Interest Rates

Inflation

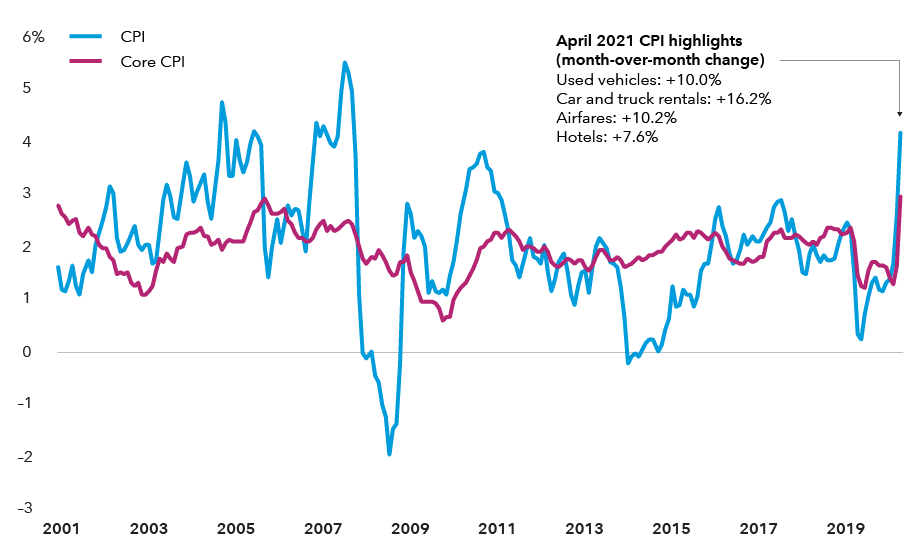

The core consumer price index rose 0.9% in April and headline CPI rose 0.8%, the Bureau of Labor Statistics reported on Wednesday, May 12. This materially changes the math on inflation. Even if the monthly trend in inflation decelerates to 0.15%, slightly below the pre-pandemic trend, we estimate that the annual change in core CPI (all items less food and energy) will stay above 2.5% for at least the next year. In all likelihood, the monthly trend will probably be much firmer than 0.15% over the coming months.

This in turn implies the year-over-year rise in core personal consumption expenditures (PCE) is likely to accelerate above 2.25% and remain there for an extended period. In essence, we are at the Federal Reserve’s target for inflation. While we still have significant progress to make on the employment front, April’s inflation report raises the probability that the Fed may look to taper its asset purchases earlier than expected. Thus, we think yields in the belly of the yield curve (five-year and seven-year Treasuries) will need to rise to reflect this higher probability.

Inflation spikes: U.S. consumer price index

Sources: Bureau of Labor Statistics, Refinitiv Datastream. As of April 30, 2021.

Interestingly, core CPI prices rose 11.6% annualized in April (+0.9% month over month), the fastest monthly pace since 1982. There were increases in almost every major category, including some of the more volatile components such as used cars (+10.0%) and travel categories such as airfares (+10.2%) and hotels (+7.6%). Said another way, we essentially got five years of price inflation in just one month! Much of this is likely due to temporary supply constraints, but there are factors that could be more persistent as roughly two-thirds of the core CPI components saw price increases.

Timing of rate hike in question

This could change the timing of an interest rate hike that is currently expected in 2023 at the earliest. At least for now, it's too early to move that timing forward; the data is too volatile and the outlook is too uncertain for the Fed to make any major adjustments. What we're seeing today is not due to a virtuous labor demand-driven inflation cycle (fundamental), but the reopening of the economy and supply bottlenecks, which we view as temporary. That could change.

If we see a string of strong employment reports (narrowing the gap on the record 8 million job vacancies in March) AND a bigger fiscal package AND core inflation trending above 2.5%, it would certainly put the Fed in play for an earlier taper and rate hikes than what we are expecting. However, it's also worth remembering that the Fed wants to see inflation above or at its 2% target rather than constantly undershooting, as well as broad-based and inclusive employment.

So, a reset of inflation at a higher level is consistent with the central bank’s long-term goals. The Fed’s June 16 meeting should provide some indication of their thinking. Lastly, it’s worth recapping that in 2011, after the global financial crisis (GFC), inflation did not stay above 3% for long because of unanticipated negative post-GFC shocks. That could happen again.

Capital’s fixed income Portfolio Strategy Group’s thematic guidance has been for a modest short duration position and an allocation to Treasury Inflation-Protected Securities (TIPS) with the aim of protecting portfolios against a potential uptick in inflation and interest rates.

For financial professionals only. Not for use with the public.

Jared Franz

Jared Franz

Tim Ng

Tim Ng