Global Equities

Bonds

Simplicity.

That’s just one of the reasons why balanced mutual funds, which combine stocks and bonds in a single portfolio, have long been a staple of Canadian investing. Their evolution — from modest beginnings as domestic diversification tools to globally oriented investment strategies today — mirror the changing needs of investors and the increasing sophistication of financial theory.

Their growth over the years has not only been driven by their hallmark simplicity, but also their potential to meet investors’ needs for capital appreciation, income and stability through diversification and risk mitigation.

“These benefits make balanced funds particularly attractive to investors with moderate risk profiles who seek growth while enjoying a smoother ride than an all-stock portfolio,” says investment director Julie Dickson.

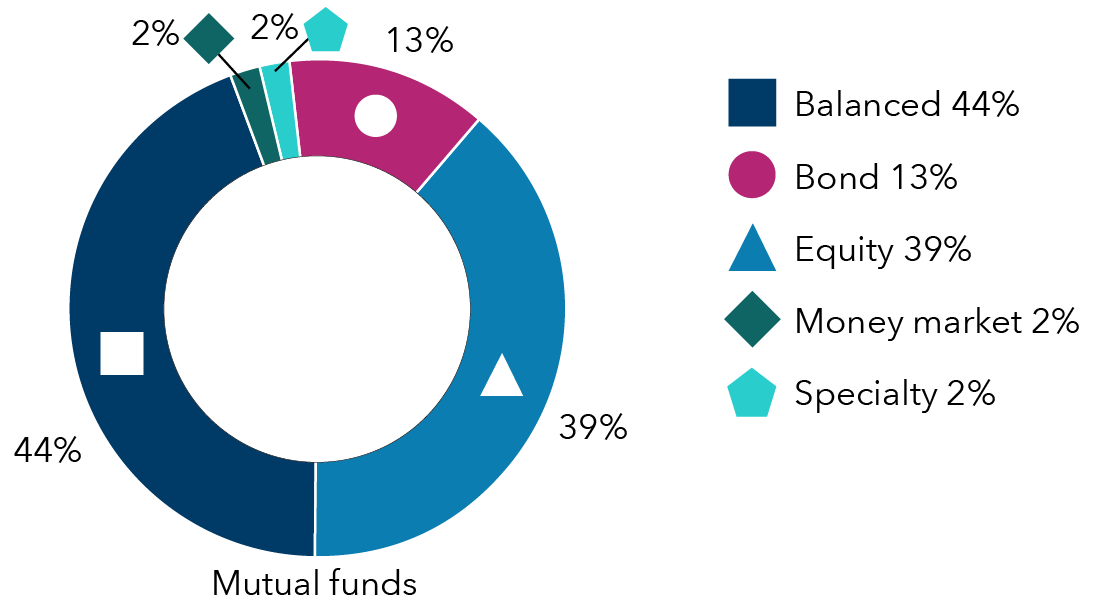

The decision to blend stocks and bonds together in a single portfolio has been a winning combination in the eyes of investors. The balanced category ranks as the largest mutual fund category in Canada, according to the Securities and Investment Management Association. The fund category comprised 44% of total mutual fund assets as of the end of 2024, as shown in the pie chart below. The category includes funds that invest in a mix of stocks and bonds as well as funds that invest in a mix of separate, stand-alone funds. Ranking second in size was the equities category at 39% of total assets followed by bonds at 13%, while money market and specialty categories accounted for 2% each.

Canadian mutual fund assets by category

Source: Securities and Investment Management Association. As of December 31, 2024

The rise of balanced mutual funds to become the largest mutual fund category did not happen overnight. Initially, balanced mutual funds — regardless of domicile — singularly focused on blending domestic equities and bonds only from their home countries after they debuted in the 1930s. This was primarily due to necessity, as it would be several more decades until globalization took root along with the investment infrastructure necessary to buy and sell foreign securities.

In time, with the rise of multinational companies, air travel, communication networks and regulatory frameworks, international and global investing became possible. But even with the necessary infrastructure in place it took another unexpected development to accelerate global balanced fund creation and adoption.

The shift to global

Modern Portfolio Theory (MPT), introduced by University of California finance professor and Nobel prize winner Harry Markowitz in 1952, revolutionized investment strategy in general and balanced funds in particular as it emphasized diversification to optimize risk-adjusted returns. MPT posits that:

- Risk and return should be evaluated at the portfolio level: Individual asset performance matters less than how assets interact within a portfolio.

- Diversification reduces risk: Combining assets with low or negative correlations can lower overall portfolio volatility.

- Efficient frontier: Investors should aim for portfolios that offer the highest expected return for a given level of risk.

As access to global markets increased over the decades, so did the ability to diversify and thereby reduce risk.

“Though domestic balanced mutual funds embody MPT principles, it became clear that a global balanced fund further enhanced this efficiency. They not only offer greater diversification and lower asset correlation, but also a larger opportunity set,” says Dickson.

For example, Canada's market is heavily weighted toward financials and commodities. Global exposure allows investors to access sectors such as technology and health care, which dominate U.S. and international markets. Global diversification also helps manage geopolitical and economic risks specific to Canada. Plus, adding global equities can not only reduce home country bias but also exposure to domestic economic and market cycles. “This aligns with MPT’s goal of constructing portfolios that lie on the ‘efficient frontier’— maximizing return for a given level of risk,” says investment product manager Anish D’lima.

Global balanced funds hit their stride

As a result, Canadian investors have increasingly turned to global balanced funds in recent years. According to the Morningstar 2025 Canadian Balanced Funds Landscape report, the number of Canadian-oriented balanced strategies shrank for the fifth straight year. In comparison, the number of global balanced strategies rose for the fourth time in five years. Further, firms have converted 18 Canadian-focused strategies into global ones over the same five-year period while another 65 Canadian-focused balanced funds were liquidated or merged away.

In sum, there were 615 global balanced strategies in Canada at the end of 2024, an increase of 102 strategies since 2020, mostly to do with new launches. Counting a handful of launches and other conversions, the number of Canadian-oriented balanced funds dropped to 190 at the end of 2024 from 261 in January 2020.

Global gaining traction

Global-oriented balanced funds vs Canadian-oriented balanced funds launches/conversions/closings 2020-2024

Source: Morningstar 2025 Canadian Balanced Funds Landscape.

The preference among investors towards global balanced funds continues despite the rare and painful setback in 2022 when, for the first time in decades, both stocks and bonds declined simultaneously.

“Though the overall balanced funds category saw outflows in 2023 and 2024, global balanced funds fared much better,” says D’lima.

To illustrate, the Morningstar Canadian neutral balanced fund category notched outflows of $4.7 billion in 2023 and $4.5 billion in 2024 compared to $2.5 billion and $1.6 billion for global neutral balanced funds for the same two years. In 2025, flows have now turned positive for global neutral balanced funds, attracting $3.4 billion, while the Canadian neutral balanced category remains in redemption, notching outflows of $1.4 billion through July 31.

Global balanced versatility

Despite the common 60% stock and 40% bond starting point, global balanced funds come in all shapes and sizes. Some stay close to the classic split between stocks and bonds, while others venture tactically around that anchor. Some use all passive funds as the building blocks, some stand by active management funds, and others use a blend of both.

“As Canadian investors continue to seek greater diversification and larger opportunity sets, global balanced funds have become a vital component of investing — providing a disciplined, diversified approach to navigating an increasingly complex financial landscape,” says Dickson.

©2025 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

Our latest insights

-

-

-

-

Markets & Economy

-

Global Equities

RELATED INSIGHTS

Commissions, trailing commissions, management fees and expenses all may be associated with investments in investment funds. Please read the prospectus before investing. Investment funds are not guaranteed or covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. For investment funds other than money market funds, their values change frequently. For money market funds, there can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you. Past performance may not be repeated.

Unless otherwise indicated, the investment professionals featured do not manage Capital Group‘s Canadian investment funds.

References to particular companies or securities, if any, are included for informational or illustrative purposes only and should not be considered as an endorsement by Capital Group. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds or current holdings of any investment funds. These views should not be considered as investment advice nor should they be considered a recommendation to buy or sell.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and not be comprehensive or to provide advice. For informational purposes only; not intended to provide tax, legal or financial advice. Capital Group funds are available in Canada through registered dealers. For more information, please consult your financial and tax advisors for your individual situation.

Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. We encourage you to consider these and other factors carefully before making any investment decisions and we urge you to avoid placing undue reliance on forward-looking statements.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2026 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2026. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under licence. All rights in the FTSE Russell indices or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indices or data and no party may rely on any indices or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The index is unmanaged and cannot be invested in directly.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com)

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capital Group trademarks are owned by The Capital Group Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capital Group funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capital Group, a global investment management firm originating in Los Angeles, California in 1931. Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

The Capital Group funds offered on this website are available only to Canadian residents.

Julie Dickson

Julie Dickson

Anish D'lima

Anish D'lima