Markets & Economy

Utilities

If there is any one element that underpins the development of artificial intelligence and reindustrialization of America, it might be electric power.

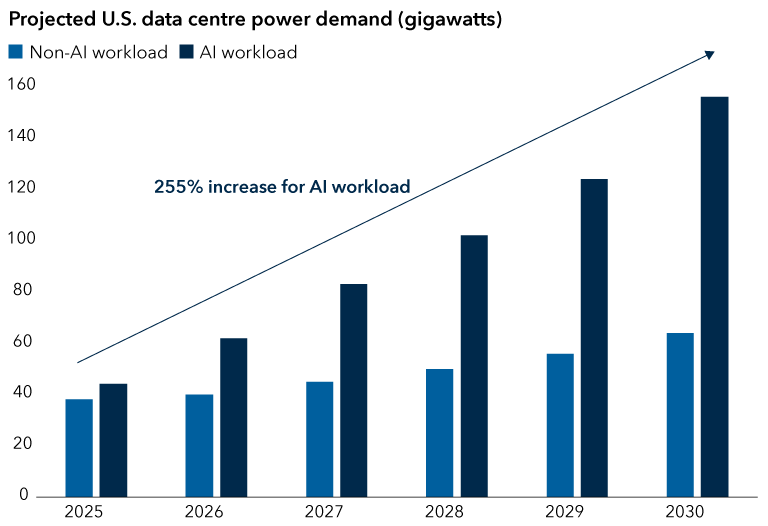

Power demand in the U.S. is set to surge over the next decade, driven by rapid expansion of AI data centres, new manufacturing facilities and electric vehicle networks. Take data centres, which account for about 4% of U.S. electricity use, with estimates suggesting that figure could climb to 9–14% by 2030.

Overall, what’s unfolding is a fundamental shift for the power industry, which has undergone a decade of stagnant consumption. Power providers are transforming into critical enablers of growth as technology giants and others race to secure more energy.

U.S. power markets will experience accelerating demand and structural constraints limiting supply. This will offer a spectrum of potential investment opportunities.

Bracing for data centre power needs

Source: Statista, McKinsey, Gartner, IDC, Nvidia company filings. As of April 2025.

Expect power constraints through 2030

U.S. policy is contributing to increased power demand, with its emphasis on domestic investment, ranging from semiconductor to pharmaceutical manufacturing facilities. For instance, there is over US$3 trillion in planned investments across the U.S. for new capacity.

The last time the U.S. witnessed massive power investments was the late 1990s and early 2000s, which resulted in an overbuild of gas-fired generation plants in newly deregulated markets.

The burst of the dot-com bubble, excessive demand outlooks and natural gas price collapse all helped plunge the market into oversupply, triggering a wave of bankruptcies and stranded assets. Today, there are few signs of this excess and speculative buildout.

With that in mind, here are several structural constraints anticipated to keep power generation tight through at least 2030:

- Equipment delays: Customers are waiting for items such as electrical components and gas turbines from firms such as GE Vernova, Siemens Energy and Mitsubishi. In some cases, turbines may take up to five years to be built and shipped.

- Grid bottlenecks: Potential wait time of five to seven years to connect new generation resources to the power grid.

- Regulatory hurdles: Permitting challenges are slowing both fossil fuel and renewable builds, compounded by federal resistance to large-scale renewable projects.

- Coal retirements: There haven’t been net new coal additions in the U.S. since 2014, and a significant amount of coal may still retire before the end of the decade.

This imbalance is already reshaping the market. Moreover, data centre operators are locking in long-term contracts with nuclear generators to secure carbon-free baseload power. As nuclear capacity is exhausted, expect similar deals with fossil fuel generators, especially those with reliable baseload assets.

Investment opportunities in utilities, industrials and materials

For investors, sectors such as utilities, industrials and materials are at the forefront of a new wave of infrastructure investment in the U.S., with opportunities among smaller and mid-sized firms.

Beneficiaries may include independent power producers such as Vistra and NRG Energy, who operate in power markets like the Electric Reliability Council of Texas (ERCOT) and regional grid operator PJM where demand is booming. NRG, for instance, was the largest contributor to year-over-year earnings growth for the U.S. utility sector during Q3, while the overall group posted the second highest earnings growth rate of all S&P 500 sectors at 23.8%, according to FactSet.

Utilities are experiencing higher earnings growth rates and increased capital investment needs. Regulated utilities typically grew earnings by 5% to 7%, but now some are projecting 7% to 9% or more. While this requires significant growth in capital investment, they can fund expansion by leveraging their statutory monopolies to issue debt and equity. Unregulated utilities, meanwhile, are seeing even higher growth rates due to inflationary power prices and widespread demand.

Regulated utilities including Entergy and Southern Company are making large investments needed to upgrade and expand grid infrastructure to support data centre demand, which may drive earnings growth higher. Entergy for instance is building new gas-fired power plants and expanding transmission infrastructure in an agreement with Meta for a large-scale AI data centre in Louisiana.

Companies producing power generation equipment and energy resource management systems, including Schneider Electric and Hitachi, are also integral to the ongoing power boom.

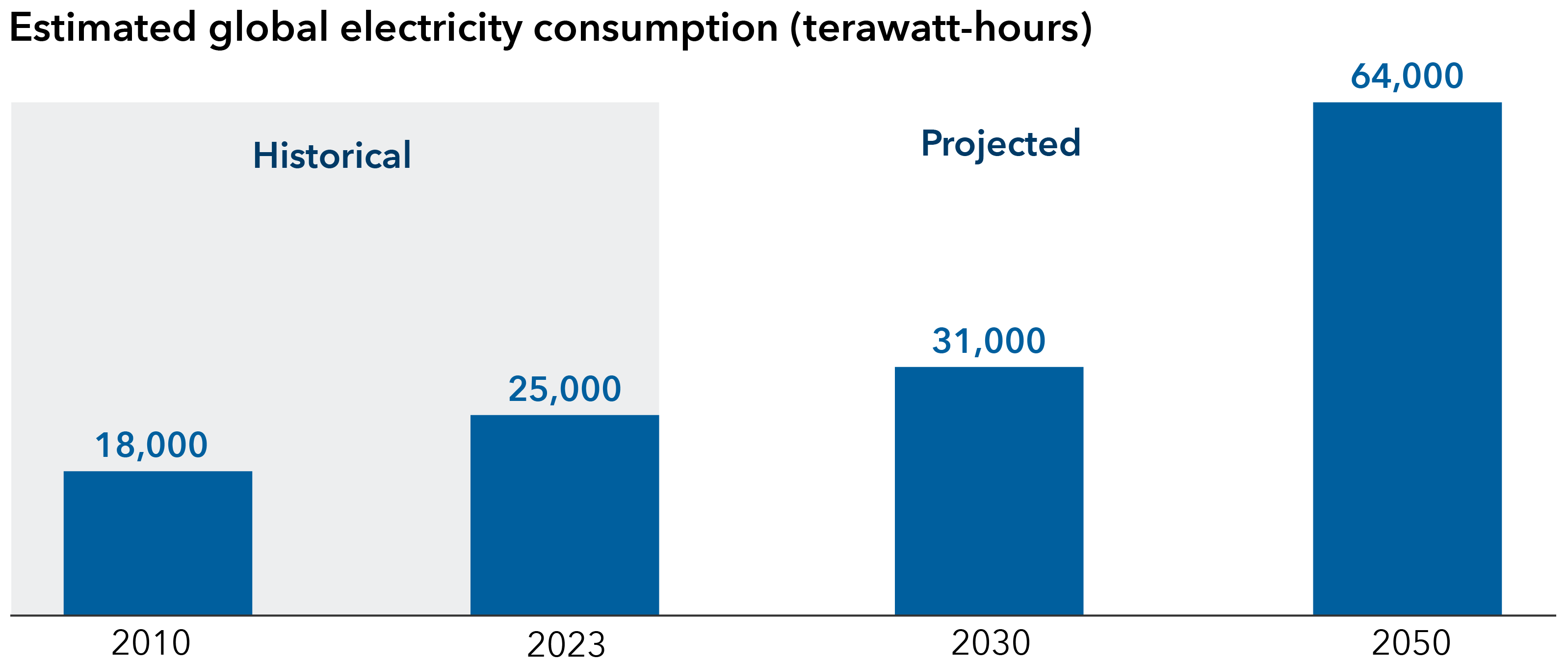

Digital infrastructure is a boon for electricity

Source: Statista, McKinsey, International Energy Agency, International Renewable Energy Agency. As of September 2024.

Outside of power, certain metals are becoming critical to meet increasing electrification needs. Copper demand is increasing as data centres require more of the metal for items such as cooling systems, wiring and connectivity. Parts for electric vehicles along with charging stations also require copper. The metal could face a shortfall of 6 million tons by 2035, according to Bloomberg New Energy Finance. Mining giants such as BHP and Freeport are among key global copper producers.

Industrial giants such as Caterpillar are also participating in the current data centre boom, supplying engines, turbines and generators. Caterpillar’s power generation sales were up 31% year over year in the third quarter. Smaller companies have also reported growing backlogs. These companies range from engineering & construction services firms, providers of high-density power systems and HVAC equipment.

Bottom line

Power is transforming into a critical enabler of growth from what was once a behind-the-scenes segment of the economy. With multiple drivers of power demand, the U.S. should see increased investment in electric infrastructure, utilization of the power generation fleet, and new technologies emerging. We expect these dynamics to offer a variety of investment prospects.

The S&P 500 Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks.

The S&P 500 Utilities Index comprises those companies included in the S&P 500 that are classified as members of the Global Industry Classification Standard (GICS®) utilities sector.

Our latest insights

-

-

-

Artificial Intelligence

-

Global Equities

-

Commissions, trailing commissions, management fees and expenses all may be associated with investments in investment funds. Please read the prospectus before investing. Investment funds are not guaranteed or covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. For investment funds other than money market funds, their values change frequently. For money market funds, there can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you. Past performance may not be repeated.

Unless otherwise indicated, the investment professionals featured do not manage Capital Group‘s Canadian investment funds.

References to particular companies or securities, if any, are included for informational or illustrative purposes only and should not be considered as an endorsement by Capital Group. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds or current holdings of any investment funds. These views should not be considered as investment advice nor should they be considered a recommendation to buy or sell.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and not be comprehensive or to provide advice. For informational purposes only; not intended to provide tax, legal or financial advice. Capital Group funds are available in Canada through registered dealers. For more information, please consult your financial and tax advisors for your individual situation.

Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. We encourage you to consider these and other factors carefully before making any investment decisions and we urge you to avoid placing undue reliance on forward-looking statements.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2026 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2026. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under licence. All rights in the FTSE Russell indices or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indices or data and no party may rely on any indices or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The index is unmanaged and cannot be invested in directly.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com)

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capital Group trademarks are owned by The Capital Group Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capital Group funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capital Group, a global investment management firm originating in Los Angeles, California in 1931. Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

The Capital Group funds offered on this website are available only to Canadian residents.

Dominic Phillips

Dominic Phillips

Mila Yankova

Mila Yankova