A core global equity fund built for an evolving world

Time tested over 50+ years, Capital Group’s flagship global equity strategy is now available as a UK-domiciled OEIC.

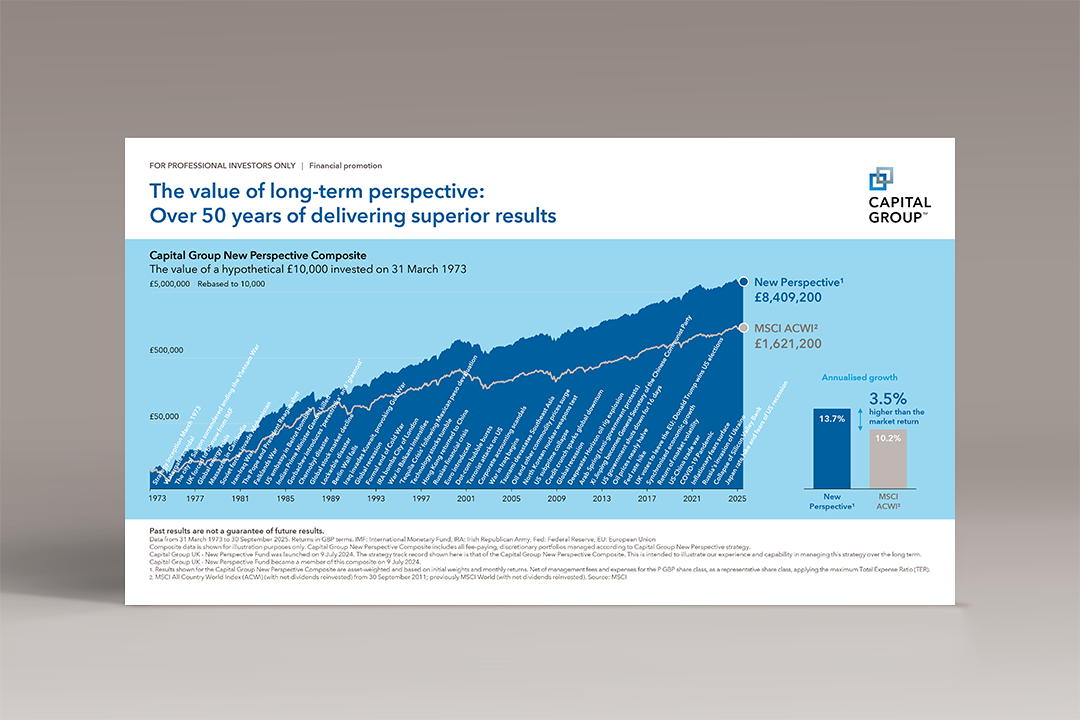

The New Perspective strategy has navigated a broad range of market environments.1 Its longevity demonstrates that identifying companies that can benefit from global change is essential in a constantly evolving world.

A global equity portfolio that thrives on change

Seeks to capture the benefits of long-term transformational changes across the global economy.

A core, flexible approach to global equities

Explore how a flexible approach and deep fundamental research can help identify companies at the forefront of change.

An investment strategy that has stood the test of time

Benefit from a 50+ year track record of strong investment returns through diverse market environments.1

Discover a global equity strategy that thrives on change

A global equity strategy that has navigated 50+ years of change

Change is constant: How to navigate an ever-changing global economy

New Perspective's Portfolio Managers highlight the benefits of a truly long-term approach.

Whether tariffs are imposed or used as a negotiating tool, portfolio manager Rob Lovelace explains what it could mean for non-US semiconductor manufacturers. Watch more

A global focus on national defense, energy security and secure supply chains is driving opportunities for innovative industrial companies. Read more

As world trade policy adjusts to the potential impact of higher US tariffs, what is the future path of globalisation? Read more

The Biden administration launched several large stimulus programs to reinvigorate the US economy. What does the return of Trump mean for US capex? Read more

Amid a confluence of transformational change in the global economy, who are the beneficiaries creating long-term investment opportunities? Read more

The AI landscape is moving quickly. We look beyond the short-term hype to focus on the long-term investment potential. Read more

Breakthroughs in genomic sequencing and data processing allow drug developers to apply precise interventions to address illnesses worldwide. Read more

As multinationals increasingly take a ‘multi-local’ approach, they are often best positioned to find effective solutions to disruption. Read more

Discover global equities thriving on change

WHY CAPITAL GROUP

Actively different

Capital Group is one of the oldest and largest global active fund managers in the world. We base our decisions on a long-term perspective, grounded in deep fundamental research, because we believe it is the best way to achieve solid long-term investment results. Since our founding in 1931, we have been privately owned, which is the cornerstone of our ability to think long-term and be truly aligned with clients.

90+ years

of active investing since 1931

£2.2T

in total assets managed

27 years

Average investment experience of our portfolio managers

230+

Investment analysts

specialise by sector and region and collaborate globally

Data as at 31 December 2024 and attributed to Capital Group, unless otherwise stated.

All data as at 31 December 2024 and attributed to Capital Group, unless otherwise stated.

1Capital Group UK - New Perspective Fund was launched on 9 July 2024. The strategy track record shown here is that of the Capital Group New Perspective Composite. This is intended to illustrate our experience and capability in managing this strategy over the long term. Prior to 30 October 2015, data is based on a representative account for the strategy. Capital Group UK - New Perspective Fund is available to UK investors from 9 July 2024 as an open-ended investment company (OEIC).

Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organisation; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups

Fund risks

Capital Group UK – New Perspective Fund

Emerging markets risk: Investments in emerging markets are generally more sensitive to risk events such as changes in the economic, political, fiscal and legal environment.

Equities risk: The prices of equity securities may decline in response to certain events, including those directly involving the companies whose securities are owned by the fund, overall market changes, local, regional or global political, social or economic instability and currency fluctuations.

Sustainability risk: Environmental, social or governance event or condition that, if it occurs, could cause an actual or potential material negative impact on the value of an investment of the fund.

Risk factors you should consider before investing:

- This material is not intended to provide investment advice or be considered a personal recommendation.

- The value of investments and income from them can go down as well as up and you may lose some or all of your initial investment.

- Past results are not a guarantee of future results.

- If the currency in which you invest strengthens against the currency in which the underlying investments of the fund are made, the value of your investment will decrease. Currency hedging seeks to limit this, but there is no guarantee that hedging will be totally successful.

- Some portfolios may invest in financial derivative instruments for investment purposes, hedging and/or efficient portfolio management.

- There are additional Emerging markets, Equities and Sustainability risks associated with this fund.