美國股市

Capital IdeasTM

資本集團投資透視

展望

A strong corporate earnings rebound could be the tailwind that drives stock prices in 2024.

Heading into the new year, the economy continues to send mixed signals. But when it comes to stock prices, one of the metrics that matters most is corporate earnings.

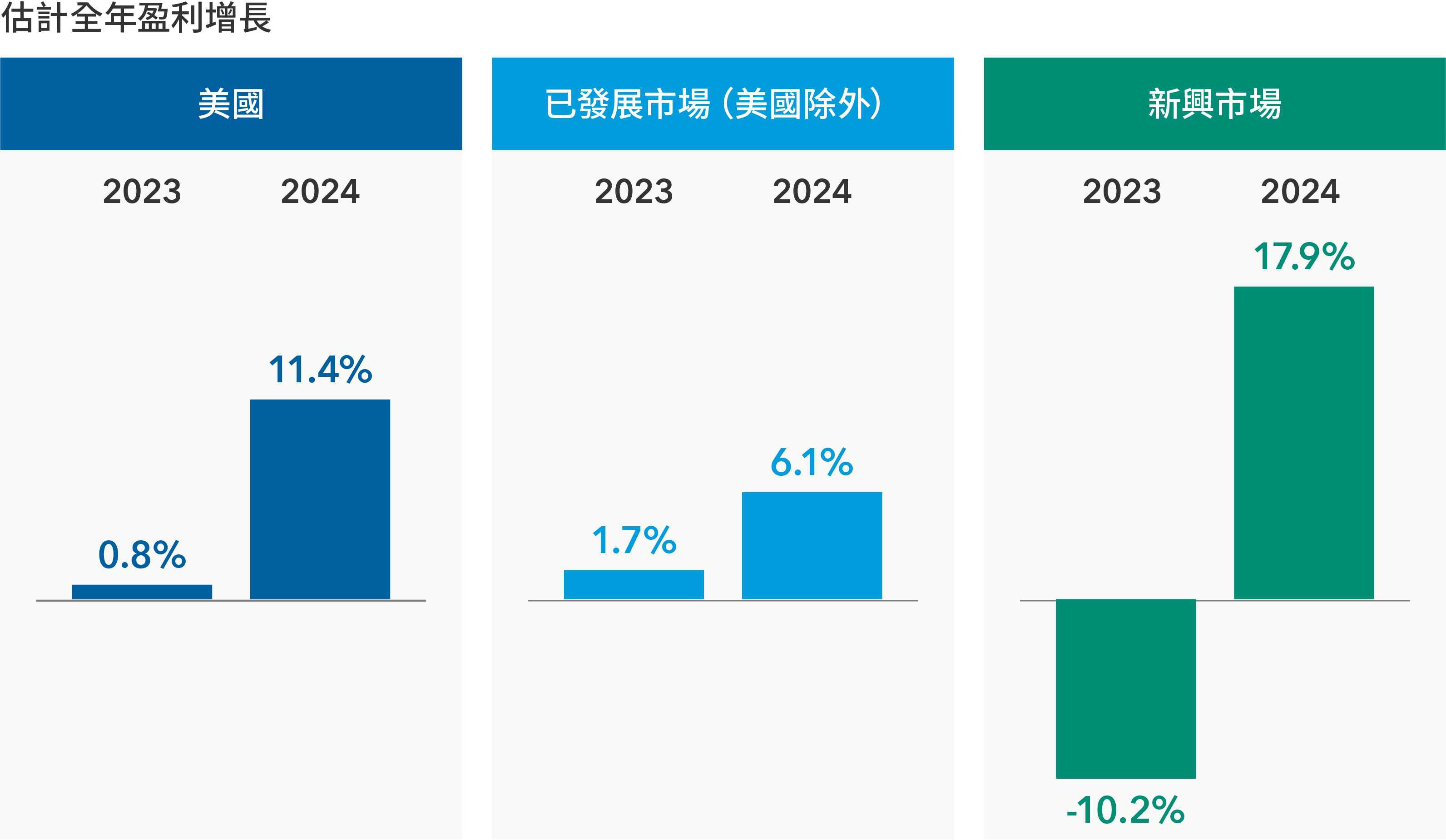

In the US, Wall Street analysts expect earnings for companies in the S&P 500 Index to rise nearly 12% in 2024, based on consensus data compiled by FactSet. That’s along with an expected 6.1% earnings boost in developed ex-US markets and a robust 18% gain in emerging markets.

預期主要市場的盈利增長穩健

資料來源:資本集團、FactSet、MSCI、標準普爾。估計全年盈利增長分別以標普500指數(美國)、MSCI歐澳遠東指數(美國除外的已發展市場)及MSCI新興市場指數(新興市場)截至2023年12月及2024年12月止年度的每股盈利普遍估計的平均值為代表。估計值截至2023年11月30日。

Given the difficulties of 2023, it’s logical to expect an earnings rebound in 2024. But there are several risks that could result in substantial earnings revisions, including sluggish consumer spending, slowing economic growth in Europe and China, and rising geopolitical risk from the wars in Ukraine and Israel.

“I don’t think it’s going to be a terrible year for corporate earnings, but I think we’re more likely to see 6% to 8% growth in the US,” says Capital Group economist Jared Franz, “and potentially higher in some emerging markets.”

Investors might look to 2023’s market leaders — US mega cap stocks driving the artificial intelligence (AI) revolution — as a continued source of strength in 2024 as applications roll out across the economy and potentially lead to further earnings growth.

Investor stock portfolios may be overconcentrated

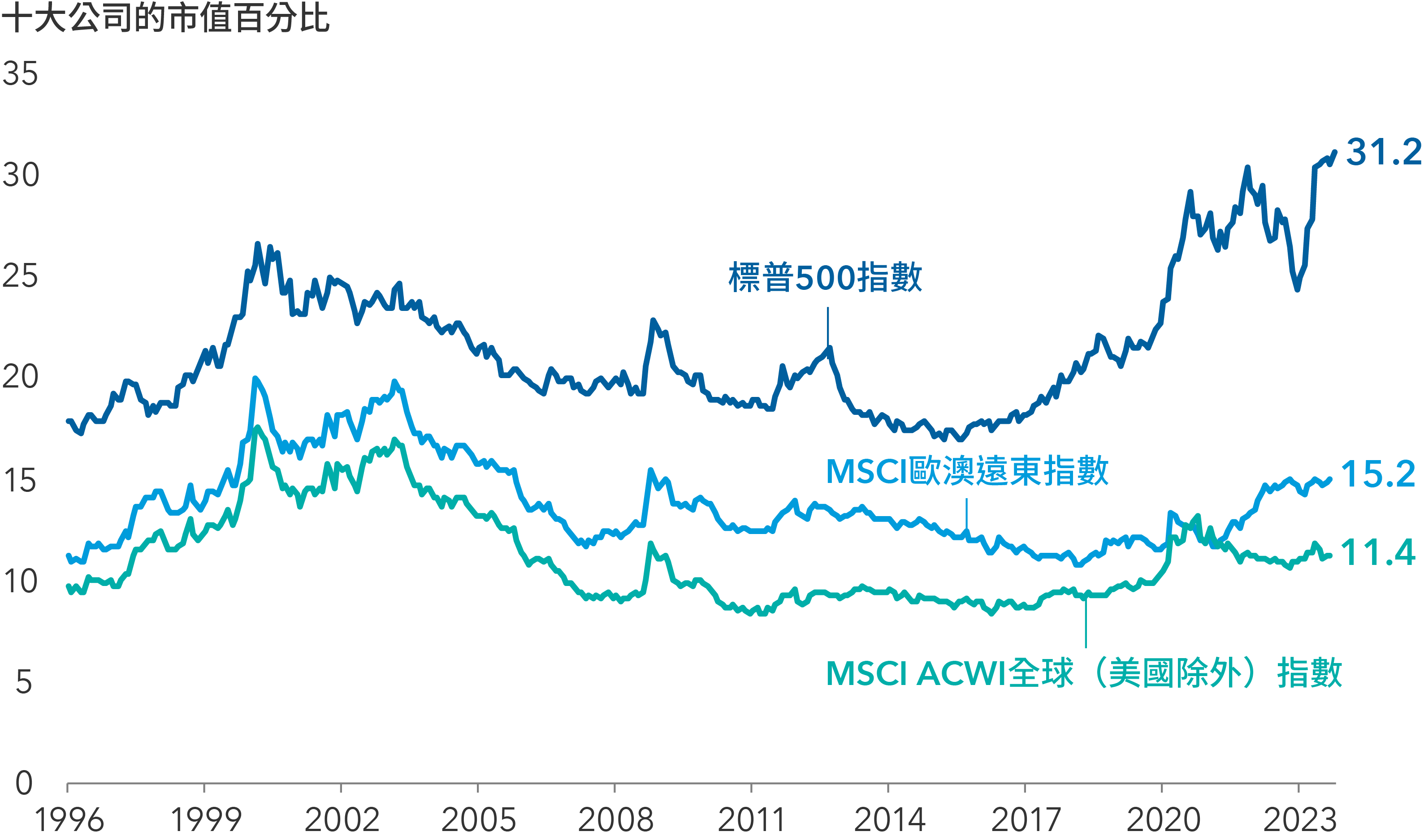

However, investors will likely be well aware by now that the US stock market is top-heavy. What they might not know is the S&P 500 Index is more heavily concentrated than it was at the peak of the dot-com era.

As of September, the five largest companies in the S&P 500 accounted for 24% of the market capitalisation of the index. That compares with a 19% weighting for the five largest companies in the index as of March 2000.

As for market gains, just seven companies — Apple, Meta, Microsoft, NVIDIA, Amazon, Alphabet and Tesla — accounted for a staggering 130% of the index’s total return in the first 10 months of 2023. In other words, without the so-called ‘Magnificent Seven’, the S&P 500 would have posted a decline.

Diversification remains essential

Such levels of concentration represent potential risks for investors, particularly those in passive index investments, which seek to replicate the benchmark’s return pattern. While tech innovators may very well continue to lead in 2024, investors should consider diversifying their stock holdings, where applicable, according to equity portfolio manager Lawrence Kymisis.

“Many of these tech leaders can continue to be good long-term investments, but I think investors should be wary of investing in a small number of companies with similar business models at such concentrated levels,” says Kymisis. “Given the level of economic uncertainty heading into 2024, I believe diversification is as essential as ever. And I believe we at Capital Group can identify great companies across industries in markets around the world, including US tech leaders.”

A quick comparison of other major developed market equity indexes with the S&P 500 shows the former are less concentrated and suggests they may offer a broader range of opportunities. As of 31 October, 2023, the 10 largest companies in the S&P 500 accounted for a 31.2% weighting of the index. In contrast, the 10 largest companies in the MSCI EAFE Index, a broad measure of developed non-US markets, accounted for 15.2% of the index weighting.

相較歷史水平及國際市場,標普500指數出現頭重腳輕的情況

資料來源:資本集團、晨星。數據截至2023年10月31日。

Compelling trends are surfacing across international markets

“That is not to suggest any form of diversification will benefit investors,” Kymisis adds. “There are plenty of fish in the sea, but our job as active portfolio managers is to identify those companies with the potential to be among the next wave of market leaders."

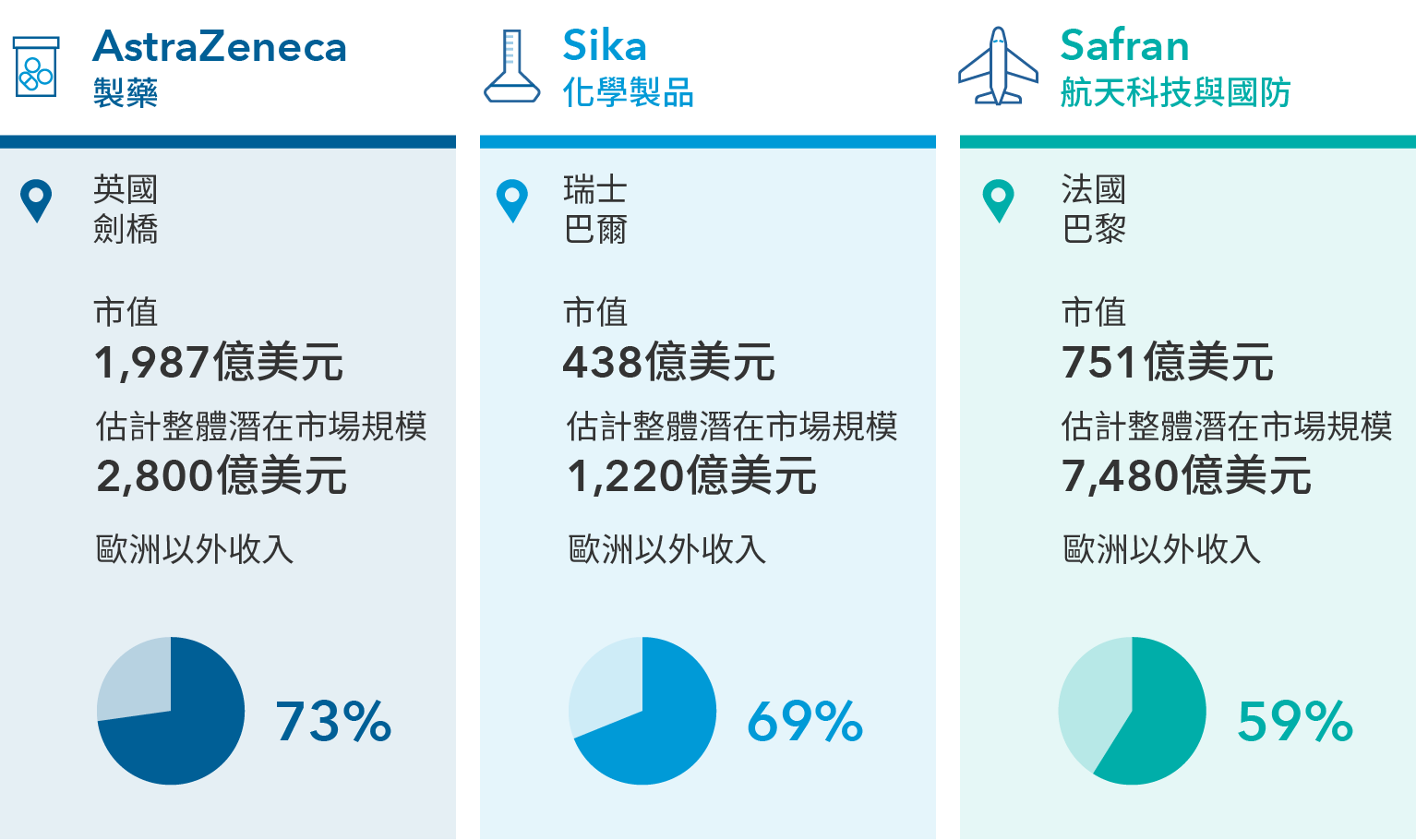

US technology giants do not hold a monopoly on innovation. Europe is home to pioneering companies driving breakthroughs across health care, aerospace and other industries.

For example, AstraZeneca, the British-Swedish COVID vaccine developer and maker of lung cancer treatment Tagrisso, has invested aggressively in research and development, resulting in a deep pipeline of oncological and rare disease therapies in late-stage development.

Air travel is a secular growth industry in a lot of countries, and demand is growing for new airplanes. With regulators in Europe and across the globe imposing stricter emissions requirements, innovation will also be key in solving sustainability challenges in the aerospace industry.

“Airlines will be incentivized to order the newest, most efficient planes, creating a tailwind for leading-edge manufacturers,” says Michael Cohen, an equity portfolio manager.

To illustrate this theme of seeking efficiency, France’s Safran, the world’s top producer of narrow-body aircraft engines, through its partnership with General Electric, is developing engines that could reduce emissions by 20%.

多個行業的創新企業均位於歐洲

資料來源:資本集團、Aviation Week Intelligence Network、公司報告、FactSet、Global Market Insights、MSCI。上述公司作為特定行業的歐洲公司示例,該等公司具有地域多元化的收入基礎;各選定公司是MSCI歐洲指數內各自行業按市值計算的十大公司。地區收入百分比來自FactSet根據公司最新公佈的數據估計,截至2023年11月30日。"TAM"是指整體潛在市場規模。

Japan takes steps to unlock value for investors

Despite strong headwinds in the Japanese economy, a few innovative Japanese firms have built durable businesses with highly defensible moats. For instance, SMC is a leader in robotic equipment components and semiconductor production, and TDK is among the largest manufacturers of high-end electric vehicle batteries.

Many Japanese companies have been known for hoarding cash and subpar governance. But government leaders and the Tokyo Stock Exchange are urging firms to adopt reforms to improve profitability and boost stock valuations. Among the reforms are steps to reduce cash on balance sheets and shed underperforming businesses. About a third of Japanese companies have price-to-book values (a financial metric used to compare the book value of a company with its market capitalisation) lower than the value of their underlying assets.

Sustained reforms could unlock opportunities across industries.

Emerging markets come out of China’s shadow

In emerging markets, China may dominate headlines, but opportunities are growing in countries such as India, Indonesia and Mexico, regions where Infrastructure growth is accelerating, government balance sheets are stronger and supply chain shifts are boosting regional economies.

New roads, housing developments and industrial parks have left parts of India unrecognizable from just a few years ago. Indonesia is attracting foreign investment to build out the electric vehicle supply chain. And Mexico is becoming a reshoring hub, as Western economies look to reconfigure supply chains.

Investment opportunities range from banks to airplane component makers to real estate developers to mining and consumer-related companies. Meanwhile, the rapid expansion of mobile-based technology platforms is tapping into demand for consumer services.

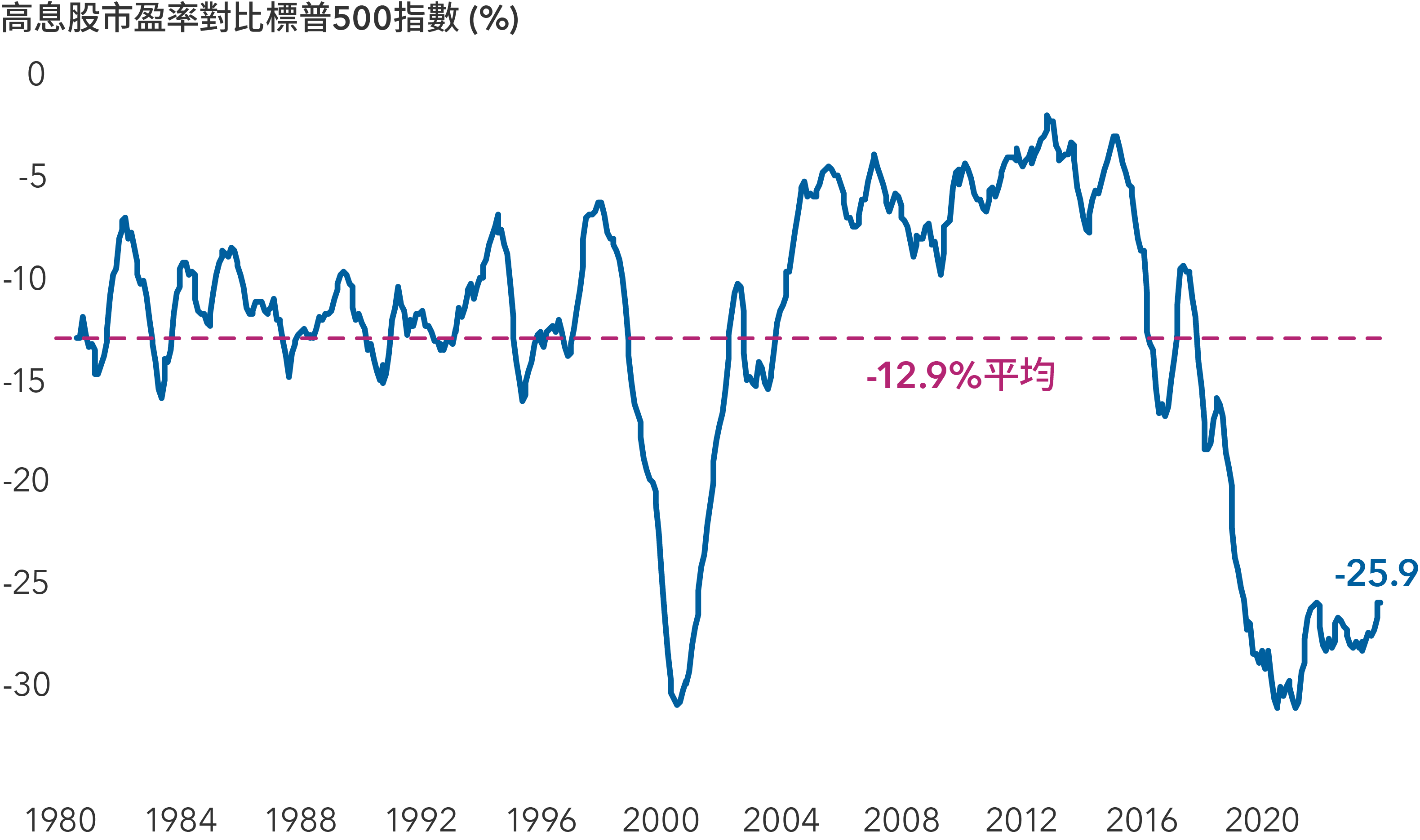

Dividend payers offer diversification potential

While investors watched the powerful AI-dominated market rally, valuations for dividend-paying stocks quietly drifted toward multi-decade lows compared to the broader market. With economic growth expected to moderate in 2024, and the potential for recession lingering, dividends may take a more prominent role in driving total returns for investors.

高息股的估值遠低於市場平均水平

資料來源:資本集團、高盛。截至2023年11月28日。高息股是指標普500指數中股息收益率處於該指數最高五分位(行業中性)的股票組別。虛線代表6個月平滑化平均值。市盈率 = 股票價格與每股盈利的比率。過往的業績表現並非未來期間業績表現的指標。

Select dividend payers across a variety of industries are adopting strategies to drive demand for their offerings. For example, retail pharmacy CVS Health is launching a new division that will work with drugmakers to produce biosimilar versions of leading therapies that are more affordable.

Other dividend payers, whose offerings tend to maintain steady demand through market cycles, can offer a measure of stability. For example, many of beverage maker Keurig Dr Pepper’s offerings, like Canada Dry and Snapple, have strong brand recognition and a history of relatively stable demand through business cycles.

“It is difficult to know when a cycle will turn, so investors may want to look for companies with growth potential but also businesses that pay dividends, which can help mitigate market volatility,” says Diana Wagner, an equity portfolio manager. “Valuation is important, but it is essential to distinguish between real values and companies with deteriorating business prospects.”

Our latest insights

-

-

長線投資

-

環球股票

-

經濟指標

-

構建投資組合

相關觀點

-

-

-

債券

我們的市場觀點

想獲得市場領先的投資見解?歡迎訂閲我們的電子通訊。

過往的業績表現並非未來期間業績表現的指標。指數屬非管理性質,投資者無法直接投資於指數。投資的價值及來自投資的收入可升亦可跌,閣下可能損失部分或全部原投資額。本資料不擬提供投資、稅務或其他意見,亦不擬招攬任何人士購買或出售任何證券。

個別人士的陳述僅代表其截至發佈日的個人立場,不一定反映資本集團或其聯屬公司的意見。一切資料為所示日期之資料,除非另行訂明。某些資料可能從第三方取得,因此概不保證該資料的可靠性。

資本集團透過三個投資部門管理股票投資。該等部門獨立作出投資與代理投票決定。固定收益投資專家為整個資本集團組織提供固定收益研究及投資管理;然而,對於擁有股票特點的證券,他們僅代表三個股票投資部門的其中之一。

Jared Franz

Jared Franz

Lawrence Kymisis

Lawrence Kymisis

Diana Wagner

Diana Wagner