Retirement Income

Practice Management

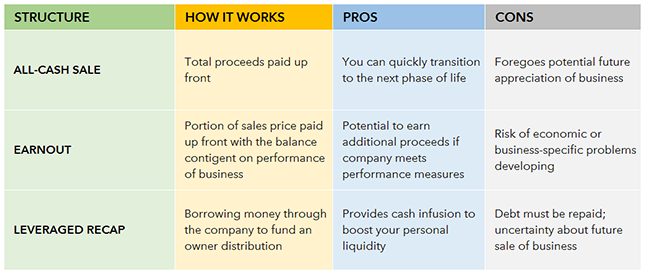

- Business owners have several ways to sell a company or extract liquidity from it.

- All-cash sales offer the most certainty, but earnouts can be lucrative if a company prospers.

- Leveraged recapitalizations may appeal to clients seeking liquidity but undecided about whether to sell.

As a trusted advisor, you can be of enormous value to entrepreneurial clients wanting to extract liquidity from a privately held business. Among other things, you can help them understand their options, both in terms of the sale itself and the impact on their personal wealth. Business owners typically have a lot of questions. They will appreciate your ability to educate them about the process and provide a steadying hand throughout a pivotal time in their financial lives. Too frequently, individuals simply hold out too long in the hopes of getting a better offer that never comes. So how can we help such clients think through what is right for them?

One of the first topics business owners want to understand is how to structure a sale. What are the basic options and, depending on their circumstances, is an immediate sale even the preferred course of action? Below are three options you may want to explore with your clients, along with the pros and cons of each. Two options involve selling a business, while the third is an interim step should a client need to pull money out of a company in advance of an eventual sale. Different transactions carry varying levels of potential risk and reward, and you can help your client realize that sometimes the offer with adequate proceeds up front may be the best, even if it’s not the highest.

1. All-cash deals offer the greatest degree of certainty.

Assuming the market price equals or exceeds the amount of money a client needs to fund his or her desired lifestyle, an all-cash sale may be the best option. Unlike some other types of transactions, a straight sale generally allows an owner to leave the business after a set period of time with money in hand and no strings attached. Sale proceeds are taxed as long-term capital gains. On the downside, cash deals eliminate the possibility of deriving future income from the company or benefiting financially if the enterprise prospers. Still, if the sale offer satisfies financial requirements, it should be strongly considered. Though they may not offer the greatest financial upside compared with some other options, all-cash deals can often minimize uncertainty.

2. Earnouts can be lucrative but do not always pay off.

One alternative to a cash sale is an earnout, in which your client sells a business to a third party but retains some financial exposure to it. This structure requires the entrepreneur to “earn” a certain portion of the purchase price through the future performance of the company. The better the performance, the bigger the potential payment. Earnouts are often used when buyers and sellers disagree about the sales price, especially regarding the company’s future prospects. This arrangement provides buyers with peace of mind that they have not overpaid, while giving sellers the opportunity to receive additional payouts if earnings growth is strong.

Under this structure, sellers are typically paid in three ways. The first is an up-front amount representing a portion of the total sales price. In many cases, sellers also receive a salary because they are often contractually obligated to stay on as consultants during a transitional period. The final payment is the earnout itself. For tax purposes, the initial payout is considered a long-term capital gain. The salary from consulting work is compensation income. The earnout itself can be taxed as either capital gains or compensation income, depending on the facts and circumstances of the sale. Of course, clients should always consult with tax professionals for clarity on their specific situations.

For sellers, the risks associated with earnouts have increased in recent years. Earnout periods, which historically have lasted from one to three years, sometimes now extend even longer. That extra time increases the risk of an economic downturn or business-specific setback eating into or eliminating an expected earnout. Beyond that, these post-transaction payments represent a growing portion of the total sales price, especially when selling to sophisticated investors such as private equity funds.

One risk is that tension will develop between entrepreneurs who are accustomed to calling the shots and the new owners to whom they suddenly answer. In other cases, earnouts are missed for reasons that are difficult for an entrepreneur to anticipate or avoid. Earnout provisions can be tied to a range of metrics but should be flexible enough to reflect the realistic prospects of a company and its industry.

3. Leveraged recaps help entrepreneurs diversify their wealth.

If your client is seeking some liquidity but uncertain about whether to sell a business entirely, a leveraged recapitalization (“recap”) may be an attractive option. Under this structure, the entrepreneur adds debt to the company in order to take a distribution via a dividend payment with the proceeds. The debt proceeds are considered a dividend and taxed at qualified dividend rates. Typically, financing comes from either a private equity firm in the form of an investment or from a bank as a loan. If the client has built up significant value in the enterprise, a recap can provide a quick cash infusion to improve personal liquidity and diversification. In other words, your client can take some chips off the table without exiting the business entirely.

Among other benefits, a leveraged recap provides time and flexibility if a business owner either can’t or doesn’t want to sell right away. Often, recaps are an interim step toward an eventual sale, allowing an owner to retain ownership until a transaction can be completed. The degree of leverage depends on several factors, including the prospects for the business and the overall industry outlook. Of course, any gross proceeds from an eventual sale would be reduced by the amount of leverage on the balance sheet.

There are several points to keep in mind when contemplating a leveraged recap. First, founders typically must remain involved in the company for at least several years, so this is not an option for clients who are seeking a quick exit. Also, recaps add more risk. Though owners stand to reap the financial upside if the company fares well, they may fall short of their financial objectives if the company or the economy falters. And in some cases, clients could be personally liable for repaying all or a portion of the debt. Therefore, it’s essential to confirm that the company will be able to shoulder the debt burden, especially during challenging economic periods.

Options for generating liquidity from the sale of a business

Naturally, selling a business is complex, and owners typically rely on a team of specialists, including investment banking, accounting and legal professionals, to help guide them through the process. But you are essential throughout the process because you will help clients chart their financial futures. A business sale involves a variety of decisions that depend on an owner’s financial needs and personal objectives. You can help clients evaluate offers in the context of their goals, helping to provide peace of mind and a smooth transition to the next stage of their lives.

RELATED INSIGHTS

-

-

Client Conversations

-

Client Relationship & Service

Use of this website is intended for U.S. residents only.

Michelle Black

Michelle Black