Liability-Driven Investing

EXPLORE

LIABILITY-DRIVEN INVESTING

Capital Group’s Institutional Solutions team provides strategic solutions to unique pension challenges to help limit downside risk

At a glance: Institutional Solutions at Capital Group

- Capital Group is a privately held global investment manager founded in 1931

- Our scale and private ownership enable significant analytic and investment resources and thought leadership for fixed income and Institutional Solutions — a direct benefit for Institutional Solutions clients

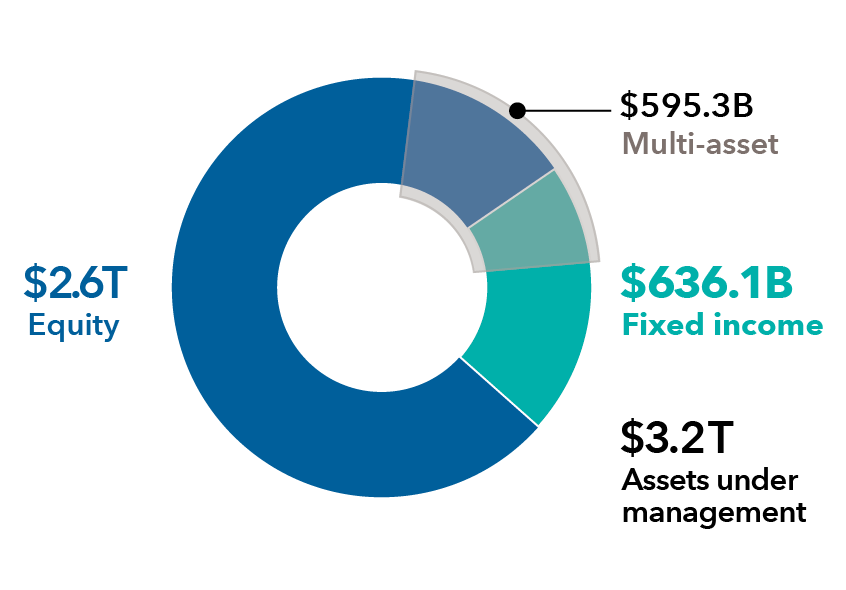

Source: Capital Group. Fixed income assets managed by Capital Fixed Income Investors. All values in USD. Preliminary data as of December 31, 2025. Totals may not reconcile due to rounding.

- Our in-depth credit research aims to assess the value of debt securities, avoid rating downgrades and find excess return

- Our U.S. investment-grade corporate team collaborates with Capital Group’s equity and high-yield credit analysts for a 360° view

Source: Capital Group. Data as of December 31, 2025.

- Our Institutional Solutions team’s portfolio managers draw on diverse views from across the firm

- Portfolio managers’ partnership with our dedicated trading desk enhances portfolio implementation and trade execution

- Multidimensional risk management helps portfolio managers appropriately reflect their highest convictions in portfolios

- Focused on generating returns through a diversified and differentiated set of securities

OUR TEAM

Capital Group’s Institutional Solutions team

- Serves as the bridge between our investment team’s security-level implementation and our clients’ broader strategic oversight of their plans and investments

- Analyzes liabilities and assets holistically, yet thoroughly, to uncover opportunities for hedging solutions to contribute more effectively to positive plan outcomes

- Customizes Institutional Solutions in strategic collaboration with our clients across a range of benchmarks, guidelines, vehicles and other sponsor-specific preferences

Gary Veerman

Head of Institutional Solutions

Colyar Pridgen

Lead Pension Solutions Strategist

Greg Garrett

Fixed Income Investment Director

Irene Chen

Pension Solutions Senior Analyst

Reflects current team as of December 2025. Investment directors do not have portfolio management responsibilities in the strategy.

Our latest Institutional Solutions insights

-

-

Liability-Driven Investing

-

Defined Benefit

Quarterly results

FIXED INCOME

Quarterly review of our long duration credit strategy and results

Our latest videos

See the U.S. long bond market’s components and credit quality come to life

Connect with our Institutional Solutions team.

Our dedicated Institutional Solutions team has experience in pension plan risk management across assets and liabilities and can help address your plan’s unique needs.

Investments are not FDIC-insured, nor are they deposits of or guaranteed by a bank or any other entity, so they may lose value.

Investors should carefully consider investment objectives, risks, charges and expenses.

This and other important information is contained in the prospectuses and summary prospectuses, which can be obtained from a financial professional and should be read carefully before investing.

Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

All Capital Group trademarks mentioned are owned by The Capital Group Companies, Inc., an affiliated company or fund. All other company and product names mentioned are the property of their respective companies.

Use of this website is intended for U.S. residents only.

Advisory services offered through Capital Research and Management Company (CRMC) and its RIA affiliates.

This content, developed by Capital Group, home of American Funds, should not be used as a primary basis for investment decisions and is not intended to serve as impartial investment or fiduciary advice.