Capital IdeasTM

Investment insights from Capital Group

Fixed Income

Given the generous level of yield currently offered by US Treasuries (UST) and the relatively tight spreads within investment grade corporate credit, would it not be better to just buy UST?

For some investors, this might be the right choice. Specifically, we think investing in UST makes sense if you have a strong view the economy is heading into a deep recession. However, 2023 has taught us that recession in the US is far from a done deal, and, in fact, there is still a meaningful probability of the economy remaining resilient and continuing to avoid a recession in 2024.

In this scenario, we think IG credit provides the better opportunity. This paper outlines three reasons why we believe this is the case:

- Historical analysis shows that during most periods, global IG corporate bonds have delivered better results than UST.

- Credit spreads are close to their historical average, but dispersion remains elevated.

- Global corporate bonds can provide the strategic core fixed income allocation of a portfolio as they provide income, capital preservation, and diversification from equities.

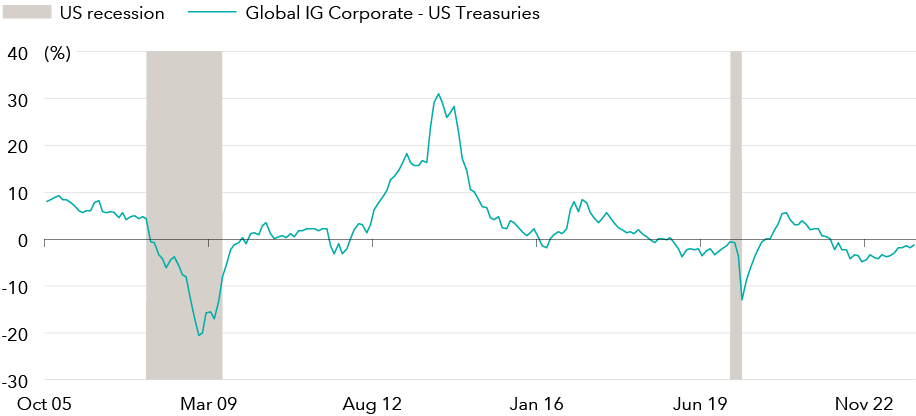

Five year rolling results of corporate bonds and US Treasuries

Source: Bloomberg. US Treasuries represented by Bloomberg US Treasuries. Global IG Corporates represented by Bloomberg Global Aggregate – Corporates USD hedged. Based on five-year rolling returns using monthly values. Data as at 22 October 2023

Our latest insights

-

-

Long-Term Investing

-

-

-

Fixed Income

RELATED INSIGHTS

Hear from our investment team.

Sign up now to get industry-leading insights and timely articles delivered to your inbox.

Past results are not predictive of results in future periods. It is not possible to invest directly in an index, which is unmanaged. The value of investments and income from them can go down as well as up and you may lose some or all of your initial investment. This information is not intended to provide investment, tax or other advice, or to be a solicitation to buy or sell any securities.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. All information is as at the date indicated unless otherwise stated. Some information may have been obtained from third parties, and as such the reliability of that information is not guaranteed.

Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organisation; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

Flavio Carpenzano

Flavio Carpenzano