Team Management

13 MIN ARTICLE

For advisor use only. Not for use with investors.

What does it take to build a top team? The formula is part art and part science, leveraging processes, technology, talent and purpose to take your firm from a practice to an enterprise.

“The best teams in the industry have figured out how to operate as an enterprise by building systems in that allow them to operate much like some of America's most successful corporations today,” says Paul Cieslik, advisor practice management consultant at Capital Group. “Much of this work involves process, but it takes the right mindset, too.” In other words, he says, you must believe in the opportunity for growth and commit to it.

Cieslik and his group engage with thousands of advisors each year, seeing firsthand how teams are implementing best practices and effective drivers of growth, and paying careful attention to what the best of the best have in common. Here are 10 key traits shared by successful financial advisory teams, and how you can apply them to your business.

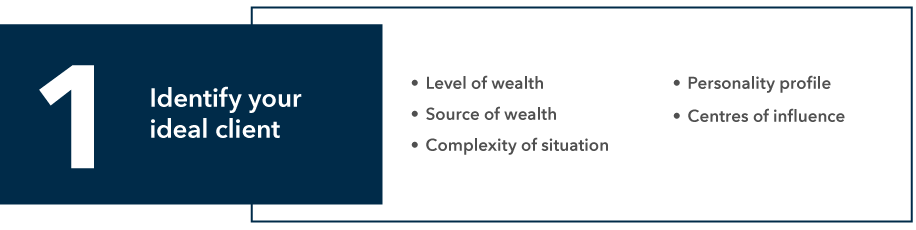

1. Identify your ideal client.

The most successful advisors have defined their core or “ideal” clients. This helps them tailor their practices to offer services that best create differentiating value over the long term. Your ideal client might seem obvious — isn’t it the clients who are easy to work with and value your service? But take a closer look, and you may find other attributes or characteristics that your clients share. By defining these ideal client traits, you may be able to tailor your services and grow referrals.

Some advisors may start by defining their ideal based on asset minimums, but you may want to take a more specialized approach and target clients with specific sources of wealth (i.e., tech stock liquidity events, family-owned businesses or inheritance) or otherwise complex financial needs. Other traits could be personality profile, personal affinities or connections with centres of influence. Some teams even try to identify one or two ideal client personas on which they structure their business acquisition efforts.

For example, Mark Wilkins, managing director at UBS Private Wealth, focuses on clients who want to leverage their wealth to “make the world a better place” and structures his firm to operate along those lines. This enables him to be away from the day to day of the office and spend time with clients in places like Kenya and Tanzania to help them vet investments in environmental projects, such as clean water.

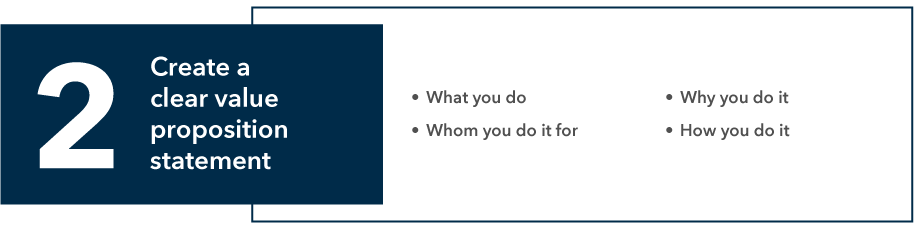

2. Have a clear value proposition.

Defining what sets your business apart may seem like table stakes, an exercise financial advisors go through at the start of their careers but rarely think about in the day to day of servicing clients. But the most successful teams keep their value proposition top of mind, using it to inform what they do, whom they do it for, why they do it and how. Some firms build it directly into their brand.

“Top teams essentially position themselves so that every opportunity that comes in front of them is one for them to lose, not one for them to win,” Cieslik says. “If you have a clear and articulate value proposition, you'll be in much better stead when you sit down in front of a client and they say to you, ‘Why should I bring my $40 million to you versus one of your competitors that I'm speaking with?’”

But that does not mean that your client value proposition should be all about tactical asset allocation or rebalancing portfolios. Instead, you want to zero in on what clients truly value: the passions or purpose that their investment goals are designed to support.

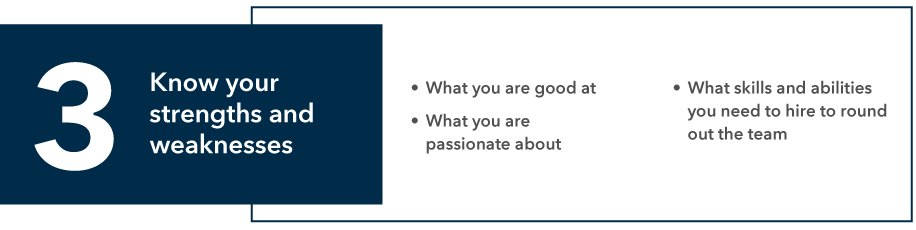

3. Know your strengths and weaknesses.

Research shows that we tend to flock to people like ourselves, but this impulse can hinder the development of a well-rounded team. Top teams use hiring to fill gaps in capabilities and strengthen the group as a whole. To do this, a first step is to assess yourself and others on the team, making note of everyone’s strengths, weaknesses and passions. Some advisors find using diagnostic tests like Myers-Briggs helpful in mapping out the personalities and skills on a team.

Those insights can be used to form a blueprint for the skills and abilities you’ll need to include on your team. “You need people that think differently, that operate differently,” Cieslik says. “It doesn’t mean they have a different view about the direction of the business. But a diverse team composed of complementary skill sets helps create true enterprise capabilities.”

For example, if you thrive in the big-picture role of a rainmaker, seek out more detail-oriented people who can help you make sure all the boxes are ticked while you build relationships. And remember that diversity doesn’t have to only mean the socioeconomic characteristics of the team. For Wilkins, a Myers-Briggs test revealed that the firm could boost its “sensitivity” quotient, which led him to focus on hiring advisors who present more emotionally in order to bridge that gap.

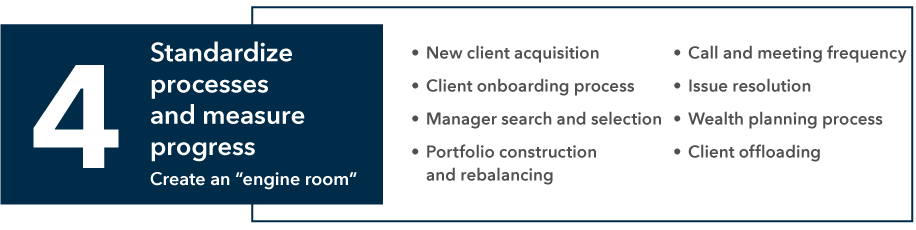

4. Create an engine room.

Top teams are more likely to standardize everything, building a sort of “engine room” using models, processes and technology to find efficiencies and create consistency in service.

For example, standard operating procedures (SOPs) provide clear sets of directions for how important business tasks are handled, so that anyone can onboard a client or answer a relationship management question with the same level of confidence. This helps to provide clients a seamless service experience, no matter which team member they are speaking to. More than 60% of the highest growth practices have SOPs in place for activities like client onboarding, according to Capital Group’s Pathways to Growth: Advisor Benchmark Study.

Those high-growth advisors were also more likely to rely on technologies to help optimize workflow processes, such as portfolio rebalancing, document management and customer relationship management. In fact, during the pandemic, there was a leap in overall adoption of tech tools by advisory firms: More than half of firms surveyed by Charles Schwab in its 2022 benchmarking survey increased their use of digital workflows, boosting gains in assets under management per professional by 11% from 2020 to 2021.1

Don’t forget to have a process for client off-loading as well. As you refine your ideal client persona and your value proposition statement, you might find that some clients no longer fit. You should have a clear-cut way to help transition those clients to another advisor who can better meet their needs.

5. Clearly define team roles and responsibilities, and train to meet them.

Top teams have mapped out roles and responsibilities for each team member, so that everyone knows how to support the client and how to succeed in their role. Firm leaders and managers should make strategic choices about the tasks that are most important to the firm’s goals to avoid overloading any one individual. “Everybody can't do everything,” Cieslik says. ”You can be really good at three or five things in a year. You really need to be focused if you really want to have exceptional performance.”

Once you have outlined the skill sets and roles you have (or want to have), you can recruit with more certainty for success, avoiding painful and costly turnover. Also, setting up clear expectations (along with paths for promotion) can boost employee engagement. Currently, only about a third of U.S. employees are engaged, according to workplace analytics firm Gallup.

But that’s not to say you don’t play an important role in building this self-sustaining business. In fact, managers account for around 70% of the variability in team engagement, a key component of high-functioning teams. By creating an operational engine room to maximize efficiencies and engage employees as people — not just workers — you can build a practice designed to lead to better client outcomes.

“This can be the differentiator between having a team that’s with you for the long haul or having to continually train new people,” Cieslik says.

6. Inspect what you expect.

What gets measured gets managed. It’s an old management axiom, but one that can apply when building a culture of continuous improvement and accountability. “So often, we pay attention to the top line and don’t look at the other elements underlying the health of the business,” Gies says. “Where are we relative to our goals at different points throughout the year?”

That is the first level of inspection. The second level is: Did you get the expected outcome based on what you did, or was it due to something out of your control? Don’t just check the box. Have a mechanism for digging deeper into the how and why goals are met to truly understand what’s going on in your practice.

Make sure your process for tracking and measuring goals is supported by candid feedback from your team and clients. Ask them for specific areas that can be improved or tactics and strategies that should be expanded more broadly. Incorporate that feedback into workflows, as appropriate.

7. Get out of the business of managing money.

“The best teams in the industry have gotten out of the business of managing money,” Cieslik says. “That doesn’t mean they don’t manage investments, but they recognize that their true value to clients is not in making daily calls on how to deploy assets in the market. It's about how they organize the entirety of the client's life situation.”

Indeed, our Pathways to Growth research found that top managers were 40% more likely to use models for investment management, as compared to their peers. This gave those advisors more time to focus on refining client acquisition and building relationship alpha by providing more value-added services to existing ones. And research from FP Transition and SEI2 suggests that the time savings received from using models could increase a practice’s valuation over the long term, a difference of more than $1 million over a decade or $100,000 per year of the analysis.

“The special sauce is around linking capital markets expertise and potential outcomes to what the client and their family are really trying to achieve to be a successful family,” says Wilkins.

8. Focus on generating outcomes, not effort.

Being busy is not the same as being productive. Top advisors understand how value is created versus how much time is spent. They seek answers to questions that are focused on outcomes: “How are we doing relative to our goals for client growth? Did we achieve that? What do we need to do differently to ensure that we meet those goals going forward?”

They also align clients to that mindset, too. For example, help orient client thinking to progress toward their goals versus progress toward the performance of a benchmark. “That's the most important thing: Will the client achieve their stated goals, in the risk profile that they've stated they're willing to accept, and in the timeline that they want to achieve it?” Cieslik says.

To distinguish outcomes from effort, try this simple exercise. Write down what you are doing at different points in the day, say, every 15 to 30 minutes. Then look at that mosaic over a week and get a sense of whether how you're spending your time is actually the best use of your time. How can you change that pattern to deliver even better client outcomes?

9. Create career paths for your people.

As mentioned above, employee engagement is key to the success of top practices, yet career paths are not always easy to find in this industry. One way to boost your employees’ commitment to you and your clients is by showing them you are interested in nurturing their careers, not just their daily tasks.

First, know where your compensation sits in the market and consider being creative with pay structure. Don’t forget the appeal of nonsalary benefits, such as remote work, flextime or other work-life balance policies.

Next, have regular conversations on career pathing. Share with employees areas in which you believe they excel, as well as where they could improve, and get their input on how they would like to grow professionally. Show them that your interest in them goes beyond recruiting and hiring to include their long-term development at your firm.

“You want to bring people along, to celebrate success along the way,” Cieslik says. Even simple, firm-wide awards celebrating a team member’s efforts in helping a client reach retirement can be meaningful and build esprit de corps.

“Understand the value of team versus the value of ‘me,’” he adds. “Nobody can do it all. Give your people incentives to participate in the success from what they do on your team.” Advisors that don’t do this might find their best people lured to other firms, where they might see more opportunities to grow and share in the economics of that growth.

10. Never stop learning.

Top-performing teams know that success is an ongoing process. They seek out opportunities to learn and share with each other, and incorporate those learnings into their business routines.

“Once team members start sharing what they've learned in serving clients or other aspects of the business,” Cieslik says, “you can get an incredible information loop from those interactions that helps rise the tide for everyone, lifting all the boats on the team.”

Another way to develop a growth mindset among your team is to conduct regular retrospectives. For example, you can use a “more, better, less, stop” framework in regularly scheduled meetings to crystallize what does and doesn’t work in the service of clients, and to learn how to make what is working better.

“It’s important to kind of retest the hypotheses you put in place when you first opened your business,” Cieslik says. “Success is a journey, not a destination.”

1”8 Highlights From the 2022 Charles Schwab RIA Benchmarking Study,” Horsesmouth, Nov. 9, 2022.

2“The Value of Time, Quantifying How Client Focus Increases the Value of Your Business,” FP Transitions and SEI, 2016.

Related content

-

Team Management

-

Client Conversations