Economic Indicators

If there’s one takeaway from how the financial markets have blazed higher this year, it’s that they can tolerate a great deal of what in any other setting would be viewed as less-than-rosy news.

The market’s fortitude was on particular display in the third quarter, as U.S. and foreign equities bounded higher despite geopolitical instability, a subdued employment outlook and a high-decibel government shutdown, among other dynamics. Bonds also powered ahead, boosted by the first interest rate cut of the year.

The upward march has been paced in part by U.S. consumers being in a good place, with real wages rising, particularly for the lowest earners. Overall spending has grown and a smaller portion of household income has gone to debt servicing. Beyond that, the Federal Reserve has signaled an openness to two more rate cuts beyond its initial move in September. And though the potential overhang of tariffs remains elevated, hopes have risen that the U.S. can manage to sidestep a full-blown trade brawl.

Beyond the U.S., expectations for global growth remain sound for this year and next. The outlook declined right after the so-called Liberation Day tariff announcement in the second quarter, but have ticked cautiously higher since then. Fiscal spending in Germany is rising as the broader European policy environment appears to be improving. Corporate reforms are underway in Japan and South Korea. There are even nascent signs of economic stabilization in China.

Of course, jitters remain just under the surface given the whirlpool of economic and political forces swirling overhead. That was shown in early October when the markets hit a speedbump amid freshly ratcheted U.S.-China trade tensions. Equities pulled back after China announced harsh new restrictions on rare-earth exports and the U.S. struck back with 100% tariffs.

It’s unclear where things go from here. The big-picture question marks are unlikely to resolve anytime soon, with contusions mounting in the job market. Nevertheless, many fundamentals are still strong — including positive forecasts for corporate earnings and global GDP — with the economy and financial markets defying naysayers throughout the year.

Explore what matters most.

The U.S. government may have sizable economic effects in the near term.

Before tariffs stole the spotlight, the Fed rate cut in September had been top of mind. Both developments showcased the power of the government to affect markets, at least in the short term.

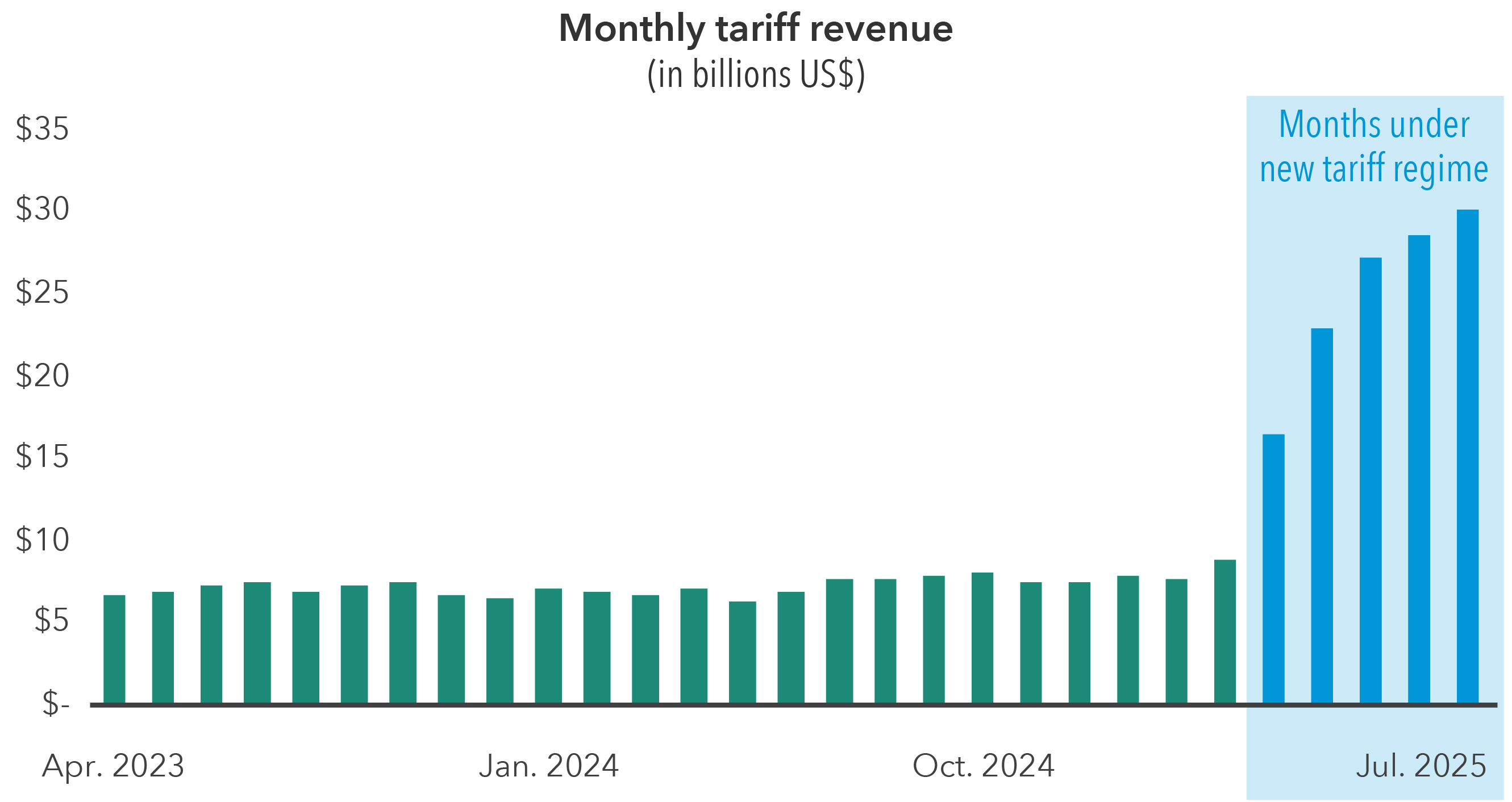

On the tariff front, import taxes have been subtly influencing the economy for most of the year. Tariff revenue leaped in March and grew in each subsequent month through July, the most-recent period with available data. Those higher prices are starting to show up in some measures of inflation. While tariffs don’t cause ongoing price increases — they typically add an initial cost when implemented — they will show up in most measures of price growth as they flow through the economy.

Tariff revenue has been growing under the new administration.

Source: LSEG. As of September 30, 2025.

Despite that, the quarter-point cut suggests the Fed is even more worried about employment. The central bank — navigating a middle path between its dual mandates of supporting employment and maintaining price stability — had held rates steady for more than a year as inflation stubbornly hovered above its target rate. Now, however, unofficial figures suggest the U.S. may have shed jobs in September. (Official statistics for the month have yet to be released due to the government shutdown.) At the moment, employers appear frozen in place — reluctant to hire or fire.

At a minimum, job growth has been on a choppy but steady decline since the surge following the pandemic. That’s a reflection of soft confidence in general amid tumult in the geopolitical world order, tariff-induced inflation and bubbling fear that the lightning-fast pace of technology may decimate jobs.

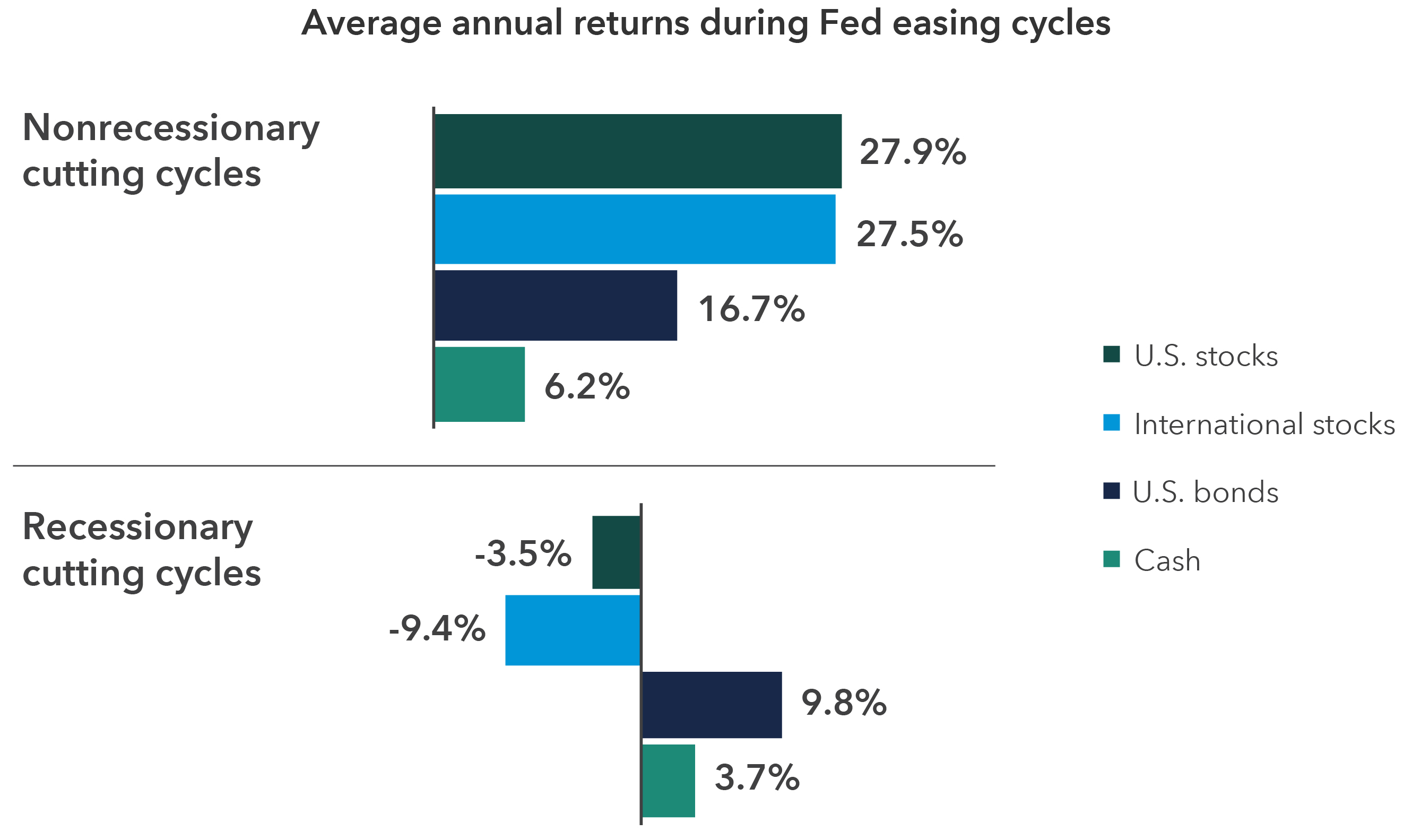

The minutes from the Fed’s September meeting indicate that the bank is prepared to make further cuts this year. That could be a boon for investors. Historically, over the course of previous rate-cutting regimes in nonrecessionary periods, equities rose an average of more than 27% and U.S. bonds returned an average of nearly 17%.

When the Fed cut during nonrecessionary periods, markets jumped.

Sources: Capital Group, Bloomberg Index Services, Ltd., Morningstar, S&P Dow Jones Indices LLC. Return calculations reflect annualized total returns over periods in which the Federal Reserve had stopped raising rates and began to actively cut rates, measured from the peak federal funds target to the lowest federal funds rate target for each cycle. Specific easing cycles include August 1984–August 1986 (nonrecessionary), May 1989–September 1992 (recessionary), February 1995–January 1996 (nonrecessionary), March 1997–November 1998 (nonrecessionary), May 2000–June 2003 (recessionary), June 2006–December 2008 (recessionary) and December 2018–March 2020 (recessionary). U.S. stocks represented by S&P 500 Index; international stocks by MSCI World ex USA Index; U.S. bonds by Bloomberg US Aggregate Index; and cash by the average investment rate of 3-month U.S. Treasury bills. As of December 31, 2024.

Oddly, the federal shutdown that began on Oct. 1 might have much less effect. Prior closures brought gushes of short-term pain, particularly for federal workers and businesses catering to them, but had limited long-term impact. The 2019 shutdown is illustrative. At 35 days, it was the longest ever. Yet the Congressional Budget Office calculated its overall impact at a scant 0.02% hit to GDP — hardly the stuff of recessions.

Technology stocks once again pulled ahead of the broad market.

The year started with an unmistakable shift in market winners, with once-scorching artificial intelligence companies taking a backseat to more staid sectors. However, that dynamic proved short-lived, as information technology and communication services led the way in the third quarter, both in the U.S. and globally. The S&P 500 Index rose 8.1%, as information technology posted a 13.2% advance. The global story was very similar: The MSCI World Index scooted up 7.3%, led by information technology at 12.3%.

Still, tech stocks remain richly valued, both in historical and absolute terms. That doesn’t mean they’re due for a fall, but it should serve as a reminder that diversification is a critical part of portfolio allocation. Investing across sectors, industries and geographies can help investors benefit from the kinds of leadership changes that have marked this year.

The Fed’s rate cut gave bonds a meaningful boost.

Bonds added another good quarter to a strong year, partly off the back of the Fed’s September rate cut. The Bloomberg U.S. Aggregate Index, which tracks U.S. investment-grade debt, was up 2% in the third quarter, bringing it to 6.1% for the year.

Municipals had a particularly strong quarter, jumping 2.2% as measured by the Bloomberg Municipal Short-Intermediate 1–10 Years Index. On an after-tax basis, they handily outpaced their taxable cousins for most high-earning investors.

Investments are not FDIC-insured, nor are they deposits of or guaranteed by a bank or any other entity, so they may lose value.

The indexes are unmanaged and, therefore, have no expenses. Investors cannot invest directly in an index.

Bloomberg Municipal Short-Intermediate 1-10 Years Index is a market-value-weighted index that includes investment-grade tax-exempt bonds with maturities of one to 10 years. This index is unmanaged, and its results include reinvested distributions but do not reflect the effect of sales charges, commissions, account fees, expenses or U.S. federal income taxes.

Bloomberg U.S. Aggregate Index represents the U.S. investment-grade fixed-rate bond market. This index is unmanaged, and its results include reinvested dividends and/or distributions but do not reflect the effect of sales charges, commissions, account fees, expenses or U.S. federal income taxes.

MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure equity market results of developed markets. The index consists of more than 20 developed market country indexes, including the United States. Results reflect dividends net of withholding taxes. This index is unmanaged, and its results include reinvested dividends and/or distributions but do not reflect the effect of sales charges, commissions, account fees, expenses or U.S. federal income taxes.

MSCI All Country World Index ex USA is a free-float-adjusted market-capitalization-weighted index that is designed to measure equity market results in the global developed and emerging markets, excluding the United States. The index consists of more than 40 developed- and emerging-market country indexes. When applicable, results through December 31, 2000, reflect dividends gross of withholding taxes, and dividends net of withholding taxes thereafter. This index is unmanaged, and its results include reinvested dividends and/or distributions but do not reflect the effect of sales charges, commissions, account fees, expenses or U.S. federal income taxes.

S&P 500 Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks. This index is unmanaged, and its results include reinvested dividends and/or distributions but do not reflect the effect of sales charges, commissions, account fees, expenses or U.S. federal income taxes.

Source: Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.”

© 2025 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

Source: MSCI. The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com)

S&P 500 Index is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2025 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.