U.S. Equities

Global Equities

Whether it’s the U.S.-China trade tiff, restructuring of the North American Free Trade Agreement or the strength of other trade partnerships around the world, there have been plenty of headlines about trade protectionism that has spurred market volatility and raised doubts about the fate of globalization.

The reality is that over the years, globalization has increased trade and capital flows across economies, resulting in global financial markets that are highly correlated. Look no further than the bouts of market volatility we’ve experienced this year: Global markets from the U.S. to Asia have sold off in tandem.

This raises several questions: Why are correlations so high? Should investors care? And more importantly, what can investors do in response?

Why are correlations so high?

Three primary reasons: trade policies, capital flows and multinational corporations.

Well-orchestrated trade policy changes designed to foster global integration have played a major role in rising market correlations. We can trace this to the General Agreement on Trade and Tariffs that kicked off in 1986 and culminated in the creation of the World Trade Organization in 1995.

During this period, there were three other major trade agreements, including the North American Free Trade Agreement between the U.S. and Canada in 1988, which expanded to include Mexico in 1994. These developments had a profound impact on global trade.

Academic research shows that the number of preferential trade agreements went from 42 in 1990 to almost 280 by 2016, and average global tariffs decreased from 22% to less than 10% over the same period. Global trade surged as trade barriers decreased, with the ratio of global trade to GDP increasing by more than 50% over the same period and sharply accelerating in the 1990s.

There was also a wave of financial liberalization that increased cross-border capital flows. Capital controls fell in developed markets and a number of stock markets opened in emerging markets. Foreign direct investment — controlling stakes with greater than 10% ownership in foreign entities —grew by over 250% from 1990 to 2016 as a percentage of GDP.

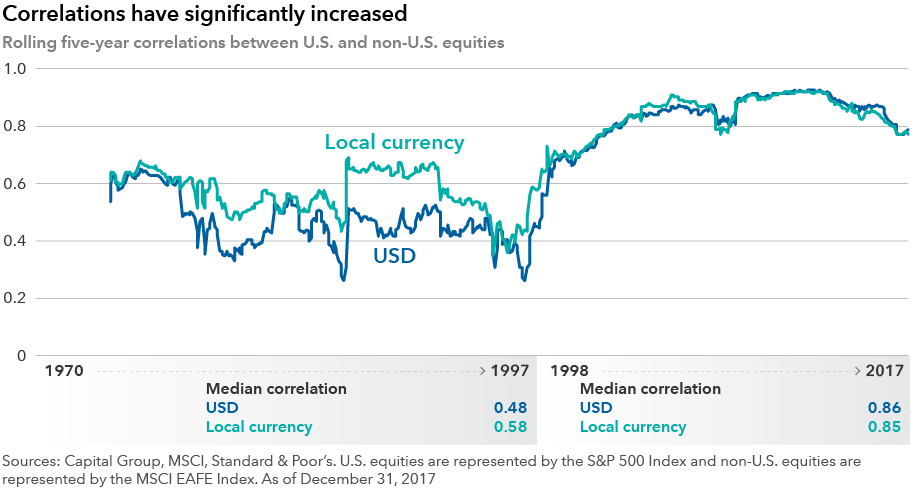

As the chart shows, correlations began to rise in the mid-1990s and have stayed consistently elevated in both normal and stressed financial markets; this includes the dot-com bust in the early 2000s and the 2008 global financial crisis that spurred quantitative easing policies pursued by major central banks.

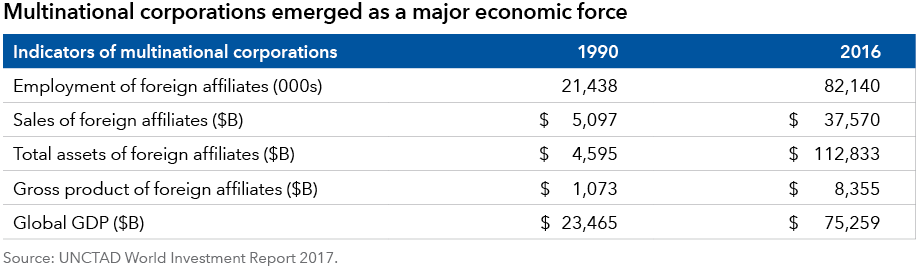

Lastly, multinational corporations have emerged as a powerful business force and represent a powerful vested interest in support of globalization.

In a 2017 report, the United Nations Conference on Trade and Development estimated that the total assets of multinational corporations' foreign affiliates grew from $4.6 trillion to $113 trillion between 1990 and 2016. Foreign affiliates alone employed 82 million individuals and produced roughly 11% of global GDP.

Why should investors pay attention?

Despite protectionist rhetoric, the depth of global financial linkages and the dominance of multinational companies today suggest that globalization is unlikely to reverse substantially in the near term.

International investing has traditionally been seen as a source of diversification and risk mitigation for U.S. investors. That’s no longer the case. Our research suggests that the automatic risk reduction from including international equities has greatly weakened as correlations have increased in the wake of more trade and capital flows across economies.

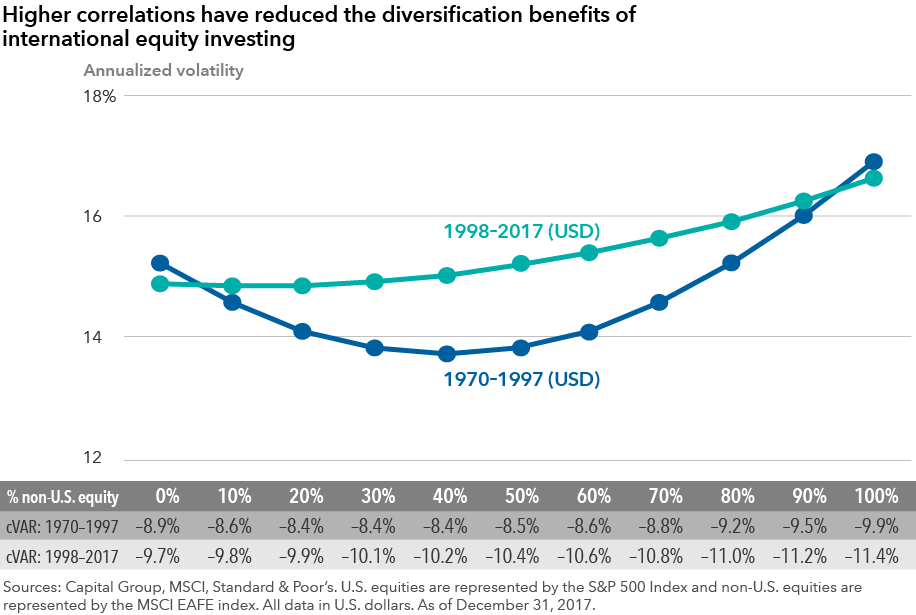

This chart shows that historically U.S. investors could simply reduce the risk of the portfolios by allocating a slice of their portfolio to companies domiciled outside the U.S.

For example, a portfolio with 40% in international equities had approximately 1.5% lower volatility than an all U.S.-equity portfolio, and lower losses in down months. This diversification profile however flattens quite significantly over the last 20 years.

While the chart demonstrates that diversification benefits may have declined, it does not mean that investors should ignore international markets completely. Rather, they may need to look at the role of international investing differently.

First, the key benefit of including international equities is in expanding the opportunity set. Over half the market capitalization of listed companies is outside the U.S. While the U.S. may seem to have a diversified mix of sectors, U.S. companies make up less than half of the global market capitalization in sectors such as telecommunication services, materials and financials.

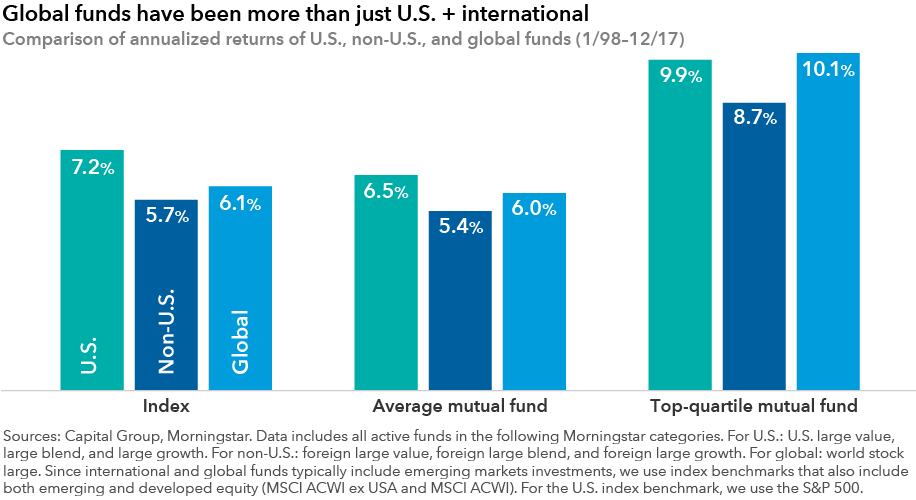

Second, flexibility to invest across borders can lead to better results, as the chart below shows. Our research finds that the top quartile global funds tracked by Morningstar exceeded the average annualized return of the S&P 500 by 290 basis points, and the MSCI World Index by 400 basis points for the 20-year period ended December 31, 2017.

Not only that, they also matched (and slightly outpaced) the returns of the top quartile U.S.-equity funds, despite significant headwinds to international equities in aggregate, demonstrating that above-average stock pickers who use a bottom-up style may be able to capture the value of global opportunities.

What can investors do?

As correlations remain high, it seems only prudent for investors to work with their advisors to evaluate strategies for a globalized world, assuming integrated markets are here to stay.

Here are some key suggestions:

- Right-size your international equity exposure. International companies make up a significant part of the global opportunity set, and most investors are still underallocated.

- Ask your advisor if you should add some global flexibility to your portfolio.

- Understand how your asset manager is investing in international markets: is it fundamental, bottom-up active management, is it passive indexing or is it a top-down asset allocation fund?

Past results are not predictive of results in future periods.

Investing outside the United States involves risks, such as currency fluctuations, periods of illiquidity and price volatility, as more fully described in the prospectus. These risks may be heightened in connection with investments in developing countries.

MSCI does not approve, review or produce reports published on this site, makes no express or implied warranties or representations and is not liable whatsoever for any data represented. You may not redistribute MSCI data or use it as a basis for other indices or investment products.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2018 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

Our latest insights

-

-

Economic Indicators

-

U.S. Equities

-

Long-Term Investing

-

Market Volatility

RELATED INSIGHTS

-

Market Volatility

-

Asset Allocation

-

Global Equities

Don’t miss out

Get the Capital Ideas newsletter in your inbox every other week

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and should not be considered advice, an endorsement or a recommendation.

Sunder Ramkumar

Sunder Ramkumar

Michelle Black

Michelle Black