RESOURCES / INVESTMENT MENUS

Help participants succeed with an investment re-enrollment

8-minute read

THE TAKEAWAY

Move plan participants into age-appropriate target date funds

Overview

Target date funds (TDFs) have grown rapidly, but not all participants have benefited

The Pension Protection Act of 2006 provided a safe harbor for plan fiduciaries investing participant assets in certain types of default investment alternatives (such as TDFs) in the absence of participant investment direction. Yet some employees have missed out.

The problem

Many plan sponsors enrolled new hires in TDFs — but not employees who joined the plan before the act took effect.

The solution

To help them, plan sponsors can do an “investment re-enrollment” by moving all plan participants’ assets into age-appropriate TDFs unless they opt out.

Impact

See investment re-enrollment in action

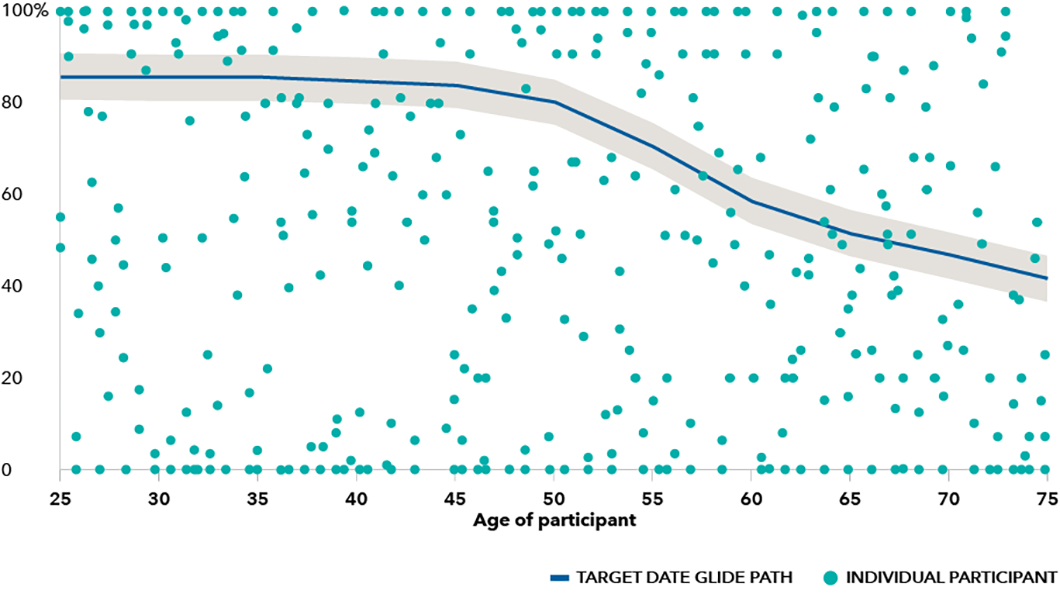

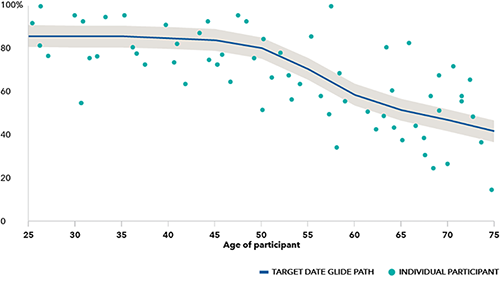

These two charts show how re-enrollment can result in a more age-appropriate equity allocation for participants not previously enrolled in a target date fund.

Before re-enrollment

Scattered equity allocations

Source: Capital Group. Examples are hypothetical.

This first chart shows that before re-enrollment, allocations to equities may be wide-ranging, often falling far outside of an age-appropriate range (i.e., proximity to retirement).

After re-enrollment

More age-appropriate equity levels

Source: Capital Group. Examples are hypothetical.

The second chart shows that more participants become invested in TDFs after re-enrollment. This change typically brings participants to a more age-appropriate level of equities.

Questions

Re-enrollment is easier than you might think. Some common re-enrollment concerns stem from misconceptions. These clear answers provide a reality check for frequently asked questions.

Tips for success

Clarify the intent

Refer to the process as a “confirmation of investments” or “selection confirmation” so participants understand the goal.

Go beyond emails and signs

Use newsletters, texts and telephone calls.

Announce early and repeat often

Announce the event 60 to 90 days in advance and explain the benefits with on-site meetings.

Tell participants they have choices

Investment selections can and should be revisited regularly.

Consider making other plan changes at the same time

For example, update the plan menu while you have your participants‘ attention.

Be mindful of existing investment options

Plans need to consider how to effectively handle assets based on potential restrictions, such as stable value, company stock, managed accounts and/or brokerage accounts.

Explore more investment menus resources

-

Investment Menu

How to evaluate target date funds

-

1Defined Contribution Institutional Investment Association, “DCIIA plan sponsor survey on automatic plan features: Responses to selected webcast Q&A,” September 2015.

2Qualified Plan Advisors White Paper Series, “Investment Refresh: Improving Participant Outcomes Through Re-enrollment.” Accessed January 3, 2020 at https://qualifiedplanadvisors.com/whitepapers/