Emerging Markets

Fixed Income

An uncertain economic outlook and high interest rates are generally not viewed as a positive backdrop for investment-grade (IG) corporate bonds (rated BBB/Baa and above). Yet, a confluence of supportive factors is underpinning this asset class. These include relatively good credit quality, high average starting yields above 5.5%, an overall duration of about seven years and stabilization of the banking sector.

As a result, credit spreads above Treasuries have tightened to slightly less than 120 basis points (bps), which is near their 10-year average of 124 basis points.

In our view, while investment-grade credit could come under selling pressure in an extreme risk-off environment — the duration profile of the sector, credit fundamentals that are better than in prior periods of economic stress, as well as sustained demand from investors — should provide a degree of support, limiting downside risk in most scenarios.

Overall, we believe investment grade provides a solid middle ground for portfolios. If the U.S. Federal Reserve executes a ”soft landing“ and avoids a recession, investment-grade credit should fare well. And if there’s a ”hard landing“, the drawdown in investment grade should be muted compared to what we would expect to see in equities.

We discuss below each of the factors that are critical to investment-grade credit.

1. Duration profile is attractive as Fed hiking cycle ends

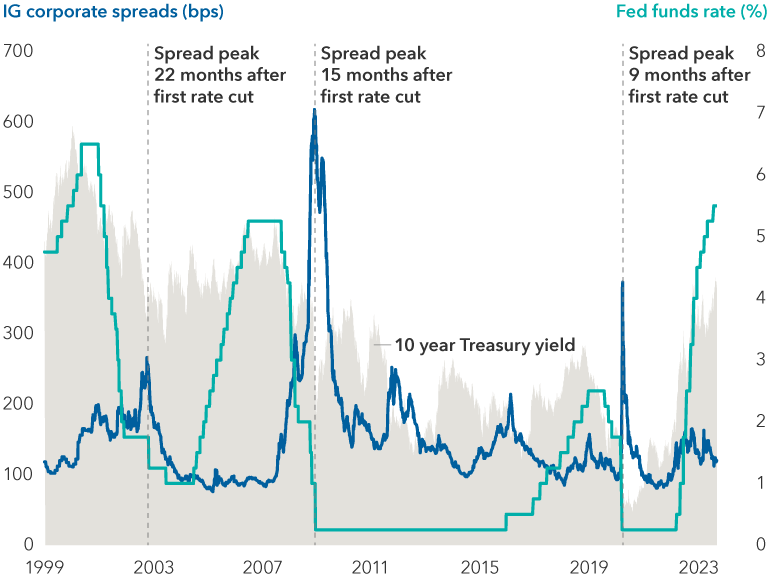

Recessionary periods and the end of the Fed hiking cycle have historically been associated with declining rates and spread widening. The Bloomberg U.S. Corporate Investment Grade Index has a duration of 7.1 years, compared to 6.3 years for the Bloomberg U.S. Aggregate Index. This could prove beneficial in a scenario where growth is slowing, leading long rates to rally as the Federal Reserve begins to ease policy.

In the past three economic cycles, yields for both short and long-term bonds have declined before spreads widened. Thus, duration of corporate bonds has helped to offset the impact of wider spreads.

In advance of a potential recession, 10-year Treasury yields could decline 100 basis points to around 3.5% and credit spreads could widen by a similar amount which would leave investors with relatively low capital losses. The income that investors can currently earn from investment grade, with yields above 5%, would continue to support total returns but may potentially move lower as spreads eventually compressed. These periods of market volatility, however, generally present an excellent opportunity for active security selection to contribute to excess returns.

Rates have tended to fall before corporate spreads widen

Source: Bloomberg. Data as of 9/7/2023. IG Corporate Spreads refers to spreads on the Bloomberg U.S. Corporate Investment Grade Index.

2. Liquidity and a more defensive posture are key amid uncertain economic backdrop

Given an uncertain economic outlook, we continue to emphasize liquidity, partly by allocating to defensive industries that have tended to outperform in challenging economic conditions and focusing on holding on-the-run issues for the credits in our clients’ portfolios.

For instance, recent mergers and acquisitions (M&A) activity in the pharmaceutical sector has created some attractive investment opportunities where large debt deals have come to market at relatively cheap prices. The sector has also held up solidly in prior downturns.

Valuations also currently look compelling for utilities, as spreads have underperformed the broader Bloomberg U.S. Corporate Investment Grade Index due to robust new debt issuance in the first half of 2023. Utility companies’ stable profitability and defensive, regulated business profile should insulate the sector if the economy weakens. Extreme weather is an increasing risk for the sector — with wildfires and hurricanes occurring more frequently — but this risk can be mitigated by credit investors through issuer and security selection.

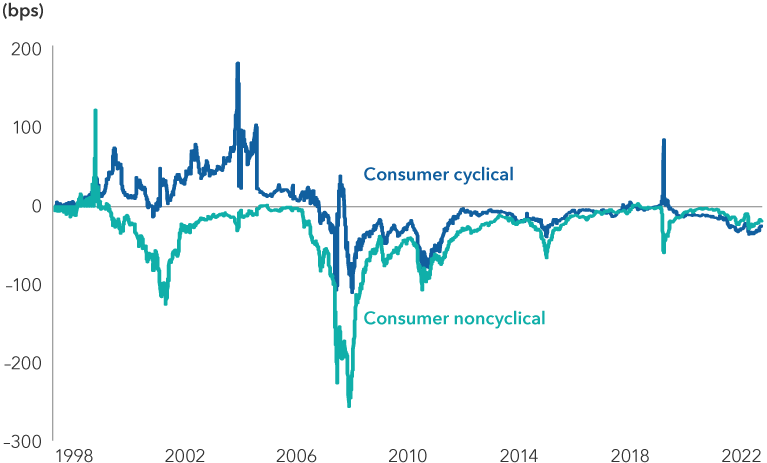

On the other side, avoiding losers can be just as important as identifying winners. Cyclicals, like chemicals, could be challenged because of the economic backdrop in both the U.S. and China, which has dominated cyclical demand in recent years. We are also limiting exposure to traditional automakers, which have been among the worst performers in the last two recessions.

Noncyclical spreads have outperformed cyclicals in prior recessions

Source: Bloomberg. Data as of 9/6/2023. Chart illustrates the difference between spreads for the consumer cyclical and noncyclical sectors within the Bloomberg Investment Grade Corporate Index and the spread for the overall Bloomberg Investment Grade Corporate Index by subtracting the spread for each sector of the index from the spread of the broader index.

3. High level of absolute yields attracts flows

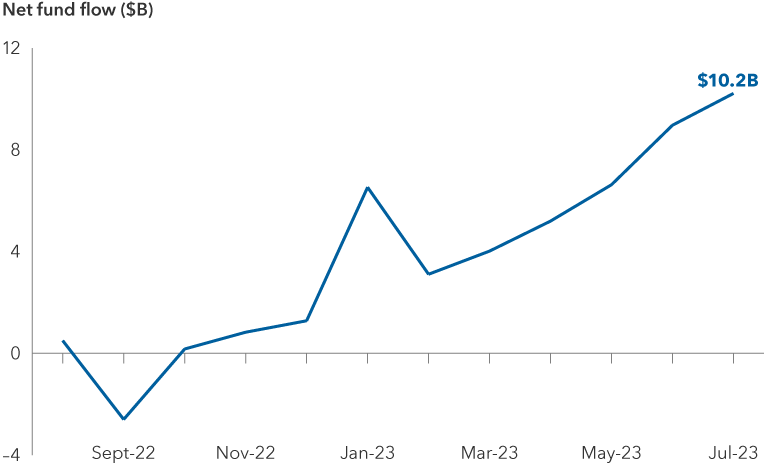

When yields reach five percent or more on investment-grade corporate bonds, rising inflows into the asset class have tended to create a favorable supply-demand dynamic that puts downward pressure on spreads.

Over the year, there has been consistent demand for U.S. dollar-denominated investment-grade credit from U.S. pension funds and international investors, particularly in Asia. Deals coming to market have been many times oversubscribed, despite overall market weakness. Additionally, lower merger and acquisitions activity has resulted in lighter issuance and constrained supply, which has been supportive of valuations.

Many investors who had been underweight to credit are now rebalancing their portfolios, contributing to the demand. We have also seen some investors moving out of equities and buying bonds, particularly among pension funds executing liability-driven investing (LDI) strategies. We expect this favorable technical backdrop to persist, as long as yields remain elevated.

Assets have been returning to IG credit

Source: Morningstar. Data as of 7/31/2023. Chart shows cumulative flows for U.S. investment-grade credit open-ended mutual funds and exchange-traded funds.

4. Financials present opportunities despite challenging Fed policy

At around a third of the Bloomberg Investment Grade Corporate Index, financials are an important part of the investment-grade debt universe, essentially serving as a proxy for the asset class. Given the ongoing funding needs of financials, they are more sensitive to interest rates. Tighter Fed policy typically creates higher funding costs and puts pressure on deposits, which can be a drag on bank profitability. Banks may also see higher losses in their securities books due to higher Treasury yields.

Bank bond valuations are starting to look attractive, but over the near-term, spreads could widen more if the economy weakens, as banks have traditionally not tended to fare well in recessions. Yet, even with a broad downgrade of regional banks occurring in August and some potential headwinds, our analysts remain constructive on the credit fundamentals of select issuers with diversified deposit bases, robust business models and strong risk controls.

The largest global financial institutions are well-capitalized partly as a result of regulations passed in the wake of the Global Financial Crisis (GFC), which provides an underpinning of support. Meanwhile, the failure of Silicon Valley Bank and Signature Bank earlier this year has continued to cast a shadow on the larger U.S. regional banks. These two areas of banking could provide compelling investment opportunities over the longer term.

If the Fed keeps rates high, smaller banks may come under continued earnings pressure and may experience a few more ratings downgrades. However, over the longer term, these risks will likely be offset by more stringent capital and liquidity rules which would strengthen fundamentals.

5. Credit quality looks solid

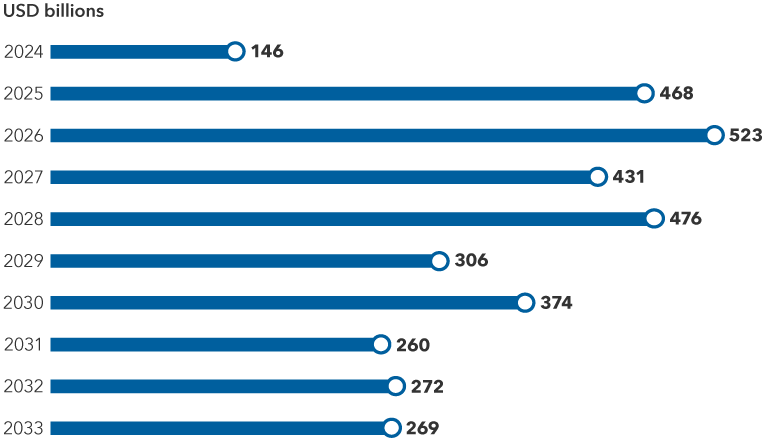

Overall, credit quality in the asset class remains solid. Interest coverage is deep and overall leverage has come down from its pandemic-era peak. Refinancing risk is also low, as a large number of companies have locked in debt at lower rates for several years.

The percentage of BBB-rated companies (one step above high yield) in the index has risen from around 25% to nearly 50% over the past three decades, which could be cause for concern. Some cyclical businesses may be at risk of falling into high yield in a recession. Yet, counter-intuitively, companies rated BBB could be at lower risk of a downgrade than in the past.

Incentivized by lower borrowing costs, many single-A companies have been willing to take a downgrade in recent years to fund M&A activity and expand their businesses. But now, sitting at BBB, the management of these companies are incentivized to do everything they can to maintain their investment-grade status as the penalties for falling to high yield are severe. For example, many companies across sectors like pharma, food and beverage, and energy have been focused on reducing debt balances accrued to support acquisitions. In many cases, they would like to maintain the flexibility to do acquisitions in the future which will encourage them to have healthier balance sheets to be able to borrow again in the future at attractive interest rates.

Hence, while some more cyclical businesses may fall into high yield, there are many companies that are steadily improving credits that can continue reducing their debt footprints even in the face of slower economic growth.

Maturity profile for investment grade index indicates low refinancing risk

Source: Bloomberg. Data as of August 15, 2023. Chart shows the total dollar value of bonds in the Bloomberg U.S. Corporate Investment Grade Index separated by the year they are due to mature from 2024-2033.

The bottom line

Even with an uncertain economic backdrop ahead, investors can find compelling opportunities in investment-grade credit. The overall duration profile of the sector is particularly appealing, with the potential for a slowdown in growth and the Fed’s hiking cycle coming to an end. Spreads may widen in a risk-off scenario, but the carry from today’s higher starting yields can provide a significant buffer to limit losses for investors.

Solid credit fundamentals and sustained demand from investors should also limit downside risk. Overall, investment-grade credit can provide a solid middle ground for portfolios in this uncertain environment and should serve investors well across a variety of economic outcomes.

Carry – interest income.

Credit spread - A credit spread is the difference in yield (the expected return on an investment over a particular period of time) between a government bond and another debt security of the same maturity but with different credit quality.

Duration measures a bond’s sensitivity to changes in interest rates.

Inflation – The rise in the prices of goods and services, as happens when spending increases relative to the supply of goods on the market – in other words, too much money chasing too few goods. Core inflation metrics strip out volatile items like food and energy.

Interest coverage – a measure of a corporate bond issuer’s ability to pay the interest on its outstanding debt.

Issuer – A legal entity that develops, registers and sells securities to finance its operations. Issuers may be corporations, investment trusts, or governments.

Liquidity – Liquidity describes the degree to which an asset or security can be quickly converted into cash without a significant concession in price.

On the run – on the run securities are the most recently issued securities of a periodically issued security

Risk-off environment - when investors become more cautious due to an unforeseen event or data point and riskier investments such as equities and credit selloff.

Bond ratings, which typically range from AAA/Aaa (highest) to D (lowest), are assigned by credit rating agencies such as Standard & Poor's, Moody's and/or Fitch, as an indication of an issuer's creditworthiness.

Bloomberg U.S. Corporate Investment Grade Index represents the universe of investment-grade, publicly issued U.S. corporate and specified foreign debentures and secured notes that meet the specific maturity, liquidity and quality requirements.

Bloomberg U.S. Aggregate Index represents the U.S. investment-grade fixed-rate bond market. This index is unmanaged, and its results include reinvested dividends and/or distributions but do not reflect the effect of sales charges, commissions, account fees, expenses or U.S. federal income taxes.

Don't miss our latest insights.

Our latest insights

-

-

Quick Take

-

-

Monetary Policy

-

Fixed Income

RELATED INSIGHTS

Don’t miss out

Get the Capital Ideas newsletter in your inbox every other week

Karen Choi

Karen Choi

Scott Sykes

Scott Sykes

Greg Garrett

Greg Garrett