Economic Indicators

If 2025 was the year that tariff-induced uncertainty upended the outlook for the global economy, 2026 could be the year that things come back into focus.

Investors should expect greater stability in the year ahead as global trade disputes subside, government stimulus measures kick in, interest rates move lower, and the boom in artificial intelligence spending continues to drive economic growth.

“The economy has been pushing through several headwinds,” says Brady Enright, a portfolio manager with New Perspective Fund®, citing rising tariffs, relatively high interest rates, and the recent U.S. government shutdown, among other challenging events. “I think there is a case that the economic backdrop improves considerably in 2026.”

The global economy shows its resilience

Sources: Capital Group, National Association for Business Economics, International Monetary Fund World Economic Outlook October 2025 (published October 14). Market consensus refers to the general views, expectations or forecasts of market participants about key economic, financial or market metrics. ECB: European Central Bank, GDP: gross domestic product, BoE: Bank of England.

Indeed, consensus estimates for global economic growth are positive across the board despite expectations for lingering trade disputes, geopolitical conflicts and elevated inflation. Worldwide, real GDP growth is projected to hit 3.1% on a full-year basis in 2026, according to the International Monetary Fund (IMF).

The U.S. economy could grow about 2.0% as AI-related spending and government stimulus measures provide support while the labor market weakens and higher tariffs reduce trade activity. Emerging markets, led by China, are expected to produce the strongest growth rates, aggregating to 4% in 2026, based on IMF projections, while the European economy comes in around 1.1%, supported by higher spending on national defense and infrastructure.

Capital Group economists, who are part of Capital Strategy Research, are slightly less optimistic about the prospects for the global economy, but they still expect to see solid growth in the U.S., Europe, Japan and most emerging markets. That’s primarily due to more clarity on U.S. tariffs and trade policy, compared to earlier in the year.

“The clearer picture on tariffs should free up businesses to make capital decisions, like investing in reshoring supply chains,” says economist Jared Franz.

Less policy uncertainty should support business confidence

Sources: Capital Group, Bloomberg, RIMES, Standard & Poor’s. Bloomberg U.S. Economic Policy Uncertainty (EPU) Index data is calculated as a rolling seven-day average using daily index values. S&P 500 returns calculated as total returns. Data as of November 30, 2025.

U.S. trade policy whipsawed financial markets this year, but 2026 could be less eventful given recent trade deals announced between the U.S., Europe and Japan, among other countries. That’s a big change from April, when President Trump unleashed the highest tariffs in nearly 100 years against every U.S. trading partner in what he called “Liberation Day.” Stocks initially fell sharply, then reversed course and staged a remarkable months-long rally.

How that happened remains up for debate. But part of the explanation is that policy uncertainty gradually declined over the ensuing months as world leaders hammered out trade deals, Trump backed away from some threats, and investors concluded that tariff rates might not be as onerous as previously expected. In fact, the actual effective U.S. tariff rate has hovered around 11% in recent months, far lower than anticipated.

U.S. recession worries, widespread in April, have calmed and markets have reflected that shift. This positive investor sentiment could continue to boost stocks in 2026 as the U.S. economy avoids a downturn and grows at a moderate pace.

“It would probably take something akin to ‘Liberation Day: Part Two’ to really sink the U.S. economy,” says Capital Group economist Tryggvi Gudmundsson. “Policy uncertainty has dissipated, and markets have moved on. While it’s likely that trade drama will flare up as new tariffs emerge, it will hopefully come with fewer market fireworks.”

Company profits are expected to rise across the globe

Sources: Capital Group, FactSet, MSCI, Standard & Poor’s. Estimated annual earnings growth is represented by the mean consensus earnings per share estimates for the years ending December 2025 and 2026, respectfully, across the S&P 500 Index (U.S.), the MSCI Europe Index (Europe), the MSCI Japan Index (Japan), the MSCI Emerging Markets Index (Emerging markets) and MSCI China Index (China). Estimates are as of November 30, 2025.

Generally favorable macroeconomic conditions are providing a positive backdrop for corporate earnings in 2026. Consensus earnings estimates for the new year are looking brighter as the Federal Reserve seeks to reduce interest rates, government spending fuels industrial activity, and many companies plan to resume major capital expenditures (CapEx) now that tariff levels are better known. The AI boom is a significant driver of CapEx expansion, spurring strong demand for computer chips, data centers and related spending.

Companies based in emerging markets are expected to enjoy the strongest earnings growth, rising 17.2%, while the United States comes in just over 14% and Europe slightly above 11%, based on FactSet earnings estimates as of November 30, 2025.

Looking ahead, there are tailwinds that should drive earnings growth and support market gains beyond the technology sector, but ultimately what’s going to matter is corporate earnings growth.

Investors should expect occasional market downturns

Although there are many encouraging signs for the year ahead, there are also clear risks on the horizon, and investors should prepare for inevitable market pullbacks.

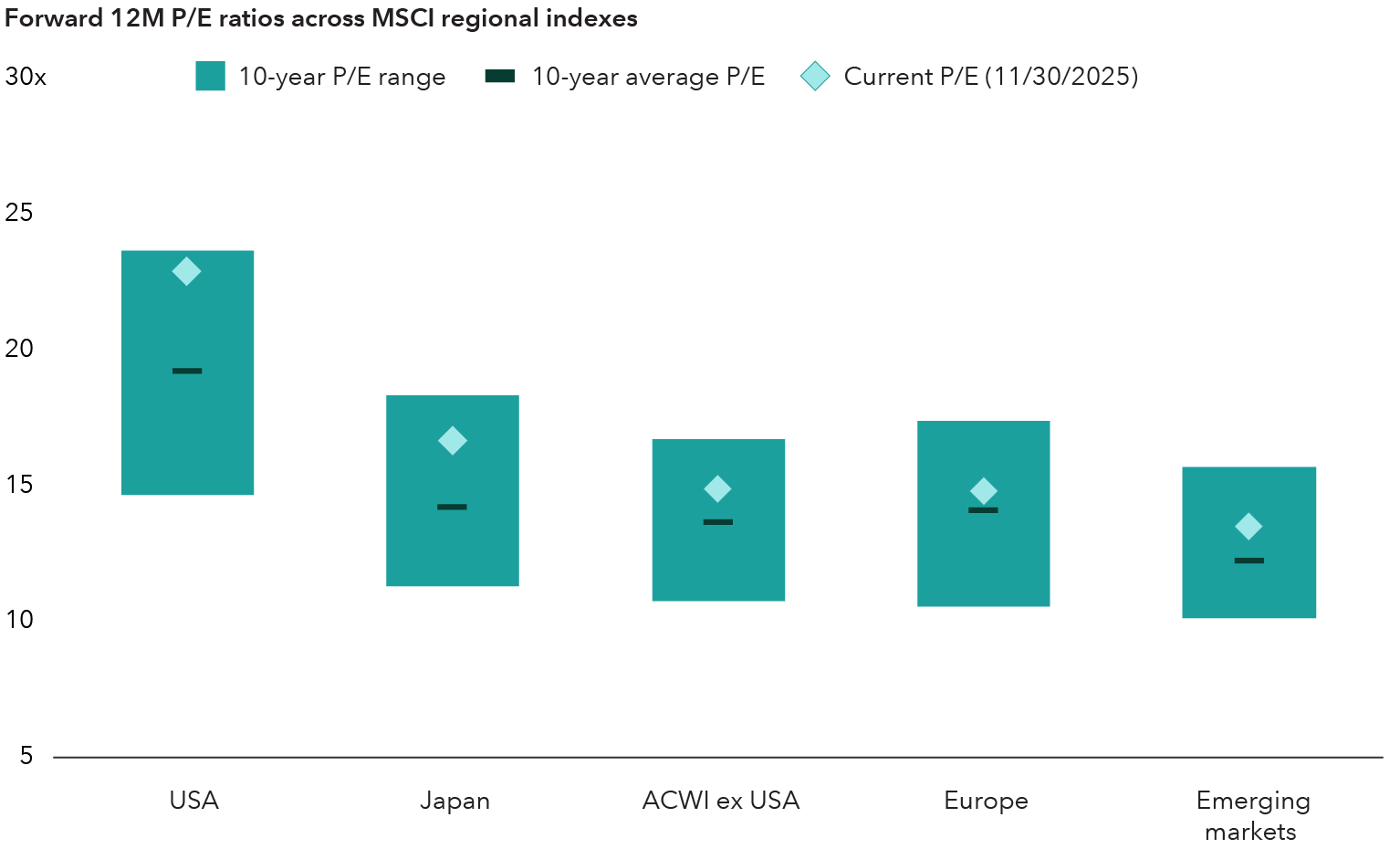

For starters, stocks are expensive. Most equity markets around the world generated strong returns from 2023 to 2025. While company earnings have generally been solid, price-to-earnings ratios (the ratio of a company’s share price to the company’s earnings per share) for U.S., developed international and emerging markets were all above their 10-year averages at the end of September 2025.

Valuations are elevated across global markets

Sources: Capital Group, MSCI, RIMES. As of November 30, 2025. Countries and regions shown are represented by their respective MSCI indexes. Forward 12-month price-to-earnings (12M P/E) ratios based on latest consensus estimates. The forward P/E ratio divides the current share price of a company by the estimated future earnings per share of that company.

Sticky inflation and mounting government debt in the U.S., Europe and elsewhere are also cause for concern. Aggressive stimulus measures to support economic growth will only contribute to debt levels, with the total for the U.S. expected to exceed 140% of GDP by 2030, according to IMF projections.

Keep in mind, stock market declines are regular occurrences. The S&P 500 Index has experienced market corrections, or declines of 10 percent or more, about once every 16 months. Whereas the index has had bear markets, or declines of 20 percent or more, about once every six years, based on market data from 1954 to 2025.

“The optimism priced into markets doesn’t leave a lot of room for disappointment,” says Capital Group economist Darrell Spence. “There will almost always be the unanticipated surprises that occur every year, even when the outlook is positive.”

The views of individual portfolio managers and analysts may differ from Capital Strategy Research views.

Past results are not predictive of results in future periods.

Gross domestic product (GDP) is the market value of the goods and services produced by labor and property located in the United States for one year.

The market indexes are unmanaged and, therefore, have no expenses. Investors cannot invest directly in an index.

Bloomberg U.S. Economic Policy Uncertainty Index measures U.S. economic policy uncertainty by counting newspaper articles on the topic.

MSCI USA Index is a free float-adjusted, market capitalization-weighted index designed to measure the performance of the large- and mid-cap segments of the U.S. market. MSCI All Country World Index (ACWI) ex USA is a free float-adjusted market capitalization-weighted index designed to measure equity market results in the global developed and emerging markets, excluding the United States. MSCI China Index captures large- and mid-cap representation across China A shares, H shares, B shares, Red chips, P chips and foreign listings (e.g., ADRs). MSCI Emerging Markets Index captures large- and mid-cap representation across 27 emerging markets (EM) countries. MSCI Europe Index is designed to measure developed equity market results across 15 developed countries in Europe. MSCI Japan Index is a free float-adjusted market capitalization-weighted index designed to measure the equity market results of Japan.

The S&P 500 Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

Source: MSCI. The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com)

The S&P 500 Index is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2025 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part is prohibited without written permission of S&P Dow Jones Indices LLC.

Our latest insights

-

-

Artificial Intelligence

-

Chart in Focus

-

Municipal Bonds

-

Global Equities

RELATED INSIGHTS

-

-

Artificial Intelligence

-

Chart in Focus

Don’t miss out

Get the Capital Ideas newsletter in your inbox every other week

Brady Enright

Brady Enright

Jared Franz

Jared Franz

Tryggvi Gudmundsson

Tryggvi Gudmundsson

Darrell Spence

Darrell Spence