Marketing & Client Acquisition

8 MIN ARTICLE

For advisor use only. Not for use with investors.

In a business built on referrals, advisors are constantly looking for sources of prospecting. These days, that means finding and leveraging centres of influence (COIs). COIs are people who work with or are around the types of clients you want to serve, or who could potentially connect, introduce or refer you to new prospects or streams of business.

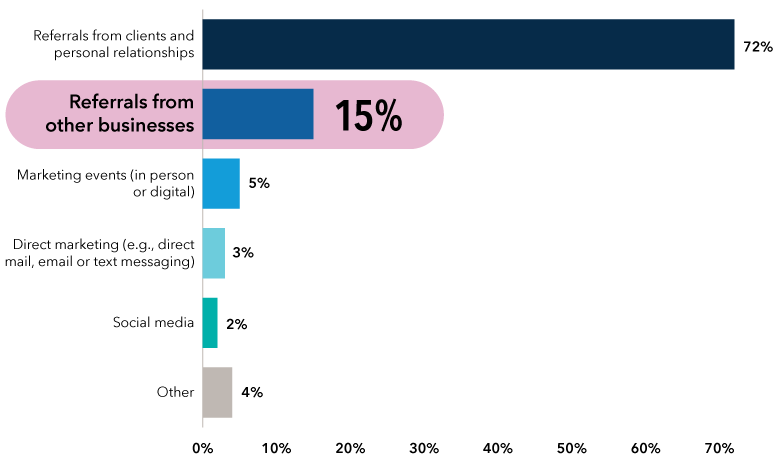

Sources of new business for advisors

Source: Capital Group, Pathways to Growth: 2023 Advisor Benchmark Study of advisors in the U.S.

The concept is sound, and professional referrals are indeed a valuable source of growth. In our Pathways to Growth: 2024 Advisor Benchmark Study of more than 1,500 U.S. advisors, personal referrals represented 72% of new business on average, but professional referrals made up another 15%.

But some advisors seem to struggle with execution. Some look everywhere for COI relationships that never materialize; others manage to find the networks, but not the new business. And if everyone is vying for the attention of every COI, how do you stand out?

Solving these issues requires an intentional approach. What type of influence are you looking for? Whose circles are you trying to join? What do you want to get from a COI relationship? There are many ways to make COI marketing work for you if you find a strategy and stick to it. Ready to choose your own COI adventure? Here are some considerations to help you embark on a strategy that’s right for you.

Start here: Define what kind of COI relationship you want to pursue

What a COI is differs depending on whom you ask. So start by defining your terms. Are you looking for:

Brand ambassadors — Engaged and valued clients who advocate for your brand among their peers. Think of them as influencers who are connected to a social network of ideal clients and professionals who work with them. They can be a great source of referrals.

Business bonding — Networking groups or advisory boards filled with professionals you admire or want to know. These groups can offer an ongoing forum to share business ideas and success stories, and potentially expose you to prospective clients or other avenues for practice growth.

Reciprocal referrers — Arrangements with local qualified professionals that you have vetted, such as accountants, bankers, attorneys, mortgage brokers, etc. You send clients in need their way, with the expectation they will do the same. This allows you to offer appropriate referrals to your clients, with the added benefit of possibly gaining new clients yourself in the bargain.

“Team client” — A working relationship with a shared client at the centre. In this scenario, you would coordinate professional efforts to help streamline complex financial and estate plans. Some advisors think of themselves as “financial quarterbacks” in a team client arrangement.

Each of these can be effective tools for prospecting and acquiring new clients. You may be looking for all of these relationships, or are ready to focus on one. But the deliberate strategies may vary depending on the type of COI relationship you are cultivating.

Path 1: Cultivating brand ambassadors

Even if existing clients are currently your biggest source of referrals, you may find that repeatedly requesting referrals from all clients is not the most effective strategy. There’s a bit of consumer science around this, according to Stephen Wershing, CFP and author of the book “Stop Asking for Referrals.” Clients make referrals not to benefit you but to help themselves. Put yourself in their shoes, and it makes perfect sense. We all tend to rave only about the things we love most, usually only when it makes us look or feel good to share. That’s why it can pay to have a process in place to focus your marketing efforts on the clients who are most likely to respond.

“It’s the path of least resistance,” says Paul Cieslik, practice management consultant at Capital Group. “Focus on those clients who love you, and utilize that existing strong bond to get into their centre-of-influence networks.”

Which clients are most likely to refer business to you? Advisors who have put in the work of client segmentation may identify them as "A" clients — the 20% who are most engaged in and enthusiastic about your business. If you have not yet identified your ideal client, that is a good first step in understanding the clients who are most valuable to your practice and why. A connection to COIs and likelihood to refer may be among the factors you consider.

Path 2: Building business bonds

Some advisors find opportunities in networks outside of the world of finance. Professional networking groups can be a great way to meet new people and broaden your horizons in more ways than one. Digital platforms like LinkedIn and Meetup make it easy to find and connect to different people or networking groups with a shared mission or interests, but it may take a few tries before you find the right one.

You can also create a business advisory group of your own. Ray Evans, CFP, AIF, with Pegasus Capital Management in Overland Park, Kansas, started a business advisory board early in his practice. Evans had remembered his father saying how flattered seasoned professionals can be when asked for advice. He wanted a group that could leverage those good feelings and help him build his business.

Evans’ advisory board started in the ‘90s with six people, including an assortment of friends in the corporate world and clients whose opinions he valued highly. Initially, they talked sports more than anything else, but over time they developed a framework of how to engage.

Today there are about 20 members from all walks of professional life. They meet as a group for lunch once a year and individually chat with Evans at some point throughout the year. About half are clients, but Evans adds, “I've only got a couple people from the [financial services] industry at any one time.” Board members from the corporate world can offer advice about areas such as technology, human resources or innovation. They also engage innovative local businesses interested in hosting a lunch and doing a presentation on their company.

Path 3: Getting the referral relationship right

Reciprocal referrals are often the trickiest COI strategies to pull off. You may be naturally inclined to connect your clients to accountants, attorneys or third-party administrations, and these professionals are likely looking for good advisors to recommend to the clients they work with. But getting referrals back can cause another potential problem: too many referrals or a lack of quality. Whatever side you are on in this relationship, if leads are not followed up, you are not helping clients.

If you are looking for a reciprocal referral relationship, it can help to have a few guardrails in place early on:

- Put clients first — It’s hard to go wrong when the primary goal is connecting clients to the professionals who can best meet their needs. Before considering a professional to recommend in a referral relationship, make sure to get to know their qualifications and their work, so you are comfortable they have the capabilities to handle the clients you refer. Your fiduciary responsibilities to your client should always come first. Be mindful of any potential conflicts of interests or disclosures that should be made to your client prior to recommending any third-party professionals to them.

- Refer more business than you get — COIs respond to referrals, which may mean that you have to put in more than you get out of the strategy initially. However, if you are working on behalf of the client, you may refer business regularly without even thinking about it. Do this more deliberately, and you are bound to attract COIs to you. Just knowing the right person for the job can make you a valuable COI yourself.

- Set the terms — If there are specific expectations for reciprocal referrals, try to spell them out: the types of services you can offer, the types of clients you seek and any minimum requirements for working with you. You should learn the same about the COIs you work with. It can also help to track COI referrals if you want to make sure they are being recognized and that the clients you are referring are actually being served.

- Strive to serve referral clients with excellence — While it may sound obvious, take steps to ensure that referred clients get the best service you can offer. Advisors often admit to not following up on referrals for a variety of reasons. Even if you can’t take the business, try and connect the prospect to someone who can. When you are receiving qualified leads from a professional referral relationship, it’s your chance to strut your stuff and build a strong reputation among your peers. It helps to develop standard operating procedures (SOPs) for how you track, follow up with and serve these clients.

Path 4: Become your client’s team leader or “quarterback”

Many advisors these days offer comprehensive planning, advising on many aspects of clients’ lives to help maximize and protect their wealth. This often involves coordination with other professionals on the client’s financial team, such as accountants, insurance agents and attorneys.

This is different than just making a referral to a qualified professional in your region. There are many roles advisors can play in a team client type of relationship, from big-picture macro-managing, to helping to coordinate important dates and information. Of course, you will take your cue from the client. But recognize the opportunities to make an impression on these COIs, which could potentially lead to new business.

Cieslik recommends coming prepared with an agenda for these meetings with COIs, outlining your position on how you can work together on behalf of this client and others. Or you may share ideas in the initial meeting that don’t work for this particular client but could open doors to future work. (Again, this is an area where clearly developed SOPs can help make the process easier.)

Forge a new path

Regardless of the path you take, if you are finding too much competition in traditional spheres, remember that COIs are everywhere and can be anyone with a role in a client’s life. Look beyond attorneys and CPAs. There is a diverse mix of professionals you might consider partnering with on behalf of a client: business valuation experts, art dealers, realtors, school board members, event planners, spiritual advisors and golf pros. You may find new and exciting opportunities in places you never thought to look.

Related content

-

Client Relationship & Service

-

Client Conversations