Fed

President Trump picked former U.S. Federal Reserve (Fed) governor Kevin Warsh to lead the Fed, elevating a recently dovish voice at a moment when U.S. policymakers are trying to decide how far and how fast to cut interest rates. The choice caps months of speculation and sets the stage for a pivotal chapter in the U.S. central bank’s history.

Warsh recently penned an op-ed in the Wall Street Journal advocating for lower interest rates, arguing the U.S. economy can have growth without inflation. However, he has been viewed as more hawkish in the past, particularly during the global financial crisis.

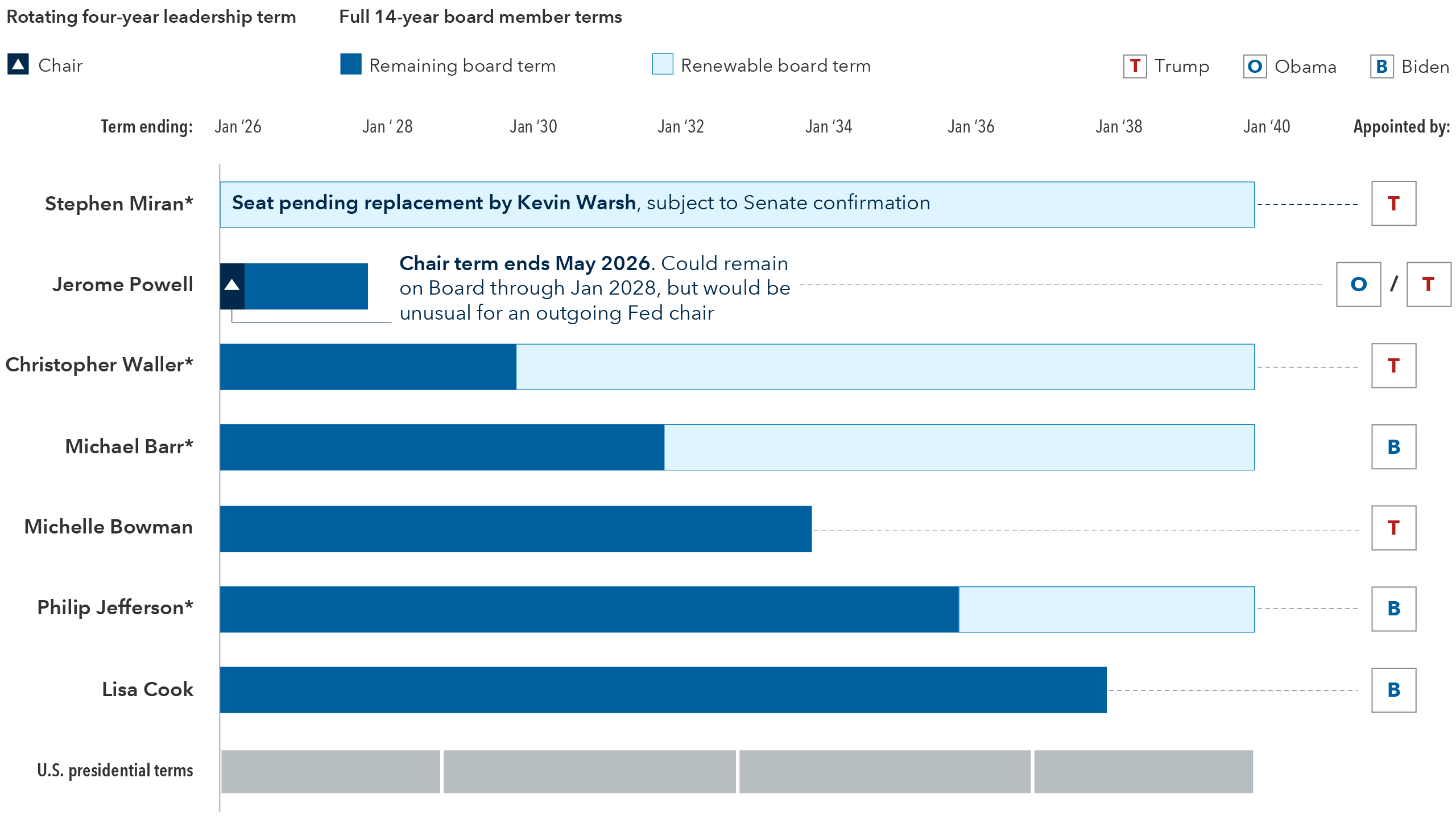

Assuming U.S. Senate confirmation, whether the Fed under Warsh will deliver substantially lower interest rates by year-end 2026 will likely still come down to jobs and inflation data, says bond manager Ritchie Tuazon. "The scenario of an extreme Fed capture, or loss of Fed independence, is unlikely as it would require all board members to follow the Fed chair. However, I do think the Fed will be more dovish, particularly as Trump appoints more governors.”

Current Fed structure may protect independence

Sources: Capital Group, Brookings, U.S. Federal Reserve. *A member of the Federal Reserve Board of Governors who is completing an unexpired portion of a prior members' 14-year term may be reappointed. Members and leadership positions are nominated by the U.S. president and confirmed by the U.S. Senate. While Stephan Miran's term is ending January 31, 2026, he may remain on the Board until a replacement is confirmed. T refers to Trump, O refers to Obama, and B refers to Biden. Renewable portion shown for illustration; reappointment is not automatic. As of January 30, 2026.

An economy out of balance

Powell is unlikely to retreat from the centre of monetary policymaking before his term as Fed chair ends in May 2026. The economic backdrop facing the Fed is increasingly challenging: The U.S. job market is showing signs of strain, but inflation remains above the Fed’s target and economic growth has been resilient. Moreover, a mid-cycle election year dominated by concerns over “affordability” could push politicians and households alike to pressure the Fed to lower interest rates.

The good news is that the incentives of the Fed and Trump administration are currently aligned, says fixed income portfolio manager Pramod Atluri. “Right now, they both want to support the labour market. That alignment means that the Fed is likely to continue to cut rates based on fundamentals rather than political pressure.”

The Fed is likely to be responsive to further signs of labour market weakness, notes Atluri, even as it pauses on rates for now. Should inflation continue to moderate through the year, the Fed could cut rates again because failing to do so as inflation falls would lead to tighter monetary policy conditions.

Rates are expected to fall in 2026

Sources: Capital Group, Bloomberg, U.S. Federal Reserve. Fed funds target rate reflects the upper bound of the Federal Open Markets Committee's (FOMC) target range for overnight lending among U.S. banks. As of January 30, 2026.

Policy interventions for lower interest rates

Could U.S. policymakers do more to lower interest rates broadly? In addition to nudging the overnight federal funds rate, officials wield heavier tools like quantitative easing (QE), a crisis-era staple it has deployed four times since 2008 to bring down long-term borrowing costs.

It’s not unreasonable to imagine the Fed attempting to affect the yield curve if rates rise dramatically. Such a move could be under consideration if the market’s backbone — the 10-year U.S. Treasury yield, which underpins borrowing costs for the global economy — jumps above 5% and stays there long enough to threaten financing conditions, Tuazon believes.

Currently, markets remain well below that threshold. As of January 29, 2026, the 10-year yield sits at 4.24%, a level that has eased from the highs of Trump’s “liberation day” tariffs but still reflects uncertainty about growth dynamics, the federal government’s fiscal path and the durability of disinflation.

Fed rate cuts have left mortgage rates virtually unchanged

Sources: Capital Group, Federal Reserve Bank of St. Louis. As of January 30, 2026.

Beyond the Fed, the Trump administration has other levers it may pull to lower interest rates. Earlier in January, U.S. officials directed government-controlled mortgage giants Fannie Mae and Freddie Mac to buy US$200 billion in mortgage assets, with the ultimate goal of reducing mortgage rates. To the extent those measures fall short, U.S. policymakers could consider further steps to lower mortgage costs, from adjusting mortgage insurance premiums and guarantee fees to additional Fannie and Freddie purchases.

The U.S. administration may also look to influence Treasury markets by reducing issuance at the long end of the yield curve or expanding the U.S. Treasury Department’s program of Treasury repurchases. How likely or effective these measures will be remains uncertain. However, for investors, the U.S. administration's push to lower interest rates may be supportive of interest rate-sensitive positions.

Fed independence on watch

Investors depend on Fed independence for good reasons. “It's an important topic because there are so many examples of countries that got into trouble by running inappropriate monetary policy,” Atluri says. “There's this view that they can get some short-term gains from implementing stimulative monetary policy, but they ultimately ignore the potential long-term pain such as hyperinflation and currency collapse.”

The Fed’s credibility as the watchdog of the world’s largest bond market has been built over decades, and the next chair may seek to preserve that legacy. Recently, investor backlash after the U.S. Justice Department subpoena of Powell and an upcoming U.S. Supreme Court ruling on whether President Trump could immediately fire Fed governor Lisa Cook, have heightened the scrutiny of Fed independence. Still, with the reappointment of the Board of Governors, we think there is a low probability of a sweeping political takeover. Other members of the board may resist political pressure, keeping the institution insulated while maintaining its traditional dual mandate of price stability amid full employment.

Whatever direction U.S. monetary policy takes, investors are paying close attention and may represent another check on the system. That’s particularly true if growth proves resilient amid a swelling federal deficit, which would keep pressure on long-term rates. In such an environment, any sign that the Fed is drifting from its mandate could show up in the form of market volatility.

Liberation day tariffs refer to an announcement by U.S. President Donald Trump on April 2, 2025, that implemented a broad set of tariffs on imports from nearly all countries.

Our latest insights

-

-

Global Equities

-

-

Markets & Economy

-

Global Equities

RELATED INSIGHTS

-

Global Equities

-

Markets & Economy

-

Emerging Markets

Commissions, trailing commissions, management fees and expenses all may be associated with investments in investment funds. Please read the prospectus before investing. Investment funds are not guaranteed or covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. For investment funds other than money market funds, their values change frequently. For money market funds, there can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you. Past performance may not be repeated.

Unless otherwise indicated, the investment professionals featured do not manage Capital Group‘s Canadian investment funds.

References to particular companies or securities, if any, are included for informational or illustrative purposes only and should not be considered as an endorsement by Capital Group. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds or current holdings of any investment funds. These views should not be considered as investment advice nor should they be considered a recommendation to buy or sell.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and not be comprehensive or to provide advice. For informational purposes only; not intended to provide tax, legal or financial advice. Capital Group funds are available in Canada through registered dealers. For more information, please consult your financial and tax advisors for your individual situation.

Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. We encourage you to consider these and other factors carefully before making any investment decisions and we urge you to avoid placing undue reliance on forward-looking statements.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2026 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2026. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under licence. All rights in the FTSE Russell indices or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indices or data and no party may rely on any indices or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The index is unmanaged and cannot be invested in directly.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com)

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capital Group trademarks are owned by The Capital Group Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capital Group funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capital Group, a global investment management firm originating in Los Angeles, California in 1931. Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

The Capital Group funds offered on this website are available only to Canadian residents.

Ritchie Tuazon

Ritchie Tuazon

Pramod Atluri

Pramod Atluri