Energy

Few technologies have spanned the gamut of public perception as thoroughly as nuclear power. At the dawn of the “Atomic Age,” futurists pictured it as a utopian force — cleaner than coal and a steady source of energy. However, the costs and potential hazards of the facilities tarnished the technology’s reputation.

Over the last few decades, many countries — Switzerland and Japan among them — banned the construction of new reactors. New projects have slowed to a trickle, largely due to stigma born of well-publicized accidents in the ’70s and ’80s.

Yet, we’re now entering what’s been dubbed the “age of electricity.” Unprecedented data center growth, rising industrial usage and swelling consumer demand are all making dependable sources of electricity more necessary than ever. And with many countries working to curtail their use of carbon-based fuel sources, nuclear energy could find fresh footing — especially as its stable electricity generation seems tailor-made to complement renewables such as wind and solar.

We discussed nuclear power with Capital Group investment professionals and distilled their views into four key insights.

Nuclear energy’s resurgence is boosted by competing demands.

The International Energy Agency (IEA), a Paris-based intergovernmental body that advises countries on energy policy, has said that the age of electricity is “fueled by growing industrial production, rising use of air conditioning, accelerating electrification and an expansion of data centers worldwide.” That need for reliable energy has run headlong into attempts to decarbonize.

Enter nuclear energy, which has the potential to bridge the demand gap while advancing the transition to green energy. It’s low carbon and produces nearly uninterrupted energy, complementing supply from renewables such as solar and wind. It could also advance energy independence for some countries.

Explore what matters most.

To be sure, safety has long been a concern. Some countries began phasing out nuclear after a serious accident in Japan in 2011, and others have cited such hazards to explain their reluctance to adopt nuclear power.

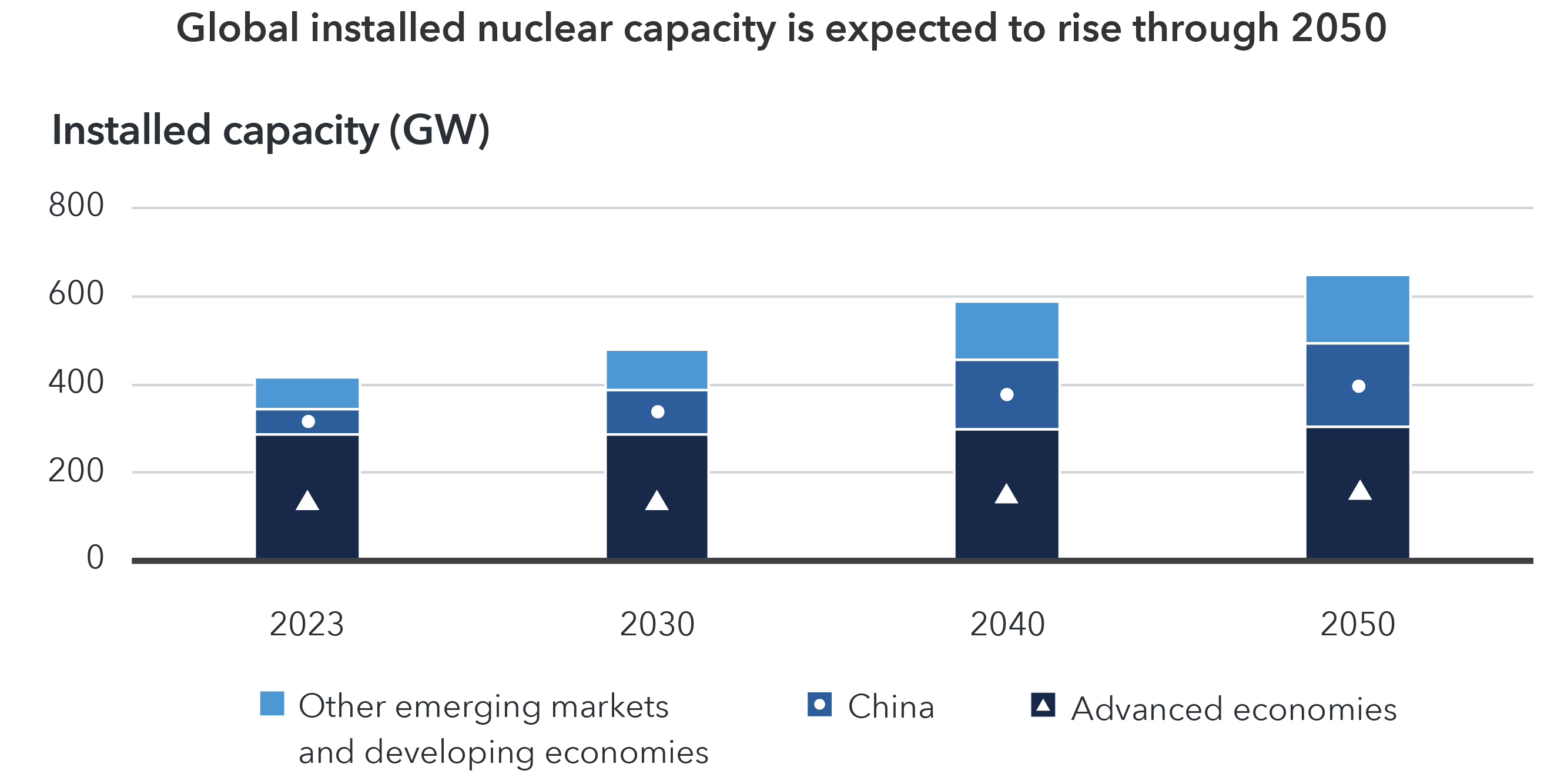

Still, investment in nuclear power has risen 50% worldwide over the past five years. The IEA has projected that global nuclear capacity will rise through 2050. The U.S., France and China — the top nuclear power producers — all have expansion plans. Many of the recent nuclear-related policy changes and nuclear power deals often involve tech companies.

“Big tech data centers require uninterrupted power 24 hours per day. Of the main types of fuel that can provide uninterrupted power on demand, only nuclear power generates no carbon dioxide emissions,” says Capital Group equity portfolio manager Mark Casey. “The more committed a tech company is to achieving a carbon neutrality target, the more likely it is to use nuclear power.”

The world’s going nuclear

Source: IEA. The Path to a New Era for Nuclear Energy. January 16, 2025. The graphic shows the IEA’s forecast for installed nuclear capacity for 2030, 2040 and 2050 under the Stated Policies Scenario, which takes into consideration existing policies and measures, as well as those under development. 2023 figures are actual. The methodology of IEA’s global energy and climate scenarios can be found on the organization’s website.

New nuclear technologies could be fruitful, but they’re still in development.

High costs and long lead times are two key challenges in building nuclear power plants. Only a handful of nuclear projects have started construction in Western Europe and North America since 2005, and they’re significantly delayed and overbudget.

Recently, small modular reactors (SMRs) have been touted as a promising solution. In theory, modules of small reactors can be manufactured in factories and assembled on-site. Proponents argue that SMR technology’s size and design features likely limit the extent of radiation leaks and the risk of catastrophic meltdown.

Yet SMR technology is neither a panacea nor a quick fix. In the past, there have been attempts to develop small nuclear reactors, and many projects suffered from poor economics and technical problems. SMRs also come with safety challenges related to novel aspects of proposed designs. More-recent SMR projects also have experienced cost overruns and delays.

Another nascent technology, nuclear fusion, is the inverse of the fission used in today’s power plants. Instead of splitting a heavy atom, it combines lighter ones, releasing a massive amount of energy. Fusion is even further away from commercialization than SMR, but commercial interest is emerging, as evidenced by Google’s recent agreement to purchase power from a planned fusion plant in the 2030s.

Friendlier governmental policy could provide a long-term boost.

With demand seemingly only growing, many countries are rethinking policies that shuttered nuclear power plants or prevented their construction.

For example, Germany decided to exit nuclear power in 2011 and subsequently closed its plants, but recently dropped its opposition. A major blackout in April caused Spain to revisit its own planned exit. Denmark is considering lifting a 40-year ban. Meanwhile, countries such as Egypt and Bangladesh are developing their first nuclear plants.

To successfully introduce or expand nuclear power capacity, policies that address high costs and long lead times will be key. The IEA observed that standardizing reactor designs, coupled with developing strong supply chains and a skilled workforce, helped China expand its nuclear fleet. Today, of the 62 reactors under construction, 29 are in China, which is expected to overtake the U.S. as the world’s top nuclear power producer by 2030.

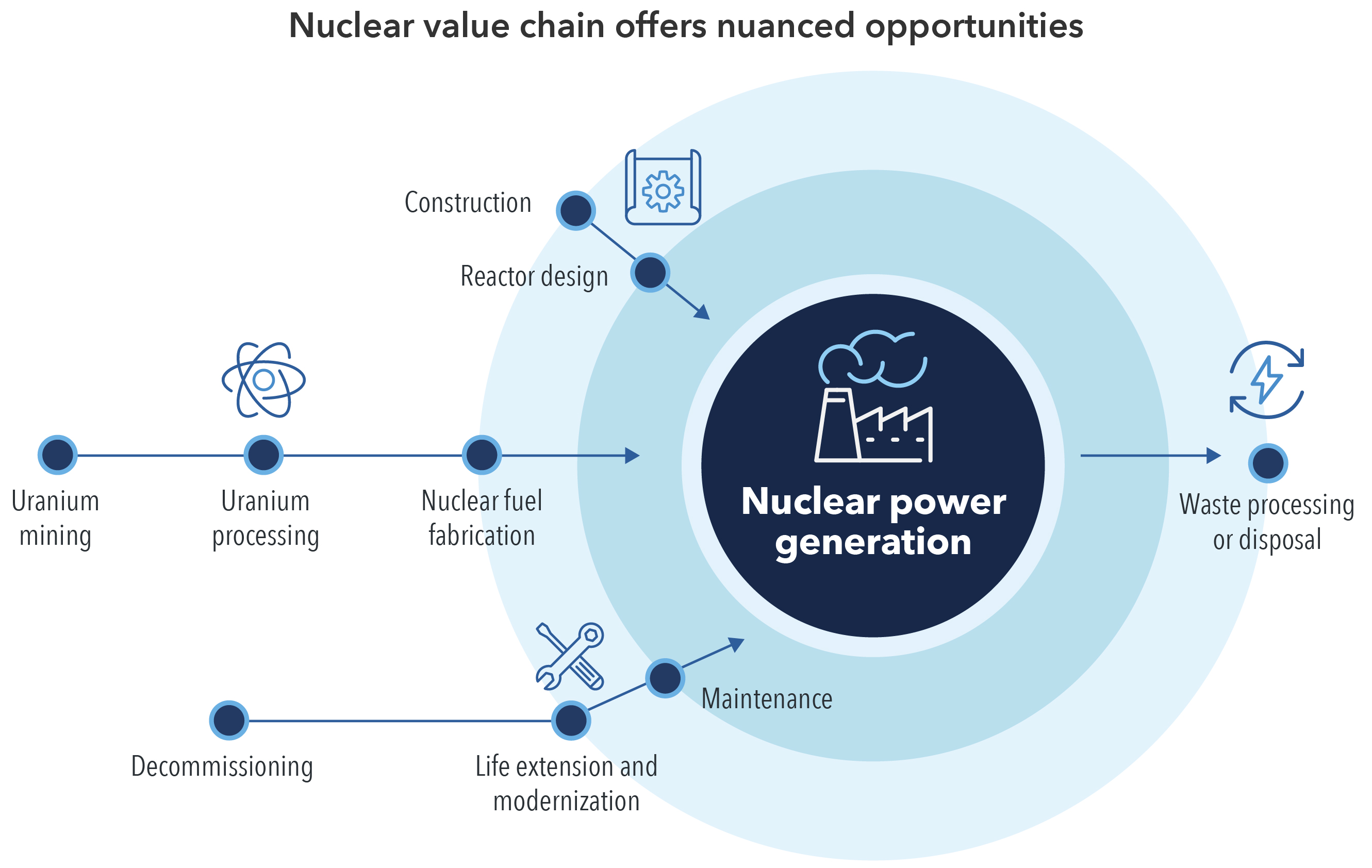

Companies upstream and downstream of the plants also offer opportunities.

Opportunities to capture the growing interest in nuclear energy can be found up and down the production chain: uranium miners, component manufacturers, specialty engineering services and more.

Take uranium mining. Expansion of nuclear power capacity will require more uranium, just as a shortage looms large after a decade-long bear market.

“I believe this uranium bull market has more room to run, as primary supply is fragile and having difficulty ramping up, secondary supply is dwindling and demand is increasing,” says Capital Group equity analyst Aditya Bapna.

Industrial companies with growing exposure to nuclear energy may be worthy of investors’ attention, too. A large U.S. machinery manufacturer recently purchased a producer of sensors for aerospace and nuclear industries.

“The market will love the added aerospace and nuclear exposure, as they are probably the two best end markets one could have in industrials over the next decade,” says Capital Group equity analyst Nate Burggraf.

For investors considering nuclear energy, generation is not the whole story

The bottom line

Global nuclear power output is expected to hit an all-time high in 2025, and more than 40 countries now have plans to expand nuclear power use. Even in countries that have historically avoided nuclear, the debate over its role in the energy mix has been reignited.

Nuclear power has experienced boom-and-bust cycles before, but this time may be different, as it is marked by increasing investment interest from the private sector, especially in new technologies such as SMRs.

Investments are not FDIC-insured, nor are they deposits of or guaranteed by a bank or any other entity, so they may lose value.