Tax & Estate Planning

Planning for multigenerational wealth is about more than money — it’s about priming the next generation to be responsible stewards.

It’s the core of the American Dream: The next generation should be better off than the last.

Nearly every client I meet holds that goal close to their heart. They want their loved ones to enjoy the advantages of wealth and be able to parlay an eventual inheritance into something more. And they’re not alone, as the aging of the baby boom generation has triggered a massive global wealth transfer.

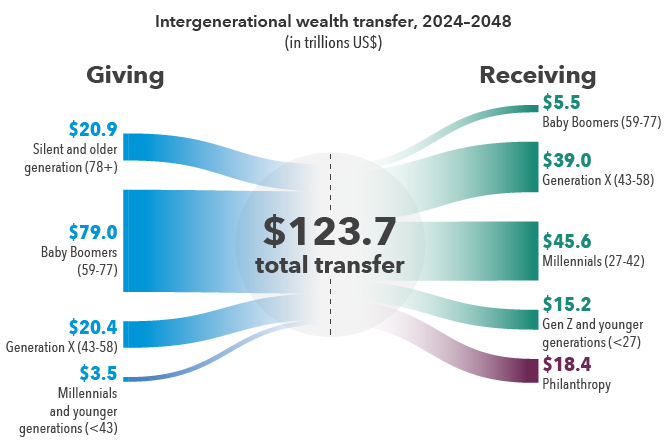

Some $124 trillion is expected to change hands by 2048. About half of that money is anticipated to flow from households worth $10 million or more, with Generation X and millennials largely being the ultimate beneficiaries of this windfall.* The sheer scale of this shift places a new spotlight on an age-old question: Are heirs ready for this responsibility?

Many clients share that they’re worried about their heirs — younger ones who grew up surrounded by wealth and might spend recklessly or never develop a work ethic; others who might hoard family wealth, too afraid to spend any of it; and those who might feel overwhelmed and unprepared for an inheritance. Clients want to impart their values and how money can be used to accomplish greater personal or philanthropic goals.

These are immemorial and generational challenges with no pat solutions. But with consistent effort, clear communication and a foundational education, it’s possible to impart your values and mold responsible stewards.

First things first — make sure everyone’s on the same page.

In my experience, the families that most successfully pass on their wealth are those that take the time to pass on their wisdom. That means open discussion about values, work ethic and, of course, money — the benefits it can bring, but also its limits and how easily it can be frittered away.

Talking about finances can be difficult. There’s social inertia against discussing wealth, and striking a balance between frank, open discussion and divulging too much about individual circumstances is its own challenge. But think of what you’re competing against: Young or inexperienced investors are bombarded with unrealistic messages about consumption. They lack firsthand experience with the corrosive effects of inflation and have a limited understanding of risk. Misconceptions can prime beneficiaries to invest and spend unsustainably — chasing high returns without considering the downside, for example.

A good way to foster communication is to hold designated family meetings at which you can explain important concepts that can set your heirs on the road to becoming responsible stewards. Capital Group Private Client Services can help facilitate and structure these conversations. We also offer several financial education classes: Basic courses that cover budgeting and building credit through to advanced instruction for topics like risk management and portfolio construction.

These family discussions shouldn’t be one-time affairs. Regular meetings can help reinforce a responsible message, and they’re excellent opportunities to remind family members of your values, philosophy and goals.

I often recommend at least annual meetups that include the whole family — and I do mean everybody. Family wealth will almost certainly flow through multiple people, including other family leaders. In fact, a large part of that $124 trillion wealth transfer will first be given “horizontally” to partners, siblings and friends, including $54 trillion that will first pass through spouses.* It’s not just children and grandchildren who need a firm financial education and an understanding of the family holdings. Decision-makers can meet more frequently, often on a quarterly basis, to go over the finer details.

The great wealth transfer is underway

Sources: Cerulli. U.S. High-Net-Worth and Ultra-High-Net-Worth Markets 2024. As of December 4, 2024.

When your family shares a solid foundation, you’re ready to build something larger.

Regular meetings and education — especially the unity they can foster — are key to helping your family forge a shared vision for multigenerational wealth. That’s not to say they’re a panacea for harmony; disagreements are natural, and money can be divisive in any case.

But principles that often inform success — well-defined goals and values, diversification and a long-time horizon — can feel intuitive for heirs who grasp the basics. Holdings that might perplex novices, such as the intricacies of municipal bonds, can suddenly make sense with the proper framework.

That common ground can prove wonders for fostering a long-term legacy. Whatever your family’s goals — supporting the arts, keeping the family business nimble and profitable, or simply ensuring that your grandchildren’s grandchildren will benefit from your hard work today — they’re likely going to be better supported by heirs who feel educated and empowered. That message will resonate more strongly with engaged and knowledgeable investors.

Explore what matters most.

Contact your Private Wealth Advisor if you want financial education classes for you or your loved ones.

Our basic education explains the importance of budgeting and how to do it in low-stress ways. We also discuss credit scores and how to build credit. The curriculum also covers securities — what they are and the different roles they can play in a portfolio. Finally, we explain general market behavior and why we believe a long-term focus serves investors well.

In more advanced classes, we think about why we invest and how we build portfolios to help achieve goals. We also confront risk as a multidimensional factor, helping investors understand it as something more comprehensive than merely the potential for loss.

And, of course, we can offer nuanced guidance for a variety of planning questions, including estate planning and trust creation.

* Source: Cerulli. High-Net-Worth and Ultra-High-Net-Worth Markets 2024 The Great Wealth Transfer: Capturing Money in Motion. Wealth transfers are projected to occur from Jan. 1, 2024, through Dec. 31, 2048. As of December 5, 2024.

Ed Gonzalez

Ed Gonzalez