Planning & Productivity

8 MIN ARTICLE

For advisor use only. Not for use with investors.

If time and capacity are the biggest obstacles you face in your profession, consider these five ways that advisors can improve productivity.

TABLE OF CONTENTS

If you are building a successful financial planning practice, two familiar obstacles you are bound to encounter are time and capacity. “Even as your top-line business is growing, you may find you need to handle more clients with limited time,” says Paul Cieslik, senior vice president of Advisor Practice Management at Capital Group.

It sounds like a good problem to have, but when stretched past capacity, your business will start to show it. In fact, it will become increasingly impossible to maintain all client relationships at the same level.

There are changes that advisors can make to build capacity, get more time and create meaningful long-term growth for their business. Here are five ways to improve productivity in your practice.

1. Think like a CEO

To work toward peak productivity, it helps to aim for a specific goal or set of goals that support it. Many chief operating officers and other corporate executives use key performance indicators (KPIs) to regularly measure business goals such as profitability, productivity and pricing. Leading KPIs can even help predict financial outcomes, provide a consistent representation of your firm’s general health and help identify areas for improvement.

Check your vitals: profitability, productivity and expenses

![A table showing how to calculate some key performance indicators (KPIs) for financial professionals seeking to better understand their profitability, productivity and expenses. Profitability KPIs include operating profit which is calculated by subtracting expenses from revenue; revenue per client which is calculated by dividing revenue by number of clients; and assets per client which is calculated by dividing assets under management (AUM) by number of clients. Productivity KPIs include revenue per staff which is calculated by dividing revenue by number of staff; profit per staff which is calculated by deducting expenses from revenue then dividing that figure by the number of staff; and clients per staff which is calculated by dividing number of clients by number of staff. Lastly is expenses which includes cost of service which is calculated by dividing expenses by number of clients.]](https://static.capitalgroup.com/content/dam/cgc/shared-content/images/tables/table-improve-productivity-check-your-vitals.png)

There are many ways advisors can combine these leading indicators for success. For example, a healthy practice may mean higher profitability and higher productivity. It could mean higher productivity and lower expenses. But one KPI advisors should pay close attention to, says Cieslik, is the cost of service. “You can’t accurately price without it,” notes Cieslik.

In the simplest terms, your operating profit is your bottom-line revenue after expenses, which include paying your firm and Uncle Sam. “Operating profit typically amounts to around one-third of what you bring in each year,” Cieslik says.

The other two thirds, the expenses, represent the overall cost of doing business. Divide that number by your total number of clients and the resulting number is what it costs to serve each one.

Armed with this and other KPIs, you can see where your practice is going in terms of profitability, productivity and expenses, and decide what levers you need to pull to get your practice into healthier condition.

2. Track your time

Some KPIs are more personal. Like tracking how you spend one of your most valuable assets: your time.

“You can understand the concept of running a business,” says Cieslik, “but to be successful, you need to know where you spend your time.”

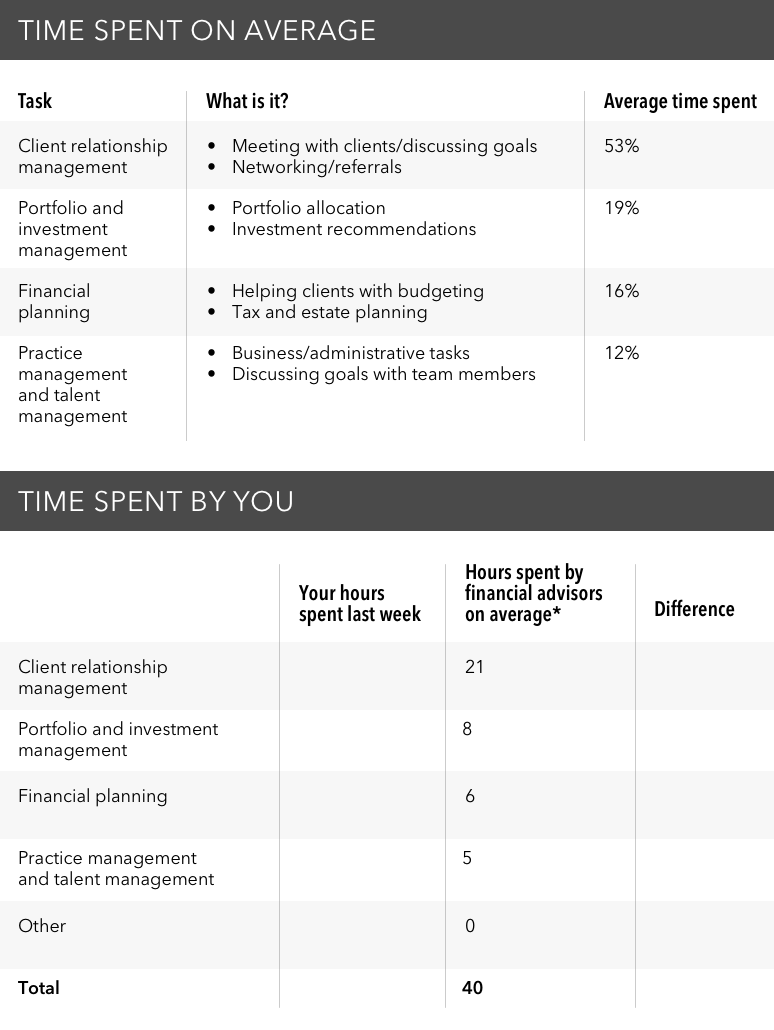

For one week, track your time carefully. Write down everything you do each day and for how long. Don’t ballpark -- these aren’t billable timesheets – this is data that you can use to identify areas for improvement. You can also use it as a benchmark to compare your results to the average advisor.

In one study conducted by Capital Group,* 56 advisors from more than 30 firms revealed that they spend the bulk of their time, 53%, on relationship management. The combination of investment and portfolio allocation and financial planning took up an additional 35% of advisors time. This does not leave much time to focus on practice management and business growth.

Source: Capital Group 2018. Based on a study of 56 U.S. financial advisors at 30 firms.

How do your numbers compare? What might be the most productive and efficient way to deploy your time going forward? If you are inclined, you can track personal hours as well. This may help you get an overall sense of where your time is spent. You are bound to learn a lot, either way.

3. Reality-check your capacity

Capacity can be a tricky subject when you’re building a business based on strong personal relationships. It’s natural to want to dedicate a lot of time and energy to each and every client, and many solo practitioners expect to do just that. As your business grows, however, you will ultimately face the obstacle of having too many clients and not enough time.

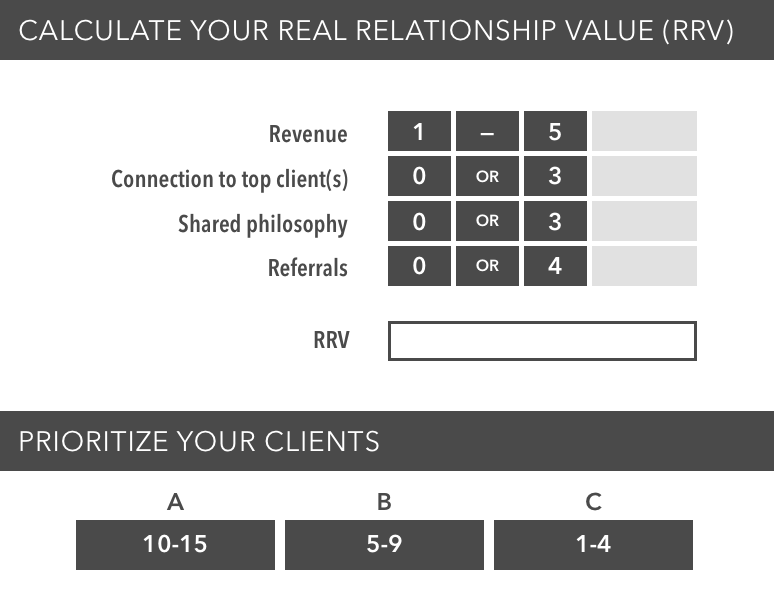

To meaningfully improve your capacity to serve clients, you need to understand what each one brings to your business. This is something different than loyalty, and more than simply measuring the cost of service or the revenue a given client brings in. The real relationship value (RRV) can offer a truly holistic view of the relationship, accounting for such aspects as centres of influence, potential for referrals, shared philosophy, likeability – there’s room to tailor this to represent whatever is most important to your practice.

Source: Capital Group

Once you’ve determined those factors, you can quantify them. This number will help you compare clients, segment them into groups and prioritize how much time you spend with each. But, Cieslik warns, segmentation for segmentation’s sake won’t do anything. You also need to understand your own capacity and tailor your service model to meet client needs in a scalable way.

“Ask yourself, how do I serve clients who are really easy to service? What value do I give different types of relationships? You could be assigning relationships a value that is actually costing you money,” he says.

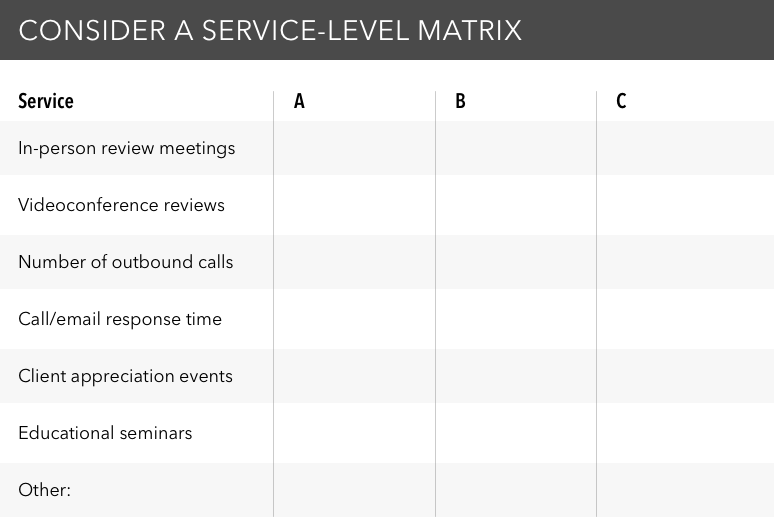

Using a service-level matrix can help you adopt a tiered approach to client relationships, with different clients getting different levels of service depending on RRV. You may find the clients with the highest RRV represent a potential niche that you can focus on and leverage for success, and spend most of your valuable time with the top 25% of your book.

You may save time and energy by offering clients with the lowest RRV a different level of service than the highest RRV clients. Low RRV clients could be good prospects for work with someone in a junior position at your firm, or may also be managed primarily through a customer relationship management (CRM) software system. Some advisors may use RRV to pare down an overfull client roster by applying minimum thresholds before taking on new clients.

4. Delegate wherever (and however) you can

One sure way to get more time is to dole out your work to others. As your business grows, you may find that certain roles and responsibilities can be done by a junior planner, a team of associates with competencies and career paths, and/or outsourcing work with a partner firm.

For example, if you are not outsourcing your investment and portfolio management, says Cieslik, that’s one thing you can do right away to get time back into your workweek. Advisors who make the move overwhelmingly report increases in business and revenue, with more time to focus on value added services and client relationships.**

To find other potential areas for delegation, allocate roles and responsibilities for each member of the team. You can do this by dividing different tasks and capabilities needed in your firm into categories. For example: client relationship management, wealth management, practice management and talent management. Then list out the specific responsibilities within each role, which can be very concrete or qualitative according to the needs, size or culture of your firm.

How do additional advisors and staff help to balance these responsibilities in a way that works for your practice?

Allocate your productivity

| Relationship management | Financial advisor 1 | Financial advisor 2 | Client service 1 | Office admin 1 | Other/outsource |

| Business development | |||||

| Initial meetings and follow up | |||||

| Client onboarding | |||||

| Conduct review meetings | |||||

| Proactive outreach | |||||

| Responding to client requests | |||||

| Wealth management | Financial advisor 1 | Financial advisor 2 | Client service 1 | Office admin 1 | Other |

| Develop investment/financial plans | |||||

| Fulfill investment transactions | |||||

| Monitor portfolio performance | |||||

| Prepare client/prospect meetings | |||||

| Conduct review meetings | |||||

| Practice and talent management | Financial advisor 1 | Financial advisor 2 | Client service 1 | Office admin 1 | Other |

| Develop and adjust team business plan | |||||

| Define and communicate client experience process | |||||

| Establish a client service matrix | |||||

| Maintain client information | |||||

| Source and select team members | |||||

| Manage and develop team members |

From a talent management perspective, this type of overview helps you set expectations for each employee from the outset, and can even be used as a guideline to evaluate members of your team at every level.

5. Do more with the time you have

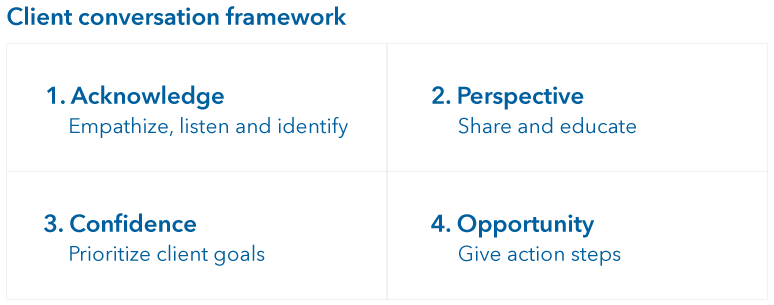

You can also increase productivity by analyzing your approach with clients. Are you efficiently delivering information in a way that instills confidence and loyalty? One of the ways to do this is to have more successful client conversations.

If you’ve built your career on strong communication skills, you may think you have this one locked. But imagine if every client conversation could serve as an opportunity to really connect, instill confidence in the work you are doing together, offer perspective on whatever is on their mind and, ultimately, help them find potential opportunities or smart moves to make.

This is where the “4-box” client conversation framework can come in handy. It’s covers four essential steps to having a meaningful conversation: acknowledge, perspective, confidence and opportunity. Using this type of consistent framework can support the goal of building trust while also creating efficiency, which is helpful both in good times and periods of extreme volatility, when the stakes may be highest.

Client Conversation Framework

SUPPORTING MATERIALS

Related content

-

Planning & Productivity

-

Marketing & Client Acquisition

*Source: Capital Group 2018. Based on a study of 56 U.S. financial advisors at 30 firms. Participants had an average 31 years of experience and an average 18 years with the firms.

**Source: “The Ins and Outs of Outsourcing,” Financial Advisor, January 2020.