AMERICAN FUNDS TARGET DATE RETIREMENT SERIES®

Helping participants when it matters most

Our target date series has weathered recent volatility and generated strong results amid diverse market environments.

AMERICAN FUNDS TARGET DATE RETIREMENT SERIES®

Helping participants when it matters most

Our target date series has weathered recent volatility and generated strong results amid diverse market environments.

The numbers speak for themselves1

Our target date series' return rankings vs. competitors (Class R-6 shares)

As of June 30, 2019

Source: Morningstar and Capital Group, using data obtained from Morningstar.

How we did it

A dynamic glide path

Equity shifts to less-volatile dividend payers as participants age, helping to control risk and pursue higher returns.

Better building blocks2

The underlying equity funds that make up the series have generated strong results versus peers.

The freedom to find winners

Managers in our flexible underlying funds are empowered to pursue the most attractive investment opportunities.

Bonds that can protect3

The series’ fixed income funds stress low correlation to equities, which can help cushion equity downturns.

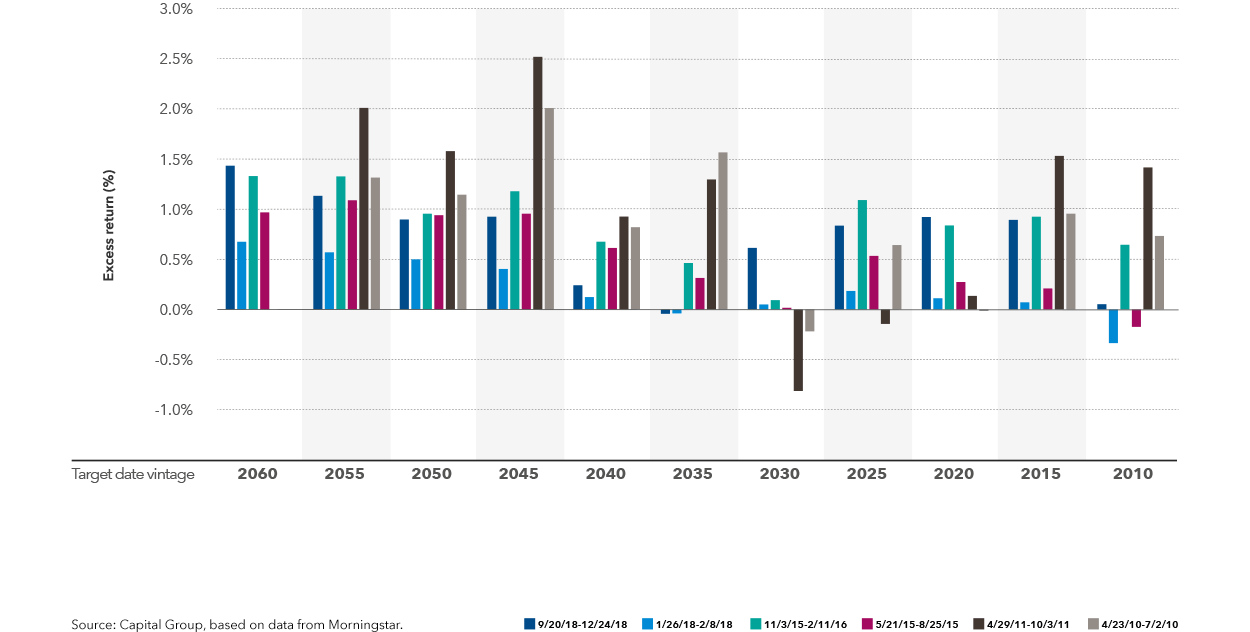

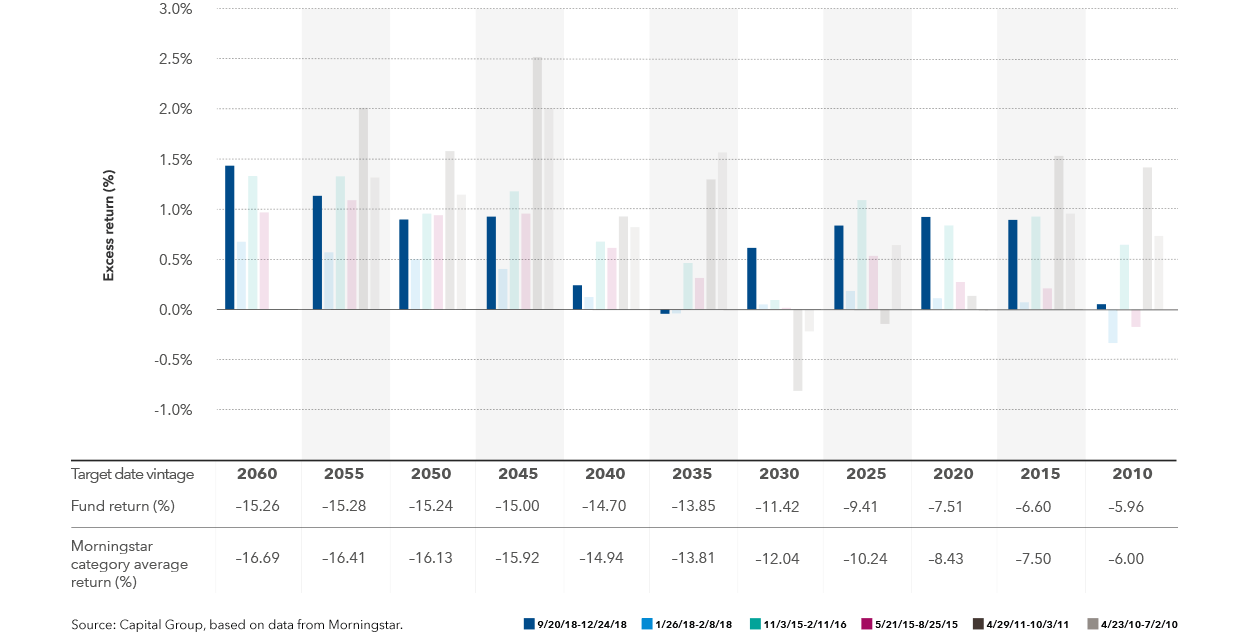

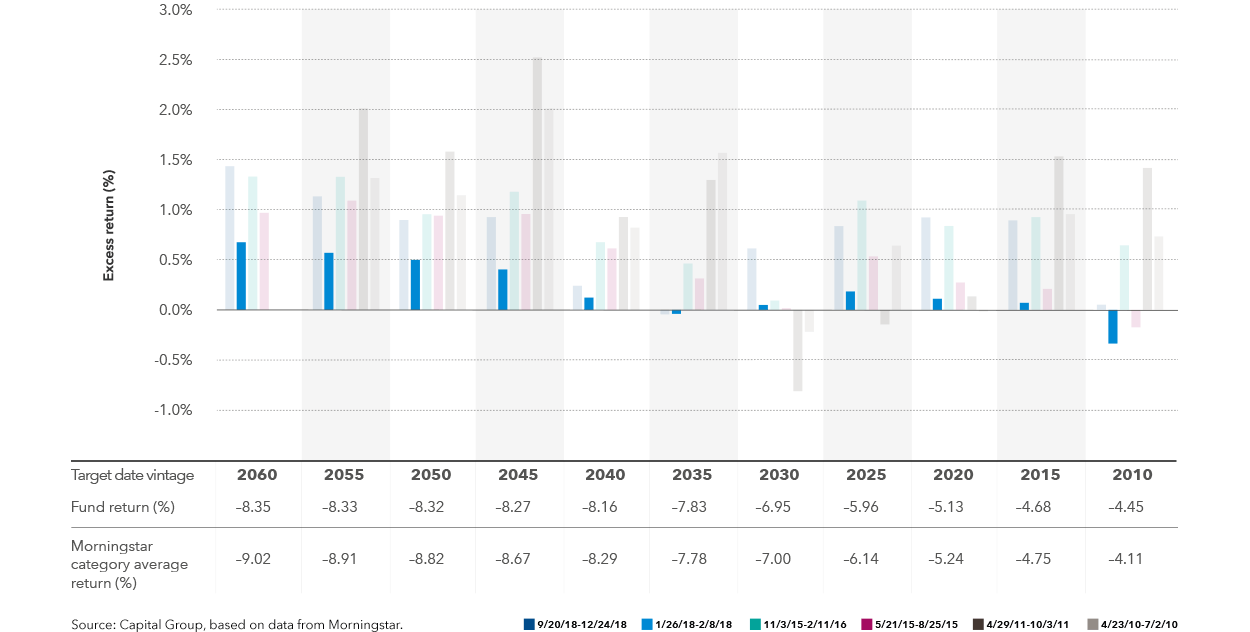

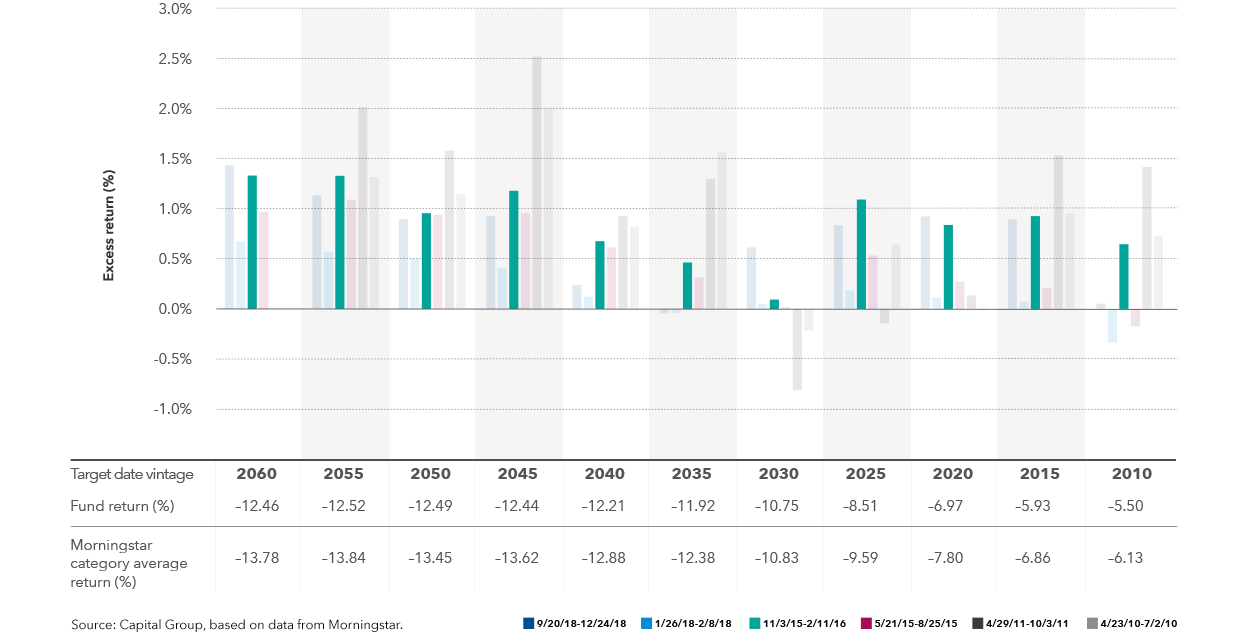

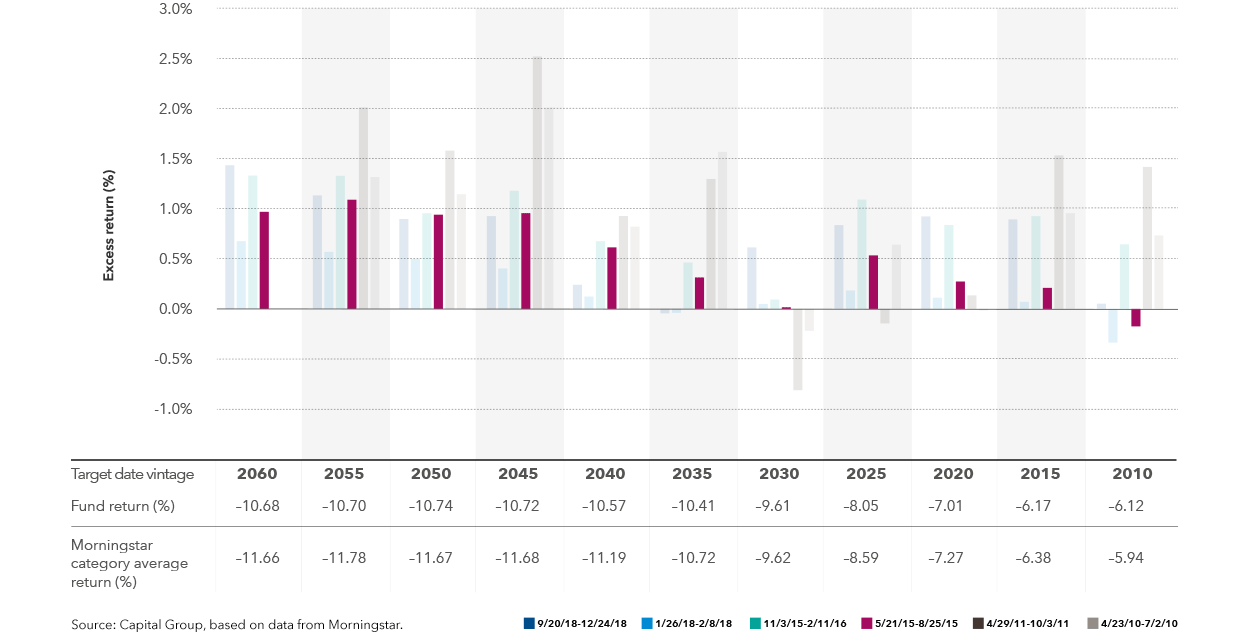

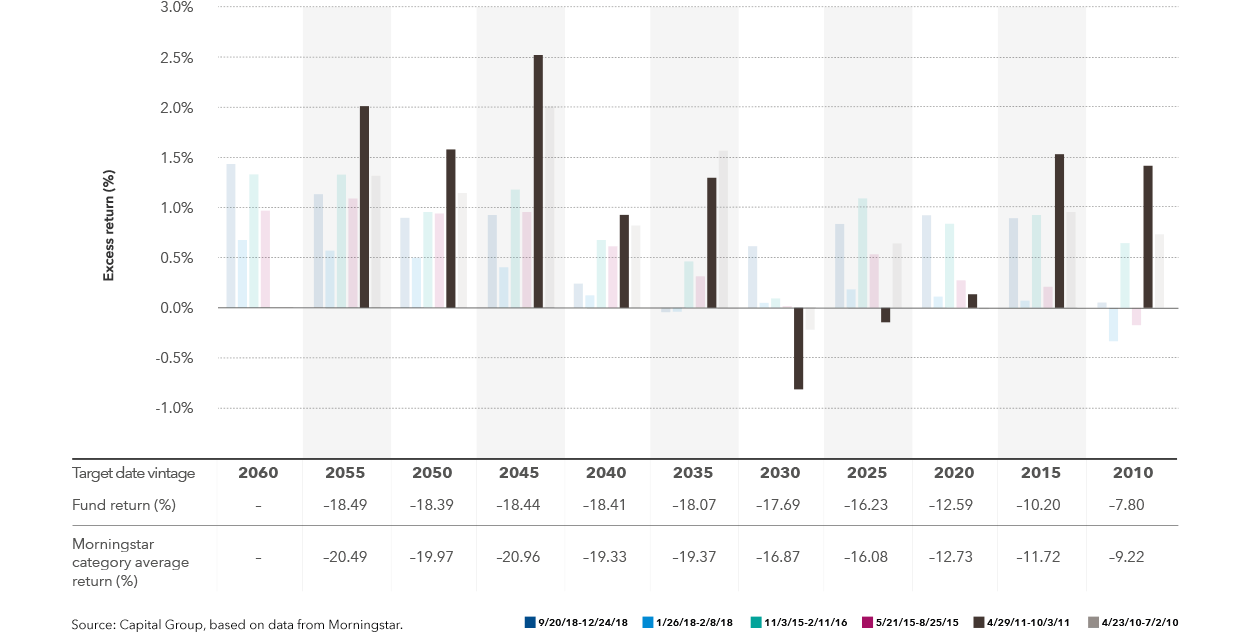

Resilient in market downturns

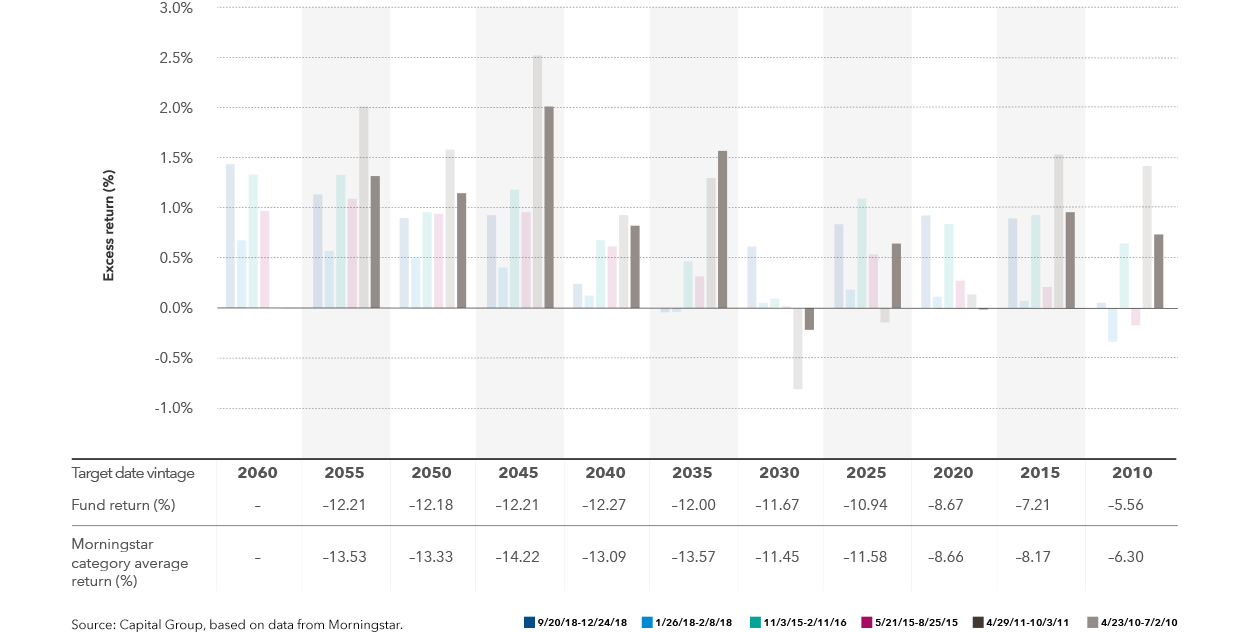

Our target date funds frequently outpaced their peers in the six U.S. equity market corrections seen over the last 10 years.

Excess returns vs. Morningstar® peer averages in U.S. equity market corrections (2009–2018)1,4

(Class R-6 shares)

-

-

ALL

-

9/20/18–12/24/18

-

1/26/18–2/8/18

-

11/3/15–2/11/16

-

5/21/15–8/25/15

-

4/29/11–10/3/11

-

4/23/10–7/2/10

-

Learn more about American Funds Target Date Retirement Series

Compare your target date fund

Learn the secrets of our success

1 Percentile rankings for one-, three- and five-year periods calculated by Morningstar. Ten-year rankings calculated by Capital Group, using data obtained from Morningstar. Rankings are based on the funds’ average annual total returns (Class R-6 shares at net asset value) within the applicable Morningstar categories. The Morningstar rankings do not reflect the effects of sales charges, account fees or taxes. Past results are not predictive of results in future periods. Investment results assume all distributions are reinvested and reflect applicable fees and expenses. The Morningstar category average includes all share classes for the funds in the category. While American Funds R-6 shares do not include fees for advisor compensation and service provider payments, the share classes represented in the Morningstar category have varying fee structures and can include these and other fees and charges resulting in higher expenses and lower results. The category includes both active and passive target date funds, as well as those that are managed both "to" and "through" retirement. Approximately one-third of the funds within the 2000–2010 category have a target date of 2005. All target date funds began on February 1, 2007, except for the 2055 fund, which began on February 1, 2010, and the 2060 fund, which began on March 27, 2015.

2 Equity funds have beaten their Lipper peer indexes in 93% of 10-year periods and 99% of 20-year periods. These results are based on Class R-6 share results for rolling periods through December 31, 2018. Periods covered are the shorter of the fund’s lifetime or since the comparable Lipper index inception date (except Capital Income Builder and SMALLCAP World Fund, for which the Lipper average was used). Expenses differ for each share class, so results will vary. Class R-6 shares were first offered on May 1, 2009. Class R-6 share results prior to the date of first sale are hypothetical based on Class A share results without a sales charge, adjusted for typical estimated expenses. Results for certain funds with an inception date after May 1, 2009, also include hypothetical returns because those funds’ Class R-6 shares sold after the funds’ date of first offering. Please see americanfunds.com for more information on specific expense adjustments and the actual dates of first sale.

3 Source: Capital Group, Morningstar, as of June 30, 2019. Seven of the eight of the underlying fixed income funds had lower five-year correlations to the Standard & Poor's 500 Composite Index than their respective Morningstar category averages (Class R-6 shares). Correlation is a statistical measure that measures how assets moved in relation to each other. A positive number means the assets moved in the same direction, and a negative number means they moved in opposite directions.

4 Source: Capital Group, using data from Morningstar. Results as of June 30, 2019. Returns are based on the funds’ average annual total returns (Class R-6 shares at net asset value) within the applicable Morningstar categories. The Morningstar returns do not reflect the effects of sales charges, account fees or taxes. Investment results assume all distributions are reinvested and reflect applicable fees and expenses. Dates shown for market corrections are based on price declines of 10% or more (without dividends reinvested) in the unmanaged S&P 500 with at least 50% recovery between declines for the earlier five periods shown.

Investments are not FDIC-insured, nor are they deposits of or guaranteed by a bank or any other entity, so they may lose value.

Investors should carefully consider investment objectives, risks, charges and expenses. This and other important information is contained in the fund prospectuses, summary prospectuses or the funds’ characteristics statement, which can be obtained from a financial professional or your relationship manager, and should be read carefully before investing.

Figures shown are past results for Class R-6 shares and are not predictive of results in future periods. Current and future results may be lower or higher than those shown. Share prices and returns will vary, so investors may lose money. Investing for short periods makes losses more likely.

American Funds offers a range of share classes designed to meet the needs of retirement plan sponsors and participants. The different share classes incorporate varying levels of advisor compensation and service provider payments. Because Class R-6 shares do not include any recordkeeping payments, expenses are lower and results are higher. Other share classes that include recordkeeping costs have higher expenses and lower results than Class R-6.

Although the target date funds are managed for investors on a projected retirement date time frame, the funds' allocation strategy does not guarantee that investors' retirement goals will be met. The target date is the year in which an investor is assumed to retire and begin taking withdrawals. American Funds investment professionals manage the target date fund's portfolio, moving it from a more growth-oriented strategy to a more income-oriented focus as the fund gets closer to its target date. Investment professionals continue to manage each fund for 30 years after it reaches its target date.

Each target date fund is composed of a mix of the American Funds and is subject to the risks and returns of the underlying funds. Underlying funds may be added or removed during the year. Investing outside the United States involves risks, such as currency fluctuations, periods of illiquidity and price volatility, as more fully described in the prospectus. These risks may be heightened in connection with investments in developing countries. Small-company stocks entail additional risks, and they can fluctuate in price more than larger company stocks. Investments in mortgage-related securities involve additional risks, such as prepayment risk, as more fully described in the prospectus. Lower rated bonds are subject to greater fluctuations in value and risk of loss of income and principal than higher rated bonds. While not directly correlated to changes in interest rates, the values of inflation-linked bonds generally fluctuate in response to changes in real interest rates and may experience greater losses than other debt securities with similar durations. Fund shares of U.S. Government Securities Fund are not guaranteed by the U.S. government. The return of principal for bond funds and for funds with significant underlying bond holdings is not guaranteed. Fund shares are subject to the same interest rate, inflation and credit risks associated with the underlying bond holdings.

This content, developed by Capital Group, home of American Funds, should not be used as a primary basis for investment decisions and is not intended to serve as impartial investment or fiduciary advice.