Marketing & Client Acquisition

Retirement Planning

Medicare is something that most Americans will use, and yet it seems shrouded in mystery. The primary source of health insurance coverage for people ages 65 and older, Medicare covers more than 65 million people, according to the Kaiser Family Foundation (KFF), an independent health policy researcher. At least 30% find the program either somewhat difficult or very difficult to understand.

That lack of clarity can be costly. According to the KFF, helping Medicare-eligible individuals select optimal plans is critical to long-term health outcomes, but also to help keep health care costs in check. As a financial advisor, you are in a unique position to help clients prepare and understand their Medicare choices when the time comes.

“Even for clients of means, helping your clients understand their options so they can make informed decisions is a great value,” says Max McQuiston, an advisor practice management consultant at Capital Group. “Some advisors may choose to provide Medicare insurance through their office, while other advisors will refer their clients to a specialist in Medicare.”

Medicare mysterious to most

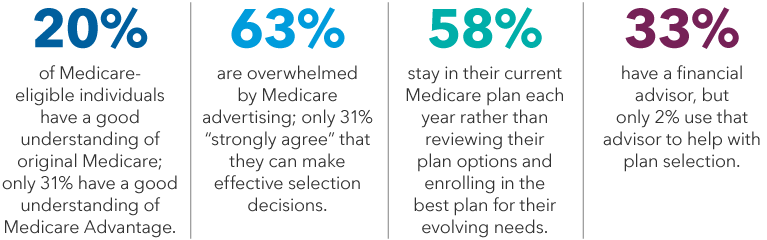

According to the findings of a recent survey of 1,142 Medicare-eligible individuals by Sage Growth Partners, confusion and misinformation can jeopardize health outcomes and increase health spending.

Source: Sage Growth Partners, “Hidden Crisis: The Medicare Enrollment Maze,” April 2022.

To help you have the conversation with clients, we have compiled the following Medicare information, considerations and important resources. From the basic to the complex, here are four questions investors have about Medicare, and how to answer them.

1. How does Medicare work?

Medicare is generally available to people who are age 65 or older. Similar to Social Security, if you worked and paid taxes for at least 10 years (or your spouse did), you are eligible to receive Medicare. In fact, if you are already receiving Social Security, you will be automatically enrolled in Medicare at age 65. If not, you will have to enroll.

The initial enrollment period starts three months before you turn 65 and ends three months after your 65th birthday month. If you don’t enroll during that period and don’t have other health coverage, you could face a penalty later.

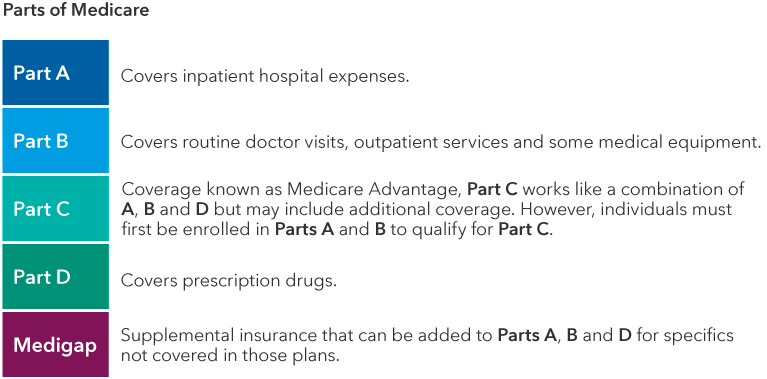

The Medicare program is broken into four distinct parts: A, B, C and D. But what’s included in each is not as elementary. For example, Parts A and B are often referred to as “original Medicare,” because together they cover routine doctor visits, outpatient services and inpatient hospital stays. Also among the basics is Part D, which covers some prescription drugs. Individuals can select their own Part D plan based on their needs and a review of the list of drugs covered, known as a formulary.

Part C, which is also known as Medicare Advantage (MA), is another coverage choice that individuals can purchase from insurers approved by Medicare. If you choose this type of plan, it will provide your Part A hospital and Part B doctor visit coverage and may also include extra coverage for things like prescription drugs, dental, vision and hearing. It’s important to note, however, that individuals must first be enrolled in Parts A and B to qualify for Part C.

Medicare Advantage differs from Medigap coverage, which is also additional insurance that can be purchased to pay for things not covered by original Medicare. You can choose either Medicare Advantage or Medigap, but not both.

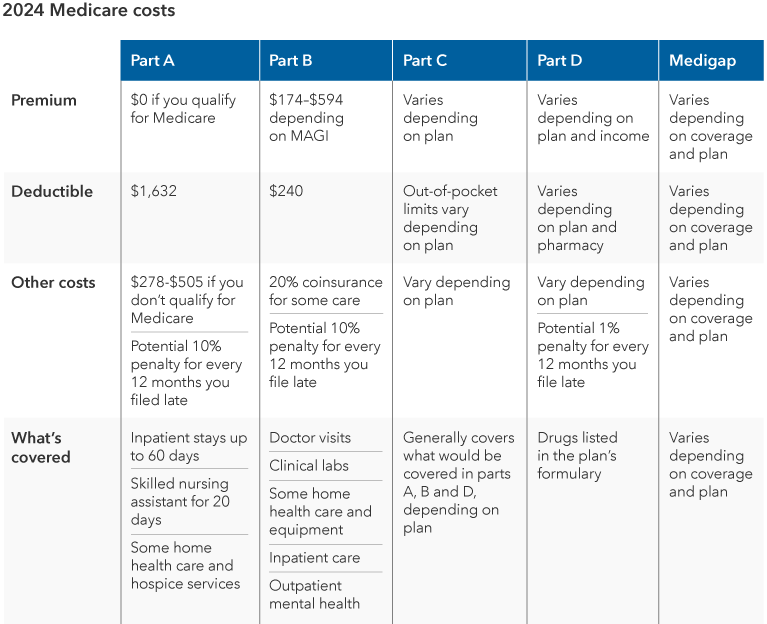

The parts of Medicare

Here is an overview of the basic parts of Medicare coverage and what is generally included in each:

Source: Medicare.gov

Medicare Advantage plans offer many benefits, but the tradeoff is these plans often work like health maintenance organizations (HMOs), with more restrictive provider networks and (for some visits) prior authorization. There are also preferred provider organization (PPO) plans available under Part C.

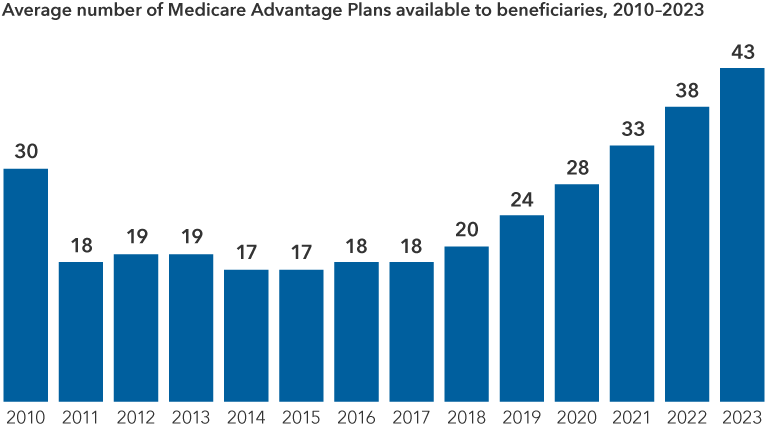

In selecting the right Medicare Advantage plan, individuals should make sure their providers are in-network and their routine services are covered. But the selection can be just as confusing. In 2023, the average Medicare beneficiary has more than 43 plans to choose from among nine issuers, according to KFF.

More Medicare Advantage plans on the market

Source: KFF analysis of CMA Landscape files for 2010-2023

In addition, the typical beneficiary has a choice of 24 Medicare Part D stand-alone prescription drug plans. As these markets continue to grow, it’s important to continue to assess benefits to the individual and how well the plan choice is controlling health care spending. This is where financial advisors can play a role, understanding the benefits of various plans depending on the situation and needs of their clients.

Help answer the question for clients:

- Start by helping your clients review their options.

- Understand whether you need to file (especially if you are still working) by answering a few questions on Medicare’s sign-up site.

- Find out if a test, service or medical item is covered by original Medicare using the program’s useful coverage tool.

- Understand prescription needs and review formularies for the right plans.

- Determine whether a Medicare Advantage plan would be beneficial.

- Make sure that existing doctors and drugs are covered before selecting a plan.

2. What does Medicare cost?

Yes, there is a cost to Medicare. Premiums are automatically deducted from monthly Social Security benefits. What each individual pays for Medicare will depend on the type of coverage selected and whether you qualify through your work history. Because Medicare is means tested, what you pay will also depend on your income. Individuals with higher incomes may have to pay more. Here’s how it breaks down.

Hospital insurance, or Medicare Part A, is premium-free to most individuals. Those who don’t qualify for Part A based on work experience may purchase this coverage out-of-pocket. In 2024, that cost is either $278 or $505 per month, depending on how long you or your spouse worked and paid into Medicare, if at all. There is an annual deductible (that’s the amount that must be paid before original Medicare kicks in to cover costs), which is $1,632 in 2024.

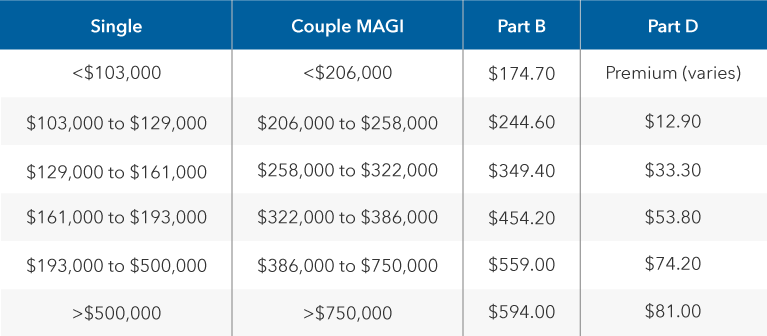

Medicare Part B insurance coverage does come with a premium, which in 2024 is at least $174.70 per month but can range depending on the individual’s income. The annual deductible for Part B is $240 in 2024.

If your income exceeds a certain level, you may have to pay something called an income-related monthly adjustment amount (IRMAA) as part of your Part B. The Social Security Administration determines IRMAA by looking at income reported on your tax returns two years prior. Specifically, it evaluates an individual or couple’s modified adjusted gross income (MAGI), which includes adjusted gross income and tax-exempt interest income.

IRMAA may increase premiums

Depending on your income bracket, you may pay more for Part B and Part D.

Source: IRMAA Certified Planner, November 2023

The highest premium in 2024 is $594 for those individuals whose MAGIs in 2022 were $500,000 or higher ($750,000 or higher for married couples filing jointly). Social Security will inform you if you must pay a premium because of your income.

Costs for parts C and D will vary according to the plans selected by the individual. Most MA plans include prescription drug coverage. It’s important to note, however, that even if you choose the Part C Medicare Advantage plan, you must be enrolled in original Medicare and continue to pay your Part B premium. In 2023, according to KFF, more than 70% of Medicare Advantage enrollees are in plans with prescription drug coverage and pay no supplemental premium other than Part B. The remainder pay an average premium of $57 per month.

Source: Medicare.gov, November 2023

What you pay may also depend on timing, because the penalties you could face if you don’t sign up by age 65 add to your monthly premium over time — as much as 10% each for Parts A and B and 1% for Part D — for each full year that you could have signed up but didn’t.

As an example, say a client waits two full years to sign up for Part B. They would have to pay a 20% late enrollment penalty (10% for each year) on top of the standard monthly premium. Some individuals may avoid these penalties if they qualify for a Special Enrollment Period, based on loss of coverage, change of address or other special situations.

When shopping for plans, note that low premiums are not always the main driver. According to a survey done by Sage Growth Partners,1 among the key factors respondents cited were making sure prescription drugs are covered (83%), ensuring doctors are in network (81%) and making sure pharmacy was covered (74%). Only 65% were mainly focused on a lower premium.

Help answer the question for clients:

Start by pointing your clients to all of the helpful (and free) resources available to them.

- Individuals can easily access their eligibility and potential premium costs by using the free Medicare eligibility tool on the Medicare.gov site. The tool is most useful to those who are at or near age 65.

- Explore health and drug plans in your area through Medicare’s plan compare tool.

- Calculate potential premiums based on IRMAA.

3. What if I already have health insurance?

The guidelines vary slightly depending on whether you or your spouse are still working and receiving insurance through an employer, the size of your company (companies with 20 employees or fewer may not offer plans that allow you to remain insured while on Medicare) and other factors. Generally, since Part A is premium-free, it’s a good idea to sign up for it even if you are still working and have other health coverage.

If you are working and have health insurance through your job, you can wait to enroll in Medicare Part B without the fear of penalty. But individuals may want to check in with their employers to determine whether adding Medicare coverage would help supplement the insurance coverage they have already.

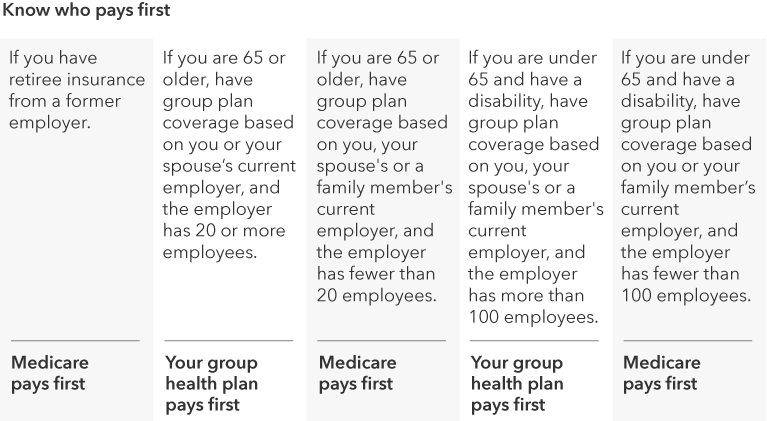

If you do have Medicare and other health insurance, coordination of benefits is important. Medicare pays first, and the other insurance becomes a secondary payer, covering costs that aren’t paid by Medicare Part B.

Coordination of benefits: Who pays first?

Advisors can help individuals who have more than one source of health coverage coordinate their insurance benefits.

Source: Medicare.gov, November 2023

Before considering a Medicare Advantage plan while working, individuals should talk to their employer benefits representative about their plan’s rules. Enrolling in a plan with restrictions may cause you to lose union or other types of employer coverage.

Another thing to be aware of if you are still working: Once you are enrolled in Part A, you cannot continue to make contributions to a health savings account (HSA). If you have an HSA and plan to contribute after age 65, delaying Part A enrollment may make sense. On the other hand, if you plan to enroll at age 65, stopping contributions a few months before you enroll is a smart strategy to avoid potential penalties.

Finally, if you (or your spouse) are getting ready to retire, or if you lose your job-based health insurance before you stop working, you have a limited time to sign up for Medicare without penalty. This is another Special Enrollment Period, and it typically lasts eight months. You may want to start thinking about signing up for Medicare a few months before you retire.

Help answer the question for clients:

As an advisor, you may be able to help clients with coordinating these benefits to get the best coverage overall.

- Help clients understand who pays first and how coverage is coordinated between Medicare and other health plans.

- Make sure that any Medicare Advantage plan selected does not have restrictions for those with other insurance.

- Clients who are contributing to an HSA should stop making contributions within six months of their 65th birthday.

4. Can I change my Medicare choices in the future?

Yes, Medicare consumers can and should review their plans every year to make sure they are taking advantage of every benefit opportunity to meet their needs and improve their coverage over time. Not all recipients do, however. Only 39% of respondents in the Sage Growth Survey review their plans annually, and only half rarely (if ever) shop for new plans.

Help answer the question for clients:

While 33% of respondents had an existing relationship with an advisor, only 2% said they work with a financial advisor to make their plan decisions. Among those who did, however, 92% said they trust their financial advisor to help them find a plan for their needs, and 83% said they would trust an online Medicare plan comparison tool recommended by their advisor. In a survey of Medicare-eligible individuals, only a small percentage worked with a financial advisor to select their plan. But those that did work with an advisor put a lot of trust in their advice.

- 92% trust their advisor to help them find the right Medicare plan for their needs

- 83% would trust an online Medicare plan comparison tool recommended by a financial advisor

- 61% would be very or extremely comfortable using an online tool recommended by an advisor

Source: Sage Growth Partners, “Hidden Crisis: The Medicare Enrollment Maze,” 2022

A healthy opportunity

With U.S. health care costs rising dramatically over the past two decades, wealth management is increasingly tied to health management. Individual costs, too, tend to rise as we age. According to the Bureau of Labor Statistics, in 2020, health care costs represented 14% of annual expenses for people between 65-74, while representing 16% of annual expenses for those 75 or older. Financial advisors have a real opportunity to help individuals better understand a topic that most of us will confront, yet few truly comprehend.

“The questions is not whether to offer Medicare advice,” says McQuiston, “but whether you do it in-house, outsource to a trusted specialist or refer clients to a Medicare specialist in your center-of-influence network.” He recommends checking in the year before a client’s 65th birthday to ask if they already have someone they work with. If you know they are invested in an HSA, they may want even more notice.

Financial advisors can play a key role in improving clients’ understanding of Medicare. Starting the conversation empowers clients to make more informed choices that have critical health and financial implications.

Max McQuiston

Max McQuiston