This article was first published on The Wall Street Journal's website on 7/22/2022.

Capital Group leaders explain how active ETFs can help advisors manage market turmoil.

"The challenge historically for ETFs … was you had to have those around an index bucket of stocks where you had to have one of everything."

Alan Wilson

Portfolio Manager, Capital Group

Over the past decade, the use of exchange-traded funds in investment portfolios has picked up steam. Benefiting from a simplified cost structure and enhanced tax efficiency versus mutual funds, ETFs had gathered more than $7 trillion in assets by the end of 2021.1

While the ETF industry has ballooned to more than 2,800 funds in the U.S. in 2021,2 most of the assets are concentrated in index-tracking strategies. Regulatory changes in 2019 opened the door for more active strategies to enter the market, but most of these ETFs have generated only limited attention from investors and their advisors.

With an apparent shift in market dynamics underway, is now the time for active ETFs to shine?

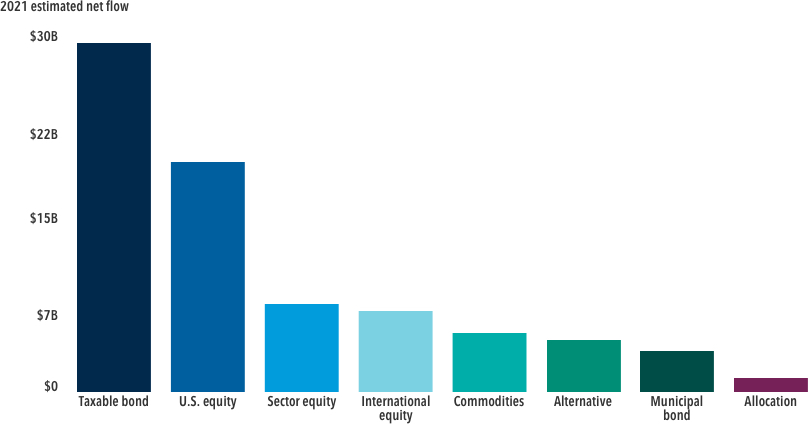

Interest in active ETFs is widespread

Active ETF flows were positive across category groups in 2021.

Source: Morningstar Direct. Data as of December 31, 2021.

Much of the recent innovation in active ETFs has centered around niche funds that give exposure to certain corners of the market, with many financial professionals faced with only limited options for the core of portfolios they oversee. As advisors seek to add value to core holdings, active ETFs that offer approaches emphasizing consistency, downside awareness and fundamental-based research may help enhance an advisor’s tool belt. Say hello to the next generation of ETFs.

![The illustration shows a surfer gliding on flat water with a large wave curling up behind him. The wave contains currency symbols for the U.S. dollar, Japanese yen and the European euro.]](https://static.capitalgroup.com/content/dam/cgc/shared-content/images/photos/etf-storefront-insights-resources/articles/wsj-core-convictions/etf-core-conviction-graphic-wave.jpg)

In recent years, investors have benefited from taking a “risk on” approach to investing. In such a market environment, which was characterized by relatively low volatility and hyper-low interest rates, many financial professionals could easily rely on index-tracking investments that helped keep costs low and returns close to the overall market.

Yet over the past year, the market has changed dramatically, with businesses and the economy beset by high inflation, global supply chain shortages, rising interest rates and heightened geopolitical tensions.

"The chance to really go through an uncertain environment and discern among companies who’s going to be hurt and who’s going to be helped and construct the portfolio that way ... it’s kind of a great time to be able to do this."

Alan Wilson

Portfolio Manager, Capital Group

Strategies to get through turbulent times

It's difficult to see the value of your investments fall. But during challenging times, try to keep some fundamental investing principles in mind:

Investors suddenly faced declining values in their investment accounts. For advisors, this shift in the investment climate has required them to juggle the responsibilities of rethinking struggling portfolios and calming the nerves of jittery clients.

In such an environment, advisors may want to consider reorienting the core of portfolios with an additional layer of oversight. Actively managed ETFs can provide a measured approach to selecting investments, helping advisors pursue a smoother return profile in an uneven market environment. In searching for the right ETFs, advisors should seek out active managers who have an established history of delivering strategies that are building blocks for core portfolios.

Capital Group has a more than 90-year history of using a disciplined approach to active management to strengthen the core of an individual investor’s portfolio. So it’s no surprise that the company’s newly launched suite of six active ETFs is in keeping with that tradition.

There’s nothing particularly flashy or trendy about the offerings. Instead, each ETF is designed to pursue timeless investor needs. The funds consist of three growth portfolios that offer varying degrees of domestic and international exposure, a core U.S. equity fund, a U.S. equity fund that emphasizes income and, lastly, a fixed income offering with a “core plus’’ strategy that pursues income but with a degree of capital preservation.

“When we considered bringing ETFs to market … we chose the transparent, active structure because it enabled us to deliver on tax efficiency for clients, and it enabled us to package the best of who we are as an organization.”

— Holly Framsted, Director of ETFs, Capital Group

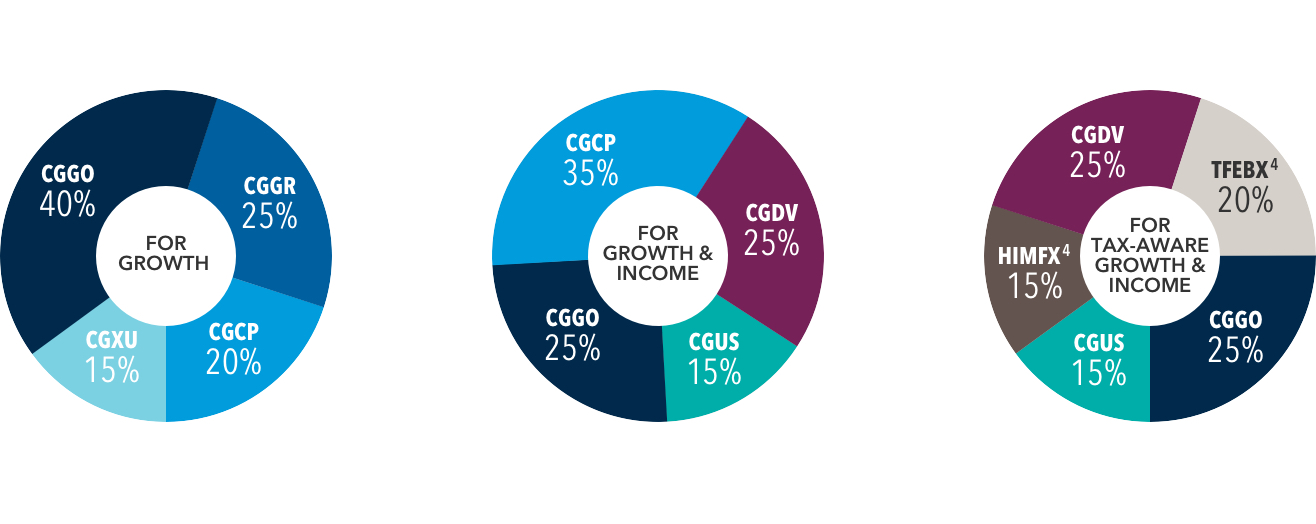

Capital Group’s debut suite of active ETFs

Designed to help investors pursue their long-term goals. Capital Group's debut suite of active ETFs includes U.S.-focused funds Capital Group Growth ETF (CGGR), Capital Group Core Equity ETF (CGUS) and Capital Group Dividend Value ETF (CGDV), international and global funds Capital Group International Focus Equity ETF (CGXU) and Capital Group Global Growth Equity ETF (CGGO) and fixed income fund Capital Group Core Plus Income ETF (CGCP).

The suite of ETFs focuses on major asset allocation categories used by financial advisors every day. And the strategies are designed to reflect long-term investment horizons that support downside awareness to pursue consistency over varying market environments. Moreover, these funds carry only a modest charge, with an average weighted expense ratio of only 40 basis points.3

Putting ETFs into action: 3 ideas for using Capital Group’s ETFs to build a portfolio’s core

The six ETFs embody what Capital Group has long been known for: an active-management approach, supported by a multimanager system and deep fundamental research, all working to help investors achieve their long-term investment goals.

Throughout our history, we’ve weathered past storms.

Learn how our new suite of active ETFs can strengthen a portfolio’s core during volatile times.

Custom Content from WSJ is a unit of The Wall Street Journal Advertising Department. The Wall Street Journal news organization was not involved in the creation of this content.

1Data from Morningstar.

2Source: ETFGI as of December 31, 2021.

3The expense ratios for Capital Group ETFs are as follows: CGGR — 0.39%, CGXU — 0.54%, CGGO — 0.47%, CGUS — 0.33%, CGDV — 0.33%, CGCP — 0.34%. The expense ratios are as of the funds' prospectuses available at the time of publication. The expense ratios are estimated.

4TFEBX (Tax Exempt Bond Fund of America®) and HIMFX (American High-Income Municipal Bond Fund®) are American Funds® mutual funds, not Capital Group ETFs. Mutual funds have different features and tax considerations than ETFs.