Capital Group created the first stock market indexes that track international equities.

We have:

47

years managing international equity portfolios

$200+

billion in international equity strategies

11

global research offices†

94

analysts based in Europe and Asia

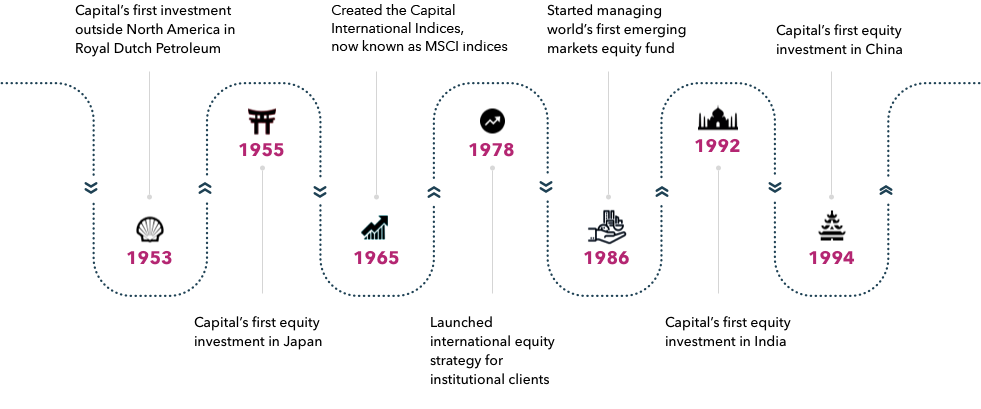

Capital is a pioneer in international equity markets.

World Markets Review

-

World Markets Review

Global markets advance on solid corporate earnings: Q4 roundup

World Markets Review for 4Q25. Global markets advanced for the quarter and year on strong corporate earnings and rate cuts from key central banks.

Our latest International Equities insights

-

U.S. Equities

3 investment opportunities in a fragmented world

-

International Equities

5 charts on what’s powering international stocks

-

Emerging Markets

Will India be the breakout emerging market this decade?

Strategies across the risk spectrum

Our diversified approach provides a range of solutions for institutions.

American Funds® International Vantage Fund

Investment objective:

Provide prudent growth of capital and conservation of principal

Benchmark:

MSCI EAFE

EM exposure: 1

3.6%

Vehicle:

Mutual fund

International Equity Strategy

Investment objective:

Long-term growth of capital

Benchmark:

MSCI EAFE

EM exposure: 2

3.8%

Vehicle:

Collective investment trust, separate account

Capital Group International Growth and Income Strategy

Investment objective:

Long-term growth of capital while providing current income

Benchmark:

MSCI ACWI ex USA

EM exposure: 2

20.0%

Vehicle:

Collective investment trust, mutual fund

Capital Group EUPAC

Strategy*

Investment objective:

Long-term growth of capital

Benchmark:

MSCI ACWI ex USA

EM exposure: 2

21.8%

Vehicle:

Collective investment trust, mutual fund

International All Countries Equity Strategy

Investment objective:

Long-term growth of capital

Benchmark:

MSCI ACWI ex USA

EM exposure: 2

20.3%

Vehicle:

Collective investment trust, separate account

Connect for more information

Interested in learning more about our international equity solutions? Call us between 8:00 a.m. and 7:00 p.m. ET, Monday through Friday.

Unless otherwise noted, all data are as of 12/31/2024.

Assets under management data are preliminary and as of December 31, 2024.

†Capital Group's Mumbai office is a macro research office only.

1Represents % of net equity assets for American Funds International Vantage Fund.

2Represents % of total portfolio equity assets for International Equity Strategy, Capital Group International Growth and Income Strategy, Capital Group EUPAC Strategy and International All Countries Equity Strategy and based on a representative account for each strategy.

Portfolio are managed so holdings will change.

MSCI EAFE (Europe, Australasia, Far East) Index is a free float-adjusted market capitalization weighted index that is designed to measure developed equity market results, excluding the United States and Canada.

MSCI Indices are now maintained by MSCI, Inc.

MSCI All Country World ex USA (ACWI ex USA) Index is a free float-adjusted market capitalization weighted index that is designed to measure equity market results in the global developed and emerging markets, excluding the United States. The index consists of more than 40 developed and emerging market country indexes.

*Effective June 1, 2025, Capital Group EuroPacific Growth Strategy is now Capital Group EUPAC Strategy.