Retirement Income

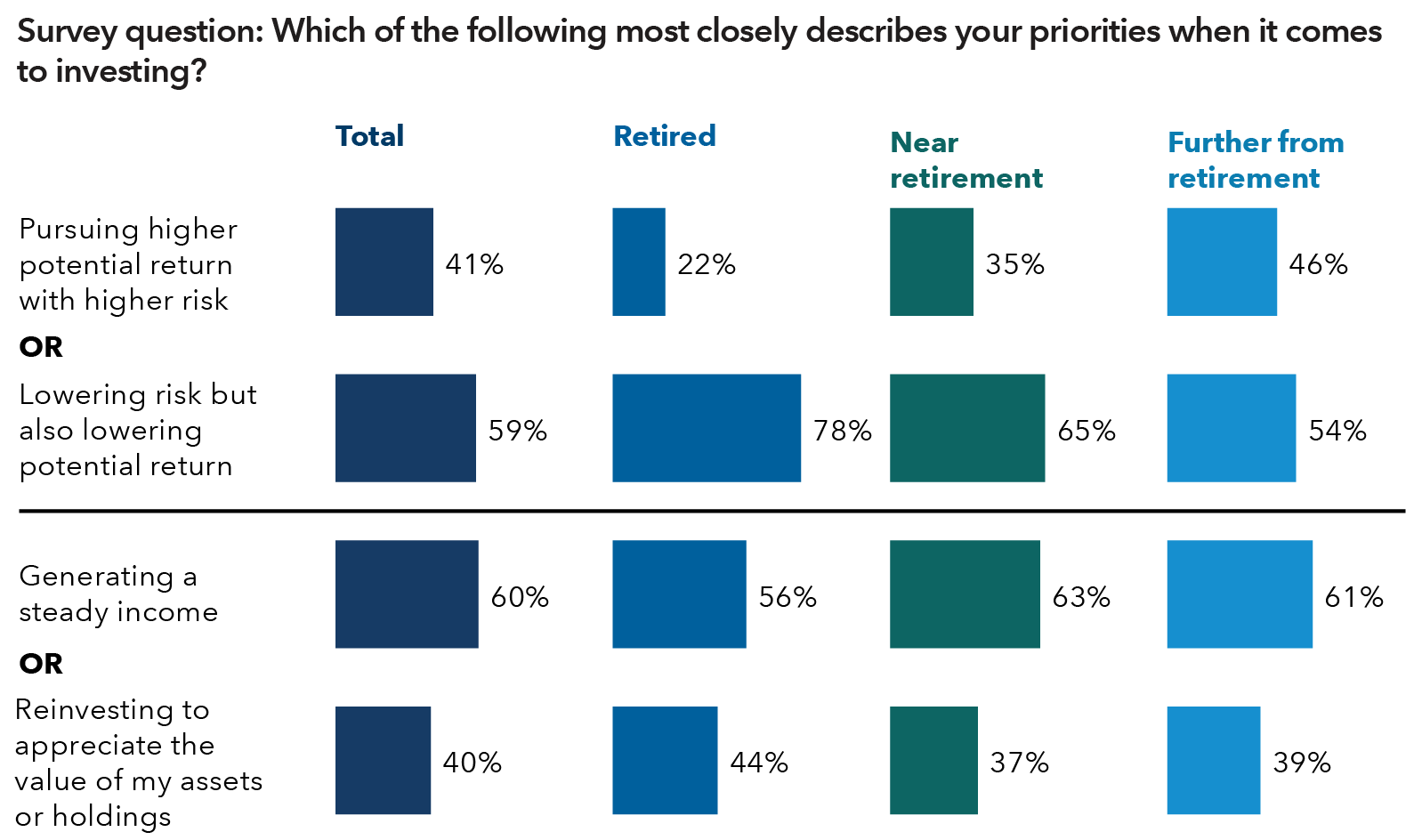

More risk, more reward? When it comes to retirement income, investors say: "No, thank you." A new Capital Group survey reveals investors prefer generating steady income and minimizing risk in retirement, even if that means accepting lower returns on their investments.

“The survey shows investors are risk-averse in retirement planning across a number of areas,” says portfolio manager Samir Mathur, who is also a member of the Capital Solutions Group. “Regarding retirement income, we find a marked preference for lower risk and steady income over higher risk and the potential for higher returns.”

Partly as a result, older investors appear to want to preserve as much of their savings as possible and tend to be more risk-averse and short-term oriented than financial advisors, who we separately surveyed. Advisors may have more work to do to help their clients pursue their retirement income objectives.

The survey asked investors to choose from among several hypothetical retirement income investment strategies with different withdrawal rates, withdrawal time periods (20 or 30 years), probabilities of loss and ending account balances.

Their choices yielded insights into how investors might behave once their long-planned retirement arrives and they must decide how to invest and spend their nest egg. Here’s what we found:

Investors are willing to sacrifice higher investment returns in exchange for steady income

When given a choice of having lower risk with lower returns in retirement or taking on higher risk with higher returns, 59% of investors preferred the lower-risk/lower-return option.

For retirement, investors prioritize steady income, lower risk

Source: Capital Group Investor Retirement Income Survey, 2025.

Investors want to preserve as much of their savings as possible

Most investors want to preserve 100% of their account balance while taking withdrawals, the survey found. Older investors (those aged 65+) and those with higher assets showed a stronger preference for maintaining their savings and were more willing to trade withdrawal power to get it.

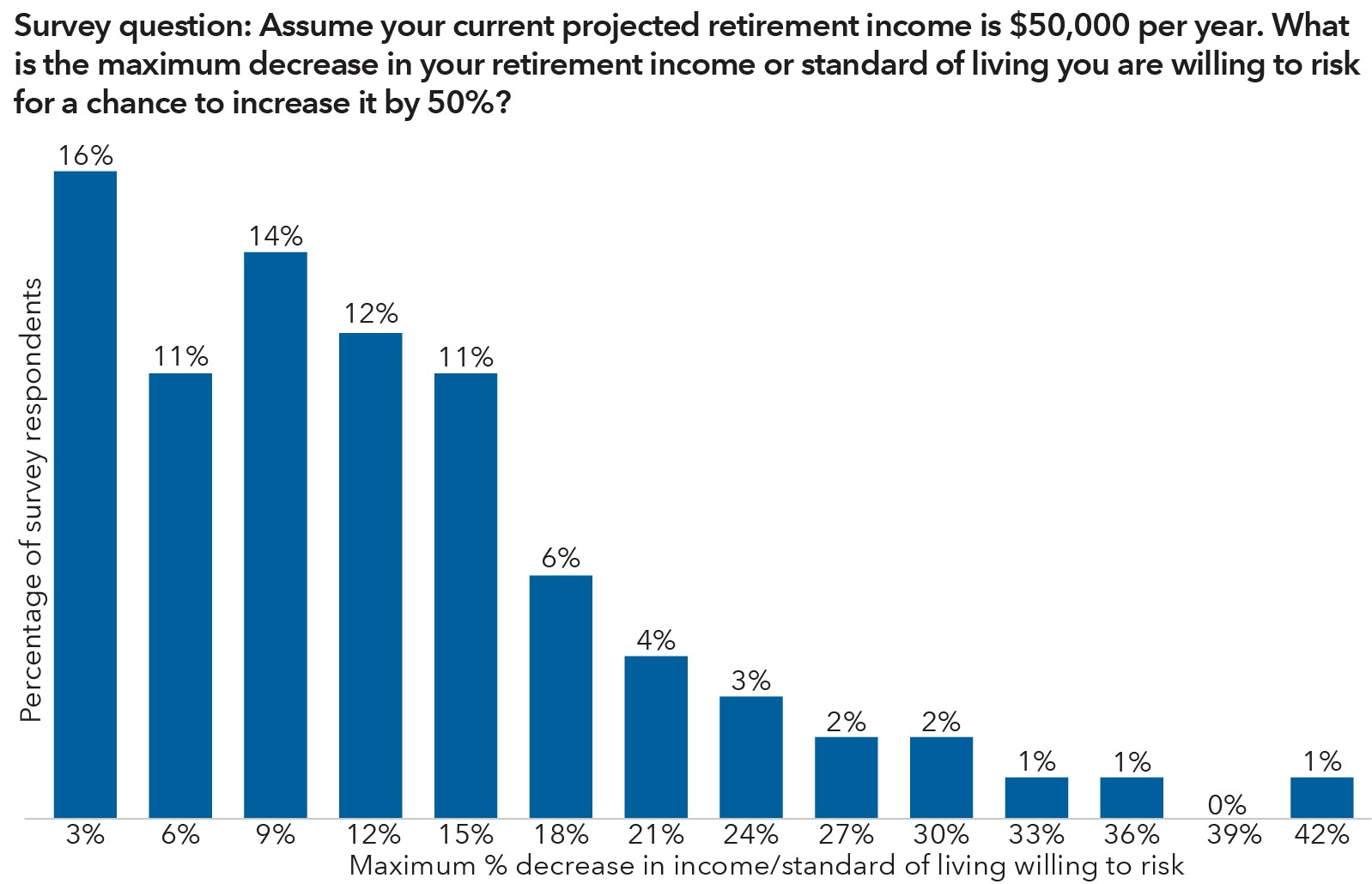

Notably, investors were unwilling to take on much risk — even for the possibility of large gains — when approaching their planned retirement age.

Few investors would risk losing more than 15% of their retirement nest egg to pursue greater returns

Source: Capital Group Investor Retirement Income Survey, 2025.

Investors are taking a pragmatic approach to withdrawals

Investors’ modest risk appetite is accompanied by reasonable expectations toward withdrawals. When asked about their sources of retirement income, investors expressed a growing preference for relying on dividends and interest and less emphasis on capital gains. But they also recognized that they may need to dip into their principal (initial investment and subsequent contributions) as needed.

Older investors rely more on Social Security, while younger investors expect to rely more on retirement savings accounts

Source: Capital Group Investor Retirement Income Survey, 2025.

Retirement spending: Withdrawal strategies differ based on starting wealth

When it comes to their actual withdrawal strategies, retirees and investors with greater assets were more likely to favor simply taking required minimum distributions while those near retirement and investors with less than $250K in assets said they would rely more on withdrawing a fixed amount. The desire to make withdrawals as needed was consistent across all age groups and asset classes, although retirees placed a greater emphasis on this approach.

Most investors have a 20-year withdrawal period in mind when evaluating retirement income investment strategies

When given a choice between a 20-year and a 30-year withdrawal period, most investors felt 20 years was the appropriate time span for a retirement income investment strategy, even though 70% of investors think their retirement savings will last longer than 20 years. Retirees and investors with assets exceeding $1 million showed a stronger preference for a 30-year timeline.

A longer time horizon may be a wise precaution to take, especially since many investors end up retiring earlier than they had originally anticipated. In a 2025 Employee Benefit Research Institute survey, 40% of retirees reported that they had retired earlier than planned, often for reasons outside their control. That means people's savings may have to last longer than they initially envisioned.

Advisors are less risk-averse and favor a longer withdrawal period

Capital Group conducted an additional survey that posed similar questions to financial advisors, who were also asked to make the same tradeoffs.* Relative to investors, financial advisors were less risk-averse and preferred a longer time horizon for retirement planning.

Although both investors and advisors prioritized preserving 100% of the account balance when evaluating retirement investment strategies, more advisors were willing to tolerate a 30% decline in account balances of their clients while most investors were only willing to risk a 15% loss.

Regarding time horizon, most advisors preferred a 30-year withdrawal period, versus the 20-year window many investors chose. This gap may reveal an opportunity for advisors to continue to encourage realistic goals aligned with each investor’s objectives, time horizon and risk tolerance.

Overall, investors are modestly optimistic

In their early working years, most people’s retirement investment strategy seems relatively straightforward: Save and invest as much as you can to maximize your nest egg.

But as people approach their retirement date, choosing an investment strategy gets more complicated: How much should you withdraw each month in retirement? How much risk should you take in your portfolio after you leave the workforce? What percentage of your assets should you seek to preserve?

Our survey showed that many investors are answering these questions conservatively, preferring to maintain their nest egg as much as possible, even if doing so might lower returns on their investments. They are approaching withdrawal strategies pragmatically. In addition, they tend to be more conservative than the financial advisors we surveyed.

About the surveys

An online survey of 5,964 investors was conducted by the firm Escalent on Capital Group’s behalf from January 9 to February 5, 2025. Participants had to be at least 20 years old, a primary/shared financial decision-maker and actively investing. The survey included a mix of advised vs. self-directed investors. Data were weighted by gender, region and age based on U.S. Census data to ensure a representative sample of the target population. A separate survey of 611 financial advisors was conducted by Escalent on Capital Group’s behalf from January 9 to January 27, 2025. Capital Group was not identified as a sponsor of the surveys. The 611 advisors we surveyed had their own books of business and had at least $25 million in assets under advisement.

Samir Mathur

Samir Mathur

Eugene Han

Eugene Han