Our history

Positioned as a pioneer in EM investing

- Managed the industry's first EM equity fund for the World Bank starting in 1986

- Created the Capital Internationl indices, now known as the MSCI Indices, in 19651

- Began investing in EM debt in 1988

Positioned as a pioneer in EM investing

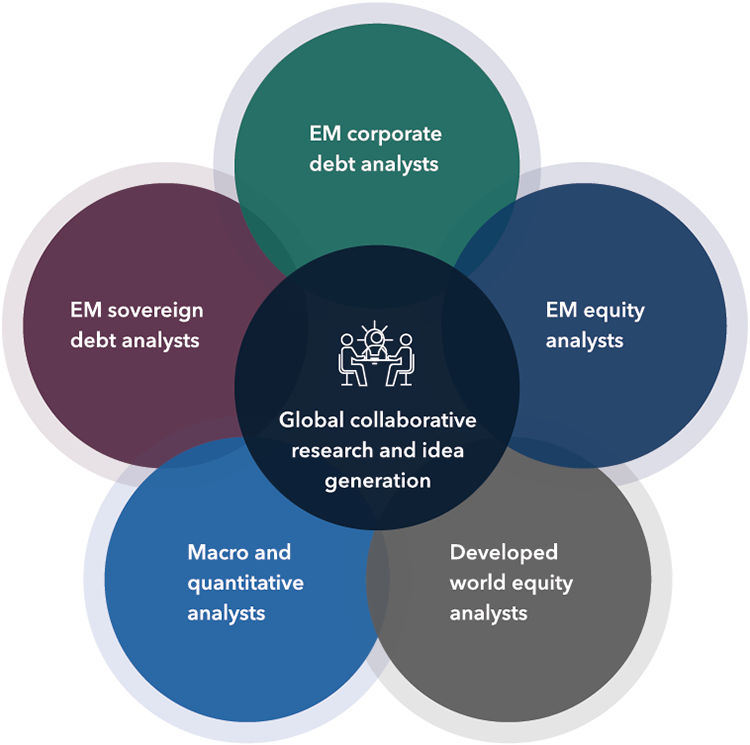

A global research team, not an EM silo

Perspectives forged through our long history and deep relationships in EM

1Commercial rights to the publication and indexes were sold to Morgan Stanley in 1986.

Our global coverage model fosters collaboration among analysts and economists across EM and developed markets. They share research and investment ideas, generating distinct insights.

Investment professionals in EM-oriented investment strategies

Average years of their industry experience

Total EM debt AUM across all investment strategies

Total EM equity AUM across all investment strategies

*Years of experience as of December 31, 2024. All other data as of March 31, 2025.

Insights

emerging markets

Corporate debt: A powerful complement to EM sovereign bonds

emerging markets

Emerging Markets debt outlook for 2025

Capital Ideas

Thinking outside the U.S. box: Emerging markets opportunities

solutions

Emerging Markets Equity

A broadly diversified portfolio of developing-country equities that places an emphasis on companies that are growing faster than their peers and/or at substantially lower-than-market valuations

New World

Invests in EM companies and multinationals with significant business in developing countries and makes opportunistic investments in government and corporate bonds of issuers in developing countries

Emerging Markets Debt (Blend)

Seeks, over the long term, high total return, of which a large component is current income, by investing primarily in fixed income and hybrid securities of corporate and sovereign developing-country issuers.

Emerging Markets Debt (Local currency)

Seeks high total return, with a large current income component, by investing in fixed income and hybrid securities in developing countries; denominated primarily in developing country currencies.