Utilities

A summer heat wave won’t be the only reason for a surge in electricity demand. Megatrends such as the rise of artificial intelligence and its intensive energy needs have boosted the earnings potential of utility companies, particularly in the U.S.

Investors are zeroing in on utilities as the next potential growth sector, says Caroline Randall, portfolio manager for Capital Group Capital Income BuilderTM (Canada). “I view the electricity network companies as the silent giants of the energy transition. We’ve reached a pivotal point where companies will need to invest more heavily in the United States electric grid, which should increase their earnings and dividend potential.”

Here’s why utilities, long known as reliable dividend payers, shouldn’t be ignored by growth investors.

Earnings expectations have jumped for utilities

Sources: Capital Group, FactSet, Standard & Poor's. Forward dividend yield from FactSet is based on current consensus expectations for the forward 12-month dividends per share. As of July 23, 2024. Past results are not predictive of results in future periods.

1. Aging U.S. electric grid needs an overhaul

With most of the U.S. electric grid dating back to the 1950s and 1960s, it’s time to update the system. “The U.S. produces a lot of electricity from natural gas and coal, and many of these sources will be retired or replaced over the next 20 to 30 years,” says portfolio manager Taylor Hinshaw.

Wildfires and floods are also stressing the system, he adds. Regional energy companies Pacific Gas & Electric and Southern California Edison have had to contend with hardening their networks against disasters, in addition to procuring clean sources of energy to meet emission standards.

Increased capital expenditure is necessary even without the expected boom in power demand, which Hinshaw estimates will increase 3.5% annually over the next decade from the current level of around 1.0%. All that spending leads to potential earnings growth as regulators allow companies to recoup their investments through rate increases.

Meanwhile, despite ongoing debates about fossil fuels versus wind and other forms of renewable energy — the transition toward the latter is already underway. The U.S. Inflation Reduction Act of 2022 includes broad incentives for clean energy uptake and has benefited states across the political spectrum.

“Certain parts of the law could get changed under a new administration, but I don’t see a future where companies stop investing in renewables,” says utilities analyst Andre Meade. Still, soaring demand for electricity means that natural gas and other fossil fuels have a long shelf life.

2. Utilities are powering the AI boom

It’s no secret that AI consumes a lot of electricity. One query to ChatGPT uses the same amount of energy as keeping a single bulb lit for 20 minutes, according to research firm Allen Institute in July 2024.

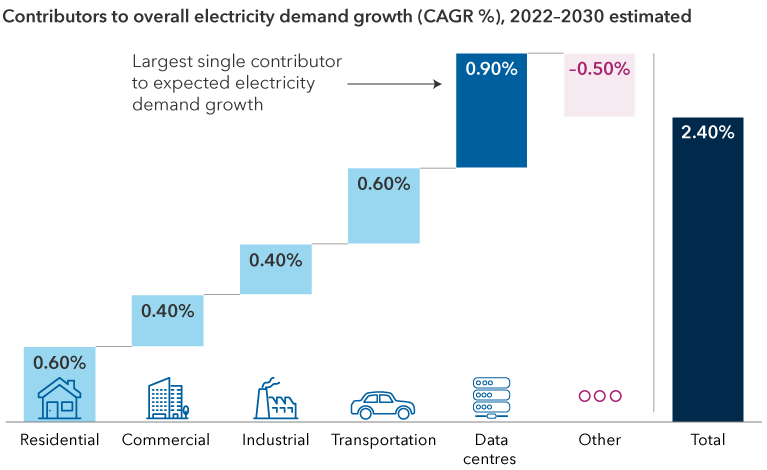

Data centres jolt demand for electricity

Sources: Goldman Sachs, U.S. Energy Information Administration (EIA). Estimates from Goldman Sachs as of April 28, 2024. CAGR is the compound annual growth rate. “Other” includes the impact of energy efficiency improvements and the change from categories not listed.

Tech companies are taking their energy needs into their own hands. This year, Amazon purchased a 960-megawatt data centre campus from Talen Energy for US$650 million, with plans to buy power from Talen’s neighbouring nuclear power plant. Stocks have soared for companies with exposure to nuclear energy, with Constellation Energy up nearly 50% year to date as of July 24, compared to the S&P 500 Index return of around 14%.

In a sign of what’s to come, Dominion Energy is building a US$10.3 billion to US$11.3 billion offshore wind farm to help meet demand and comply with emissions legislation. The company currently provides electricity to most data centres in the United States, which are largely located in northern Virginia’s “data centre alley,” according to ratings agency Standard & Poor’s. California is a distant second, with dozens of other markets in the Southeast, Texas, Ohio and Arizona planning facilities.

Hinshaw foresees regulators incentivizing companies to develop more capacity, much like Dominion’s offshore wind project. That’s because the increase in data centres could tighten electricity supply across the country. Concerns have already surfaced about potential grid reliability as critical infrastructure is used more often when electricity demand peaks.

Building new capacity does not come without risks. Namely, what if demand requirements fall short? On that front, fierce competition for electricity has given utilities negotiating power when it comes to constructing new data centres. This includes upfront payments and even refunds from tech companies if the build-outs don’t go as planned, according to Meade. “A utility will not want to invest to serve a 1,000-megawatt data centre and see 200 megawatts show up,” he says.

3. Made in USA: Reshoring ignites energy demand

Companies have embraced reshoring or moving manufacturing back to the United States, as the pandemic and geopolitical events caused major disruptions to supply chains.

“It’s a trend that’s here to stay, in part because it provides high-quality manufacturing jobs, which have a positive impact on the local economy,” Hinshaw adds. Moreover, while some trends, such as the energy transition, may slow under a Republican-led government, reshoring resonates under both political parties.

Industries that have large energy requirements — semiconductors, pharmaceuticals and autos — are part of the reshoring wave. Within semiconductors, Intel plans to roll out its foundry in the U.S. with funds from the CHIPS and Science Act (Creating Helpful Incentives to Produce Semiconductors).

Companies are being more strategic and considering the possibility of factory shutdowns, labour shortages and other risk factors. Most companies are creating multiple supply chains, and there’s a general desire to avoid manufacturing in countries with import tariffs, such as China.

Can utilities offer the best of value and growth?

Tailwinds over the coming decade spell growth opportunities for utilities. “This is absolutely not just about AI,” stresses Hinshaw. “If you look ahead a decade, trends such as moving industrials onshore and electrifying home appliances are enough to increase electricity demand markedly.”

Utilities have recently shown higher correlation to the S&P 500 Index

Sources: Capital Group, Morningstar, Standard & Poor's. As of June 30, 2024.

Add to this the sector’s reputation as something of a bond proxy for its ability to provide some income and stability during past periods of equity volatility. Utilities have typically offered reliable income for investors, with utility stocks within the S&P 500 Index having a historical dividend yield between 3% to 5%. And investors often turn to utility stocks when the economy weakens since they have tended to hold up well compared to the S&P 500 Index.

Utilities should continue to retain their dividend attributes, but the sector may be more volatile going forward as more growth investors become interested in the stocks. “These are not your grandfather’s utilities,” Meade concludes.

Correlation is a statistical measure of how two securities or indexes move in relation to each other. A correlation ranges from negative 1 to 1. A positive correlation close to 1 implies that as one moves, either up or down, the other will move in “lockstep,” in the same direction. A negative correlation close to negative 1 indicates the two have moved in opposite directions.

S&P 500 Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks.

S&P 500 Utilities Sector comprises those companies included in the S&P 500 that are classified as members of the GICS utilities sector.

Our latest insights

-

-

Currencies

-

Market Volatility

-

Market Volatility

-

Markets & Economy

RELATED INSIGHTS

-

Artificial Intelligence

-

Global Equities

-

Markets & Economy

Commissions, trailing commissions, management fees and expenses all may be associated with investments in investment funds. Please read the prospectus before investing. Investment funds are not guaranteed or covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. For investment funds other than money market funds, their values change frequently. For money market funds, there can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you. Past performance may not be repeated.

Unless otherwise indicated, the investment professionals featured do not manage Capital Group‘s Canadian investment funds.

References to particular companies or securities, if any, are included for informational or illustrative purposes only and should not be considered as an endorsement by Capital Group. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds or current holdings of any investment funds. These views should not be considered as investment advice nor should they be considered a recommendation to buy or sell.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and not be comprehensive or to provide advice. For informational purposes only; not intended to provide tax, legal or financial advice. Capital Group funds are available in Canada through registered dealers. For more information, please consult your financial and tax advisors for your individual situation.

Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. We encourage you to consider these and other factors carefully before making any investment decisions and we urge you to avoid placing undue reliance on forward-looking statements.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2026 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2026. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under licence. All rights in the FTSE Russell indices or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indices or data and no party may rely on any indices or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The index is unmanaged and cannot be invested in directly.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com)

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capital Group trademarks are owned by The Capital Group Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capital Group funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capital Group, a global investment management firm originating in Los Angeles, California in 1931. Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

The Capital Group funds offered on this website are available only to Canadian residents.

Caroline Randall

Caroline Randall

M. Taylor Hinshaw

M. Taylor Hinshaw

Andre Meade

Andre Meade