- It may be time to fortify core bond allocations. As the threat of a U.S. recession looms, bonds can provide diversification from equities.

- Tax-loss harvesting opportunities abound. Consider harvesting your clients’ losses before markets recover — and consider reinvesting assets in active fixed income ETFs.

- Yields are attractive at this stage of the cycle, even on traditionally lower risk fixed income assets — suggesting it may be an opportune time to consider investing. However, quality is important. Active fixed income ETFs can help you pursue value across sectors.

- With interest rates and Federal Reserve policy uncertain, active fixed income ETFs can help you manage interest rate risk* and may provide greater tax efficiency to portfolios over the long term.

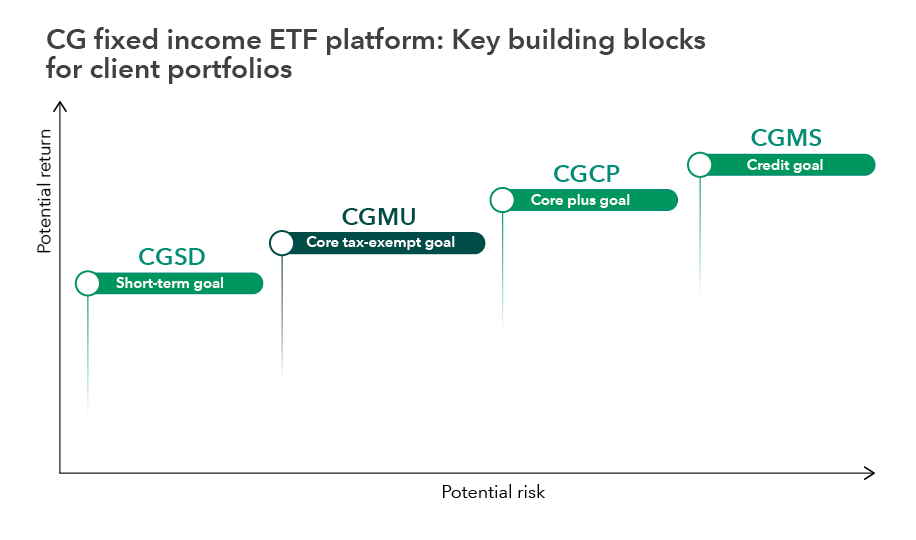

The higher rate environment has resulted in more attractive yields across fixed income, making it a compelling area to consider. Bonds are currently offering significantly higher yields without having to take on more risk, which means you don’t have to venture too far on the risk spectrum to pursue attractive income in a portfolio. Whether you’re tax-loss harvesting and wondering where to reinvest assets or unsure how to navigate fixed income allocations amid unpredictable Fed policy, we’ve identified three reasons why bonds (and active fixed income ETFs) appear compelling in the current environment.

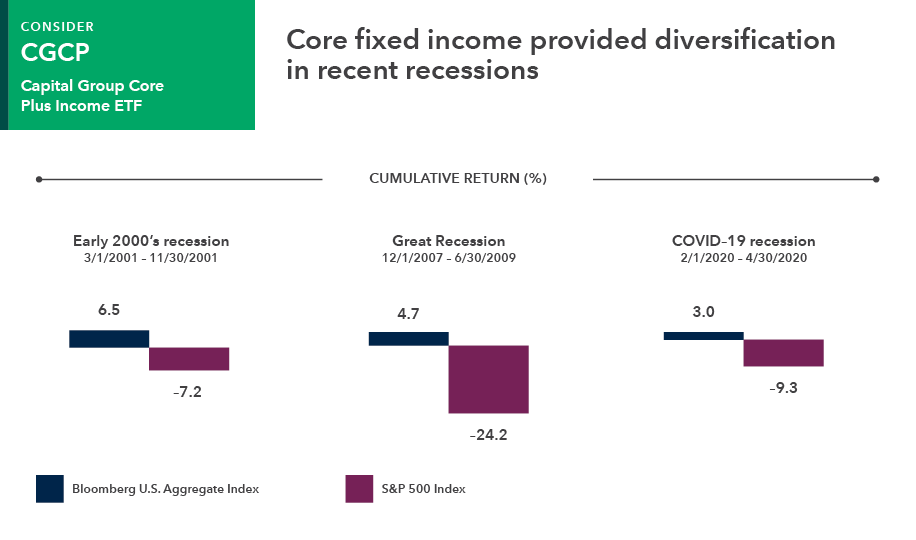

Reason 1: The importance of diversification

Bonds are expected to return to providing diversification from equities, which will likely be beneficial if there’s a recession.

- Expected rate hikes have largely been priced into the market based on the Fed’s consistent message to anticipate additional rate increases.

- Core and core-plus bond funds’ diversification benefits appear to be normalizing, returning core bond funds to their traditional role of helping to cushion volatility in equity markets as they have over the past three recessions.

- Furthermore, attractive bond yields provide a compelling opportunity set amid continued macroeconomic uncertainty.

- Consider fortifying the core of portfolios with an active core or core-plus fixed income allocation, such as the Capital Group Core Plus Income ETF (CGCP).

Sources: Morningstar, Bloomberg Index Services Ltd. The Bloomberg U.S. Aggregate Index represents the U.S. investment-grade fixed-rate bond market. The S&P 500 Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks. Recession periods defined by the National Bureau of Economic Research. Correlations calculated using daily returns. Returns shown are cumulative. Past results are not predictive of results in future periods.

Reason 2: Option to tax-loss harvest in bond funds

If you’re still holding fixed income funds purchased in early 2022 or before, there may be an opportunity to generate losses to offset gains elsewhere, if any, and lower tax liabilities. However, fixed income tax-loss harvesting opportunities may become scarcer if bond markets continue to recover and inflation pressures recede.

- Tax-loss harvesting allows investors to realize losses by selling funds that have lost value, reinvesting the proceeds and using the capital loss to offset capital gains on other investments.

- Active fixed income ETFs may be an interesting reinvestment option for transitioning assets while realizing losses because they may offer improved tax efficiency with mutual funds. They also may provide greater tax efficiency to the portfolio over the long term.

- If you’re unsure where to reinvest, consider active fixed income ETFs. As of 3/31/23, the average yield to worst on the Capital Group Short Duration Income ETF (CGSD) was 5.8% and it was 7.0% on the Capital Group U.S. Multi-Sector Income ETF (CGMS).

"When it comes to tax-loss harvesting, our active fixed income ETFs can be a compelling investment during the wash sale period† as a way for investors to preserve their allocations and maintain exposure to a changing market while still booking losses."

Holly Framsted

Capital Group Director of ETFs

Capital Group active fixed income ETFs can serve as tax-loss harvesting swaps for many common fixed income allocations

| Morningstar category | Expense ratio1 | Avg yield to worst | 30-day SEC yield (as of 6/30/23) |

|---|---|---|---|

| CGSD: Capital Group Short Duration Income ETF | |||

| Short-Term Bond | 0.25% | 6.90% | 5.01% |

| CGCP: Capital Group Core Plus Income ETF | |||

| Intermediate Term Core Plus Bond | 0.34% | 6.80% | 5.27% |

| CGMS: Capital Group U.S Multi-Sector Income ETF | |||

| Multisector Bond | 0.39% | 7.50% | 6.57% |

| CGMU: Capital Group Municipal Income ETF | |||

| Muni National Intermediate | 0.27% | 4.10% 6.95%§ |

3.54% 6.00%‖ |

Source: Morningstar Direct, all data as of 6/30/23. Yield to worst is the lowest yield that can be realized by either calling or putting on one of the available call/put dates, or holding a bond to maturity.

§Tax-equivalent yield as of 6/30/23. The taxable equivalent yield assumptions are based on a federal marginal tax rate of 37%, the top 2023 rate. In addition, we have applied the 3.8% Medicare rate.

‖Tax-equivalent 30-day SEC yield as of 6/30/23. The taxable equivalent yield assumptions are based on a federal marginal tax rate of 37%, the top 2023 rate. In addition, we have applied the 3.8% Medicare rate.

Reason 3: Late-market cycle opportunities across fixed income sectors

The global economy appears to be in the late stages of a market cycle, possibly offering an opportune time to invest in fixed income securities — if you know where to look.

- The bond market appears to be normalizing and may present an attractive entry point for investors as lower valuations present some compelling opportunities.

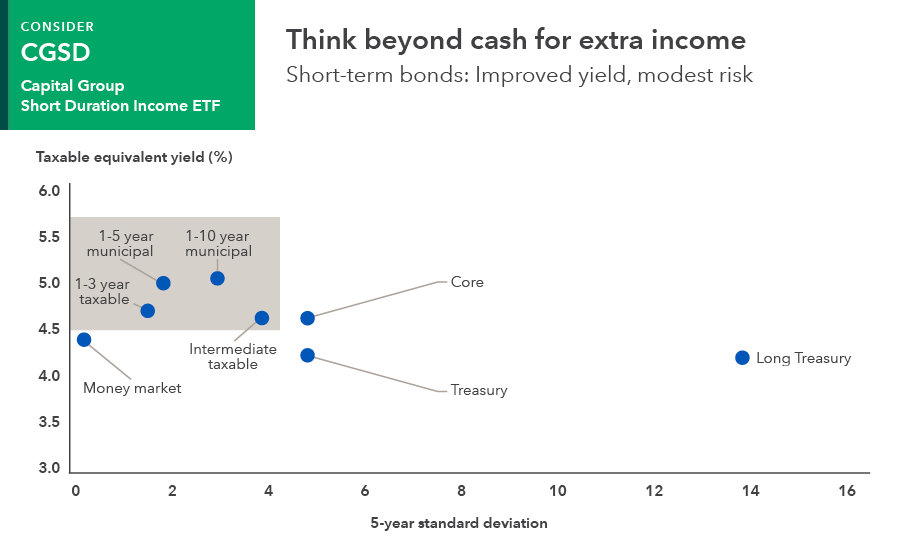

- Higher yields in short-duration, high-quality bonds appear to present an opportunity to earn more income than cash without taking on a significant amount of risk.

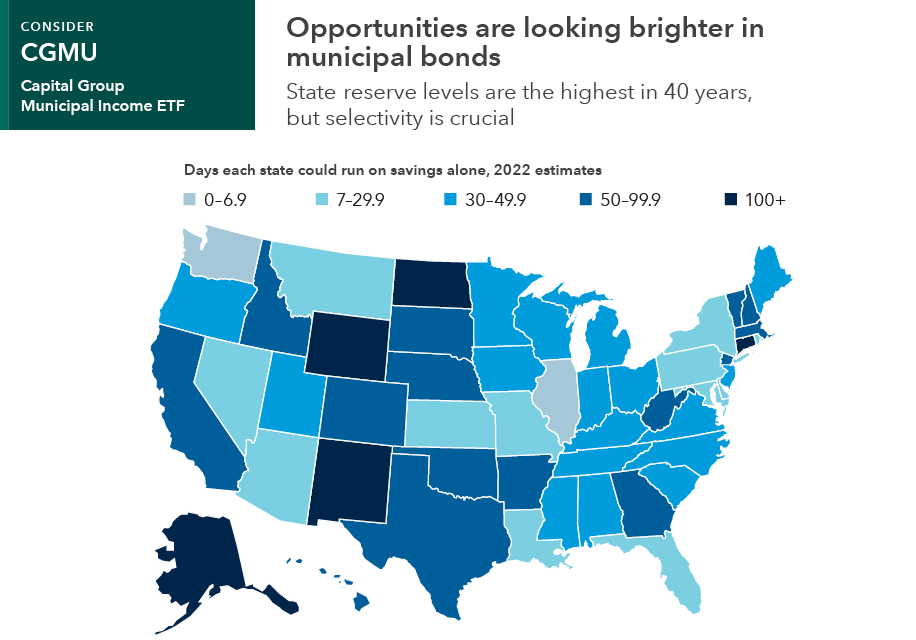

- Within municipal bond markets, solid credit fundamentals and high reserves suggest issuers are well positioned to weather a potential recession.

- High-income areas of the fixed income market look appealing but it’s important to rely on research and be selective. In the current environment, it’s not necessary to take on a lot of risk to pursue attractive yields.

"CGSD, our short duration income ETF, has relatively low interest rate sensitivity and aims for income and capital preservation. In comparison to other short duration offerings that are income oriented, CGSD emphasizes higher quality as well as more diversity in the income-producing sectors reflected in the portfolio. We believe that may lead to less volatility over time while still delivering the potential for attractive income and returns relative to much of the yield-focused peer group."

Anmol Sinha

Investment Director for CGSD

As of December 30, 2022. Source: Bloomberg Index Services, Ltd., Morningstar. Money Market: Morningstar Prime Money Market Category average. 1-3 year taxable: Bloomberg U.S. Aggregate 1-3 Year Index (represents securities in the one to three year maturity range of the U.S. investment-grade fixed-rate bond market), Intermediate taxable: Bloomberg U.S. Aggregate Intermediate Index (represents securities in the two to 10 year maturity range of the U.S. investment-grade fixed-rate bond market), 1-5 year municipal: Bloomberg Municipal Short 1-5 year Index (a market-value-weighted index that includes investment-grade tax-exempt bonds with maturities of one to five years), 1-10 year municipal: Bloomberg Municipal Short-Intermediate 1-10 year Index (a market-value-weighted index that includes investment-grade tax-exempt bonds with maturities of one to 10 years), Core: Bloomberg U.S. Aggregate Index, Treasury: Bloomberg U.S. Treasury Index (represents U.S. dollar-denominated, fixed-rate, nominal debt issued by the U.S. Treasury), Long Treasury: Bloomberg U.S. Long Treasury Index (represents U.S. dollar-denominated, fixed-rate, nominal debt issued by the U.S. Treasury with maturities of ten years or more). Yields for indexes are yield to worst. Money market yield is 7-day SEC yield. Taxable-equivalent-rate assumptions are based on a federal marginal tax rate of 37%, the top 2022 rate. In addition, we have applied the 3.8% Medicare tax. Standard deviation is a common measure of absolute volatility that tells how returns over time have varied from the mean. A lower number signifies lower volatility. Past results are not predictive of results in future periods. The indexes are unmanaged and therefore, have no expenses. Investors cannot invest directly in an index.

"CGMU has the flexibility to act on what managers believe could be potential weaknesses in municipal credit spreads that may pop up to create attractive valuations."

Greg Ortman

Investment Director for CGMU

Sources: Capital Group, Pew Charitable Trusts; National Association of State Budget Officers. Data is reported by each state for its fiscal year, which ends June 30 in all but four states: New York (March 31), Texas (August 31), Alabama (September 30) and Michigan (September 30).

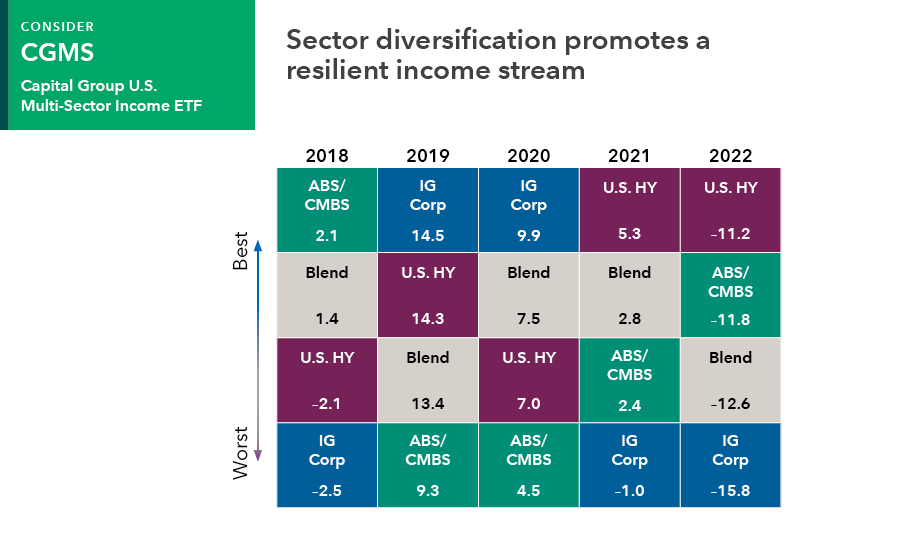

In the current bond environment, it’s important to be selective about sources of income, which is where an experienced active manager can help, particularly with a multi-sector income strategy. Such strategies allow flexibility across sectors to help focus on areas that have potential to offer the most added value.

"When pursuing higher income, you want a diversified fund for two reasons: first, diversification offers the potential for better risk management and second, no single income sector always comes out on top — therefore flexibility is a key to uncovering the best relative value across sectors and maximizing longer term risk-adjusted results. Given the complexities of credit markets, you'll want an active manager to be pulling those risk levels for you."

Harry Phinney

Investment Director for CGMS

Data as of December 31, 2022. U.S. HY represents Bloomberg U.S. Corporate High Yield 2% Issuer Capped Index (covers the universe of fixed-rate, non-investment-grade debt. The index limits the maximum exposure of any one issuer to 2%.); IG Corp represents Bloomberg U.S. Corporate Investment Grade Index (represents the universe of investment-grade publicly issued U.S. corporate and specified foreign debentures and secured notes that meet the specified maturity, liquidity, and quality requirements); ABS/CMBS represents 80% Bloomberg CMBS Ex AAA Index (represents the universe of U.S. commercial mortgage-backed securities, excluding issuers with credit ratings of AAA, the highest credit quality rating)/20%Bloomberg ABS Ex AAA Index (represents the universe of U.S. asset-backed securities, excluding issuers with credit ratings of AAA). Blend is Multi-Sector Income Fund Custom Blended Index comprises: 45% Bloomberg U.S. Corporate High Yield 2% Issuer Capped Index, 30% Bloomberg U.S. Corporate Investment Grade Index, 15% J.P. Morgan EMBI Global Diversified Index (a uniquely weighted emerging markets debt benchmark that tracks total returns for U.S. dollar-denominated bonds issued by emerging markets sovereign and quasi-sovereign entities), 8% Bloomberg CMBS Ex AAA Index, 2% Bloomberg Ex AAA Index. Past results are not predictive of results in future periods. The indexes are unmanaged and therefore, have no expenses. Investors cannot invest directly in an index.

Active fixed income management may hold added appeal in an uncertain environment

The current fixed income environment presents opportunities that may help position portfolios for the year ahead. However, if you hold passive fixed income strategies, it’s important to remember that you will need to carefully monitor interest rate risk and duration across those funds. For support in these areas, consider investing in active fixed income funds, particularly active fixed income ETFs, which may offer tax efficiency. Our portfolio construction team has experience identifying opportunities to simplify fixed income allocations, potentially lowering clients’ fees and allowing you to spend more time supporting your clients and growing your business. To learn more, request a consultation today.

Tax-loss harvesting: The practice of selling securities that have declined in market value to realize the capital loss so it can be used to offset capital gains.

*Interest rate risk is the risk of a decline in the value of fixed income assets due to a change in interest rates.

†The Internal Revenue Service's wash-sale rule regulates the timing around how quickly a substantially identical security can be purchased after the underperforming asset was sold to realize a tax benefit from tax-loss harvesting.

The S&P 500 Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks.