Federal Reserve

President Trump picked former fed governor Kevin Warsh to lead the U.S. Federal Reserve, elevating a recently dovish voice at a moment when policymakers are trying to decide how far and how fast to cut interest rates. The choice caps months of speculation and sets the stage for a pivotal chapter in the central bank’s history.

Warsh recently penned an op-ed in the Wall Street Journal advocating for lower interest rates, arguing the U.S. economy can have growth without inflation. However, he has been viewed as more hawkish in the past, particularly during the global financial crisis.

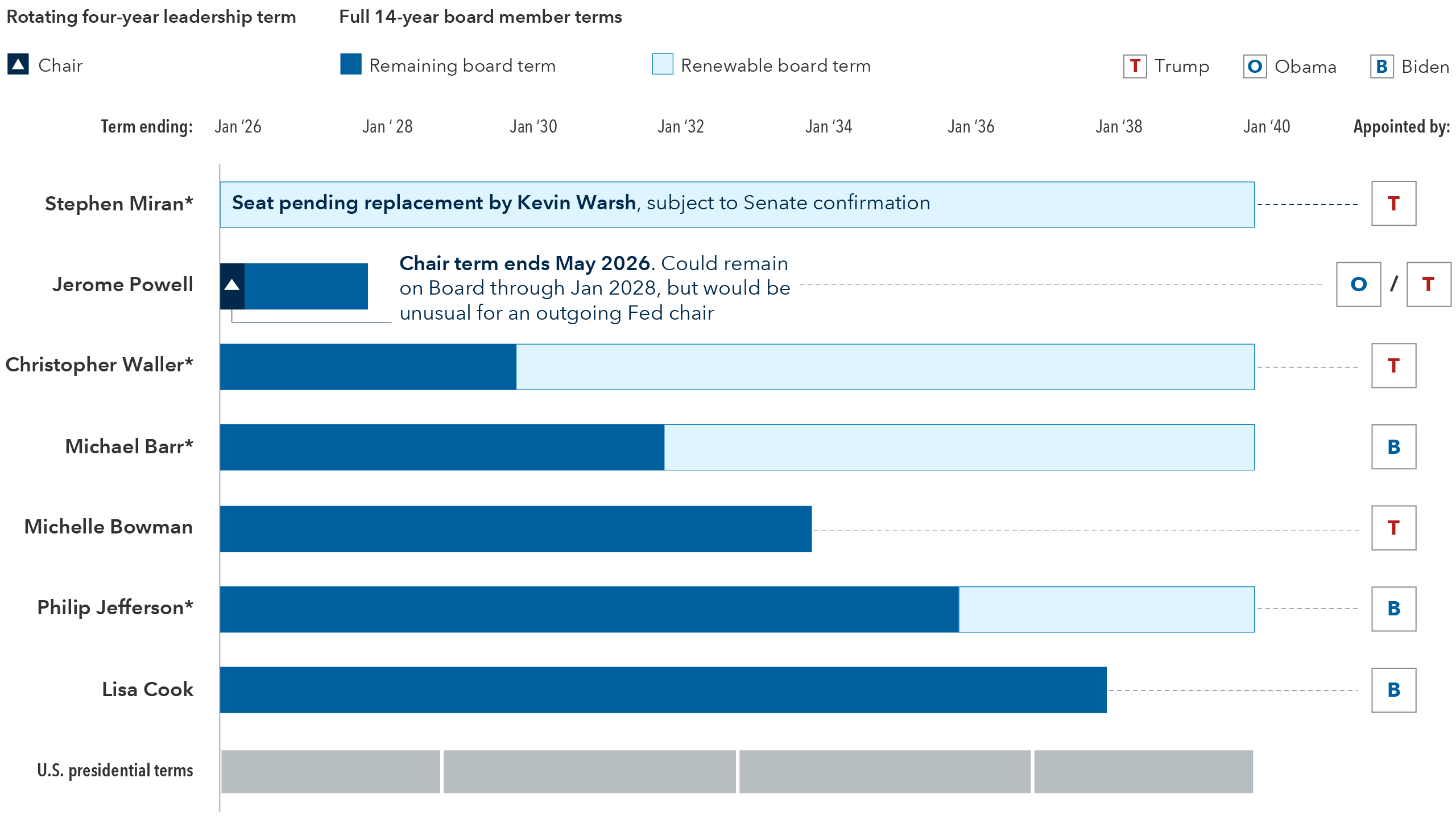

Assuming Senate confirmation, whether the Fed under Warsh will deliver substantially lower interest rates by year-end 2026 will likely still come down to jobs and inflation data, says Ritchie Tuazon, bond manager for American Funds® Strategic Bond Fund. “The scenario of an extreme Fed capture, or loss of Fed independence, is unlikely as it would require all board members to follow the Fed chair. However, I do think the Fed will be more dovish, particularly as Trump appoints more governors.”

Current Fed structure may protect independence

Remaining terms of Federal Reserve Board of Governors

Sources: Capital Group, Brookings, Federal Reserve. *A member of the Federal Reserve Board of Governors who is completing an unexpired portion of a prior members' 14-year term may be reappointed. Members and leadership positions are nominated by the U.S. president and confirmed by the U.S. Senate. While Stephan Miran's term is ending January 31, 2026, he may remain on the Board until a replacement is confirmed. T refers to Trump, O refers to Obama, and B refers to Biden. Renewable portion shown for illustration; reappointment is not automatic. As of January 30, 2026.

An economy out of balance

Powell is unlikely to retreat from the center of monetary policymaking before his term as Fed chair ends in May 2026. The economic backdrop facing the Fed is increasingly challenging: The U.S. job market is showing signs of strain, but inflation remains above the Fed’s target and economic growth has been resilient. Moreover, a mid-cycle election year dominated by concerns over “affordability” could push politicians and households alike to pressure the Fed to lower interest rates.

The good news is that the incentives of the Fed and Trump administration are currently aligned, says Pramod Atluri, principal investment officer for The Bond Fund of America®. “Right now, they both want to support the labor market. That alignment means that the Fed is likely to continue to cut rates based on fundamentals rather than political pressure.”

The Fed is likely to be responsive to further signs of labor market weakness, notes Atluri, even as it pauses on rates for now. Should inflation continue to moderate through the year, the Fed could cut rates again because failing to do so as inflation falls would lead to tighter monetary policy conditions.

Rates are expected to fall in 2026

Sources: Capital Group, Bloomberg, U.S. Federal Reserve. Fed funds target rate reflects the upper bound of the Federal Open Markets Committee's (FOMC) target range for overnight lending among U.S. banks. As of January 30, 2026.

Policy interventions for lower interest rates

Could policymakers do more to lower interest rates broadly? In addition to nudging the overnight federal funds rate, officials wield heavier tools like quantitative easing (QE), a crisis-era staple it has deployed four times since 2008 to bring down long-term borrowing costs.

It’s not unreasonable to imagine the Fed attempting to affect the yield curve if rates rise dramatically. Such a move could be under consideration if the market’s backbone — the 10-year U.S. Treasury yield, which underpins borrowing costs for the global economy — jumps above 5% and stays there long enough to threaten financing conditions, Tuazon believes.

Currently, markets remain well below that threshold. As of January 29, 2026, the 10-year yield sits at 4.24%, a level that has eased from the highs of Trump’s “liberation day” tariffs but still reflects uncertainty about growth dynamics, the federal government’s fiscal path and the durability of disinflation.

Fed rate cuts have left mortgage rates virtually unchanged

Sources: Capital Group, Federal Reserve Bank of St. Louis. As of January 30, 2026.

Beyond the Fed, the Trump administration has other levers it may pull to lower interest rates. Earlier in January, officials directed government-controlled mortgage giants Fannie Mae and Freddie Mac to buy $200 billion in mortgage assets, with the ultimate goal of reducing mortgage rates. To the extent those measures fall short, policymakers could consider further steps to lower mortgage costs, from adjusting mortgage insurance premiums and guarantee fees to additional Fannie and Freddie purchases.

The administration may also look to influence Treasury markets by reducing issuance at the long end of the yield curve or expanding the Treasury Department’s program of Treasury repurchases. How likely or effective these measures will be remains uncertain. However, for investors, the administration's push to lower interest rates may be supportive of interest rate-sensitive positions.

Fed independence on watch

Investors depend on Fed independence for good reasons. “It's an important topic because there are so many examples of countries that got into trouble by running inappropriate monetary policy,” Atluri says. “There's this view that they can get some short-term gains from implementing stimulative monetary policy, but they ultimately ignore the potential long-term pain such as hyperinflation and currency collapse.”

The Fed’s credibility as the watchdog of the world’s largest bond market has been built over decades, and the next chair may seek to preserve that legacy. Recently, investor backlash after the Justice Department subpoena of Powell and an upcoming Supreme Court ruling on whether President Trump could immediately fire Fed governor Lisa Cook, have heightened the scrutiny of Fed independence. Still, with the reappointment of the Board of Governors, we think there is a low probability of a sweeping political takeover. Other members of the board may resist political pressure, keeping the institution insulated while maintaining its traditional dual mandate of price stability amid full employment.

Whatever direction monetary policy takes, investors are paying close attention and may represent another check on the system. That’s particularly true if growth proves resilient amid a swelling federal deficit, which would keep pressure on long-term rates. In such an environment, any sign that the Fed is drifting from its mandate could show up in the form of market volatility.

Liberation day tariffs refer to an announcement by U.S. President Donald Trump on April 2, 2025, that implemented a broad set of tariffs on imports from nearly all countries.

Our latest insights

-

-

Artificial Intelligence

-

Chart in Focus

-

Municipal Bonds

-

Global Equities

RELATED INSIGHTS

Don’t miss out

Get the Capital Ideas newsletter in your inbox every other week

Ritchie Tuazon

Ritchie Tuazon

Pramod Atluri

Pramod Atluri