Capital Group Funds (Canada)

- Summary

- Portfolio managers

- Distributions

- Literature

Monthly Fund Data (PDF)

Quarterly Holdings (PDF)

Investment Objective

Long-term growth of capital and income through investments primarily in common stocks of U.S. issuers.

Fund Description

A focus on U.S. companies with growing dividends

Emphasis on well-established blue chip companies representing a wide cross section of the U.S. economy.

Emphasis on well-established blue chip companies representing a wide cross section of the U.S. economy.

Returns

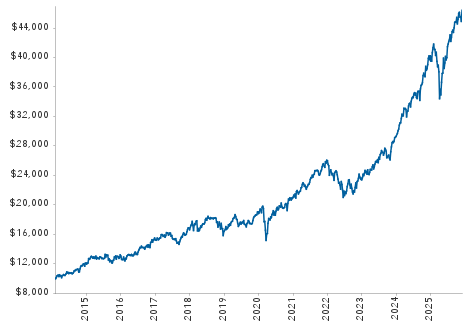

Growth of $10,000 since inception (Series F)

Returns include reinvestment of all distributions and do not reflect the effect of a sales charge. Past returns are not predictive of future returns.

| Returns (%) | Series F | |

| 1 month | 0.84 | |

| YTD | 0.84 | |

| 1 year* | 9.31 | |

| 3 years* | 23.52 | |

| 5 years* | 16.93 | |

| 10 years* | 13.51 | |

| Lifetime* | 13.50 | |

| Lifetime (cumulative) | 357.05 | |

| 2025 | 14.66 | |

| 2024 | 34.99 | |

| 2023 | 25.25 | |

| 2022 | -9.97 | |

| 2021 | 23.67 |

*Annualized compound returns.

While the fund has been in existence for a longer period, returns are calculated as of January 31, 2014, the fund's merger date which was a material change to the fund.

Portfolio information

| Fund assets ($mil) combined series | $519.9 | |

| Dividend yield1 | 1.34% | |

| Companies / issuers | 162 | |

| Income distributions paid | December | |

| Capital gains paid | December | |

| Portfolio turnover (2024) | 33% | |

| Trading expense ratio2 | 0.02% | |

| Weighted average market cap ($bil): | ||

| Portfolio | $1,141.6 | |

| Benchmark3 | $1,262.3 | |

| Top 10 holdings as a % of: | ||

| Portfolio | 43.2% | |

| Benchmark3 | 30.4% | |

Sector diversification

| Information Technology | 28.6% |

| Industrials | 12.5% |

| Communication Services | 11.2% |

| Health Care | 11.1% |

| Consumer Discretionary | 9.9% |

| Financials | 8.9% |

| Consumer Staples | 6.6% |

| Energy | 3.2% |

| Materials | 2.5% |

| Utilities | 1.9% |

| Real Estate | 0.7% |

| Cash and cash equivalents & other assets less liabilities |

2.9% |

Portfolio characteristics

| Series F | |

| FundSERV | CIF 827 |

| MER4 | 0.71% |

| Fund inception | Nov 1, 2002 |

| Minimum initial investment | $500 |

| Trade settlement | T+15 |

Portfolio managers

| Years with Capital / Years in profession | |

| Chris Buchbinder | 30 / 30 |

| Grant Cambridge | 29 / 29 |

| Martin Jacobs | 25 / 38 |

| Jim Lovelace | 44 / 44 |

| Greg Miliotes | 19 / 28 |

| Martin Romo | 33 / 33 |

| Jessica Spaly | 22 / 27 |

Top 10 holdings

| % of Portfolio | |

| Broadcom | 6.5 |

| Microsoft | 6.1 |

| NVIDIA | 5.9 |

| Alphabet | 5.8 |

| Amazon.com | 4.6 |

| Eli Lilly | 3.8 |

| Meta Platforms | 3.0 |

| British American Tobacco | 3.0 |

| Philip Morris International | 2.3 |

| Royal Caribbean Cruises | 2.2 |

| Total top 10 holdings | 43.2 |

Quarterly holdings (PDF)

| 1 | Income generated by portfolio securities, before expenses; does not reflect unitholder distributions. |

| 2 | As of June 30, 2025. |

| 3 | S&P 500 Index. |

| 4 |

Capital Group, at its discretion, currently waives some of its management fees or absorbs some expenses of certain Capital Group funds. Such waivers and absorptions may be terminated at any time, but can be expected to continue for certain portfolios until such time as such funds are of sufficient size to reasonably absorb all management fees and expenses incurred in their operations.

The management expense ratio for the portfolio is based on unaudited total expenses for the six-month period ended June 30, 2025, and is expressed as an annualized percentage of daily average net assets during the period. Actual MERs may vary. For the six-month period ended June 30, 2025, the total net asset value of the series was of sufficient size to reasonably absorb all management fees and expenses incurred in the operations of the fund attributable to this series, and therefore there were no waivers or absorptions during this period.

|

| 5 | Prior to May 27, 2024, the trade settlement cycle for Capital Group Funds (Canada) was trade date (T) + 2. |

| Updated on a monthly basis. | |

| Totals may not reconcile due to rounding. | |

| Commissions, trailing commissions, management fees and expenses all may be associated with investments in investment funds. Please read the prospectus before investing. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Investment funds are not guaranteed or covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. For investment funds other than money market funds, their values change frequently. For money market funds, there can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you. Past performance may not be repeated. | |

Chris Buchbinder

Years at Capital: 30

Years in profession: 30

Based in San Francisco

Christopher D. Buchbinder is an equity portfolio manager at Capital Group. Earlier in his career at Capital as an equity investment analyst, he covered U.S. telecommunication services, autos, and auto parts & equipment companies. He began his career as a participant in The Associates Program, a two-year series of work assignments in various areas of the Capital organization. He holds a bachelor's degree in economics and international relations from Brown University graduating cum laude.

Grant Cambridge

Years at Capital: 29

Years in profession: 29

Based in Los Angeles

Grant L. Cambridge is an equity portfolio manager at Capital Group. Earlier in his career, as an equity investment analyst at Capital, he covered insurance, airlines, air freight, home builders, asset managers and software companies, as well as small- and midcap companies. Prior to joining Capital, he worked for BTM Capital, a subsidiary of the Bank of Tokyo-Mitsubishi in Boston. He holds an MBA from Harvard Business School, a master's degree from Suffolk University and a bachelor's degree from Bentley College.

Martin Jacobs

Years at Capital: 25

Years in profession: 38

Based in Los Angeles

Martin Jacobs is an equity portfolio manager at Capital Group. As an equity investment analyst, he covers U.S. industrials, machinery and electrical equipment companies. Before joining Capital, Martin was an executive director and senior investment analyst at Brinson Partners, Inc. in Chicago and an industry analyst at Security Pacific Merchant Bank in New York. He was also a research analyst at the Wharton Center for Applied Research, Inc. Martin holds an MBA in finance from the Wharton School of the University of Pennsylvania and a bachelor’s degree in industrial and systems engineering from the University of Southern California. He also holds the Chartered Financial Analyst® designation and is a member of the CFA Institute.

Jim Lovelace

Years at Capital: 44

Years in profession: 44

Based in Los Angeles

James B. Lovelace is an equity portfolio manager at Capital Group. Earlier in his career, as an equity investment analyst at Capital, Jim covered beverages & tobacco, restaurants & lodging, household products and personal care companies. Jim began his career at Capital as a participant in The Associates Program, a two-year series of work assignments in various areas of the organization. He holds a bachelor's degree with honours in philosophy from Swarthmore College. He also holds the Chartered Financial Analyst® designation and is a member of the Los Angeles Society of Financial Analysts.

Greg Miliotes

Years at Capital: 19

Years in profession: 28

Based in San Francisco

Greg Miliotes is an equity portfolio manager at Capital Group. He also serves on the Capital Group Management Committee. Earlier in his career at Capital, as an equity investment analyst, he covered U.S. diversified industrials, heavy machinery and waste companies, U.S. small-cap health care companies and large-cap medical technology. Prior to joining Capital, Greg was an investment analyst responsible for health care stock selection with RS Investments. He holds a master’s degree and certificate in global management and public management from Stanford Graduate School of Business and a bachelor’s degree in mechanical engineering from the Massachusetts Institute of Technology.

Martin Romo

Years at Capital: 33

Years in profession: 33

Based in San Francisco

Martin Romo is an equity portfolio manager at Capital Group. He also serves on the Capital Group Management Committee. Earlier in his career, as an equity investment analyst at Capital, he covered the global chemicals industry, mortgage and consumer financials, and select conglomerate companies. He holds an MBA from Stanford Graduate School of Business and a bachelor's degree in architecture from the University of California, Berkeley.

Jessica Spaly

Years at Capital: 22

Years in profession: 27

Based in San Francisco

Jessica C. Spaly is an equity portfolio manager at Capital Group. Earlier in her career, as an equity investment analyst at Capital, Jessica covered U.S retailing, branded apparel and footwear, and e-commerce. Prior to joining Capital, Jessica was a private equity analyst for Kohlberg Kravis Roberts & Co. and an analyst in mergers and acquisitions for Morgan Stanley. She holds an MBA from Harvard Business School, graduating with high distinction as a Baker Scholar, and a bachelor’s degree in economics from Harvard College graduating magna cum laude and Phi Beta Kappa.

| Capital Group funds and Capital International Asset Management (Canada), Inc., are part of Capital Group, a global investment management firm originating in Los Angeles, California in 1931. Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed-income investment professionals provide fixed-income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups. |

| Commissions, trailing commissions, management fees and expenses all may be associated with investments in investment funds. Please read the prospectus before investing. Investment funds are not guaranteed or covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. For investment funds other than money market funds, their values change frequently. For money market funds, there can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you. Past performance may not be repeated. |

Distributions

|

Historical Prices & Distributions

Select Dates

From:

To:

| The fund was subject to a merger, which was a material change to the fund, as of January 31, 2014. |

| Commissions, trailing commissions, management fees and expenses all may be associated with investments in investment funds. Please read the prospectus before investing. Investment funds are not guaranteed or covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. For investment funds other than money market funds, their values change frequently. For money market funds, there can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you. Past performance may not be repeated. |