Fixed Income

Jump to a section

MULTI-SECTOR INCOME

Multi-Sector Income provides potential for a diversified source of income that features less volatility and drawdown than a portfolio of high-yield or emerging market bonds. The fund has the flexibility to make changes to sector allocations in response to market conditions, investment insights and outlook.

Multi-Sector Income invests primarily in a blend of four high-income sectors, with the flexibility to adjust investment exposures in response to market conditions, investment insights and outlook.

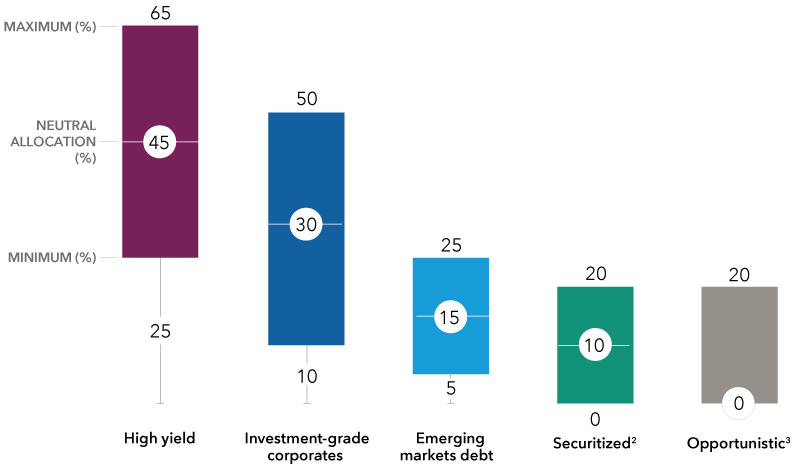

The portfolio management team targets multiple sources of income. In stable markets the fund ordinarily consists of approximately 45% high yield, 30% investment grade, 15% emerging markets debt and 10% securitized debt. But Multi-Sector Income also has the flexibility, as illustrated below, to substantially adjust exposures in any given market climate.

A flexible framework to help pursue high income

Diversification across income sectors (%)1

Blending high-income sectors automatically builds in diversification, enabling investors to capture potential yield while reducing overall portfolio risk.

Within the strategy’s four primary sectors, no single sector has consistently posted the highest annual returns over time.4 As the chart shows, sector income varies year over year. This underscores the case for active monitoring by investment professionals who understand the underlying risk and complex drivers of returns.

Within high income, no single sector consistently posted the highest return every year.4

.png)

The average difference between annual returns of the highest and lowest sectors for the period was stark, at 13.0%.5

Data as of December 31, 2023.

High yield represents Bloomberg U.S. Corporate High Yield 2% Issuer Capped Index; IG corp. represents Bloomberg U.S. Corporate Index; Emerging Markets Debt (EMD) represents JPMorgan EMBI Global Diversified Index; Securitized represents 80% Bloomberg CMBS Ex AAA Index /20% Bloomberg ABS Ex AAA Index.

Flexibility to adjust income sector exposures from a global opportunity set mainly in high yield and investment-grade corporate bonds as well as emerging markets and securitized debt.

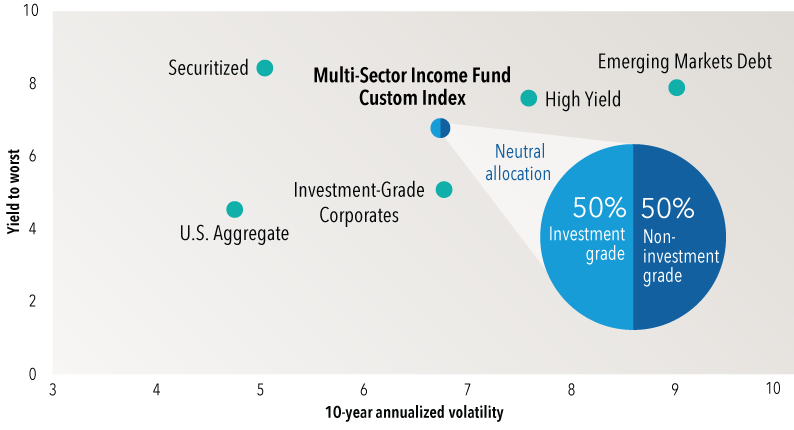

Pursue income by investing across fixed income markets

The scattergram chart below shows the four primary sectors in which the fund invests. You can see the sectors are widely dispersed in terms of volatility and yield. By blending them with the added flexibility to shift allocations among each, the mandate can potentially capture much of the yield and reduce overall portfolio risk.

Fixed income sector yields relative to 10-year annualized volatility (%)

Data as of December 31, 2023. Standard deviation (volatility) based on returns in USD. U.S. Aggregate represents Bloomberg U.S. Aggregate Bond Index. High Yield represents Bloomberg U.S. Corporate High Yield 2% Issuer Capped Index; Investment-Grade Corporates represents Bloomberg U.S. Corporate Index; Emerging Markets Debt represents J.P. Morgan EMBI Global Diversified; Securitized represents 80% Bloomberg CMBS Ex AAA Index /20% Bloomberg ABS Ex AAA Index. Multi Sector Income Fund Custom Blended Index comprises: 45% Bloomberg U.S. Corporate High Yield 2% Issuer Capped Index, 30% Bloomberg U.S. Corporate Investment Grade Index, 15% J.P. Morgan EMBI Global Diversified, 8% Bloomberg CMBS Ex AAA Index, 2% to September 30, 2023, and 8% Bloomberg Non-Agency CMBS Ex AAA Index thereafter.

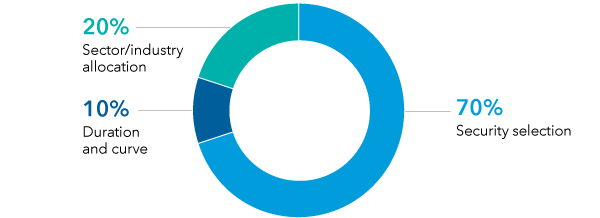

Potential sources of excess returns

Chart shows the fund’s potential sources of excess returns. Security selection may represent 70% while sector and industry allocations may represent 20% with duration and curve positioning, representing 10%.

AN EXPERIENCED TEAM

The Multi-Sector Income investment team

The portfolio managers overseeing the fund are supported by the research, size and scale of Capital Group’s global fixed income team, which manages US$308 billion (as of December 31, 2023) in multi-sector strategies around the world.

Xavier Goss

Los Angeles

20 years of industry experience

Damien McCann

Los Angeles

24 years of industry experience

Scott Sykes

New York

23 years of industry experience

Kirstie Spence

London

28 years of industry experience

Shannon Ward

Los Angeles

31 years of industry experience

Years of experience as of December 31, 2023.

Dedicated specialists, long tenure, global support

Each portfolio manager is a dedicated specialist in multi-sector income investing. Portfolio managers invest in their funds6 and compensation emphasizes long-term results – not assets under management.

Why Capital Group for multi-sector investing

1973

Begins managing investment-grade corporates and securitized debt for U.S investors

1988

Emerging markets debt securities added to Capital Group portfolios in the U.S.

242

Fixed income investment professionals in offices around the world*

US$308 billion

Global multi-sector assets*

Fund literature

Connect with our team

Our dedicated team is here to help.

INSIGHTS

Fresh perspectives from our fixed income team

-

-

Fixed Income

-

Fixed Income

For advisor use only. Not for use with investors.

*As of December 31, 2023. Figures are approximate and include high yield, investment-grade corporate, emerging markets debt and securitized. Reflects the Capital Group global organization.

1 Minimum and maximum allocation amounts are not intended to reflect limits; they indicate the typical range within which a sector will be represented. Neutral allocation reflects the allocation under normal market conditions.

2 Securitized benchmarked against 80% Bloomberg CMBS Ex AAA Index /20% Bloomberg ABS Ex AAA Index.

3 Opportunistic includes, but is not limited to, U.S. Treasuries, non-corporate credit and other debt instruments.

4 Based on the returns from 2008-2023 backing high yield, IG corp, emerging market debt, and securitized. Returns are in USD.

5 Calculated using the best-to-worst returns spread each year from 2008–2023 for high yield, investment-grade U.S. corporates, emerging market debt, and securitized. Returns are in USD.

6 Portfolio managers of Capital Group’s Canadian fund offerings who do not reside in Canada are restricted from investing in the Canadian funds they manage.

This content is confidential and designed for the exclusive use of registered dealers and their representatives. Canadian securities legislation, including National Instrument 81-102, prohibits its distribution to investors, potential investors or the general public. It is not intended to be a sales communication, as defined in the Instrument, and has not been designed to comply with its requirements relating to sales communications.

Views expressed regarding a particular company, security, industry or market sector should not be considered an endorsement or an indication of trading intent of any investment funds managed by Capital International Asset Management (Canada), Inc. These views should not be considered as investment advice or as a recommendation to buy or sell.

Capital Group funds are available in Canada through registered dealers. Funds may not be available for distribution by all dealer firms. Please confirm with your home office whether our funds are among your firm's approved offerings.

All Capital Group trademarks are owned by The Capital Group Companies, Inc. or an affiliated company in Canada, the U.S. and other countries.

Capital Group funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capital Group, a global investment management firm originating in Los Angeles, California in 1931. Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.