Our distinctive approach to fixed income has made us one of the world’s most successful managers.

Capital Group is one of the world’s largest active fixed income fund managers. A distinctive approach is the driving force behind this success.1

As a private company with over 90 years of history and over 50 years of fixed income investing, we are singularly focused on asset management that takes a long-term perspective.

What sets us apart?

242

fixed income professionals1

Distinctive approach

of analysts investing in their ideas

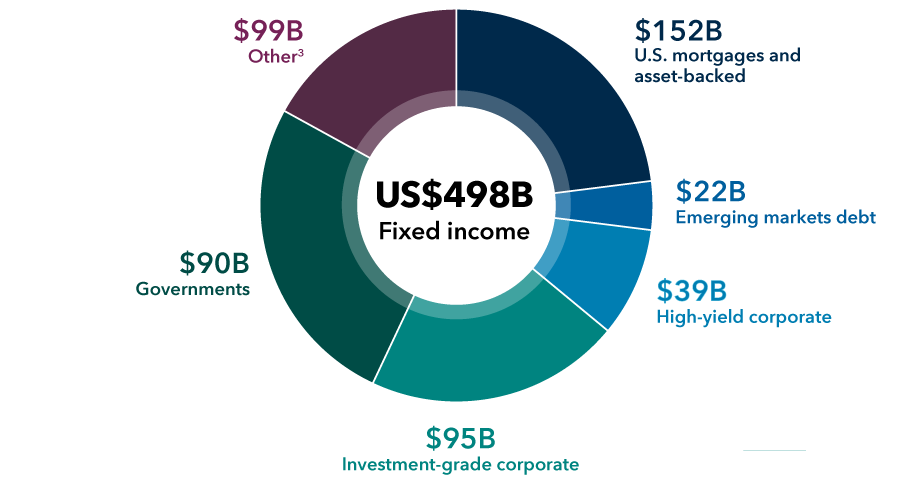

US$498 billion

in fixed income assets1

1 Data as of December 31, 2023. Reflects the Capital Group global organization. Fixed income assets managed by Capital Fixed Income Investors.

Actions speak louder than words

The Capital System™

Our signature approach is bottom-up investing, based upon on-the-ground research with multiple portfolio managers. What sets us apart is that our investment analysts not only provide investment ideas to portfolio managers, they are also able to act on the courage of their convictions and invest.

Buying a bond gives the clearest possible signal of conviction

Creates diversified, high-conviction portfolios

Integrated research with equity analysts creates unique insights

More than meets the eye

We have been managing fixed income assets for over 50 years.2

Reflecting investor confidence in our fixed income capabilities, Capital Group’s fixed income assets under management globally grew more than 100% from 2015 to 2023.

Leverage our experience and scale for a different fixed income experience.

Data as of December 31, 2023. Reflects the Capital Group global organization. Fixed income assets managed by Capital Fixed Income Investors. All values in USD. Totals may not reconcile due to rounding.

2 Capital Group’s first fixed income strategy introduced in the U.S. in 1973.

3 Mainly comprises money market instruments and U.S. municipal bonds.

Discover Capital Group’s Canadian fixed income strategies

Multi-Sector Income

The power of diverse credit sectors in a single portfolio

Canadian Core Plus Fixed Income

Canadian core bonds plus global investment grade and higher yielding bonds

World Bond

A diversified global strategy, with a focus on investment-grade bonds

Looking for a more balanced approach?

Tap into our fixed income expertise within our multi-asset strategies.

Explore insights to help you navigate today’s market

-

-

Emerging Markets

-

Commissions, trailing commissions, management fees and expenses all may be associated with investments in investment funds. Please read the prospectus before investing. Investment funds are not guaranteed or covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. For investment funds other than money market funds, their values change frequently. For money market funds, there can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you. Past performance may not be repeated.

Capital Group funds are available in Canada through registered dealers. For your individual situation, please consult your financial and tax advisors.

The Capital Group funds offered on this website are available only to Canadian residents.

All Capital Group trademarks are owned by The Capital Group Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capital Group funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capital Group, a global investment management firm originating in Los Angeles, California in 1931. Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.