Global Equities

Fixed Income

The booming private credit market offers investors the potential for higher returns and greater diversification, though it comes with trade-offs.

In recent years, the financial world has opened wider than ever before, with investors steadily gaining easier and cheaper access to options such as hedge funds, private equity and venture capital that were once out of reach. These vehicles have surged in popularity as investors sought attractive long-term returns and diversification beyond those offered by traditional stocks and bonds.

One of the faster-growing areas within this evolving landscape is private credit. As the name implies, these are loans made by nonbank lenders to private corporate borrowers. Many midsize businesses prefer raising capital in the private credit market over taking conventional bank loans or issuing public debt or equity.

From an investor perspective, private credit has several potential benefits. As an asset class, it has tended to offer higher yields than comparable publicly traded debt.* It’s also been less correlated with public market volatility.**

Despite its appeal and long history, access to private credit has historically been limited to large institutions such as endowments and extremely wealthy investors who met strict criteria. Capital Group is now partnering with KKR, a company that has specialized in private investment opportunities for nearly 50 years, to offer two new fixed income “public-private” funds that seek to expand access to the private credit marketplace.

Here is a primer on private credit, including potential opportunities and risks that investors must consider.

Private credit helps businesses fund their goals.

For many years, businesses — especially privately owned, middle-market entities — took out traditional bank loans to build manufacturing plants, purchase equipment or raise working capital. That dynamic changed notably in the aftermath of the 2008 global financial crisis, as tightened financial regulation — in particular, stringent capital requirements — made banks less willing to engage in these loans. That left a void that private lenders emerged to fill.

For borrowers, the private credit market can allow for more tailored and flexible financing options than are available through banks. Generally speaking, nonbank lenders have more leeway to customize loans and modulate terms to meet borrower needs. That allows for improved efficiency, customization and certainty of loan approval — all key attractions for businesses.

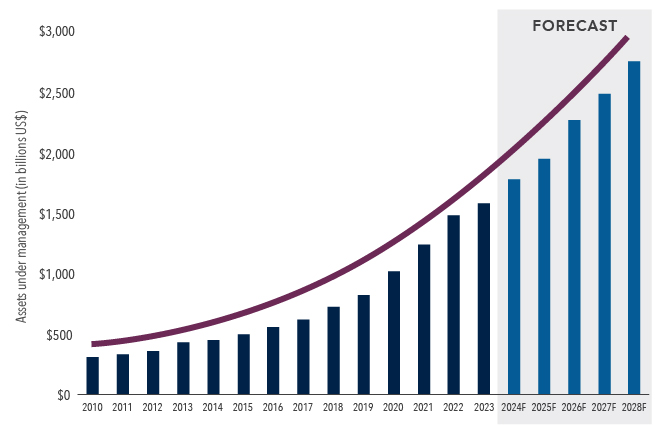

Private credit is forecast to continue rapidly growing

Sources: Statista; Preqin, Future of Alternatives 2028. Data through 2023 is as of October 2024; forecast data for years 2024 through 2028 is as of October 2023.

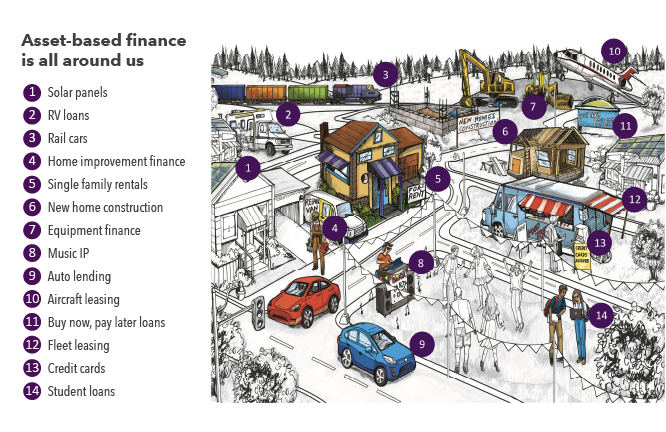

Private credit comes in several flavors, with two of the most prominent being direct lending and asset-based finance. Direct lending involves privately originated loans, generally made to small and midsize businesses. They’re similar to bank loans, but with stronger investor covenants and often a higher priority in repayment. Asset-based finance refers to loans in which the underlying collateral is the asset itself, such as manufacturing equipment, an aircraft or royalties from a song catalog. The collateral generates cash flows that can help protect the lender if the borrower fails to pay.

Source: KKR.

Private credit can offer higher yields — but there are trade-offs.

For investors, private credit works like this: Investors pool money in an investment fund. The fund manager identifies borrowers, negotiates terms and issues loans with the capital it has raised. Borrowers repay their obligations over time with interest. The fund’s goal is to return the principal and interest to investors.

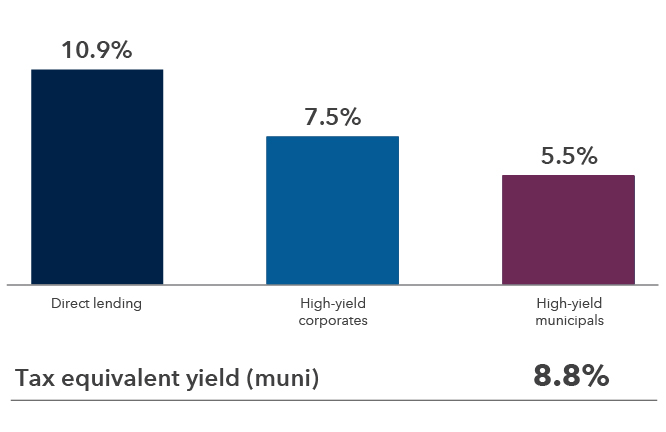

A key appeal of private credit is the potential for higher investment returns than publicly traded debt securities. The higher yields are intended to compensate investors for the more complex structure of private credit investments, including the underlying loans being relatively illiquid, where there is no or limited secondary market to sell the loan to other investors.

Direct lending has tended to have higher yields than high-yield bonds

Sources: Capital Group, LSEG. Cliffwater Direct Lending Index (Direct Lending), Bloomberg U.S. Corporate High Yield Index (High-yield corporates), Bloomberg High Yield Municipal Index (High-yield municipals). The tax-equivalent yield of the municipal yields have been adjusted by the 37% federal tax rate. Direct lending data reflect current yield, which is determined by dividing its annual income by its share price. High-yield data reflects yield-to-worst. The indexes are unmanaged and, therefore, have no expenses. Investors cannot invest directly in an index. Past results are not predictive of results in future periods. All returns in US$ unless otherwise noted. As of December 31, 2024.

Direct lending and asset-based finance come with distinct risks relative to publicly traded bonds. The loans are typically held to maturity by the originator and are not listed on a securities exchange or traded daily like public stocks and bonds.

Many of these loans are made to companies that would be considered below investment grade (Bb/Ba and below) if they were rated by an agency. These investments also involve separate regulations and tax implications.

A key factor is liquidity, or the ease with which an asset can be sold for cash without materially affecting its price. A highly liquid asset, such as a stock with a high trading volume on the public market, can generally be sold easily. Traditional “open-end” mutual funds and exchange-traded funds allow shareholders to cash out shares daily.

By contrast, a common way to access private credit is through vehicles that typically permit only periodic repurchases. These vehicles are known as “interval” funds because repurchases are allowed only at certain intervals, often on a set date each quarter. Interval funds send a written “repurchase offer” to shareholders stating the deadlines for repurchase requests.

Additionally, the funds permit only a certain percentage of outstanding shares to be sold at any one time. In the event of large-scale repurchase requests, investor repurchases could be limited to a portion of their requests.

The repurchase limits are intended to prevent the equivalent of a run on the bank, in which a fund manager must prematurely return cash to investors before the underlying loans come due. By controlling the amount of capital flowing out of a fund, the fund manager can help protect remaining shareholders and avoid selling long-term assets at potentially discounted prices.

As a result, private assets typically offer higher yields to compensate for their reduced liquidity. This is known as the “illiquidity premium.”

Investors must consider all factors when assessing private credit.

Because of the complexity and liquidity provisions of private credit investments, these funds are typically designed for investors who have long time horizons and are willing to hold assets that cannot easily be sold in the short term. In other words, investors can earn potentially higher returns in exchange for forgoing some liquidity and taking on additional risk.

The two new funds that Capital Group has launched with KKR feature a combination of publicly traded securities and private market investments to provide private-market access in a thoughtful and blended approach. Your Private Wealth Advisor can provide more information.

Investors should carefully consider investment objectives, risks, charges and expenses. This and other important information is contained in the fund prospectuses, which can be obtained from a financial professional and should be read carefully before investing.

Covenants are agreements between two parties. In loans, they're often terms of the loan designed to protect the lender's interests.

*Source: Based on an analysis of index yields over the trailing 10 years across private credit (using Cliffwater Direct Lending Index as proxy), investment-grade bonds (Bloomberg U.S. Aggregate Index) and high-yield bonds (Bloomberg U.S. Corporate High Yield 2% Issuer Capped Index). As of September 30, 2024, the most recently available time period for all indexes at the time of publication. Past results are not predictive of results in future periods. Private credit yields averaged 10.8%, investment-grade bond yields averaged 2.9% and high yield bonds averaged 7.0% over the period.

**Source: Capital Group analysis using Cliffwater, Standard & Poor’s and Bloomberg data. 10-year correlation to the S&P 500 total returns for U.S. high-yield bonds was 0.86, leveraged loans was 0.80 and private credit (using Cliffwater Direct Lending Index as a proxy) was 0.66 as of September 30, 2024, the most recent data available for all the categories. 10 year correlation to the Bloomberg U.S. Aggregate Index was 0.41 for U.S. high yield, 0.09 for leveraged loans and -0.05 for private credit over the same 10-year period.

KKR Credit Advisors (US) LLC serves as the sub-adviser with respect to the management of the fund’s private credit assets. Capital Group and KKR are not affiliated. The two firms maintain an exclusive partnership to manage and deliver public-private investment solutions to investors.

The funds are non-diversified funds that have the ability to invest a larger percentage of assets in the securities of a smaller number of issuers than diversified funds. As a result, poor results by a single issuer could adversely affect fund results more than if the funds were invested in a larger number of issuers.

The Cliffwater Direct Lending Index is an asset-weighted index of directly originated middle market loans that was created to help investors better understand direct lending characteristics and benchmark manager performance.

Bloomberg U.S. Aggregate Index represents the U.S. investment-grade fixed-rate bond market. This index is unmanaged, and its results include reinvested dividends and/or distributions but do not reflect the effect of sales charges, commissions, account fees, expenses or U.S. federal income taxes.

Morningstar LSTA US Leveraged Loan Index is a market-value weighted index designed to measure the performance of the U.S. leveraged loan market.

Bloomberg U.S. Corporate High Yield 2% Issuer Capped Index covers the universe of fixed-rate, non-investment-grade debt. The index limits the maximum exposure of any one issuer to 2%. This index is unmanaged, and its results include reinvested distributions but do not reflect the effect of sales charges, commissions, account fees, expenses or U.S. federal income taxes.