Global Equities

Technology & Innovation

- The emergence of 5G wireless technology heralds a new era in communications.

- Faster data transmission speeds could transform industries, including health care, robotics and driverless cars.

- The largest benefits of 5G may come from technological innovations that are just sketches on a drawing board today.

If measured solely by the pizzazz of its name, 5G doesn’t exactly set hearts aflutter. It lacks the futuristic allure of, say, artificial intelligence or machine learning. And it doesn’t conjure images of science fiction springing to life in the same vein as self-driving cars, advanced robotics or wearable electronics.

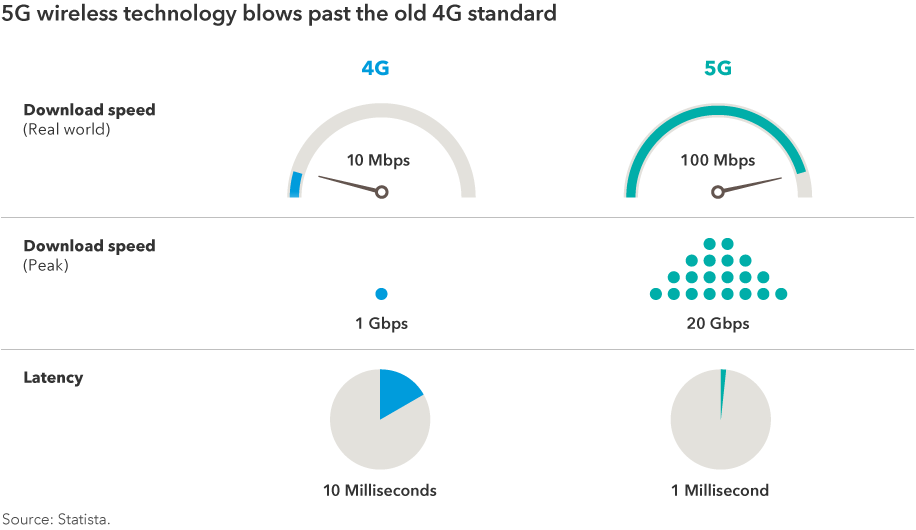

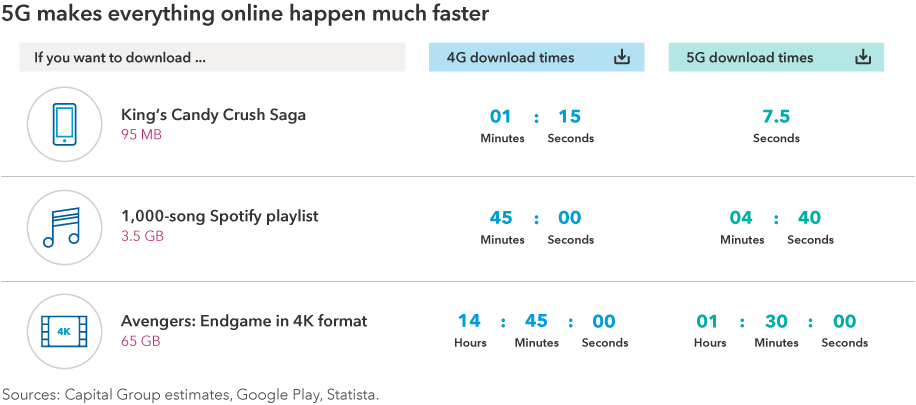

But what 5G lacks in public relations appeal, it makes up for in sheer transformational potential. This fifth generation of wireless communication is projected to be as much as 100 times faster than the current 4G, with seamless connections that promise relief for cellphone users plagued by dropped calls or interminable waits to log into websites.

In fact, 5G is an essential ingredient underpinning many of tomorrow’s most prominent technologies. Robots, for example, can only perform the intricate tasks envisioned for the future if they can wirelessly synchronize with one another in real time.

The most far-reaching benefits of 5G might not come from what’s expected but from applications that are little more than sketches on a drawing board today. That was the case with 4G when it was rolled out nearly a decade ago. 4G made good on its promise of speed and connectivity. But beyond that, it provided the technological scaffolding that set the stage for today’s sprawling ecosystem of smartphone apps: streaming video and music, social networking and portable gaming.

The high stakes involved in 5G are reflected in fierce competition between the U.S. and China. As part of their larger clash over trade and technology, the world’s two biggest economies are squaring off in a sprint for 5G superiority, believing it will provide a gateway to broader economic and digital primacy. Indeed, if 4G is any guide, the country that best implements 5G stands to reap significant financial rewards.

5G is the digital promised land

Of course, none of this will happen immediately. Despite breathless marketing campaigns from smartphone makers and cell service providers, it will take time to work through the normal growing pains that accompany a rollout this grand in scale and ambition. Technological standards must be ironed out, logistical hurdles must be overcome and major infrastructure investments must be made.

Still, there’s a lot to be excited about, both for the companies providing the components and services, and for consumers thirsting for a digital promised land of blazing speed and nearly instantaneous reaction times. In coming years, 5G is likely to uncork some of the current 4G bottlenecks, lay the foundation for coming innovations and, ultimately, usher in a new era of communications.

Reducing latency is a wireless game changer

Every generation of cellular network has improved on the one it preceded. The second generation added digital capabilities, allowing phones to send text messages and, eventually, photos. The third made those systems swifter and more reliable. The fourth added bandwidth by converting nearly all cell networks to digital streams.

Where 5G shines is in its ability to reduce latency — the time lag it takes two machines to communicate with one another. Think of when you dial a friend on your smartphone and wait through a moment of silence before the other phone rings. That moment is travel time; your request must reach the other device and be processed, and the response must arc back to your phone.

Latency is measured in milliseconds, or thousandths of a second, and though that doesn’t sound like much, it’s a major roadblock to time-sensitive actions. Imagine driving down the street and seeing another car darting into an intersection. You slam on the brakes to avoid a collision. That might feel like a single action, but it’s actually a multistep process. For most drivers, it takes about 1,500 milliseconds, or a second and a half.

5G answers the need for speed

For most 4G networks, it takes about 50 milliseconds to carry your request one way; 5G networks have the potential to get to a reliable 1 millisecond. Again, that might not sound like much, but shaving that from your reaction time at highway speed would allow you to brake about 10 feet earlier. And if your car is driving itself, every inch matters.

Such time savings are even more valuable in systems that make hundreds or thousands of server requests a minute, especially those in which the speed of one function depends on that of another. On an assembly line, for example, a robot can’t go faster than the one preceding it. Latency also limits multitasking or switching between jobs. High latency adds time to each step, making some tasks too inefficient to justify.

Many sectors could benefit from 5G

Self-driving cars head the list of industries that are expected to reap the benefits of 5G. Ultrafast communications will give vehicles more time to react to surprises and broadcast warnings to others. Think back to the car in the intersection. For autonomous vehicles, a 2 millisecond call to central control, followed by a 1 millisecond warning to every nearby car, could prevent a crash.

Industrial robotics could also get a huge boost, as automated machines would be able to execute more complicated tasks. Robots would be better equipped to handle multiple tasks. Beyond that, 5G may let factories operate robots without cumbersome wires. And machines with lightning-fast reflexes could minimize factory floor injuries by identifying and avoiding their human counterparts.

The emergence of 5G could have profound effects on health care. For instance, it could speed the use of robotic surgery, allowing doctors to remotely control devices without any delay or loss in fidelity. This could allow a specialist in one part of the world to operate on a patient in another.

And as network-connected devices become more common — think internet-enabled refrigerators and GPS-equipped dog collars — households are likely to place a much higher load on the network. Lower latency and greater bandwidth will serve to make the “internet of things” more manageable.

Global race is on for 5G supremacy

The ultimate impact of 5G could extend beyond the merely technical. If past is prelude, successful adoption could add oomph to entire economies, as the U.S. experienced with 4G. By modernizing its creaky 3G system, the U.S. created a fertile environment for domestic technology companies to develop new ways of storing and transmitting content. And robust public access ensured there was an audience to consume that content. Investors benefited greatly as Facebook, Netflix and Alphabet (parent of Google and YouTube) fortified their market-leading positions.

A feverish race is now on for 5G dominance. China has long sought to establish itself as a major player in cellular networking, both by helping to develop system protocols and nurturing its own hardware producers. One of these, Huawei, is among the largest producers of networking hardware, though it’s effectively been banned from U.S. markets because of concerns that its devices could provide sensitive data to the Chinese government.

As part of its strategy, China siloed its internet and developed its own search engine, social media and e-commerce titans: Baidu instead of Google, WeChat instead of Facebook, Alibaba instead of Amazon. It now has its own highly developed internet ecosystem. That’s placed China in a strong position to reap the benefits of 5G — and perhaps position some of its companies as global leaders.

The scramble for 5G primacy is sure to create opportunities for long-term investors. Businesses that churn out cutting-edge technology, as well as those harnessing it to roll out new or improved products, have the potential to stand out in the global marketplace. Once 5G becomes widely available, it will open business models that didn’t previously exist due to technological limitations. It will also boost the current tech giants as internet search, social media and e-commerce become further ingrained in daily life.

Though it’s hard to fully predict what the 5G world will look like, a new era of technological innovation is on the horizon.

Our latest insights

-

-

Artificial Intelligence

-

Technology & Innovation

-

-

Demographics & Culture

RELATED INSIGHTS

-

Global Equities

-

Artificial Intelligence

-

Technology & Innovation

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

Unless otherwise indicated, the investment professionals featured do not manage Capital Group‘s Canadian mutual funds.

References to particular companies or securities, if any, are included for informational or illustrative purposes only and should not be considered as an endorsement by Capital Group. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds or current holdings of any investment funds. These views should not be considered as investment advice nor should they be considered a recommendation to buy or sell.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and not be comprehensive or to provide advice. For informational purposes only; not intended to provide tax, legal or financial advice. We assume no liability for any inaccurate, delayed or incomplete information, nor for any actions taken in reliance thereon. The information contained herein has been supplied without verification by us and may be subject to change. Capital Group funds are available in Canada through registered dealers. For more information, please consult your financial and tax advisors for your individual situation.

Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. We encourage you to consider these and other factors carefully before making any investment decisions and we urge you to avoid placing undue reliance on forward-looking statements.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2024 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2024. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under licence. All rights in the FTSE Russell indices or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indices or data and no party may rely on any indices or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The index is unmanaged and cannot be invested in directly.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

MSCI does not approve, review or produce reports published on this site, makes no express or implied warranties or representations and is not liable whatsoever for any data represented. You may not redistribute MSCI data or use it as a basis for other indices or investment products.

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capital Group trademarks are owned by The Capital Group Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capital Group funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capital Group, a global investment management firm originating in Los Angeles, California in 1931. Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

The Capital Group funds offered on this website are available only to Canadian residents.

Isaac Sudit

Isaac Sudit