Artificial Intelligence

It remains to be seen just how transformative the artificial intelligence boom will prove to be in reshaping the economy, businesses and American society. But one outcome is already clear: AI has cast an otherworldly spell on the stock market.

A blaze of excitement over the possibilities of AI helped push the S&P 500 to its third-straight year of double-digit gains in 2025. And continued AI enthusiasm — fused with an impressively resilient economy and a potentially accommodative Federal Reserve — raises hope for 2026.

Several factors could line up for investors this year. Forecasts for global GDP growth and corporate earnings are solid. The U.S. economy has repeatedly shaken off predictions of a tariff-induced downturn. Consumers remain entrenched in their won’t-take-no-for-an-answer approach to spending. Perhaps most encouraging, global equity markets are broadening.

That’s not to say that 2025 was easy for investors — or that 2026 will be any less pulse-pounding. In fact, if “AI” was the acronym of the past year, “volatility” was the full word.

Glossy annual returns across the globe masked how much of a roller coaster the markets experienced: The S&P 500 was up nearly 18%, the MSCI EAFE Index topped 30% and the Bloomberg U.S. Agg, representing the general taxable bond market, came in at over 7%. Yet U.S. equities started the year with a nearly 20-point decline, led by AI-exposed tech stocks. Bonds seesawed before stabilizing after second-half interest-rate cuts. And fourth-quarter returns across markets were more of a saunter than a sprint.

Looking ahead, there are plenty of reasons for caution. Inflation remains heightened. The job market appears to have stalled, with employers reluctant to hire or fire. Signs of stress have emerged among lower-income consumers. There is fear that politics could intrude on Fed independence. And the valuations of some AI stocks are nerve-jangling, to say the least.

Beyond the markets, uncertainty has become a near-constant refrain across the non-investment world. The federal government shutdown that began in October became the longest in history. Europe shored up its national defense as the Ukraine conflict ground on. And 2026 started on a similarly tumultuous note, kicking off January with a surprise U.S. attack on Venezuela that culminated in the arrest of its president, Nicolas Maduro.

Yet, for all this sturm und drang, markets have seemed unperturbed by geopolitical events. Instead, they’ve responded to bread-and-butter economic stories such as Germany’s large stimulus program, increased defense spending and U.S. economic optimism.

Explore what matters most.

The Venezuelan situation shows what holds investors’ attention.

The calendar had barely turned to 2026 when the financial world got a reminder of the sometimes-sudden twists in geopolitics. It’s unclear if the U.S. action in Venezuela will produce lasting effects on politics or the economy. Thus far, however, it’s had little discernible impact on the financial world, including on the oil market.

That’s partly because Venezuela, for all its petroleum reserves, is still a relatively minor oil producer, responsible for about 1% of global output as of 2024. It’s also unclear how stable the country will be in coming months or years, and that lack of clarity could be a deterrent to making expensive long-term investments, such as refineries.

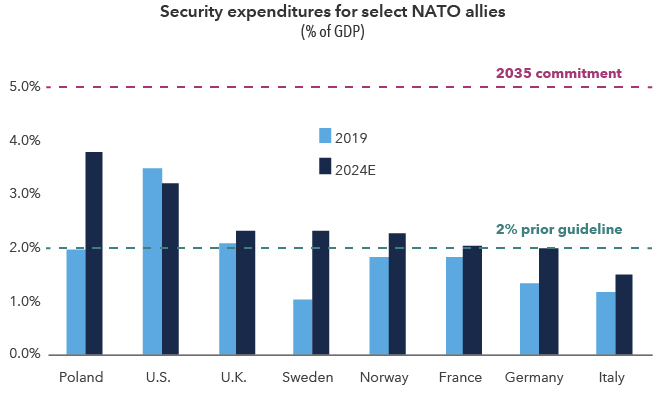

Increased European defense spending could be a tailwind to GDP

Sources: Capital Group, NATO. Figures for 2024 are estimates based on most recently available data, as of October 31, 2025. New 5% commitment was announced June 27, 2025. Percentage of GDP is based on constant prices and exchange rates, indexed to 2021.

In Europe, expanded German stimulus, blossoming demand for electricity and higher defense spending prompted by the Ukraine conflict and NATO demands all helped spur optimism. These factors could be durable — earnings per share growth, a measure of profitability, for European corporations is projected to leap from an anemic 0.3% for 2025 to a robust 12.2% this year. In Japan, efforts to modernize corporate structures appear to be bearing fruit, and profitability is expected to continue steadily growing. Another bright spot emerged in the fourth quarter as the health care sector surged globally, partly on approvals for new drugs and clarity around U.S. pharmaceutical pricing.

AI is still powering returns, particularly in the U.S.

The most highly watched dynamic in the stock market has been the cyclone-force rally in AI stocks. Visions of an AI-powered world have spurred a gargantuan capital spending boom that could benefit companies far beyond the technology sector.

However, the ferocity of the rally has sparked increasing fear of an AI bubble akin to the 1990s dot-com frenzy. The risks were demonstrated by the industry’s sharp pullback in April on fears that China’s DeepSeek had cheaply replicated the efforts of companies such as OpenAI. While the industry strongly rebounded later in the year, the incident underlines why high concentration can be a liability for investors.

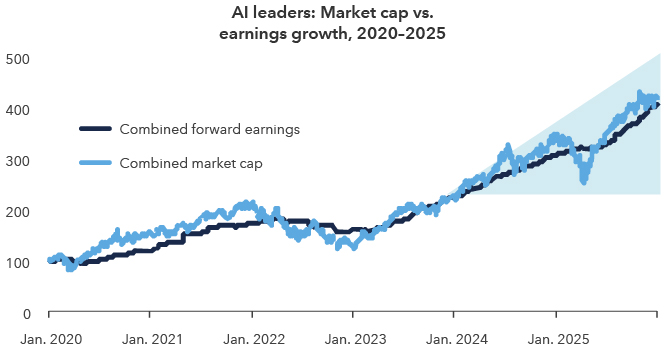

However, while fears of a dot-com-style bubble aren’t groundless, they may be overstated. Many of the large AI-exposed companies — Google and Nvidia, for example — have strong balance sheets and stout cash flow, a stark difference from the paper wealth of the unproven upstarts of the dot-com era. And while giant tech stocks today are still very expensive relative to their profitability, they’re nowhere near the startup valuations of the late ’90s.

AI stock price has been supported by rising earnings expectations

Sources: Capital Group, Bloomberg. Past results are not predictive of results in future periods. Data aggregates forward 12-month net income (“forward earnings”) and market capitalization (“market cap”) for seven of the largest AI-exposed companies: Alphabet, Amazon, Apple, Broadcom, Meta, Microsoft and Nvidia. Data are indexed to 100 on January 1, 2020. As of December 31, 2025.

For more insights on the AI outlook, the rally in international markets and other topics, read our annual equity roundtable with Capital Group investment professionals.

Bonds benefited from a more dovish Fed.

The Fed cut rates for the third time in December, giving fixed income a boost. Investment-grade (BBB/Baa and above) taxables cleared 7% for the year, with municipals close behind despite a rocky start to 2025, hitting 5% as represented by the Bloomberg Municipal Short-Intermediate 1–10 Years Index.

Some Capital Group fixed income professionals are anticipating that more easing could be on the way, which could provide a further tailwind. We discuss what that might look like — and what else could be affecting bond returns — in our annual fixed income roundtable.

The indexes are unmanaged and, therefore, have no expenses. Investors cannot invest directly in an index. Past results are not predictive of results in future periods.

Related insights

-

-

-

Economic Indicators