Municipal Bonds

Bonds

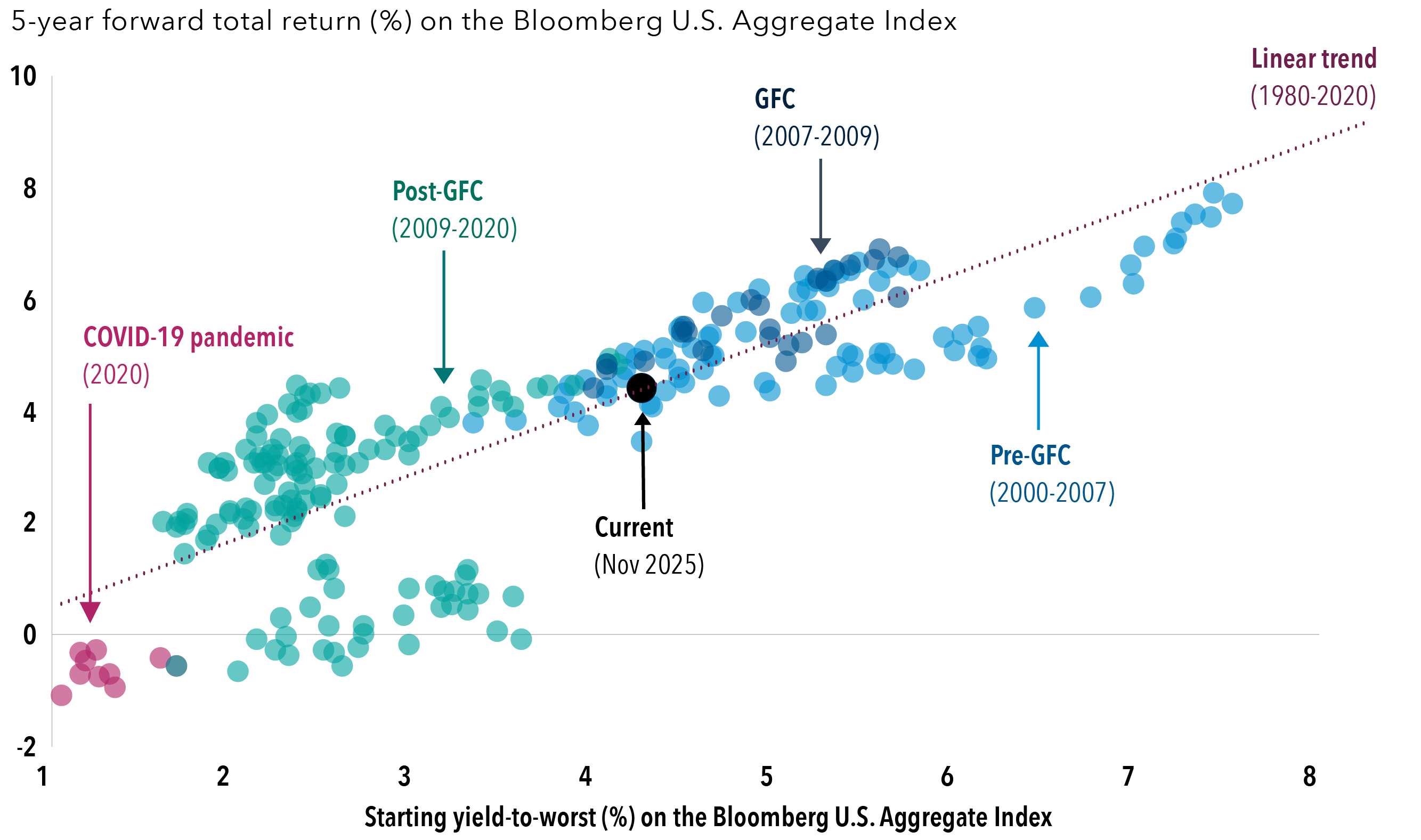

The bond market is riding into 2026 on powerful tailwinds: a resilient economy, strong investments in AI and rate cuts from the Federal Reserve. Yields that remain elevated relative to levels seen in the decade following the global financial crisis also point to solid return potential.

The Bloomberg U.S. Aggregate Index has posted a gain of 7.0% for the year through December 11, its strongest showing since 2020 and a sharp turnaround from losses inflicted by the Fed’s hiking cycle in 2022.

History shows a correlation between starting yields and forward returns

Sources: Capital Group, Bloomberg. Historical 5-year forward returns between 2007 and 2020. Dates for periods shown: Pre-GFC: 1/1/00-4/30/07; GFC: 4/30/07-4/30/09; Post-GFC: 4/30/09-2/28/20; COVID-19 pandemic: 2/28/20-10/31/20. Current yield as of November 30, 2025.

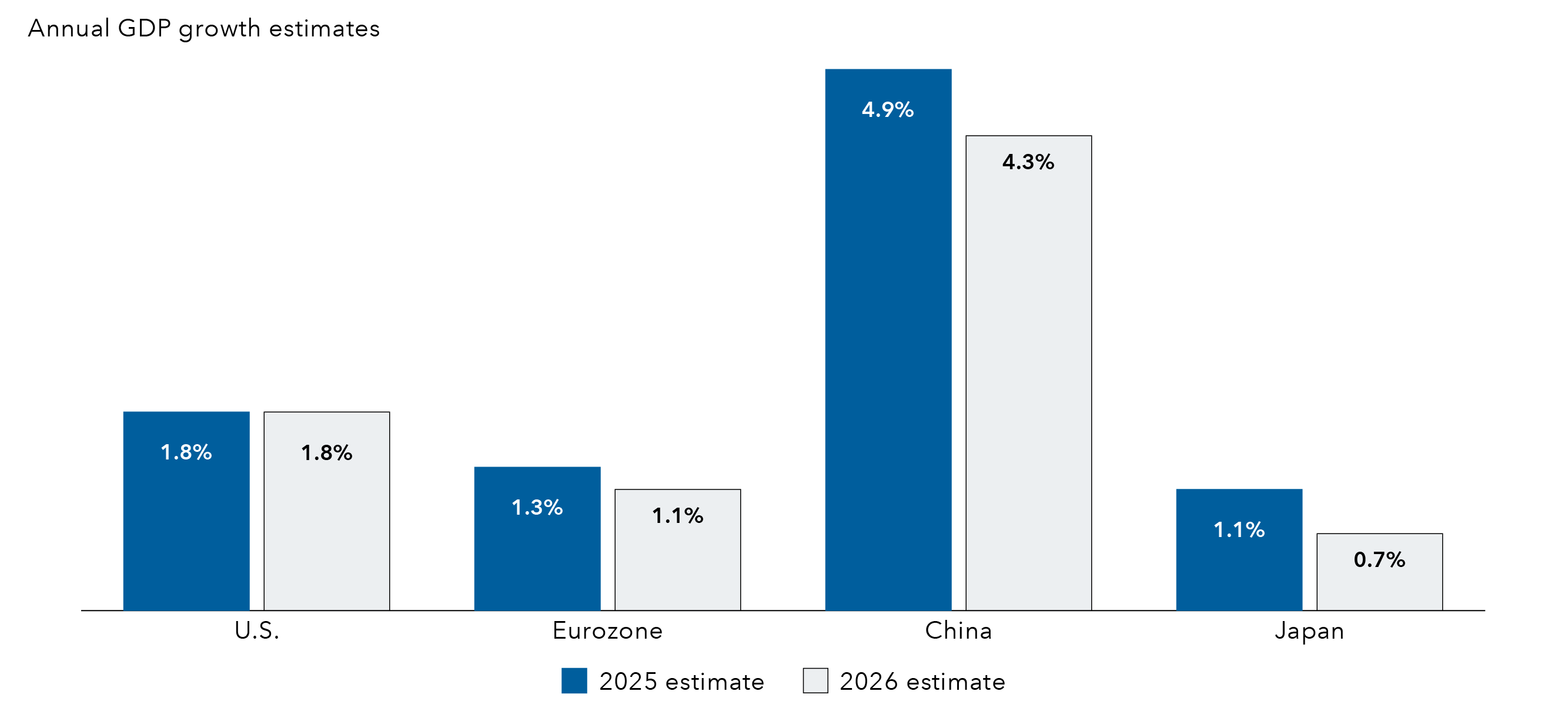

Although headlines may cite tight corporate spreads, we see factors that may help sustain those levels in the coming year. We anticipate global growth will moderate but remain positive in 2026 and potentially reaccelerate in the second half of 2026. Corporate fundamentals appear solid, with profits expected to increase, while AI is promising transformative gains. We remain in the very early stages of AI adoption but the potential boost to U.S. productivity is significant.

Global growth is expected to moderate but stay positive

Sources: Capital Group, LSEG. As of 12/4/25.

Still, U.S. growth could be challenged by political and economic uncertainty. U.S. tariff increases and the reordering of international trade continue to reverberate across the global economy. To date, companies appear to have largely avoided passing on costs to consumers through measures ranging from rerouting trade to drawing down inventories. But we anticipate the stagflationary impacts of these measures will become more evident as tariff policy crystalizes and firms increasingly look to pass a greater degree of costs through to consumers — weighing on corporate investment, labor markets and consumer spending.

A weaker labor market and uneven drivers for growth also pose risks for the U.S. economy. Job growth has slowed, and the economy remains vulnerable if layoffs accelerate. Consumer spending, which is increasingly driven by the high-income cohort, could falter amid rising unemployment or an equity market correction. Meanwhile, uncertainties persist around the sustainability of major drivers like AI-related spending.

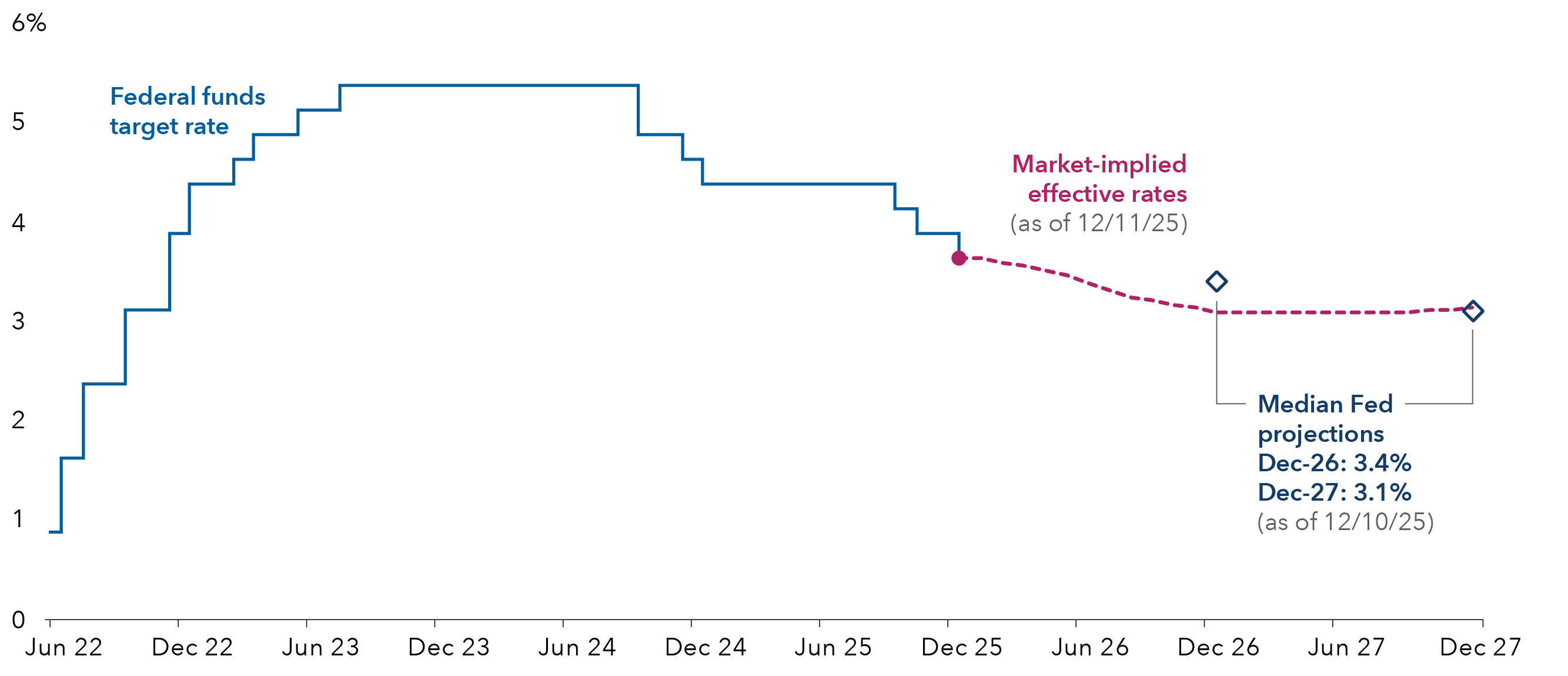

The Fed faces a difficult balancing act as it enters 2026 amid these competing economic forces as well as the divisions between hawkish and dovish members of its policy-setting committee. After delivering a 25-basis-point (bps) cut in December’s meeting, the Fed has suggested that a series of rate cuts is not guaranteed as they monitor inflation pressures. Markets anticipate the fed funds rate will end 2026 around the 3.1% mark, down from its current range of 3.5% to 3.75%. While we see a case for that outcome, we’re watchful for factors like further deterioration in the labor market, political pressures or a reemergence of inflationary pressures that could knock that trajectory off course.

Both the Fed and the market are projecting modest rate cuts in 2026

Sources: Capital Group, Bloomberg, U.S. Federal Reserve. The fed funds target rate shown is the midpoint of the 50 basis point range the Federal Reserve aims for in setting its policy interest rate. Market-implied effective rates are a measure of what the fed funds rate could be in the future and are calculated using fed funds rate futures market data. Median Fed projections are based on the Summary of Economic Projections released by the Federal Open Market Committee on 12/10/25.

Looking across the globe, economic growth may converge while monetary policy diverges. The Eurozone is expected to maintain modest growth though inflation pressures may rise, China is showing signs of stabilizing, Japan remains on the cusp of sustained reflation and emerging markets are providing a potential engine for global growth. There are potential rate hikes on the table for the European Union and Japan, while continued easing appears more likely in the U.K. and across select emerging markets.

Against this backdrop, portfolio managers remain cautious while taking advantage of sectors and issuers with relatively attractive valuations on a risk-adjusted basis. A steepening of the Treasury yield curve (an increase in the difference between long-term and short-term interest rates) remains a high conviction from a rates perspective. On the credit front, corporate fundamentals are solid and technicals are supportive, which may help sustain valuations. At the same time, spread compression across sectors and ratings cohorts present opportunities to move up in quality and reduce risk without sacrificing yield.

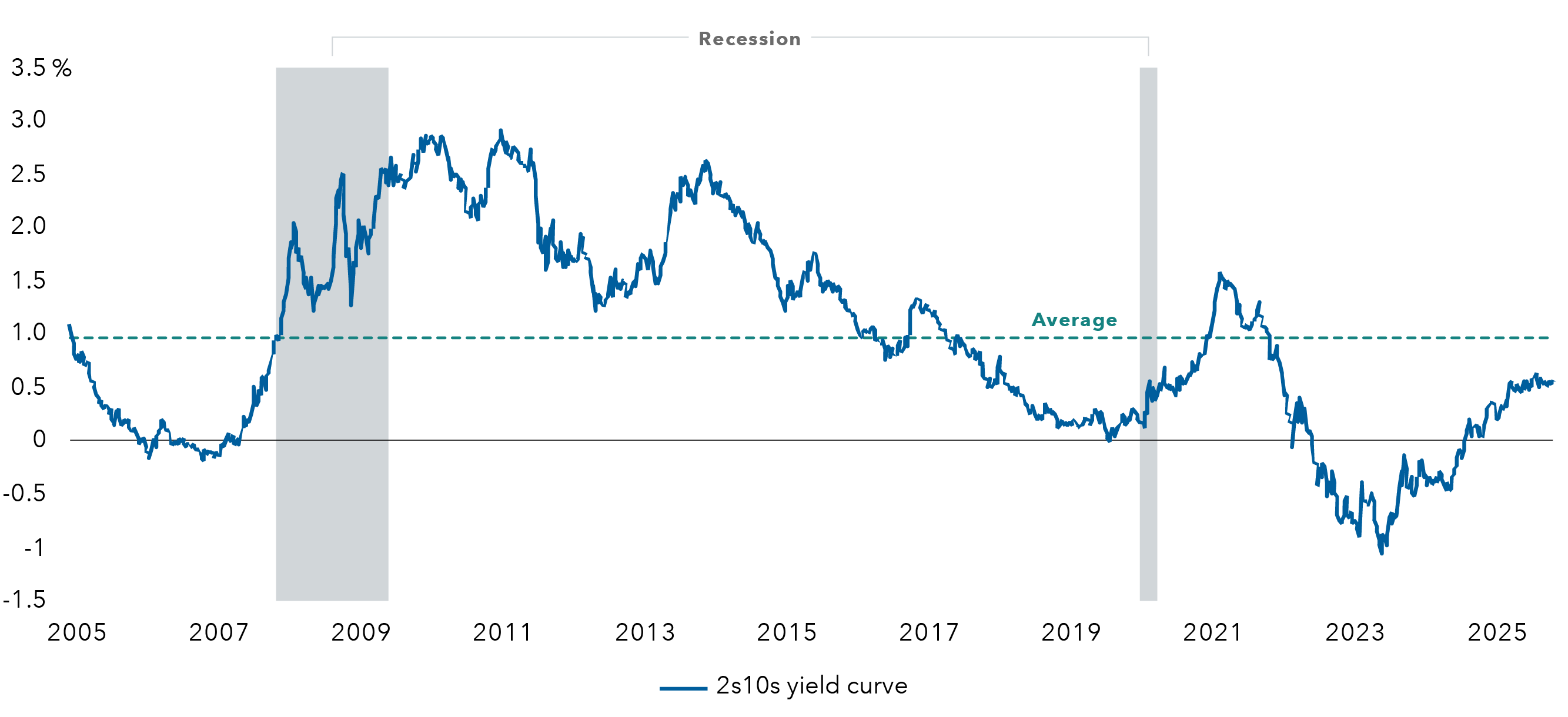

A core conviction: Positioning for curve steepening

Fiscal policies, favorable risk-reward probabilities and attractive valuations suggest that the U.S. Treasury yield curve is more likely to steepen further rather than flatten. Convictions on this view are grounded in forces impacting each end of the curve. For shorter term bonds, yields may decline as labor markets soften further and the Fed adopts a more dovish stance, either in response to higher unemployment or due to a more dovish composition starting in 2026. For longer term bonds, yields may move higher amid fiscal deficit concerns and policy uncertainty that’s challenging the narrative of U.S. exceptionalism. Positioning portfolios in the event the yield curve should steepen may serve as a hedge if recessionary risks rise and the Fed needs to cut more aggressively than currently anticipated.

In terms of implementation, we tend to favor higher exposure to short and intermediate maturities (2–5 years) and lower exposure to the long end (10+ years) relative to benchmarks. Although the curve has steepened in 2025, there is ample room for further steepening given current valuations compared to curve levels typically experienced over a cycle. The belly of the curve (5–10 years) appears particularly expensive. Investors have gravitated to this part of the curve’s higher yields and relatively more carry-friendly profile relative to the shorter end.

The yield curve has room to steepen based on historical levels

Source: Federal Reserve Bank of St. Louis via FRED. Data as of 12/3/25. The 2s10s yield curve represents the 10-year U.S. Treasury yield minus the 2-year U.S. Treasury yield.

The key risk to this curve position is if inflation surprises significantly to the upside and stays elevated, especially if the labor market does not deteriorate further. In that scenario, Fed conversations would likely intensify around the margin for rate cuts relative to the neutral rate of interest, a theoretical rate at which the economy is neither stimulated nor restricted. The more hawkish Fed contingent, which argues that current policy rates are not far above the neutral rate, may be resistant to further cuts.

We expect 10-year Treasuries will trade in a range of about 3.75% to 4.50%, guided by factors including sustained economic growth, elevated fiscal deficits and a cautious Fed. While a sharp economic slowdown or a dramatic inflation spike could push rates outside their current range, neither scenario is our base case. Amid range bound rates, managers will continue to opportunistically add or reduce duration should it reach the outer bounds of the range while positioning for a steeper yield curve is more of a structural position intended to be held over the Fed cutting cycle.

Opportunities in credit despite tight spreads

The coming year may offer broad opportunity across spread sectors as potential rate cuts and sustained growth maintain a supportive backdrop.

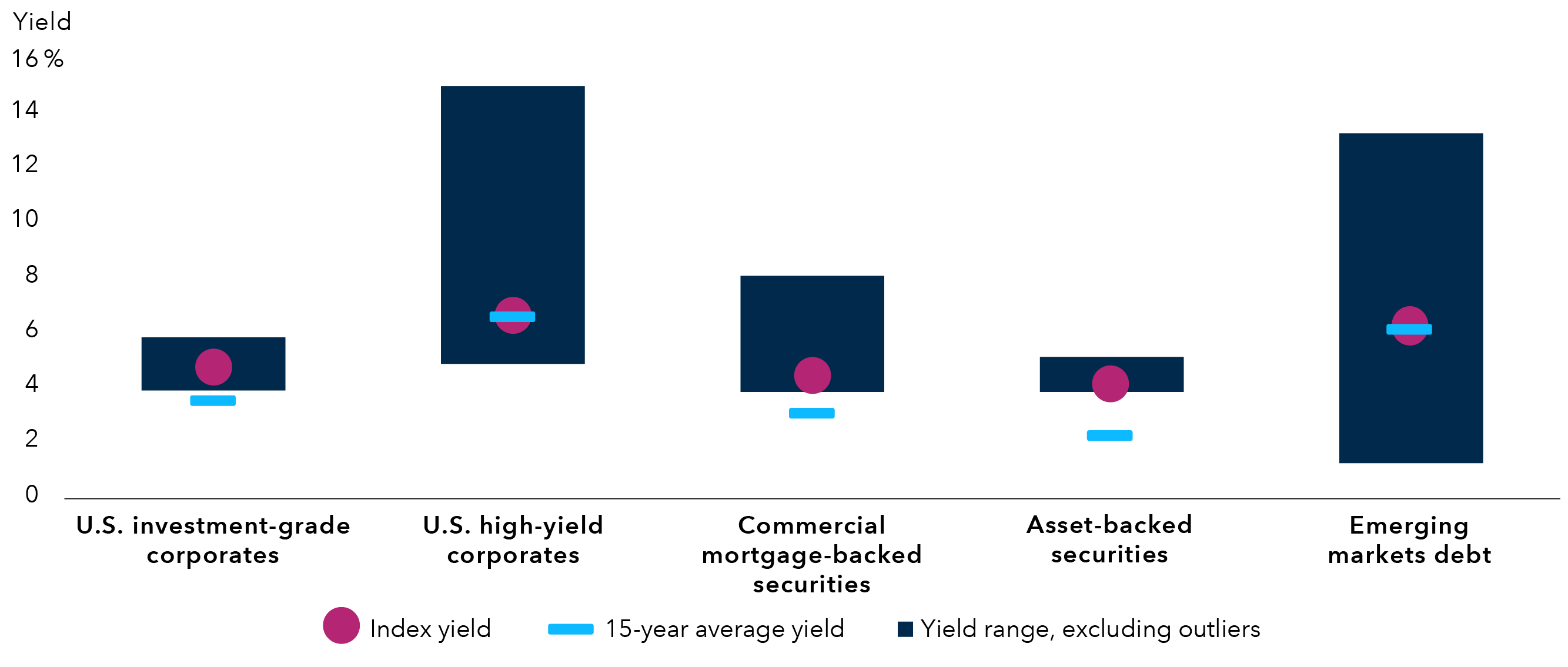

Yields are relatively attractive and dispersion reveals a breadth of opportunity across credit sectors

Sources: Capital Group, Bloomberg, J.P. Morgan. Data as of 11/25/25. Yields shown are yield-to-worst. U.S. investment-grade corporates (BBB/Baa and above) is the Bloomberg U.S. Corporate Investment Grade Index. U.S. high-yield corporates is the Bloomberg U.S. Corporate High Yield 2% Issuer Capped Index. Commercial mortgage-backed securities is the Bloomberg CMBS ERISA-Eligible Index. ABS is the Bloomberg ABS Index. Emerging markets debt is the J.P. Morgan GBI-EM Global Diversified Index. Yield range represents the 5th to 95th percentile of yields in each sector, as of 11/25/25.

Within U.S. corporate credit, resilient fundamentals and strong technicals have sent spreads over Treasuries to their lowest levels in decades. That backdrop may help spreads sustain their tight levels. That said, spreads have relatively limited room to tighten, but much more room to widen in a risk-off environment.

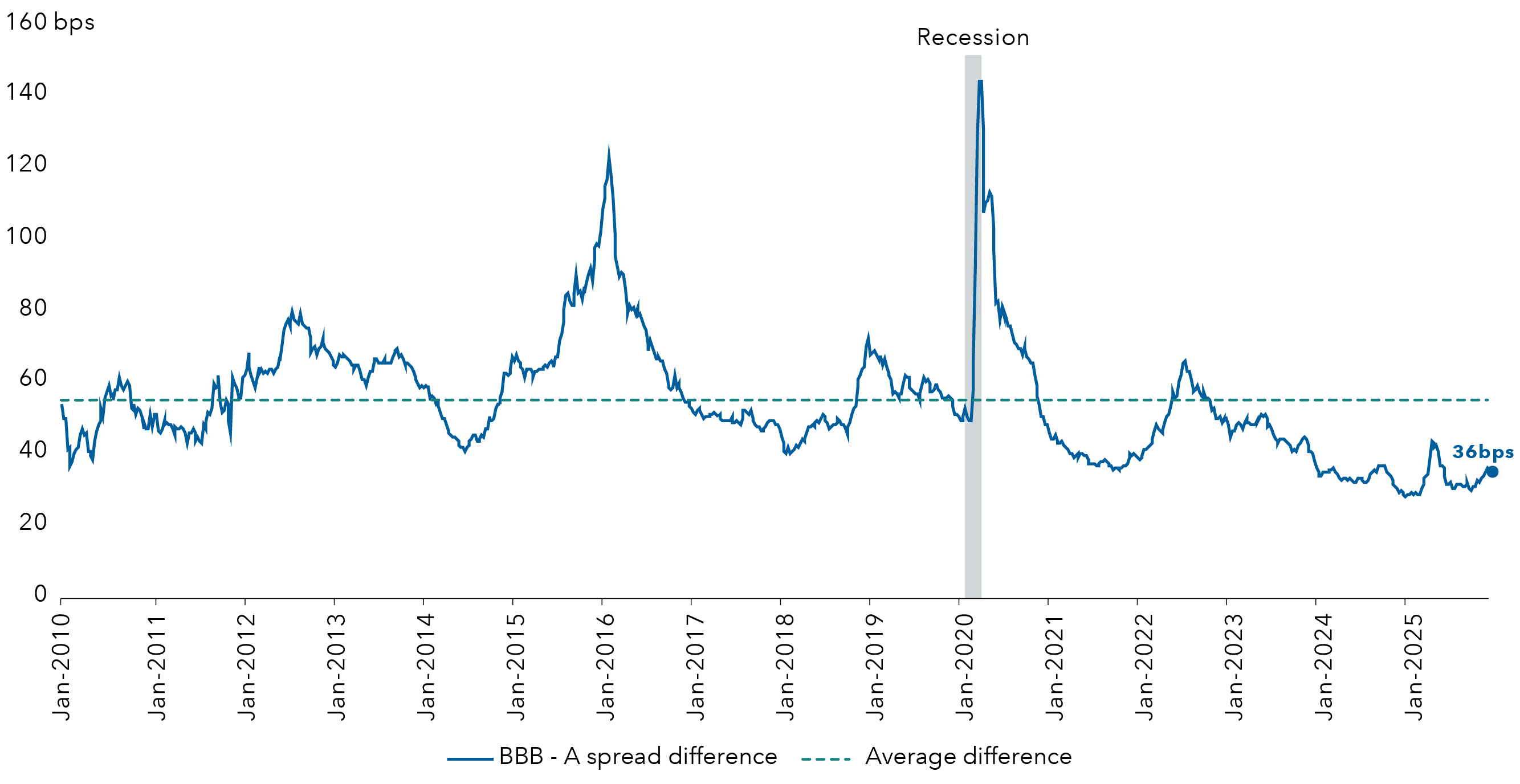

From a fundamental perspective, U.S. investment-grade corporates remain on solid footing. Annual earnings growth for the S&P 500 Index is estimated to rise to 14.2% next year from 11.4% in 2025, according to data from FactSet as of November 30, boding well for corporate health and profitability. From a technical lens, modest supply paired with strong investor demand has underpinned the market. Investment-grade corporate bond spreads have tightened to reach the lowest fifth percentile within the past two decades, even as average credit quality has drifted downward. Premiums to hold riskier debt within the universe have compressed as well, opening the door to a shift into higher quality debt without giving up much yield. Managers are finding opportunities in higher quality issuers within pharmaceuticals, utilities, tobacco, insurance and financials, including European banks.

The spread premium for holding riskier IG bonds has dropped

Source: Bloomberg. Data as of 11/28/25. Figures based on the BBB and A subsets of the Bloomberg U.S. Corporate Investment Grade Index.

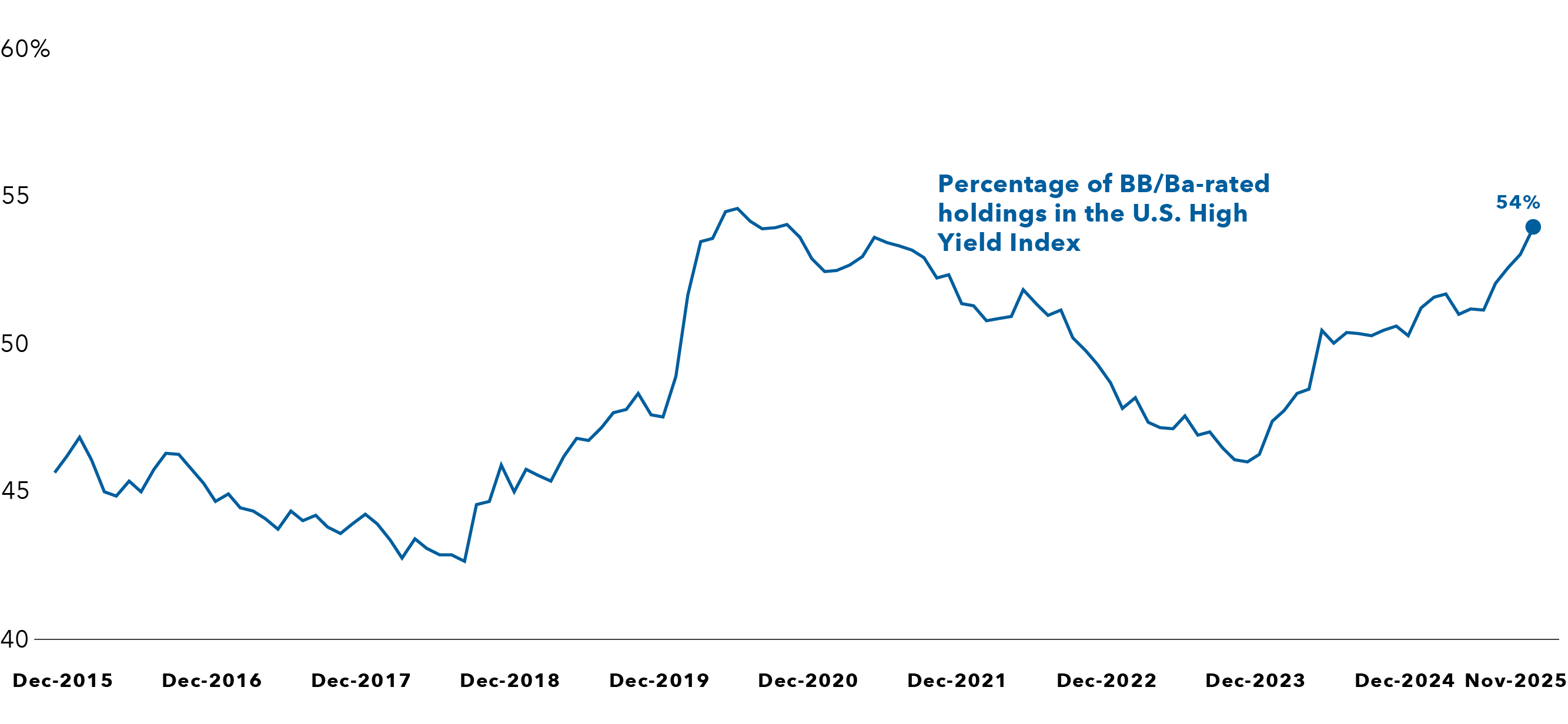

U.S. high-yield corporate fundamentals look relatively attractive as average credit quality has continued to improve over the last decade and default rates have remained relatively low at 3.3% as of October 2025. Balance sheet management and leverage levels remain generally in check. While spreads have tightened to the lowest decile over the past two decades, much of that historic data reflects a market that was less liquid and lower quality than today’s relatively liquid, BB-rated-heavy composition. Also, wider yield dispersion in high-yield corporates versus investment-grade corporates enhances security selection potential. Managers are maintaining a selective approach, favoring issuers within industries like media, cable, and satellite, where mergers and acquisitions are creating opportunities.

High-yield credit quality has trended higher over the past decade

Source: Bloomberg. As of 11/28/25. U.S. high yield represented by the Bloomberg U.S. Corporate High Yield 2% Issuer Capped Index.

Securitized credit remains an attractive area of the market, offering compelling relative value and diversification benefits. Agency mortgage-backed securities (agency MBS) remain somewhat attractive following recent tightening, particularly considering the carry profile and our view that a rangebound rate environment continues. Senior positions in credit risk transfer deals, a type of agency-issued MBS that carry some credit risk, and hybrid adjustable-rate mortgages are attractive. In areas such as commercial mortgage-backed securities, we prefer senior risk, primarily AAA-rated bonds where lower rates are aiding refinancing activity.

High-yielding investments can be found in other pockets of the securitized universe. Within asset-backed securities, seasoned subprime auto exposure — particularly older vintages that are more de-levered — offer incremental yield. Collateralized loan obligations, which are typically backed by pools of corporate loans, also stand out. Our analysts favor the higher rated A- to AA-rated tranches, which appear to offer compelling yields and sufficient protection.

Looking outside the U.S., emerging markets (EM) debt is benefiting from robust economies and central banks with flexibility to further ease policy. The most compelling opportunities lie in local currency bond markets, where attractive real yields, contained inflation and steep yield curves are creating opportunity. Duration exposure is particularly appealing in Latin American markets — especially Brazil, Colombia and Mexico — and select Asian economies, including India, Malaysia and the Philippines. In contrast, hard currency sovereigns offer limited protection against U.S. policy uncertainty or growth concerns. EM corporate credit appears expensive, warranting a highly selective approach.

Spread premiums for holding riskier debt have compressed, creating opportunity to move up in quality without sacrificing much yield. In core and core-plus portfolios, managers are generally favoring agency MBS and other high-quality securitized sectors over corporates on a relative value basis. Spread compression further reinforces the need for careful security selection and a conservative stance, maintaining flexibility to add risk opportunistically should spreads widen.

Within multisector and other credit-driven mandates, security selection is anticipated to be a major driver of alpha across corporate credit, securitized debt and emerging markets debt with a focus on avoiding issuers that could underperform should spreads widen. Yield dispersion within sectors provides opportunity to capture additional upside, particularly in high-yield and EM debt.

Adaptability remains key

As we step into a new year, the bond market remains attractive as a source of returns with strong fundamentals. Sticky inflation, labor market weakness and evolving Fed policy will keep curve dynamics in sharp focus, with steepeners a core conviction. Elevated starting yields offer a strong foundation for returns, while credit markets demand a disciplined, selective approach amid tight spreads. Against this backdrop, adaptability will be key — positioning portfolios with a balanced approach to seeking carry and downside protection as monetary policy and global growth trends unfold.

Past results are not predictive of results in future periods.

There have been periods when the results lagged the index(es) and/or average(s). The indexes are unmanaged and, therefore, have no expenses. Investors cannot invest directly in an index.

Bloomberg U.S. Aggregate Index represents the U.S. investment-grade fixed-rate bond market.

Bloomberg U.S. Corporate High Yield 2% Issuer Capped Index covers the universe of fixed-rate, non-investment-grade debt. The index limits the maximum exposure of any one issuer to 2%.

Bloomberg U.S. Corporate Investment Grade Index represents the universe of investment grade, publicly issued U.S. corporate and specified foreign debentures and secured notes that meet the specified maturity, liquidity and quality requirements.

Bloomberg CMBS Index represents the universe of U.S. commercial mortgage-backed securities.

Bloomberg ABS Index represents the universe of U.S. asset-backed securities.

JP Morgan Government Bond Index – Emerging Markets (GBI-EM) Global Diversified covers the universe of regularly traded, liquid fixed-rate, domestic currency emerging market government bonds to which international investors can gain exposure.

S&P 500 Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks.

Bond ratings, which typically range from AAA/Aaa (highest) to D (lowest), are assigned by credit rating agencies such as Standard & Poor's, Moody's and/or Fitch, as an indication of an issuer's creditworthiness.

A spread over Treasuries is the difference between the yield of a bond and the yield of a similar maturity Treasury bond.

Duration measures a bond’s sensitivity to changes in interest rates. Generally speaking, a bond's price will go up 1% for every year of duration if interest rates fall by 1% or down 1% for every year of duration if interest rates rise by 1%.

Stagflation is an economic condition characterized by slowing economic growth, high unemployment and rising prices that occur simultaneously.

Carry refers to the income or cost from holding an investment.

Risk-off environment refers to a market environment where investors prioritize the preservation of capital over seeking higher returns, usually due to heightened economic concerns or uncertainty.

Alpha is a measure of an investment's performance that indicates its ability to generate returns in excess of its benchmark.

Don't miss our latest insights.

Our latest insights

RELATED INSIGHTS

-

Municipal Bonds

-

Global Equities

-

Long-Term Investing

Don’t miss out

Get the Capital Ideas newsletter in your inbox every other week

Chit Purani

Chit Purani

Damien McCann

Damien McCann

Xavier Goss

Xavier Goss