Artificial Intelligence

Bonds

Rising inflation and slowing global growth are two dominant themes casting a pall over the current market environment. With increasing geopolitical uncertainty, tightening monetary policy, supply chain challenges and higher commodity prices at play, a period of global stagflation could potentially be on the horizon.

Navigating the foggy road to normal has never been more challenging, but with a long-term lens one can better understand the strong normalizing effect that disinflationary forces such as rising debt levels, technological advancements and aging demographics could have. Having a clear understanding of these can help investors better find their way.

Investing in fixed income during a time of a high inflation and rising rates can seem worrisome. However, today’s starting yields offer an attractive entry point for investors. Yields across fixed income sectors are sharply higher than their lows over the past few years.

Rising yields reflect more income potential across bond markets

.png)

Sources: Bloomberg Index Services Ltd., JP Morgan. As of 6/30/22. Sector yields above include Bloomberg U.S. Aggregate Index, Bloomberg U.S. Corporate Investment Grade Index, Bloomberg U.S. Corporate High Yield Index, and 50% J.P. Morgan EMBI Global Diversified Index/50% J.P. Morgan GBI-EM Global Diversified Index blend. Period of time considered from 2020 to present. Dates for lows from top to bottom in chart shown are: 8/4/20, 12/31/20, 7/6/21 and 1/4/21.

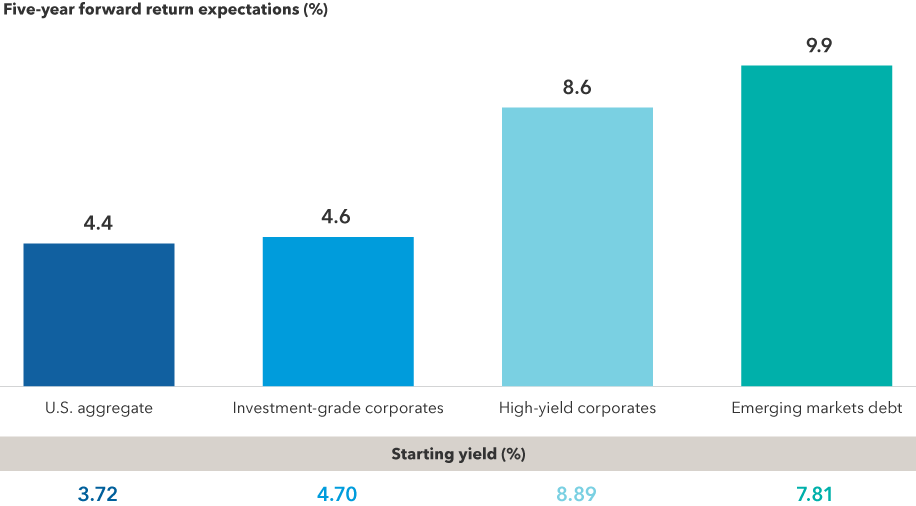

At current yields, history suggests higher total returns over the next few years. This means that investors could benefit from holding bonds across fixed income asset classes, including investment grade, high yield and emerging markets. This higher income can offer more of a cushion for total returns over time, even if price movements remain volatile. In fact, a greater portion of investors’ income needs could potentially be met with traditional fixed income than would have been the case in recent years

Historically, at current yield levels, longer term returns have been strong

Sources: Capital Group, Bloomberg, J.P. Morgan. Yields and USD monthly return data as of June 30, 2022, going back to January 2000 for all sectors except emerging markets debt, which goes back to January 2003. Sector yields in USD above include Bloomberg U.S. Aggregate Bond Index, Bloomberg U.S. Corporate Investment Grade Index, Bloomberg U.S. Corporate High Yield Index, 50% J.P. Morgan EMBI Global Diversified Index/50% J.P. Morgan GBI-EM Global Diversified Index blend. Past results are not predictive of results in future periods.

Despite current volatility, the broad credit universe provides ample opportunities for investors to add value through bottom-up research and security selection in each of the four primary credit sectors — high yield, investment grade, emerging markets and securitized debt (or debt backed by auto loans, credit card receivables or other assets). Keeping a long-term view and employing balance can help smooth the way.

Investors who seek a balanced portfolio should ensure that their fixed income allocation meets the four key roles bonds are meant to play in a portfolio.

1. Diversification from equities: When stocks struggle, owning bonds with a low correlation to equities can result in lower portfolio volatility.

2. Capital preservation: A fixed income allocation should help protect principal in most market environments, especially when rates and rate expectations have moved higher.

3. Income: Providing dependable income is a central function of a bond allocation.

4. Inflation protection: Bonds directly linked to an inflation index can help to protect an investor’s purchasing power.

Notably, investment-grade corporate bonds have become more attractive as corporate fundamentals continue to improve, with relative debt levels falling across both European and U.S. investment-grade bonds. Valuations also look attractive as global investment-grade corporate yield has increased alongside higher government bond yields and wider spreads.

U.S. high-yield fundamentals have also been improving. The credit quality of the market has improved with a higher proportion of BB-rated companies and a lower share of CCC-rated bonds, which could potentially make the market more resilient to a slowdown in growth. Defaults are currently very low, and although they may pick up should we enter a recession, we believe the yield cushion and active security selection can offset the potential risks. Yields have also become more attractive, moving from the low levels reached in 2021 to 7.5% currently. However, as volatility is expected to remain high and a higher degree of uncertainty in the economy persists, we position our credit portfolios defensively focusing on fundamentals and bottom-up research.

The emerging market debt (EMD) universe has broadened and deepened significantly in the last few decades and, as the asset class has developed, it has become more appealing to a broader investor base. Issuance has increased thereby improving liquidity. That said, rising inflation, slowing global growth, tightening U.S. monetary policy and a soaring U.S. dollar have all weighed on the sector.

The Russia-Ukraine conflict has created an additional headwind relative to other comparably rated developed market corporate debt. However, there is reason to be optimistic about the future of emerging markets. Current yield levels can provide significant cushion to further volatility.

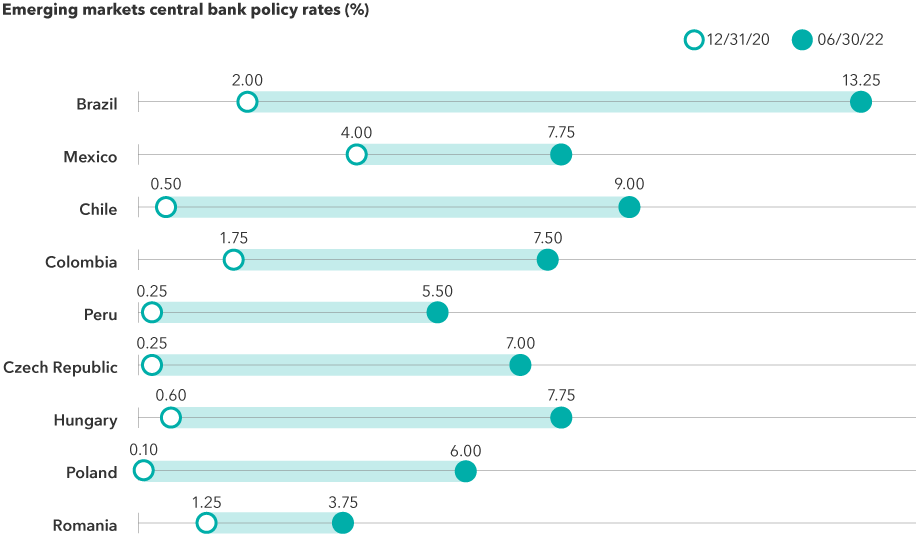

Many EM countries have aggressively hiked interest rates

Sources: Capital Group, Bloomberg, JPMorgan, Morningstar. As of 6/30/22.

Emerging local currency debt has been the fastest growing segment of the EMD asset class for quite some time and is now the largest part of the universe. We have a preference for local currency bonds. Compared with developed markets, EM central banks are much more advanced in their policy tightening. In addition, the increase in core inflation in emerging markets has generally been more modest than in developed markets. More aggressive rate hikes coupled with more muted inflation suggest good value in EM duration. In most of these markets hedging costs are high, so our duration exposure is primarily on an unhedged basis.

Overall EM currencies remain undervalued, but selectivity remains crucial in assessing mainly those currencies from commodity exporters countries. We still have a constructive view on commodity prices because supply shortages haven’t been alleviated. In many cases, supply issues have actually deteriorated yet global activity is still reasonable. As such there is still a structural tailwind for commodity prices.

Securitized credit can also offer a diverse array of investment opportunity across asset-backed, commercial real estate, non-agency mortgage and collateralized leveraged loan sub-sectors. Many of the fundamental drivers of these sectors are distinct from corporate and sovereign credit. This brings diversity to a portfolio.

We are currently finding good value in the single-asset single-borrower (SASB) market. These niche investments create more concentrated risks than traditional commercial mortgage-backed securities (CMBS), but the market largely consists of very high-quality properties and lends itself to deep, property-specific fundamental research. This presents an opportunity for investors to gain access to specific assets that they find attractive. This sector is under-researched by many market participants, and this enables our team of securitized credit analysts to identify numerous mispriced investment opportunities.

Uncertainty will remain in markets for the foreseeable future, and the investment environment will be challenging for investors globally. However, there will continue to be opportunities for active managers with strong research capabilities to navigate these headwinds, and allocations to fixed income assets will remain as crucial as ever.

This commentary has been republished here with permission from Global Investor Group, publisher of Global Investor magazine. Additional charts and data were added by the Capital Ideas staff.

Bond ratings, which typically range from AAA/Aaa (highest) to D (lowest), are assigned by credit rating agencies such as Standard & Poor's, Moody's and/or Fitch, as an indication of an issuer's creditworthiness.

The Bloomberg U.S. Aggregate Index represents the U.S. investment-grade fixed-rate bond market.

The Bloomberg U.S. Corporate Investment Grade Index represents the universe of investment grade, publicly issued U.S. corporate and specified foreign debentures and secured notes that meet the specified maturity, liquidity, and quality requirements.

The Bloomberg U.S. Corporate High Yield Index covers the universe of fixed-rate, non-investment-grade debt.

The 50% J.P. Morgan EMBI Global Diversified Index/50% J.P. Morgan GBI-EM Global Diversified Index blend is a uniquely weighted emerging market debt benchmark that

tracks total returns for U.S. dollar-denominated bonds issued by emerging market sovereign and quasi-sovereign entities in addition to the universe of regularly traded, liquid fixed-rate, domestic currency emerging market government bonds to which international investors can gain exposure. The 50%/50% JP Morgan EMBI Global/JP Morgan GBI-EM Global Diversified blends the JP Morgan EMBI Global Index with the JP Morgan GBI-EM Global Diversified Index by weighting their cumulative total returns at 50% each. This assumes the blend is rebalanced monthly.

Our latest insights

-

-

Demographics & Culture

-

-

-

Global Equities

RELATED INSIGHTS

Commissions, trailing commissions, management fees and expenses all may be associated with investments in investment funds. Please read the prospectus before investing. Investment funds are not guaranteed or covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. For investment funds other than money market funds, their values change frequently. For money market funds, there can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you. Past performance may not be repeated.

Unless otherwise indicated, the investment professionals featured do not manage Capital Group‘s Canadian mutual funds.

References to particular companies or securities, if any, are included for informational or illustrative purposes only and should not be considered as an endorsement by Capital Group. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds or current holdings of any investment funds. These views should not be considered as investment advice nor should they be considered a recommendation to buy or sell.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and not be comprehensive or to provide advice. For informational purposes only; not intended to provide tax, legal or financial advice. We assume no liability for any inaccurate, delayed or incomplete information, nor for any actions taken in reliance thereon. The information contained herein has been supplied without verification by us and may be subject to change. Capital Group funds are available in Canada through registered dealers. For more information, please consult your financial and tax advisors for your individual situation.

Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. We encourage you to consider these and other factors carefully before making any investment decisions and we urge you to avoid placing undue reliance on forward-looking statements.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2024 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2024. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under licence. All rights in the FTSE Russell indices or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indices or data and no party may rely on any indices or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The index is unmanaged and cannot be invested in directly.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

MSCI does not approve, review or produce reports published on this site, makes no express or implied warranties or representations and is not liable whatsoever for any data represented. You may not redistribute MSCI data or use it as a basis for other indices or investment products.

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capital Group trademarks are owned by The Capital Group Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capital Group funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capital Group, a global investment management firm originating in Los Angeles, California in 1931. Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

The Capital Group funds offered on this website are available only to Canadian residents.

Mike Gitlin

Mike Gitlin