Municipal Bonds

Economic Indicators

The resilience of the U.S. economy never fails to amaze me. Despite all the turmoil in the world, the U.S. economy somehow manages to look past it, power through it, and come out stronger on the other side.

Along those lines, there is a lively debate among economists these days over whether U.S. economic growth could accelerate to 5% this year. That’s a number we haven’t seen on a sustained, multiyear basis since the 1960s and 1970s. Over the last two decades, U.S. gross domestic product (GDP) growth has generally been less than half that amount — averaging roughly 2.1%.

What needs to happen to return to the days of 5% growth? A lot. But based on my analysis, it is within the realm of possibility. And we really aren’t that far off, given that the most recent GDP print (3Q 2025) came in last week at 4.4% annualized.

U.S. economic growth has slowed in recent decades

U.S. real GDP growth (annual % change)

Sources: Capital Group, Bureau of Economic Analysis. GDP figures shown are for full years, while recessionary periods are quarterly. Latest data available is through the third quarter of 2025, as of January 27, 2026.

Don’t discount election year politics

The first consideration is that 2026 is an election year. The U.S. midterm elections are just 10 months away, and President Trump has made it clear he wants to run the economy hot as we head toward November. That means bringing interest rates down, wages up, boosting the labor market, and using government stimulus measures to put money directly in the hands of American consumers.

Since consumer spending accounts for roughly two-thirds of the U.S. economy, greater consumption is the key to reaching 5% GDP growth. Simply put, we need more people to buy more goods and services. We need wage growth to rise from 3.5% today to roughly 5%. We need job growth in the range of 200,000 per month. We need rent, oil prices and food prices to decline. And we need statutory U.S. tariff rates to roll back to 10% or lower, from roughly 17% today.

I think the U.S. Federal Reserve would need to reduce short-term rates more than the two cuts priced into markets this year, taking the federal funds rate below 3%, which is highly accommodative. In turn, we need 10-year Treasury rates, which influence borrowing costs of all kinds, to fall toward 3%. We need home mortgage rates at 4%. And we need to see a refinancing wave to help fuel a recovery in the hard-hit commercial real estate market.

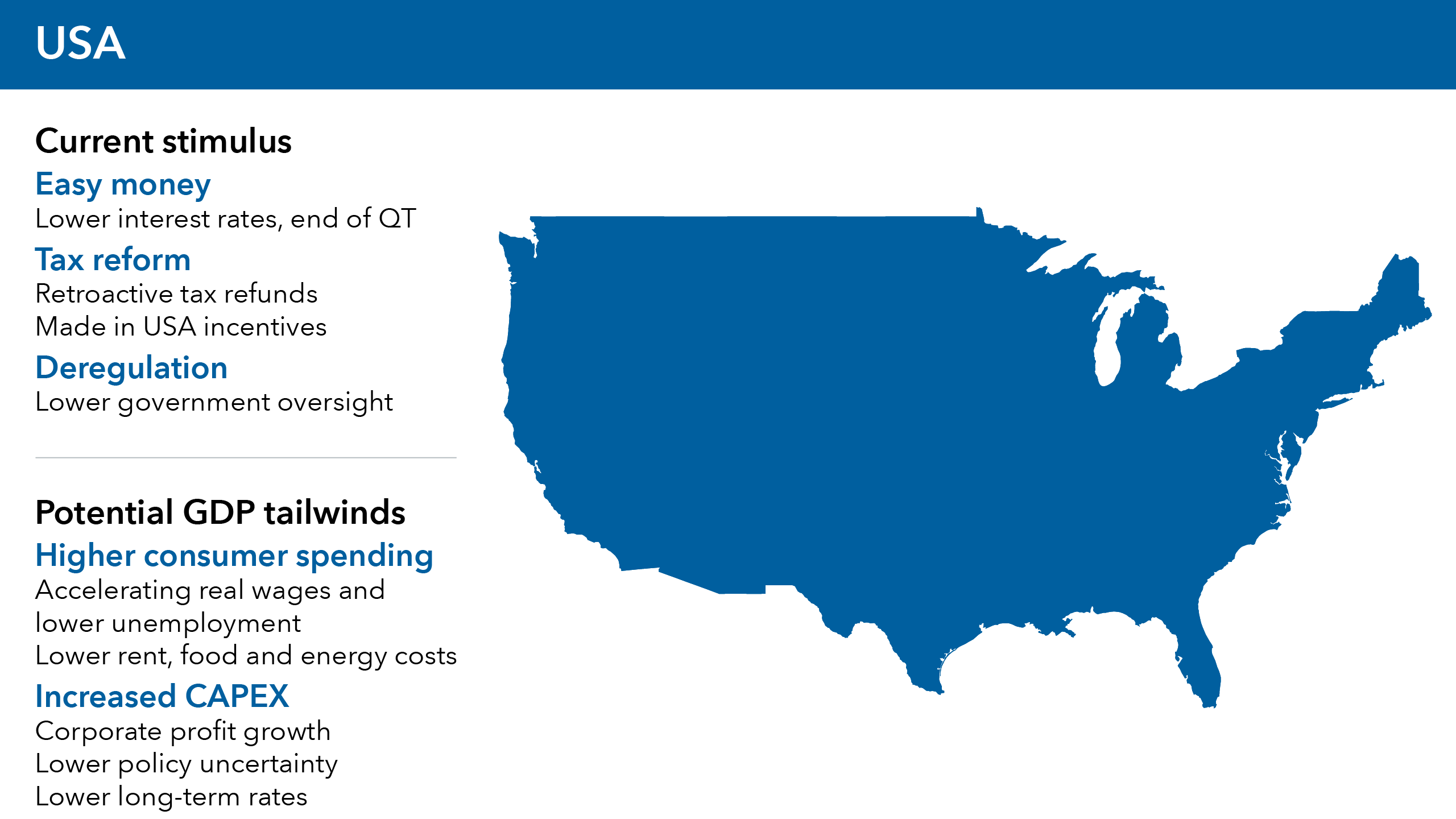

Stimulus measures should boost consumption

Numerous government stimulus measures are already in place — from tax cuts included in the One Big Beautiful Bill Act, to retroactive tax refunds, to massive tax breaks and subsidies for companies that agree to move their manufacturing operations to the United States. More recently, the president has championed the idea of “tariff dividends” for U.S. citizens under certain income thresholds, though such a move typically requires an act of Congress.

Source: Capital Group. QT, or quantitative tightening, refers to policies that reduce the U.S. Federal Reserve’s balance sheet. Capital expenditure (CAPEX) is money invested for acquisitions, upgrades and renovations. It can be tangible (i.e., real estate) or intangible (i.e., licenses, software).

We know from the pandemic years that if you give U.S. consumers money, they will spend it. Americans aren’t too keen on saving. Larger tax refunds are expected to put an extra $100 billion into the hands of consumers this year, much of it landing in bank accounts at the start of the summer vacation season.

Last year, U.S. households received tax refunds averaging slightly more than $3,000. This year, the average refund should be around $4,000, according to projections from the U.S. Treasury Department.

AI-powered productivity boost

Finally, we need to see a rebound on the industrial side of the U.S. economy, which has been stagnant for the past three years. That’s an unusually long recession for U.S. industrial activity and, in my view, it isn’t likely to continue much longer. We are already seeing evidence of increasing inventory investments as the global economy, along with the U.S. economy, picks up speed.

Moreover, many companies are using artificial intelligence (AI) to boost productivity. This is a trend that I think many investors are underestimating. Yes, AI is hurting some workers, particularly in entry-level jobs, but it’s also turning more experienced employees into AI-powered super workers. That should enable these employees to pursue higher wage increases over time.

I think we are in the early innings of this AI productivity boost across corporate America. Thus, I’ve increased my U.S. productivity estimate to 3% this year, up from 2.5% previously, and I wouldn’t be surprised if it rises to 4% in a 1990s-type, tech-inspired scenario.

2.8% GDP growth is more realistic

While I think 5% GDP growth is possible this year, there are also many risks associated with such an optimistic forecast. In the stock market, we would call that “priced for perfection.” It leaves no room for disruption from trade disputes, geopolitical conflicts, labor market weakness, social unrest or market turbulence that could result from one or more of those events.

Given the resilience of the U.S. economy, offset by the chances of a geopolitical or domestic event hampering growth at times, I have increased my GDP forecast to 2.8% for the full year 2026. That is above consensus and higher than my previous forecast in December.

At the end of the day, I feel comfortable being above consensus for two reasons: the powerful influence of an election year, and the impressive productivity gains we are seeing as the AI revolution energizes the U.S. economy.

Gross domestic product (GDP) is the market value of the goods and services produced by labor and property located in the United States for one year.

Don't miss our latest insights.

Our latest insights

-

-

Global Equities

-

Long-Term Investing

-

Federal Reserve

-

RELATED INSIGHTS

-

Economic Indicators

-

Markets & Economy

-

Economic Indicators

Don’t miss out

Get the Capital Ideas newsletter in your inbox every other week

Jared Franz

Jared Franz