Markets & Economy

The latest U.S. consumer price index (CPI) report released Wednesday, May 11, has confirmed that the U.S. Federal Reserve has a long way yet to go in its fight against inflation. Core inflation — all items except food and energy — rose 6.2% year over year in April, keeping it at a level not seen in nearly 40 years.

Much of this is, no doubt, created by supply shocks, which fall outside the central bank’s area of control, as Fed Chair Jerome Powell pointed out in his press conference earlier this month. The Fed can, however, affect demand in the historically tight labour market. Its plan to continue implementing 50 basis point (bps) rate hikes should introduce some slack — but the question is, how far will it have to go to achieve its goal on inflation?

We are starting to see a moderate wage-price spiral developing in the United States, and as I've looked at the landscape, I don’t see a clear path to bring inflation back to the Fed’s 2% target in USD without putting the economy into a recession.

Here are four charts about labour dynamics that explain why I believe this is the case.

1. Workers expect bigger salaries to make up for higher prices

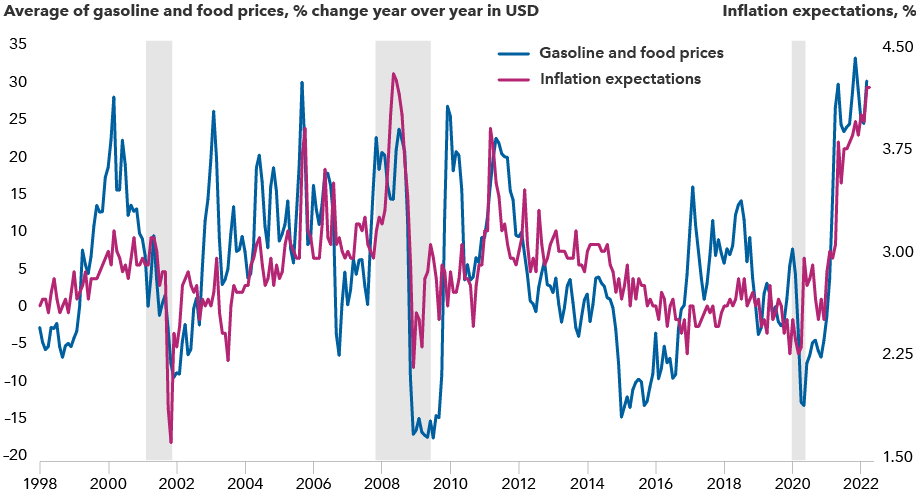

Workers are asking for higher compensation because the prices of the products that impact their inflation expectations have surged. As the chart below shows, people’s view of inflation is very closely linked to the prices of gasoline and food. U.S. gasoline prices are already sitting at record highs, even before the peak summer driving season kicks off. And a number of factors, such as the war in Ukraine and a looming fertilizer shortage, are pushing food prices higher.

Inflation expectations largely track food and fuel prices

Sources: University of Michigan, U.S. Bureau of Labor Statistics. Data as of April 30, 2022. Shaded areas represent recessions.

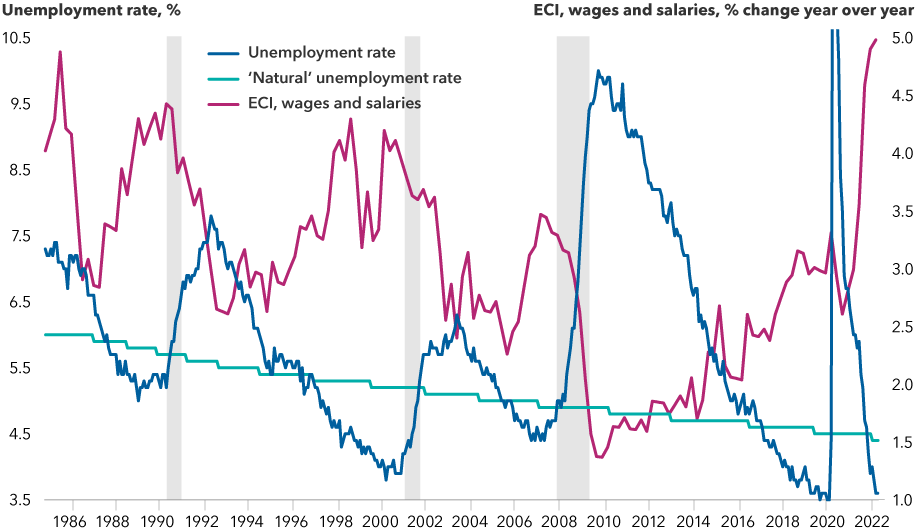

2. Employers are raising wages given tight market

U.S. workers are getting the higher compensation they are asking for because the labour market is extremely tight. Many workers who went missing during the pandemic have not come back. Today’s U.S. unemployment rate is similar to before the pandemic, but the labour force participation rate still lags. It was 62.2% in April 2022, compared to 63.4% in February 2020, according to the Bureau of Labor Statistics (BLS). Employers also reported a record 11.5 million open jobs in March 2022, according to BLS data.

The natural unemployment rate, which represents unemployment not linked to cyclical demand, has declined over time, but is still likely a full percent above the current unemployment rate, and perhaps higher.

Compensation soars as unemployment returns to pre-pandemic lows in the U.S.

Sources: Bureau of Labor Statistics, Congressional Budget Office. ECI = employment cost index. Data as of April 30, 2022. Shaded areas represent recessions.

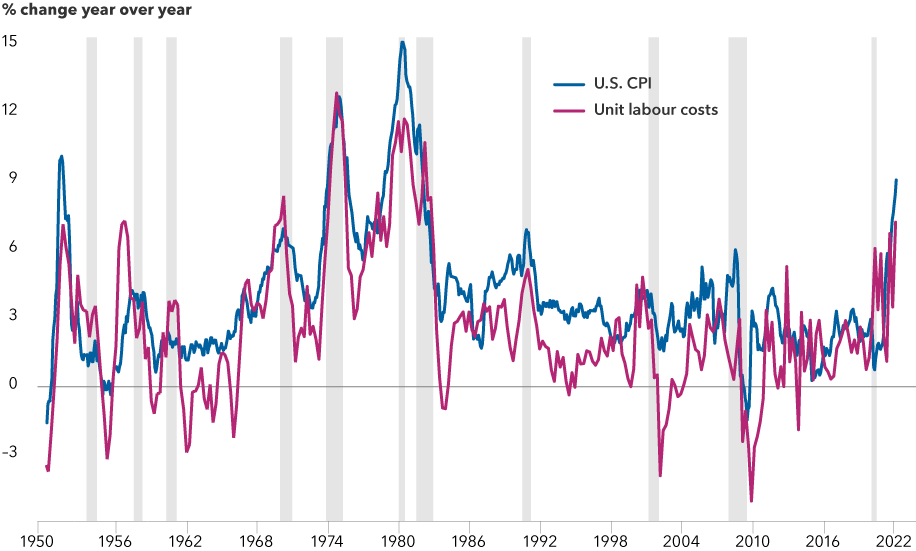

3. Productivity growth is not offsetting compensation costs

Productivity has not been keeping up with wage growth, so unit U.S. labour costs have been rising sharply. In fact, over the past four quarters, productivity fell 0.6%, resulting in a 7.2% increase in unit labour costs, the largest since an 8.2% increase in 1982.

Less for more: Productivity declines as wages rise

Source: Bureau of Labor Statistics. CPI = consumer price index. Data as of April 30, 2022. Shaded areas represent recessions.

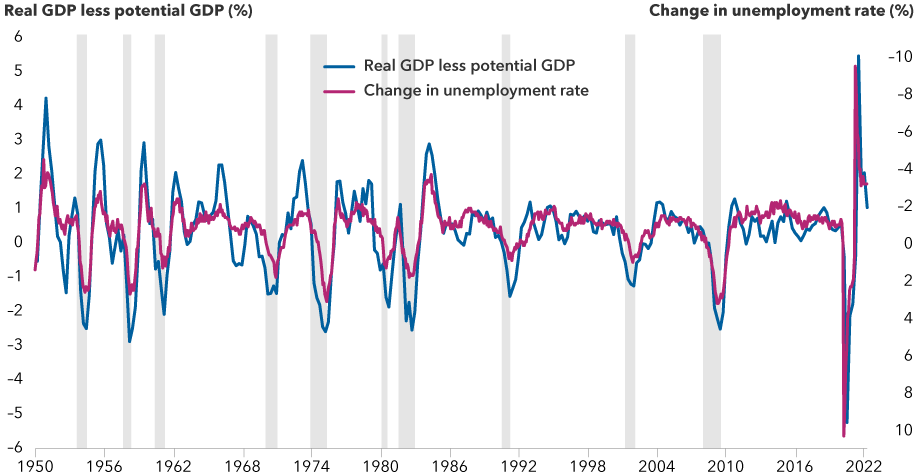

4. Relieving this pressure could require growth to slow well below potential

The U.S. unemployment rate may need to rise as much as 2.0% or more before wage growth starts to moderate. Okun’s law, which describes the relationship between employment and production, suggests if that were to occur in one year, it would require gross domestic product (GDP) growth to be 4% lower than potential, or the level where it would be if all of the economy’s resources were fully employed.

Okun’s law indicates growth must slow to bring U.S. inflation down

Sources: Capital Group calculations, Bureau of Labor Statistics, U.S. Congressional Budget Office, U.S. Bureau of Economic Analysis. Data as of April 30, 2022. GDP = gross domestic product. Potential GDP is the theoretical level of where a country’s GDP should be if all its resources are fully employed. Y-axis on the right-hand side of the chart is inverted to illustrate the correlation between GDP and unemployment. Shaded areas represent recessions.

The bottom line

U.S. Inflation appears to be increasingly entrenched and persistent. Interest rates, both short- and long-term, could go up more than the market expects. The only way to really break the wage-price spiral, in my view, is to create a lot of slack in the labour market, which is done by pushing the unemployment rate up, which in turn could lead us into a recession.

There are, of course, alternative scenarios that could come to pass, including: 1) inflation falls of its own volition, 2) the Fed capitulates and lets inflation run unchecked, or 3) the Fed achieves a “soft landing” (a moderate economic slowdown). However, none of these appear to me to be high-probability outcomes, and a soft landing may not free up much slack anyway.

Given the Fed’s focus on taming inflation, which is being exacerbated by recent developments that include rolling COVID-19 shutdowns of cities in China and a prolonged Russia-Ukraine conflict, there is now a higher probability that we may be in a recession by the end of 2022 or early 2023.

Our latest insights

-

-

Global Equities

-

Artificial Intelligence

-

Technology & Innovation

-

RELATED INSIGHTS

-

-

Artificial Intelligence

-

Technology & Innovation

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

Unless otherwise indicated, the investment professionals featured do not manage Capital Group‘s Canadian mutual funds.

References to particular companies or securities, if any, are included for informational or illustrative purposes only and should not be considered as an endorsement by Capital Group. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds or current holdings of any investment funds. These views should not be considered as investment advice nor should they be considered a recommendation to buy or sell.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and not be comprehensive or to provide advice. For informational purposes only; not intended to provide tax, legal or financial advice. We assume no liability for any inaccurate, delayed or incomplete information, nor for any actions taken in reliance thereon. The information contained herein has been supplied without verification by us and may be subject to change. Capital Group funds are available in Canada through registered dealers. For more information, please consult your financial and tax advisors for your individual situation.

Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. We encourage you to consider these and other factors carefully before making any investment decisions and we urge you to avoid placing undue reliance on forward-looking statements.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2024 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2024. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under licence. All rights in the FTSE Russell indices or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indices or data and no party may rely on any indices or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The index is unmanaged and cannot be invested in directly.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

MSCI does not approve, review or produce reports published on this site, makes no express or implied warranties or representations and is not liable whatsoever for any data represented. You may not redistribute MSCI data or use it as a basis for other indices or investment products.

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capital Group trademarks are owned by The Capital Group Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capital Group funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capital Group, a global investment management firm originating in Los Angeles, California in 1931. Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

The Capital Group funds offered on this website are available only to Canadian residents.

Darrell Spence

Darrell Spence