Capital IdeasTM

Investment insights from Capital Group

Emerging Markets

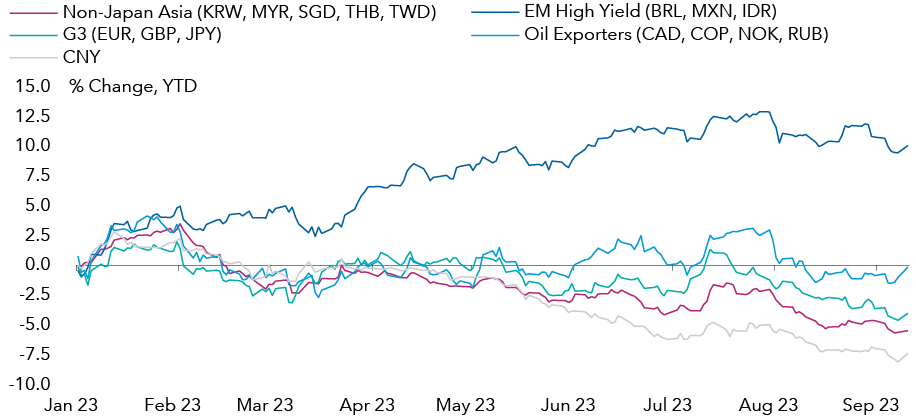

The EM carry trade1 has been a successful strategy so far this year, as many EM countries, particularly those in Latin America, have been able to offer investors high real interest rates, diminishing policy risks and attractive valuations.

Chart 1: High carry currencies have been strong year-to-date

Past results are not a guarantee of future results.

As at 11 September 2023. KRW: South Korean won, MYR: Malaysian ringgit, SGD: Singapore dollar, THB: Thai baht, TWD: Taiwan dollar, BRL: Brazilian real, MXN: Mexican peso, IDR: Indonesian rupiah, EUR: Euro, GBP: Pound sterling, JPY: Japanese yen, CAD: Canadian dollar, COP: Colombian peso, NOK: Norwegian krone, RUB: Russian rouble. Source: Macrobond

The strength of the EM carry trade now looks to be fading as EM central banks start to cut rates. This reduction in interest rate differentials between EM and developed market (DM) countries could weaken some EM currencies, as was the case in Chile earlier this year. Crowded investor positioning within EM carry trades, meanwhile, has the potential to amplify any reversal in positioning.

That said, given the high starting interest rate for many EM countries, real rates may continue to look attractive even as central banks cut rates. Moreover, in many cases, investors are guided by risk sentiment and fundamentals as well as the real rate differential. We look into both those factors in this paper.

1. An exchange rate “carry trade” goes against the uncovered interest rate parity theory (UIP). According to UIP, the expected change in an exchange rate should be equal to the interest rate differential for the two currencies for the same period. If this does not happen, in theory, there is an opportunity to make an abnormal return, using the carry trade, by borrowing a low interest-rate currency and investing in a higher interest rate currency.

Our latest insights

-

-

Long-Term Investing

-

-

-

Fixed Income

RELATED INSIGHTS

Hear from our investment team.

Sign up now to get industry-leading insights and timely articles delivered to your inbox.

Past results are not predictive of results in future periods. It is not possible to invest directly in an index, which is unmanaged. The value of investments and income from them can go down as well as up and you may lose some or all of your initial investment. This information is not intended to provide investment, tax or other advice, or to be a solicitation to buy or sell any securities.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. All information is as at the date indicated unless otherwise stated. Some information may have been obtained from third parties, and as such the reliability of that information is not guaranteed.

Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organisation; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

Jens Søndergaard

Jens Søndergaard