Energy

Long shunned, nuclear energy appears poised for a comeback. The world’s largest technology firms, including Microsoft and Amazon, are increasingly exploring nuclear energy as a solution for their enormous power needs. The growth of artificial intelligence (AI) and the vast electricity requirements of data centres have placed additional emphasis on electricity even as companies attempt to meet their emissions goals.

Big tech seeks nuclear power with AI push

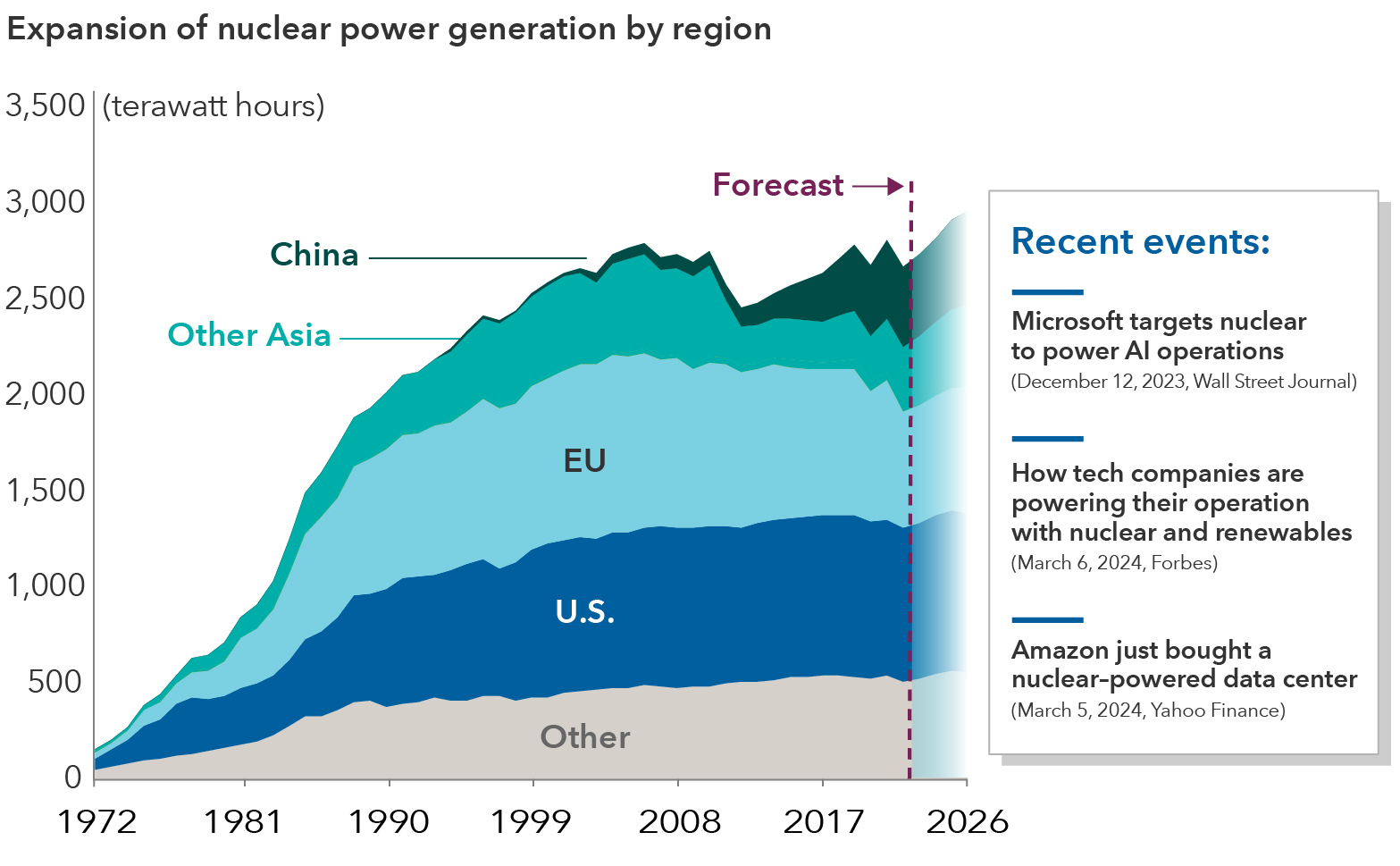

Sources: Capital Group, International Energy Agency (IEA). Evolution of nuclear power generation from 1972 until 2023 in terawatt hours and IEA projections from 2024–2026. Data as of January 17, 2024. Note: IEA’s forecast is based on projects currently under construction and expected to be operational by the end of 2026. EU refers to the European Union. India data was combined into “Other Asia.”

Last June, Microsoft struck a deal with Constellation Energy to supply one of its data centres in Virginia with nuclear power. More recently, Amazon purchased a data centre in Pennsylvania from Talen Energy with a plan to utilize nuclear power from one of Talen’s nearby plants.

"Big tech companies will be a key driver of reigniting the nuclear power conversation, as their data centres require 24/7 power from reliable sources that curb carbon dioxide emissions," equity portfolio manager Mark Casey said.

For utility companies that own nuclear plants, they’re gaining a "new lease on life," where their lowest cost form of power is generating more revenue than was previously forecast, Casey added. Electricity usage from AI, cryptocurrencies and data centres could double by 2026, according to estimates from the International Energy Agency (IEA). Data centres gobbled up about 460 terawatt hours (TWh) of electricity in 2022 and could surpass 1,000 TWh in 2026.

Emerging markets countries also appear to be turning to nuclear power to address their growing needs, led by China and India, both of which are expected to add more nuclear capacity. With an added 29 gigawatts of nuclear capacity projected to be online by 2026, over 50% of that capacity will be built in China and India, according to the IEA. Nuclear power usage differs across the European Union. For example, France satisfies 70% of its energy consumption with nuclear power, whereas it makes up 3.3% of Germany’s energy mix.

Greater international acceptance of nuclear energy — along with broader governmental recognition that nuclear power can be used in addition to other forms of energy such as wind and solar — have shifted perspectives on nuclear power’s potential, says equity investment analyst Adam Ward.

“I’m coming to the conclusion that nuclear will achieve a meaningful price premium for its power, as it’s the only source that is both carbon free and the potential to be 100% reliable,” Ward said.

Our latest insights

-

-

Currencies

-

Market Volatility

-

Market Volatility

-

Markets & Economy

RELATED INSIGHTS

-

Global Equities

-

Markets & Economy

-

Emerging Markets

Commissions, trailing commissions, management fees and expenses all may be associated with investments in investment funds. Please read the prospectus before investing. Investment funds are not guaranteed or covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. For investment funds other than money market funds, their values change frequently. For money market funds, there can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you. Past performance may not be repeated.

Unless otherwise indicated, the investment professionals featured do not manage Capital Group‘s Canadian investment funds.

References to particular companies or securities, if any, are included for informational or illustrative purposes only and should not be considered as an endorsement by Capital Group. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds or current holdings of any investment funds. These views should not be considered as investment advice nor should they be considered a recommendation to buy or sell.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and not be comprehensive or to provide advice. For informational purposes only; not intended to provide tax, legal or financial advice. Capital Group funds are available in Canada through registered dealers. For more information, please consult your financial and tax advisors for your individual situation.

Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. We encourage you to consider these and other factors carefully before making any investment decisions and we urge you to avoid placing undue reliance on forward-looking statements.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2026 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2026. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under licence. All rights in the FTSE Russell indices or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indices or data and no party may rely on any indices or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The index is unmanaged and cannot be invested in directly.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com)

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capital Group trademarks are owned by The Capital Group Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capital Group funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capital Group, a global investment management firm originating in Los Angeles, California in 1931. Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

The Capital Group funds offered on this website are available only to Canadian residents.

Mark Casey

Mark Casey

Adam Ward

Adam Ward