Municipal Bonds

- Tax reform sparks an unusual muni yield curve opportunity.

- Not-for-profit hospitals can reward the patient investor.

- Housing munis offer a structural yield advantage.

2019 is already shaping up to be a good year for muni investing. And that comes on the heels of several years of positive market returns. Who said Fed rate hikes are bad for bonds?

As a portfolio manager for several funds and separately managed accounts — including Limited Term Tax-Exempt Bond Fund of America® and The Tax-Exempt Fund of California® — I’m seeing truly varied opportunities in municipal bonds.

I’ll highlight three of them here. First, the shape of the municipal bond yield curve — which is quite steep relative to the Treasury yield curve — offers compelling value. I am also finding opportunity in the continuing wave of consolidation among not-for-profit hospitals. Finally, there are persistently attractive valuations in housing.

1. Tax reform sparks an unusual muni yield curve opportunity.

The shape of any bond curve is a big deal for bond investors. When curves are steep, the additional yield offered by longer maturity bonds can be very enticing. It’s surprising that the potential benefit of managing curve exposure in munis isn’t more widely known.

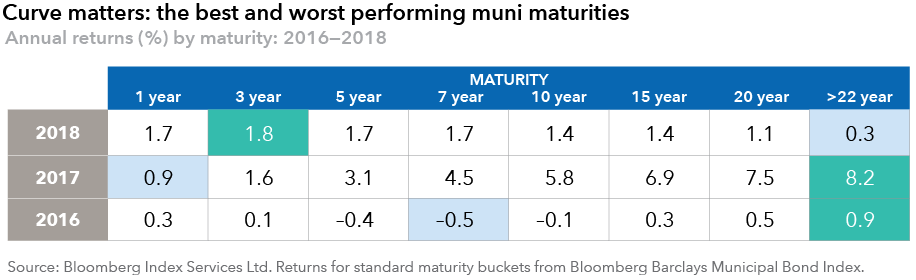

In the few years since the Federal Reserve embarked on its most recent hiking cycle, for example, returns across the curve have varied meaningfully.

The Tax Cuts and Jobs Act of 2017 has also been a game changer for the curve — altering the balance of muni bond supply and demand. Before tax reform was enacted in December 2017, there was a surge of muni bond issuance.

Mindful that cheap refinancing through so-called advanced refunding bonds looked set to become much trickier, states and other issuers rushed to market. This increased the supply of bonds and put downward pressure on muni bond prices. (Recall that bond prices move inversely to yields.)

At the same time, tax reform cut the corporate tax rate from 35% to 21%, diminishing the advantage of holding municipals for U.S. banks and insurance companies. Historically, banks and insurers have been important investors in munis with maturities of 20 years or longer.

Consequently, the steepness of the muni curve relative to the Treasury yield curve has increased thanks to a smaller supply of muni bonds on the whole and lower demand for longer term munis.

So how exactly can an investor seek to benefit from the muni curve’s relative steepness? The basic idea is that, sooner or later, the divergence between the two curves will fade as the gravitational pull of the much larger and more liquid Treasury market is felt by munis.

I’ve looked at different segments of the muni curve, and 10-year munis offer attractive relative value compared to five-year munis. This kind of positioning can be augmented with a mirror image approach in U.S. Treasuries: using futures contracts to favor five-year over 10-year Treasuries. As the two curves move toward one another again, this approach could, in my view, generate attractive potential returns.

2. Not-for-profit hospitals can reward the patient investor.

Health care has historically been a large exposure for many of our tax-exempt bond strategies, with hospital bonds often a favorite. Amid economic growth and Medicaid expansion (which accompanied extra payments for uncompensated care and bad debt), many not-for-profit hospitals have strengthened their balance sheets in the past decade.

Our team of muni investment analysts looks to distinguish between hospitals of similar credit ratings. Often their focus is on regions where health care reimbursement is most favorable. They also regularly talk with hospital executives, as well as with colleagues from our equity and taxable bond investment teams.

In my view, collaboration helps create differentiated investment insights and enables us to get ahead of trends. On that note, the multiyear hospital consolidation wave shows no signs of receding any time soon. Large systems see mergers and acquisitions as a way to stay competitive and diversify. And from the smaller hospital’s perspective, acquisition can represent a lifeline as margins continue to get squeezed.

Each credit must be assessed on its own merits, but it’s fair to say that large multi-state health care systems can be especially attractive. That said, single site hospitals also pique my interest — if they have dominant market share and a high percentage of revenue derived from commercial insurance. Hospital bonds currently account for just under 10% of outstanding investment-grade municipal bonds, and typically offer yields above those of the broader market.

3. Housing munis offer a structural yield advantage.

There are nearly $4 trillion in muni bonds outstanding. In a market of this size, there are likely to be areas that are not as closely researched by investors. Housing is a case in point.

My focus is on single family housing bonds. These munis are issued by various state and local housing authorities across the country, with bond proceeds used to help low-income and first-time buyers purchase their homes. In many cases, the credit story around these bonds has improved: The underlying mortgage pools are either federally insured, or are structured in ways that can reduce the risk of default.

From a valuation standpoint, housing muni bonds offer attractive relative value. For very high-quality credits, it’s not uncommon to see housing munis offer around 0.75% additional yield over similarly rated munis from some other sectors.

As is always the case at Capital, investment decisions center on individual bonds. Bond-by-bond credit research is at the heart of how we invest.

Bloomberg Barclays Municipal Bond Index is a market value-weighted index designed to represent the long-term investment-grade tax-exempt bond market.

The index is unmanaged, and results include reinvested dividends and/or distributions but do not reflect the effect of sales charges, commissions, account fees, expenses or U.S. federal income taxes.

The return of principal for bond funds and funds with significant underlying bond holdings is not guaranteed. Fund shares are subject to the same interest rate, inflation and credit risks associated with the underlying bond holdings. Lower rated bonds are subject to greater fluctuations in value and risk of loss of income and principal than higher rated bonds.

State-specific tax-exempt funds are more susceptible to factors adversely affecting issuers of their states' tax-exempt securities than more widely diversified municipal bond funds. Income from municipal bonds may be subject to state or local income taxes and/or the federal alternative minimum tax. Certain other income, as well as capital gain distributions, may be taxable.

The use of derivatives involves a variety of risks, which may be different from, or greater than, the risks associated with investing in traditional cash securities, such as stocks and bonds.

The Capital Group companies manage equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

Our latest insights

-

-

-

Interest Rates

-

-

Municipal Bonds

This is the headline for the Newsletter promo. Customize the message.

Related Insights

-

-

Long-Term Investing

-

Never miss an insight

The Capital Ideas newsletter delivers weekly investment insights straight to your inbox.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and should not be considered advice, an endorsement or a recommendation.

Mark Marinella

Mark Marinella