Japan

We expect short-term volatility in Japanese equities, given recent macro events, but we do not expect a longer term downturn because fundamentals remain intact, underpinned by corporate reform and reflation.

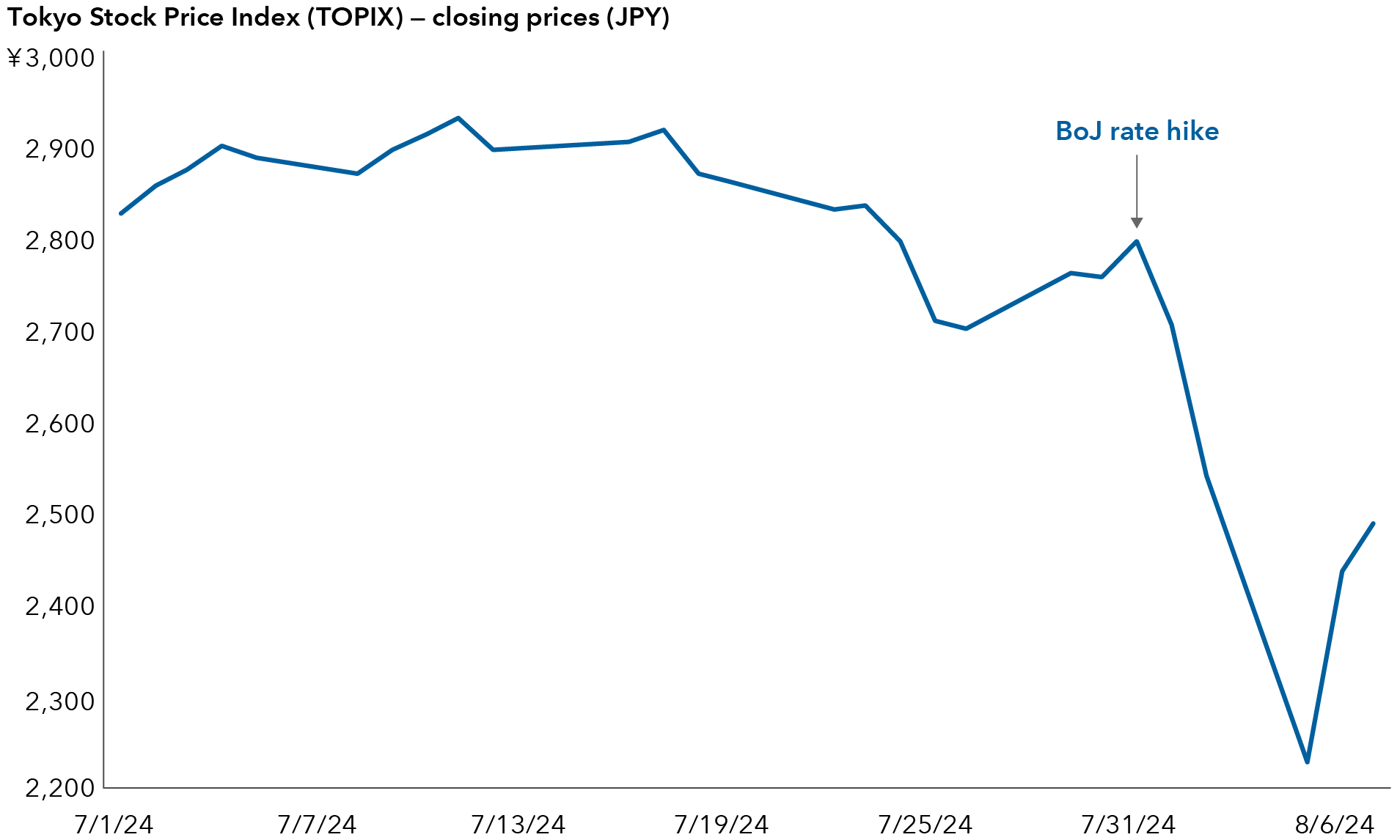

Over recent days, the Nikkei 225 Index suffered its biggest daily loss ever and briefly entered a bear market*, with the broader Tokyo Stock Price Index (TOPIX) similarly battered largely due to a rate hike by the Bank of Japan (BoJ) and a spike in the yen. The BoJ surprised markets by raising its benchmark interest rate to 0.25% — its highest level since the Global Financial Crisis of 2007–2008 — and announced plans to pare back its quantitative easing program. This led the yen to appreciate significantly against the U.S. dollar.

Japanese government bonds and equities initially recoiled on concerns the policy shift may have been too aggressive. Investors added fuel to the fire when they began unwinding popular carry trades, which is when traders borrowed yen to buy higher yielding assets in other currencies. While the carry trades may continue to unwind, some of the market reaction may have been overblown, as the BoJ is likely to proceed gradually. In a global context, our economists believe the U.S. economy will show resilience despite some signs of weakness. Against this mixed backdrop, we have already seen a significant rally, with the Nikkei 225 registering its largest ever single-day gain and the TOPIX close behind on August 6.

A gradual implementation of BoJ policy may be successful at capping yen depreciation, lowering inflation and boosting real domestic demand, all of which would be good for Japanese domestic equities. There is still a risk that wage growth does not materialize, the unwinding of the yen carry trade upsets global markets, or that the U.S. weakens more than expected. While all these concerns are valid and need monitoring, the violent market reaction would suggest investors are too quick to discount Japan’s ongoing reflation. Under a scenario where policy normalizes at a palatable pace, markets can likely absorb any tightening of global liquidity. Gradual policy changes are warranted in these conditions.

The BoJ has relented because inflation remains above target and is threatening to reaccelerate in light of a weak yen (raising import prices) and a tight domestic supply (especially in labour). This could weaken real household income further and create a much bigger macro and political problem in Japan. By raising rates gradually, the bank hopes to keep yen depreciation and imported inflation in check. This would allow nominal wage growth to catch up with inflation, which would strongly support domestic demand over time. We believe the the BoJ may pause in September.

That said, BoJ Deputy Governor Shinichi Uchida has quickly acknowledged the bank will not hike rates when markets are unstable, making another move in September less likely. In contrast, the U.S. Federal Reserve is likely to cut at that stage. In the short term, the performance of the yen and Japanese equities will depend not only on local monetary policy but also what the Fed does and what happens with macro data, especially in the U.S. Capital Group’s U.S. economist Darrell Spence is not anticipating a recession and sees the recent rise in U.S. unemployment as a function of the labour force surge, and not due to a contraction in employment.

Japanese equities look to crawl back after rate hike

Source: Source: Bloomberg. Data from July 1, 2024, to August 7, 2024. Past results are not predictive of results in future periods.

While we expect some volatility, fundamentals for Japanese equities are strong on a multi-year horizon and valuations remain cheap, with recent pullbacks bringing the market in the range of the historically attractive 12 times price-to-earnings (P/E) level. Perhaps the most obvious factor behind Japanese equities’ resurgence has been efforts to modernize the country’s business landscape and eliminate long-running resistance to prioritizing shareholder interests.

Broadly, Japanese companies have a lot of cash on their balance sheets. Unlike in the past, many now want to return cash to shareholders. They have implemented a combination of buybacks, better capital allocation and rationalization. We believe these improvements in corporate governance will stay on track. If anything, recent volatility will put more pressure on companies to protect their share price.

We expect market leadership to rotate, as the investors realize that the extended period of substantial yen weakness may be behind them. Domestically-oriented companies are likely to do better, particularly among food, software, local banks and local consumer brands. Investors are also likely to focus on quality companies with dominant market share and strong balance sheets rather than those with only low valuation and without strong self-help factors.

Until recently, the low price-to-book (P/B) was the predominant factor for the individual stock return. Besides, the large-cap exporters and semiconductor equipment makers benefited from the substantially weaker yen and the AI boom, leading Goldman Sachs to coin the Seven Samurai stocks to include Screen Holdings, Advantest, Disco, Tokyo Electron, Toyota Motor, Subaru and Mitsubishi Corp. We anticipate improved returns across a wider spectrum of stocks, including small- to medium-sized companies, as major changes to market dynamics often come with changes in market leadership.

Exporter stocks may not perform as badly as feared in the stronger yen environment, as the TOPIX earnings-per-share has become less currency sensitive than before, thanks to the substantial production shift overseas that took place before the latest weak yen trend started a few years ago. Finally, semiconductor-related stocks may be weak in the near term amid market volatility but remain good opportunities in the long term, given expectations of the large capital expenditure on artificial intelligence on a multi-year horizon.

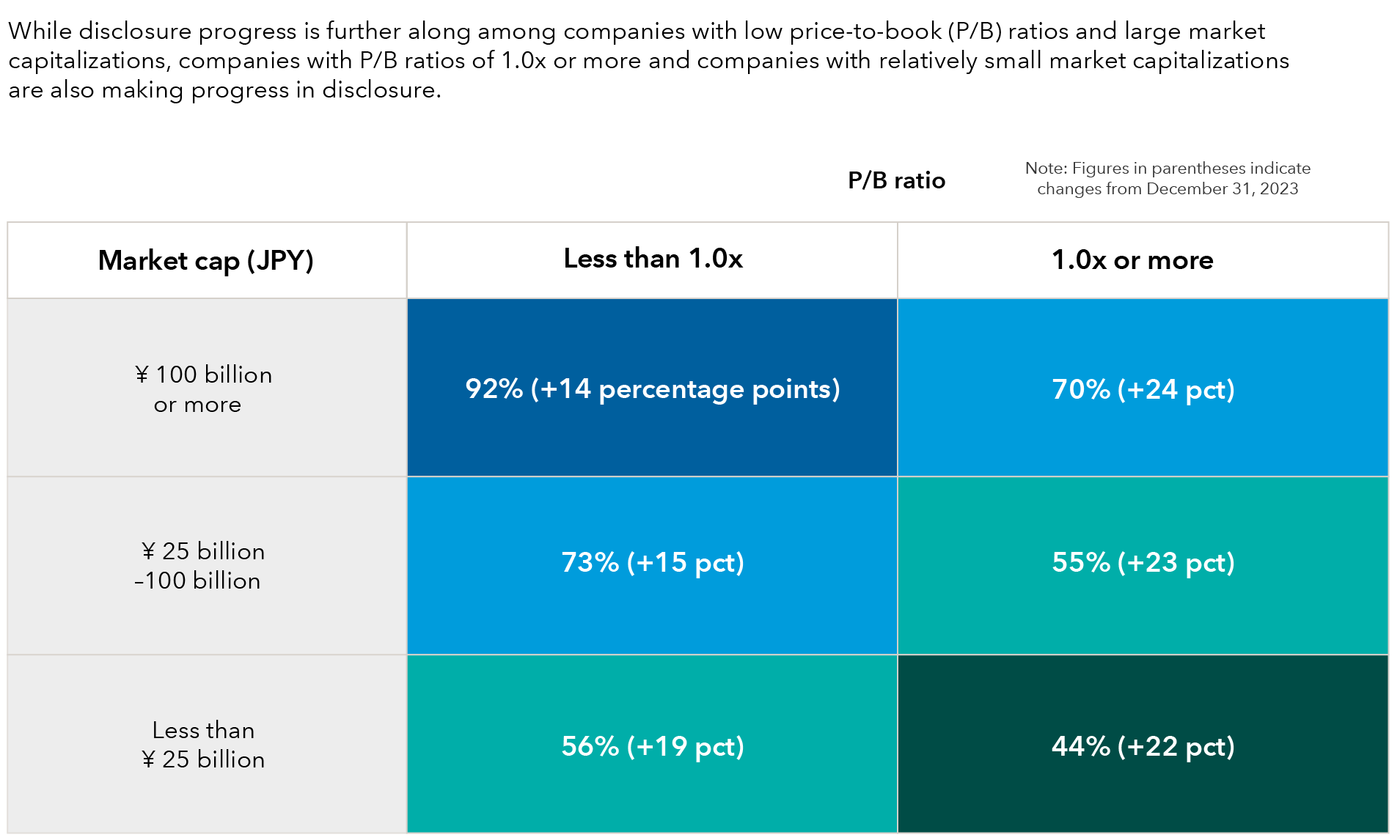

Our experience suggests there is still significant room for improvement among small- and mid-sized companies. Since the start of this year, the Tokyo Stock Exchange has started publishing progress reports on companies adhering to its reform agenda. One of the original initiatives from the exchange included encouraging companies to improve on dialogue with shareholders and disclosure, noting that individuals including senior management should be able to carry out such actions.

Figures from the end of April showed 92% of firms with a market cap of JPY 100 billion (around US$630 million) or more and a P/B ratio of less than 1.0 have now disclosed their improvement initiatives. The universe of small- and-mid-cap stocks is also presenting opportunities after the recent market rout, where specific companies are reasonably priced and can withstand a weakening market environment.

Japan company disclosures are improving

Source: Japan Exchange Group. As of April 30, 2024. Figures in parenthesis indicate changes from December 31, 2023. In March 2023, the Tokyo Stock Exchange (TSE) requested that all companies listed on the Prime and Standard Markets take "action to implement management that is conscious of cost of capital and stock price.” https://www.jpx.co.jp/english/equities/follow-up/02.html

While progress is encouraging among smaller businesses, disclosure numbers are much lower, at 44% for companies with a market cap of JPY 25 billion (around US$160 million) or less and a P/B ratio above 1.0. The Tokyo Stock Exchange has clarified that its request does not only apply to companies with P/B ratios below 1.0, With this announcement, reforms should spread further among small- and mid-caps with higher P/B ratios during the upcoming earnings season.

* Down 20% or more from a previous market high

Akira Horiguchi and Eu-Gene Cheah are portfolio managers for Capital Group International Equity Fund (Canada).

TOPIX is a market benchmark with functionality as an investable index, covering an extensive proportion of the Japanese stock market. TOPIX is a free-float adjusted market capitalization-weighted index. TOPIX shows the measure of current market capitalization assuming that market capitalization as of the base date (January 4, 1968) is 100 points. This is a measure of the overall trend in the stock market, and is used as a benchmark for investment in Japan stocks.

Indices including TOPIX (Tokyo Stock Price Index), calculated and published by JPX Market Innovation & Research, Inc. (JPXI), are intellectual properties that belong to JPXI. All rights to calculate, publicize, disseminate, and use the indices are reserved by JPXI.

Seven Samurai is a group of Japanese equities, coined by Goldman Sachs, or Japan’s version of the Magnificent Seven. The Magnificent Seven refers to the seven largest contributors to the S&P 500 in 2023. The companies are Alphabet, Amazon, Apple, Meta Platforms, Microsoft, NVIDIA and Tesla.

Our latest insights

-

-

Currencies

-

Market Volatility

-

Market Volatility

-

Markets & Economy

RELATED INSIGHTS

-

Artificial Intelligence

-

Global Equities

-

Markets & Economy

Commissions, trailing commissions, management fees and expenses all may be associated with investments in investment funds. Please read the prospectus before investing. Investment funds are not guaranteed or covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. For investment funds other than money market funds, their values change frequently. For money market funds, there can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you. Past performance may not be repeated.

Unless otherwise indicated, the investment professionals featured do not manage Capital Group‘s Canadian investment funds.

References to particular companies or securities, if any, are included for informational or illustrative purposes only and should not be considered as an endorsement by Capital Group. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds or current holdings of any investment funds. These views should not be considered as investment advice nor should they be considered a recommendation to buy or sell.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and not be comprehensive or to provide advice. For informational purposes only; not intended to provide tax, legal or financial advice. Capital Group funds are available in Canada through registered dealers. For more information, please consult your financial and tax advisors for your individual situation.

Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. We encourage you to consider these and other factors carefully before making any investment decisions and we urge you to avoid placing undue reliance on forward-looking statements.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2026 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2026. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under licence. All rights in the FTSE Russell indices or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indices or data and no party may rely on any indices or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The index is unmanaged and cannot be invested in directly.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com)

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capital Group trademarks are owned by The Capital Group Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capital Group funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capital Group, a global investment management firm originating in Los Angeles, California in 1931. Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

The Capital Group funds offered on this website are available only to Canadian residents.

Akira Horiguchi

Akira Horiguchi

Anne Vandenabeele

Anne Vandenabeele

Eu-Gene Cheah

Eu-Gene Cheah