Global Equities

Technology & Innovation

With remarkable speed, the COVID-19 pandemic has accelerated select investment themes across a number of industries. Nowhere is that truer than the media and entertainment sectors where technological advances and work-from-home trends are rapidly changing the landscape.

Structural shifts in media consumption are disrupting the business models of traditional media giants as momentum builds for cord cutting, streaming video services and more interactive forms of entertainment. The resulting shift in viewership habits, especially among young people, could profoundly alter the outlook for media companies in the years ahead.

With that in mind, here are five powerful themes that I believe will play a major role in the evolution of media and entertainment over the next decade.

1. Video games will surpass pay TV as the largest in-home entertainment market.

Video games should enjoy at least another decade of demographic tailwinds generated by young people playing and spending more, and older people continuing to stay in the game, so to speak. Dramatic advancements in graphics quality, increased access to cloud-based gaming platforms, and the further adoption of in-game monetization efforts should allow video games to continue taking time and wallet share from traditional pay TV companies.

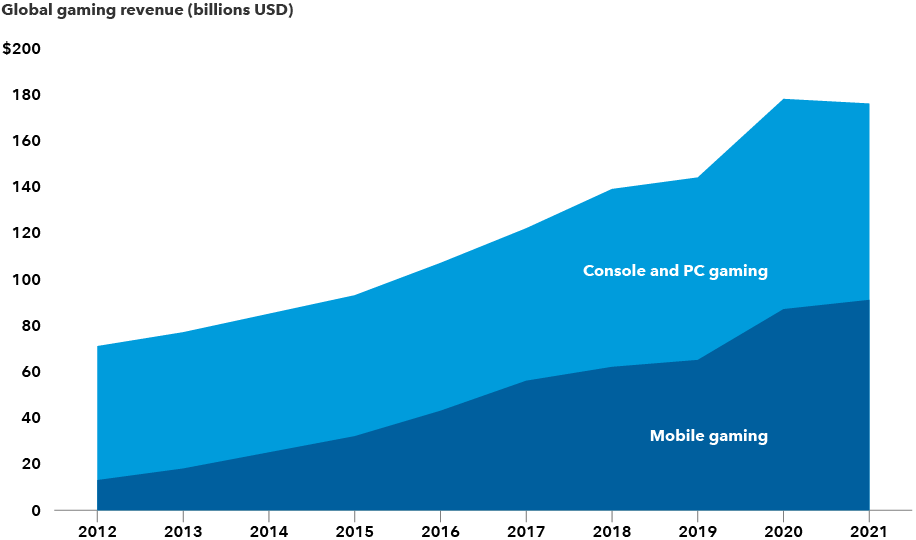

Game on: Video game revenues have soared during the pandemic

Sources: Capital Group, Newzoo. 2021 revenues are estimates as of April 2021.

Pandemic-related lockdowns over the past year allowed the gaming industry to shine like never before. Console makers Microsoft (Xbox), Sony (PlayStation) and Nintendo (Switch), as well as game developers such as Activision, Electronic Arts and Take-Two Interactive, experienced huge increases in engagement and revenue as homebound consumers turned to video games for interactive fun and perhaps some degree of escapism.

In my estimation, the US$130 billion video game industry should be able to sustain a 5% annual growth rate over the next decade. On that path, video games will eventually surpass the US$200 billion pay TV market that is growing at just 1% to 2% per year.

2. The number of U.S. pay TV bundle subscribers will fall dramatically.

In a related theme, I expect almost all general entertainment television viewing to shift away from legacy pay TV bundles and toward on-demand streaming over the next decade. Live sports and news, which account for about 25% of viewing, will be the only viable reasons that some consumers pay US$100 or more per month for a bundle of channels.

Only about half of the 125 million American households are avid sports fans, leaving a potential residual base of 60 to 70 million consumers in the bundle. However, it would only take one company buying a few key sports rights and making them available outside the bundle for the declines to accelerate even faster. NBCU is already making the Premier League and Olympics available on the Peacock streaming service. Meanwhile, the renewal of NFL Sunday Ticket in 2022 could spell the end of bundling as we know it. If it is made available on ESPN+, Amazon Prime Video or YouTube TV, that will be another reason for consumers to ditch the legacy bundle.

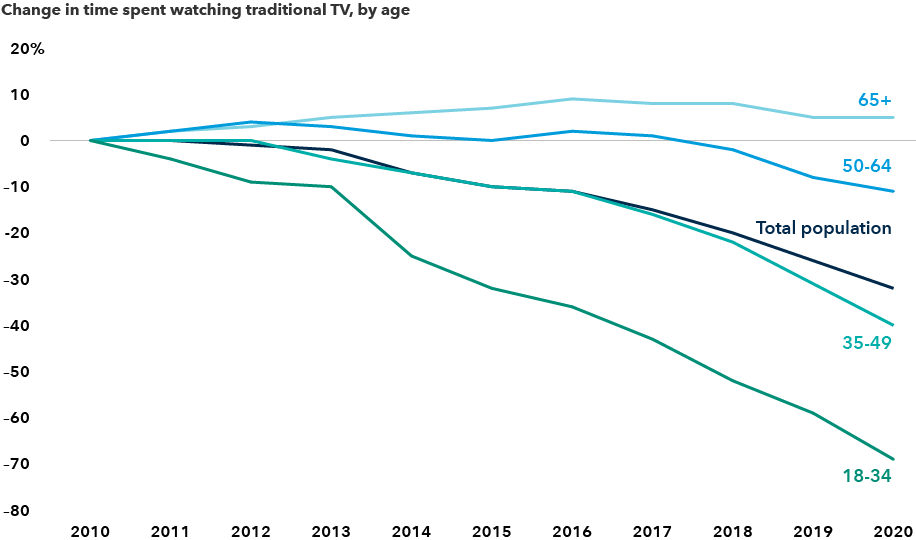

Young people are increasingly shunning pay TV

Sources: Capital Group, Nielsen. Traditional TV includes live TV and recordings of live TV (for example, using a DVR).

In another blow to the future of pay TV, young people in particular are turning away from conventional viewing in huge numbers. Since 2010, the time spent watching traditional TV by those ages 18 to 34 has declined by about 70%, according to ratings firm Nielsen. Traditional TV has also lost significant ground among people ages 35 to 49. Only the 65+ crowd has remained loyal over the past 10 years.

3. Video streaming will grow to become the primary form of movie and TV consumption.

It is becoming increasingly clear that streaming services are the primary replacement for traditional pay TV bundles. As consumers become comfortable cutting the cord, streaming giants such as Netflix, Disney+ and Amazon Video are the primary beneficiaries.

Similar to the video game industry, streaming services got a huge shot in the arm during the COVID-19 lockdowns as millions of new subscribers flocked to them in a binge-watching flurry. Once the domain of old TV shows and movies, new and original content is now driving growth at the major streaming services. Think “Stranger Things” on Netflix, “The Mandalorian” on Disney+ or “The Marvelous Mrs. Maisel” on Amazon Video.

Netflix, for example, is expected to have a content budget of US$25 billion to US$30 billion by 2030, allowing it to potentially drop four US$100 million series or movies each week. Given that enormous budget, there is a good chance Netflix will make something that most U.S. households will want to watch, enabling it to eventually reach about 90 million U.S. subscribers.

4. Professional football viewership could be in structural decline.

Today, the value of live sports to advertisers and legacy media companies is unquestioned — and the NFL is the gold standard. However, a growing number of NFL players are retiring after only a few years in the league due to fears of permanent injury. Additionally, most of the stabilization in viewership over the last two years has been attributed to the return of the older demographic after the NFL began focusing less on politics and more on the game. Viewing declines continue among younger people who are interested in a broader array of sports and less likely to play high school football.

Anecdotally, I grew up in a Midwest “Friday Night Lights” kind of town where even the freshman team had no trouble finding players and half the population would show up for varsity football games. A little more than a decade later, the freshman team can barely scrape together 25 kids, and attendance is down significantly as parents worry about health issues. As a sports fan, it pains me to say this, but a decade from now, I think pro football viewership could suffer a significant hit.

5. Autonomous vehicles may provide an extra hour a day for media consumption.

With smartphone adoption maturing in the developed world, we are approaching daily media consumption of 10 to 11 hours per person. Driverless cars could provide a major growth boost in the years ahead. Given that the average commute in the U.S. is about 30 minutes each way, that potentially frees up another hour per day of media consumption.

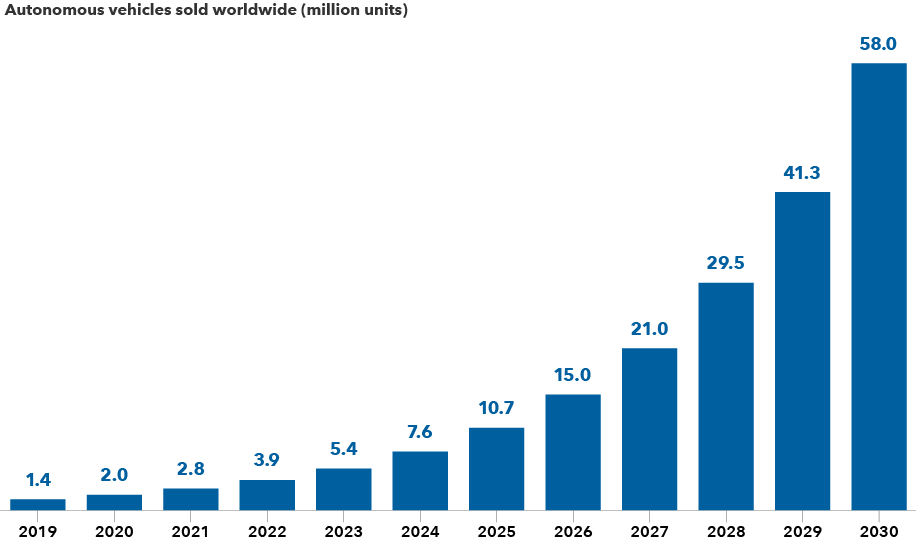

Driverless cars could allow for greater media consumption

Source: Statista. Forecasts for 2020–2030 are as of April 2021.

With an estimated 2 million units sold in 2020, driverless cars currently are not a large part of the market, but are expected to grow exponentially. Boosted by lower prices and government mandates for electric vehicles, the number of driverless cars could reach 58 million by 2030, based on various industry estimates. That could free up even more time to enjoy streaming movies, podcasts and music services over the next decade.

Our latest insights

RELATED INSIGHTS

-

Global Equities

-

-

U.S. Equities

Commissions, trailing commissions, management fees and expenses all may be associated with investments in investment funds. Please read the prospectus before investing. Investment funds are not guaranteed or covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. For investment funds other than money market funds, their values change frequently. For money market funds, there can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you. Past performance may not be repeated.

Unless otherwise indicated, the investment professionals featured do not manage Capital Group‘s Canadian investment funds.

References to particular companies or securities, if any, are included for informational or illustrative purposes only and should not be considered as an endorsement by Capital Group. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds or current holdings of any investment funds. These views should not be considered as investment advice nor should they be considered a recommendation to buy or sell.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and not be comprehensive or to provide advice. For informational purposes only; not intended to provide tax, legal or financial advice. Capital Group funds are available in Canada through registered dealers. For more information, please consult your financial and tax advisors for your individual situation.

Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. We encourage you to consider these and other factors carefully before making any investment decisions and we urge you to avoid placing undue reliance on forward-looking statements.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2026 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2026. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under licence. All rights in the FTSE Russell indices or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indices or data and no party may rely on any indices or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The index is unmanaged and cannot be invested in directly.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com)

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capital Group trademarks are owned by The Capital Group Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capital Group funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capital Group, a global investment management firm originating in Los Angeles, California in 1931. Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

The Capital Group funds offered on this website are available only to Canadian residents.

Nathan Meyer

Nathan Meyer