investments.

Cash and cash-equivalents may be held for liquidity purposes to support the Fund’s overall investment objective

Monitoring of environmental or social characteristics

The sustainability indicators used by this Fund to measure the attainment of each of the environmental or social characteristics it promotes are as follows.

The Investment Adviser applies ESG and norms-based exclusions to implement a Negative Screening Policy to the Fund’s investments. The Fund will monitor:

• percentage of sovereign issuers failing the Investment Adviser’s process for assessing sovereigns; and

• percentage of corporate issuers failing a screen under the Negative Screening Policy.

The Fund applies investment restrictions rules at the time of purchase on a pre-trade basis in portfolio management systems to restrain investment in companies or issuers based on the exclusion criteria. The portfolio also undergoes regular/systematic post-trade compliance checks. The methodology applied to sovereign and corporate issuers respectively in support of this screening is described in detail under the section “Investment Strategy” of this document.

In the event that exclusions cannot be verified through the third-party provider(s) or if the Investment Adviser believes that third party data and/or assessment is incomplete or inaccurate, the Investment Adviser will aim to identify business involvement activities through its own assessment (including third-party data sources). Please refer to Fund’s Negative Screening Policy for further details.

The exclusionary screens are implemented pre-trade and the carbon target is managed and monitored at the aggregate portfolio level. The methodology applied in support of this screening is described in detail under the section “Investment Strategy” of this document.

Methodologies

The Fund implements one binding ESG-related criteria: sector- and norms-based screens in the form of exclusions, with the methodology applied to this commitment having already been presented in detail in the previous sections.

The SFDR classification is related to the European Union’s regulation and is not equivalent to approval or recognition as an ESG Fund by regulators in Asia Pacific.

Data sources and processing

Data sources

The Investment Adviser uses a combination of internal research and third-party data providers to gather ESG-related data.

Third-party providers are used to calculate the carbon footprint of the Fund and for identifying corporate issuers' involvement in activities inconsistent with ESG and norms-based screens. In the event that exclusions cannot be verified through third-party data or if the Investment Adviser believes that third-party data and/or assessment is incomplete or inaccurate, the Investment Adviser reserves the right to identify business involvement activities through its own assessment (including by using other third-party data sources).

Exclusions for sovereign issuers are identified through the Investment Adviser’s proprietary research. The Investment Adviser leverages data from third-party institutions such as the United Nations and the World Bank to calculate ESG scores across the sovereign universe. Sovereign issuers are evaluated on: (1) a gross national income-adjusted basis to better understand how well a country manages ESG risk relative to its wealth and available resources, as well as (2) on an absolute basis. If the Investment Advisor believes that the third-party data and/or assessment is incomplete or inaccurate, the Investment Adviser reserves the right to identify exclusions for sovereign issuers through its own assessment.

Data quality and processing

Capital Group periodically reviews the performance quality of provider organizations and conducts ongoing monitoring and due diligence activities commensurate with the significance of the services provided.

Data are regularly updated in Capital Group’s internal platforms and made available to relevant teams. When issues are identified in third-party data, they are reported back to the provider(s). The Investment Adviser also applies systematic data quality checks to catch discrepancies and validate with the provider when issues arise.

Proportion of data that is estimated

Third-party providers may estimate data. While reported data are prioritized, Capital Group uses estimated data when reported data are unavailable. The proportion of estimated data varies depending on the data point due to inconsistencies in reporting by investee companies.

Limitations to methodologies and data

The methodology and sources relating to the exclusions and the ESG integration approach as a whole have certain limitations. In order to identify all publicly traded companies globally which are involved in activities such as the production of controversial products and revenue derived from activities that are inconsistent with the ESG and norms-based screens, the Fund uses data from third-party provider(s). In the event that data cannot be obtained through third-party providers or if the Investment Adviser believes that third-party data and/or assessment is incomplete or inaccurate, the Investment Adviser will aim to identify business involvement activities through its own assessment (including by using other third-party data sources).

Due diligence

Members of Capital Group's compliance, risk management and internal audit staff conduct periodic assessments on the design and operating effectiveness of the firm’s ESG activities and key controls. This includes compliance with internal processes and procedures as well as with the regulatory landscape in the jurisdictions in which the company operates. Capital Group meets regularly with the third-party data providers to review the quality of the services provided.

Pre-trade and post-trade checks are also in place as further explained in section “Monitoring of environmental or social characteristics” above.

Engagement policies

Establishing dialogue with companies is an integral part of the Investment Adviser’s investment management service to clients. Capital Group’s investment teams meet on a regular basis with company management, including executive and non-executive directors, chairs and finance directors. This enables the company to engage and generate dialogue on any issues that could affect the company’s long-term prospects, including exposures to sustainability issues.

Where Capital Group's investment teams identify an issue material to the long-term value of a company or they are concerned about relative ESG performance, Capital Group's investment professionals and governance teams will engage with management. Management’s response and the steps they take to minimize any associated risks, forms an important part of Capital Group's assessment of management quality, which itself is a key factor in the stock selection decisions.

Designated reference benchmark

The Fund has not designated a reference benchmark to meet the environmental and/or social characteristics it promotes.

Where can more product-specific information be found?

More product-specific information can be found in the pre-contractual template:

https://docs.publifund.com/1_PROSP/LU1577354035/en_LU

More product-specific information can be found in the periodic reports: