Artificial Intelligence

Global Equities

There’s a new reality taking shape in global markets.

Commentators have in the last few months mostly focused on a rotation from growth to value, but I think that view is too simplistic. I see many shifts happening simultaneously that could likely define the next decade in markets around the world.

Many investors are expecting a return to normal after inflation subsides and central banks stop raising rates. But I believe the world is undergoing significant changes and that investors will need to reset their expectations about how a typical investing environment will look. Here are five seismic shifts happening in economies and markets right now, as well as the long-term investment implications of each:

1. From falling rates to rising rates and higher inflation

The market is grappling with a macro environment it hasn’t seen in a long time. Inflation is its highest since the early 1980s. And until recently we've had 40 years of declining interest rates. That’s longer than most investment managers’ careers, if not lifetimes. That’s part of the reason we see a market struggling to adjust to this new reality.

Is this the end of a 40-year disinflation cycle?

Sources: Capital Group, Refinitiv Datastream. As of 10/26/22.

It’s easy to assume these are market dislocations that will quickly reverse — bond markets are currently pricing a return to 2% inflation within two years, for example. But these cycles often last much longer than people anticipate, and there is reason to believe higher inflation is structural and likely to persist.

In this new environment I’m especially cautious of highly levered companies, or those raising new debt. Money isn’t “free” anymore, so a larger slice of earnings will go to service debt. Companies with the ability to fund their own growth as well as those with strong pricing power and dependable cash flows will remain attractive in a high-inflation, higher-cost-of-capital world.

2. From narrow to broader market leadership

I think we're going to be in a much less narrowly concentrated market going forward. The last decade was dominated by a handful of tech stocks that you basically had to own to keep up with the market. I don't think that's going to be the case anymore.

I expect opportunities to arise from a variety of companies, industries and geographies. Well-managed companies beyond the tech sector may have their chance to shine again.

For example, e-commerce companies have gone from being the disruptors to being challenged themselves. They’re often very low margin and expensive to scale with difficult delivery logistics to manage. Very few have done it well. Some traditional retailers that have combined the benefits of brick-and-mortar stores with a compelling online shopping experience are starting to take share from pure e-commerce companies.

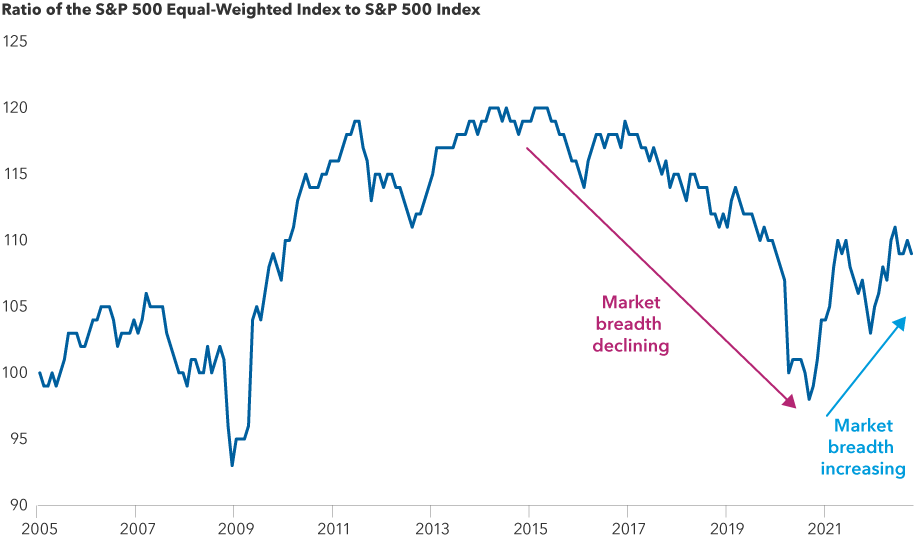

Market leaders are becoming less concentrated

Sources: Capital Group, Refinitiv Datastream, Standard & Poor's. As of September 30, 2022. Indexed to 100 as of 1/1/05.

After the market’s dive in 2020, I expected leadership to broaden, and it has done so. In my view, this is a healthy development and supports why I have been trying to de-concentrate my own portfolios. In theory, it should be a positive backdrop for stock pickers over indexers.

3. From digital to physical assets

The last bull market was dominated by tech companies that made their fortunes on digital assets, such as online marketplaces, streaming platforms, search engines and social media. This overshadowed the fact that you can’t build a new economy without older industries. Not that digital-first companies are going away, but I think investors will start to place greater emphasis on commodities and producers of physical assets.

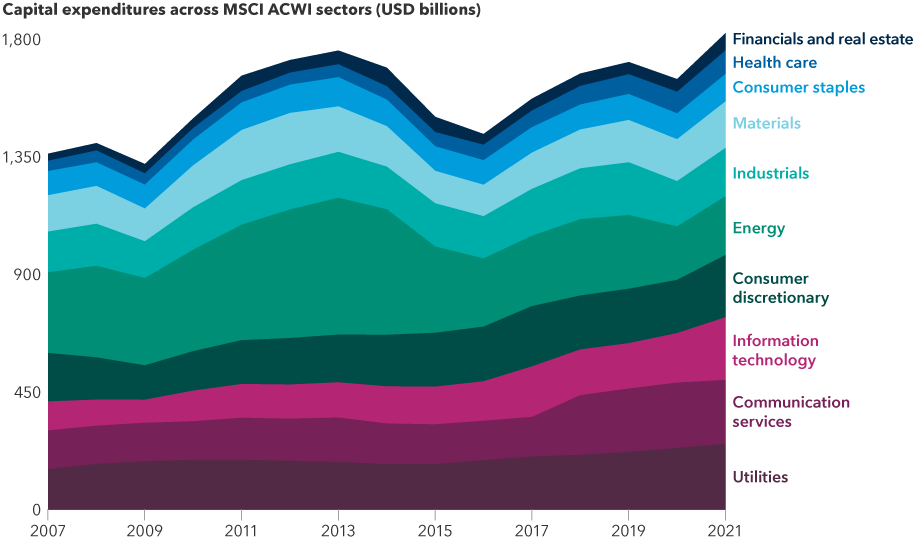

Capital spending super cycle could power a new industrial renaissance

Sources: Capital Group, FactSet, MSCI. In current U.S. dollars. As of December 31, 2021.

Some might assume that trends like the shift to renewable energy will squeeze out incumbents in traditional sectors like industrials, materials or energy. On the contrary, there may be winners among businesses that are helping other companies be more energy efficient — whether that's smart buildings, power management or HVAC systems that reduce gas emissions. Other global trends such as grid modernization, reshoring and energy security may cause a boom in capital investment across industries. These are areas where smartly managed industrial companies might have a real renaissance.

4. From multiple expansion to earnings growth

Many newer investors got comfortable with stocks being very expensive over the last five to 10 years and now assume stocks will return to those levels during the next bull market. When rates were near zero the market could support loftier multiples, but I think those days are over.

An exercise I’m trying to apply when evaluating my portfolio is to ask: “What if stocks don’t return to 25x earnings in 2027? What if they only trade at 15x earnings?” If I can make a stock work at that level, then I can probably limit my downside. Using that lens, I'm trying to find emerging and growth-oriented companies that are not valued as such. I like those that may also offer potential upside to the valuation, but where the investment thesis doesn’t depend on it.

If multiple expansion is limited in the next bull market, stock returns will have to be powered by earnings growth. That means markets aren’t likely to be as patient with unprofitable companies. Stocks whose business models depend on cheap money are going away. Companies that funded losses while trying to scale rapidly even where the economics didn’t work are going away. Markets once paid up heavily for future growth, but now with higher interest rates they are less willing to do so. The market is calling time on business models that don’t work when money is no longer free.

5. From global supply chains to regional supply chains

The globalization of supply chains is another multi-decade trend that is shifting. For a generation, companies have moved manufacturing abroad to cut costs and boost margins. But the limitations of placing efficiency over resilience are now clear. Rising geopolitical tension and pandemic-induced disruptions have led companies to consider bringing supply chains closer to home.

While bottlenecks caused by COVID shutdowns have improved, many companies are still being impacted. The auto industry is a prime example. Major automakers have tens of thousands of unfinished cars waiting for final parts, and that missing component is often as minor as an inexpensive semiconductor chip. Now companies are creating supply chain redundancies so that a single disruption doesn’t derail their entire operation.

Even as pandemic-related issues ease, I believe increased geopolitical conflicts are here to stay and will continue to fuel this change. The current environment reminds me of the 1970s, with tension between Russia and the West, more aggressive confrontations with China, the rise of authoritarian leaders around the world and less global cooperation. Since the fall of the Berlin Wall, we’ve had more than 30 generally peaceful and prosperous years. But there are more risks now, and this backdrop suggests lower valuations are warranted and “surprises” should feel less surprising.

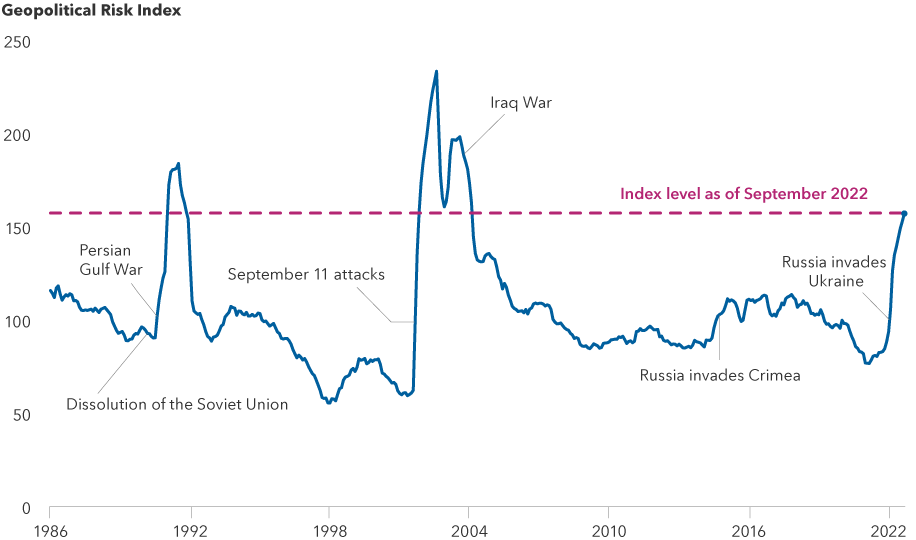

Higher global tensions have increased risk of relying on international supply chains

Sources: Capital Group; Caldara, Dario and Matteo Iacoviello (2022), “Measuring Geopolitical Risk,” American Economic Review, April, 112(4), pp.1194-1225. The Geopolitical Risk Index is a measure of adverse geopolitical events and associated risks based upon the tally of newspaper articles covering geopolitical tensions, using a sample of 10 newspapers going back to 1985. Index level values reflect a 12-month smoothed average of monthly data. As of September 2022.

Consider Taiwan Semiconductor Manufacturing Company (TSMC), the world’s dominant manufacturer of cutting-edge semiconductors. After having concentrated the bulk of its capacity in Taiwan — a focal point of geopolitical concerns — the company is building its first manufacturing hub in the United States. It’s also constructing a new plant in Japan. That regionalization should create a more efficient supply chain for some of its top U.S.-based clients, including automakers and technology companies like Apple, Qualcomm and Broadcom.

A flexible investment approach can help weather the storm

The combination of low rates and rising markets made the last 10 years feel like one long sunny day at the beach. While some rain showers have now driven beachgoers indoors, they’re still looking out the window waiting for the storm to pass. They don’t realize that there’s a new weather system upon us with more clouds, colder temperatures and much stronger winds. The world’s not ending, but it may be a wetter, cloudier and colder place — and life won’t be a day at the beach.

That may sound like a dark outlook, but I actually see this as a really exciting time to be an investor. My fellow managers and I are able to adjust to this new reality of investing in a variety of ways.

Although we haven’t gotten everything right, we have been shifting from higher growth sectors like consumer discretionary and information technology to health care and industrials over the past few years in anticipation of this new reality. New market environments present new opportunities, and that’s where experience and flexibility can be essential.

The S&P 500 Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks.

The MSCI All Country World Index (ACWI) is a free float-adjusted market capitalization-weighted index designed to measure equity market results in the global developed and emerging markets, consisting of more than 40 developed and emerging market country indexes.

Get the 2023 Outlook report

Our latest insights

-

-

Demographics & Culture

-

-

-

Global Equities

RELATED INSIGHTS

Commissions, trailing commissions, management fees and expenses all may be associated with investments in investment funds. Please read the prospectus before investing. Investment funds are not guaranteed or covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. For investment funds other than money market funds, their values change frequently. For money market funds, there can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you. Past performance may not be repeated.

Unless otherwise indicated, the investment professionals featured do not manage Capital Group‘s Canadian mutual funds.

References to particular companies or securities, if any, are included for informational or illustrative purposes only and should not be considered as an endorsement by Capital Group. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds or current holdings of any investment funds. These views should not be considered as investment advice nor should they be considered a recommendation to buy or sell.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and not be comprehensive or to provide advice. For informational purposes only; not intended to provide tax, legal or financial advice. We assume no liability for any inaccurate, delayed or incomplete information, nor for any actions taken in reliance thereon. The information contained herein has been supplied without verification by us and may be subject to change. Capital Group funds are available in Canada through registered dealers. For more information, please consult your financial and tax advisors for your individual situation.

Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. We encourage you to consider these and other factors carefully before making any investment decisions and we urge you to avoid placing undue reliance on forward-looking statements.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2024 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2024. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under licence. All rights in the FTSE Russell indices or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indices or data and no party may rely on any indices or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The index is unmanaged and cannot be invested in directly.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

MSCI does not approve, review or produce reports published on this site, makes no express or implied warranties or representations and is not liable whatsoever for any data represented. You may not redistribute MSCI data or use it as a basis for other indices or investment products.

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capital Group trademarks are owned by The Capital Group Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capital Group funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capital Group, a global investment management firm originating in Los Angeles, California in 1931. Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

The Capital Group funds offered on this website are available only to Canadian residents.

Jody Jonsson

Jody Jonsson